0/ Here is a thread on the Cloud analysis piece @sarahdingwang and I posted recently. We love the level of response and discussion. But wanted to summarize and address some of the comments.

1/ If you haven't read the piece, it's here (hint: neither Dropbox nor repatriation are core to the analysis. Nor have much to do with the results or conclusion)

a16z.com/2021/05/27/cos…

a16z.com/2021/05/27/cos…

2/ We present the impact of the cloud on the market caps of 50 public software companies based on its estimated contribution to their COGS

3/ What we found -- In the case of reducing cloud infra spend by 2x these companies (very conservatively!) get a lift of $100B in aggregate market cap. We also SWAG that the number is likely $500B+ industry wide based on total cloud spend.

4/ This was an analysis on public software companies at scale. Startups / enterprise were not the primary target of our analysis nor does it obviously apply to them.

But it could be the ghost of Christmas future...

But it could be the ghost of Christmas future...

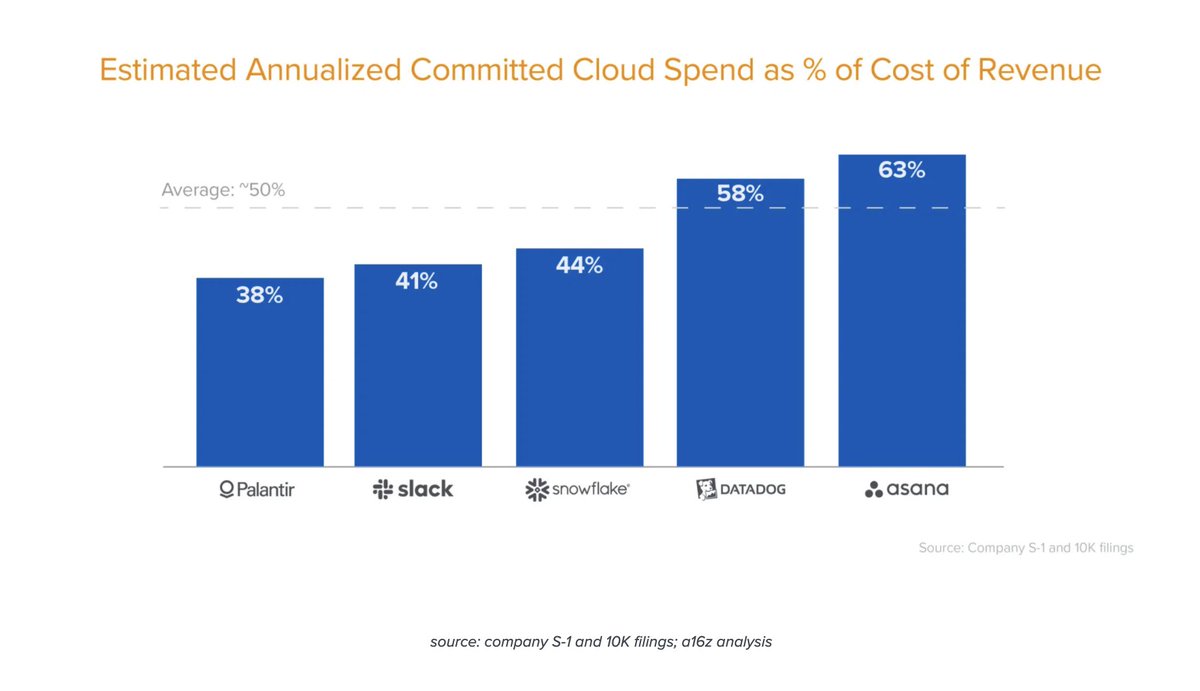

5/ Based on our benchmarking, we assumed committed cloud spend accounts for ~50% of COGs on average...Cloud contribution to COGs at this rate and scale is a relatively recent phenomena. Of the 50 companies we included, 76% went public in 2015 or later.

6/ ... this is clearly an emerging problem with many examples .. e.g. we spoke with a billion dollar company where cloud is 80% of COGs. And as @clintsharp notes below that Splunk had north of $100m in AWS spend w/o gross margins on that business!

https://twitter.com/clintsharp/status/1398274773436682245?s=20

7/ Method: We dug through the S-1s/10Ks of 100+ companies and selected ones that noted significant cloud spend or CSPs as a third party vendor risk. We then estimated the potential market cap increase at current multiples based on the lift to margin from 2x savings.

8/ We also spoke with a number of practitioners who are dealing with this today (all from companies that have scaled); they converged on 2-3x savings as a conservative estimate on what a company can save if they focus on reducing cloud spend.

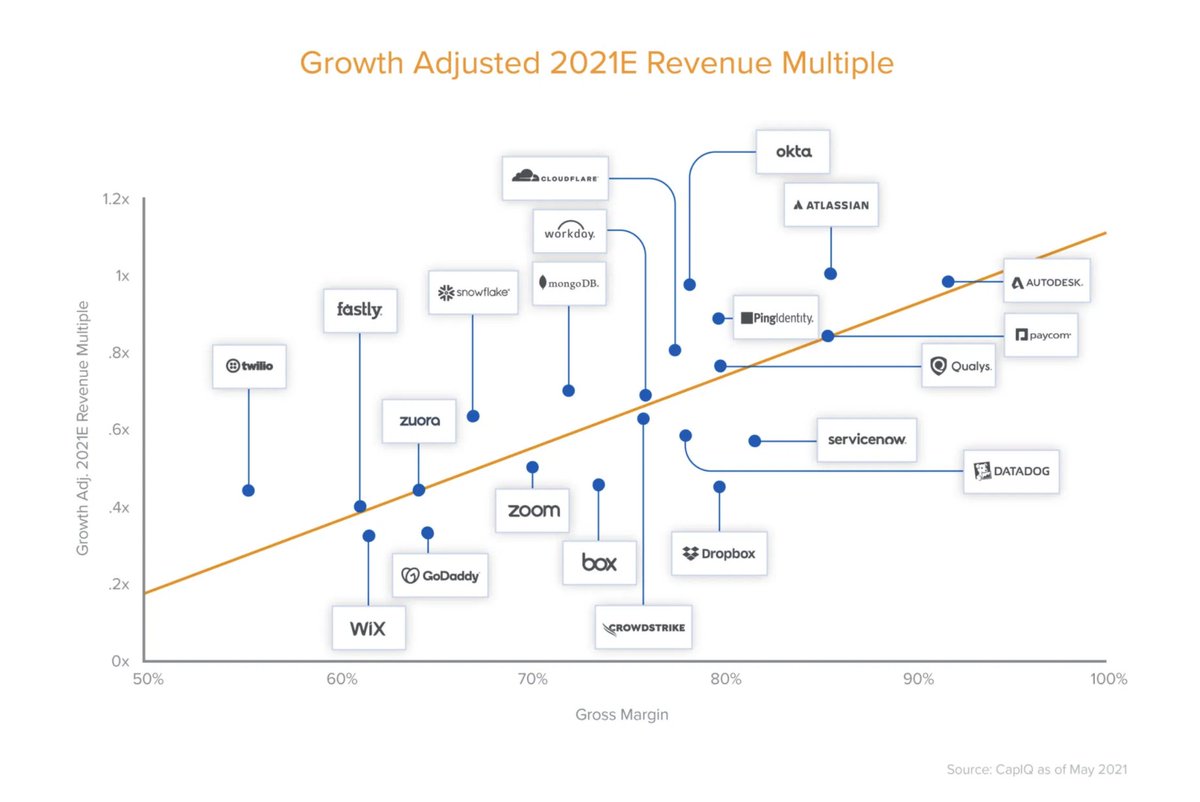

9/ What's the conclusion? Well ... $100B is a big number across 50 companies! The cost of cloud is not just about the impact to COGS, but the multiplier on potential savings when it comes to your valuation ...

(con't) ... As you’re scaling, it starts to make sense to think about reducing spend either by surfacing costs to eng, rewriting, using third party optimizations, repatriation, going hybrid, avoiding single CSP lock-in, etc.

10/ Why include repatriation at all? We were surprised to find a number of companies who had either partially repatriated or were in the process. We don’t take a position whether it is right in any given situation or company.

https://twitter.com/kostadis_sports/status/1399468749237882880?s=20

11/ What's the cloud paradox? Public cloud is the only thing that makes sense for small companies, new projects, and workloads not in COGs.

Yet, for a growing number of companies, the economic impact is enormous. And once they know it, it's often too late to do much about it.

Yet, for a growing number of companies, the economic impact is enormous. And once they know it, it's often too late to do much about it.

12/ OK. That's the core of the analysis, to which we got a ton of responses. Below are answers to the most common ones.

13/ “What about a price drop through competition?” Prices have been steadily dropping for a decade. But CSP margins remain at 30%+. And many people are locked into their CSPs. Oligopoly dynamics are different from competitive markets, so not clear what will happen (or when).

14/ “But Dropbox is a one off(!!)” We used Dropbox as an illustrative example because the data is public. We didn't use it to drive the savings assumptions on the analysis. So even if you ignore any mention of it, the results are the same.

15/ “Repatriation is bad for XYZ reasons!” We agree! It's a complex decision that varies by company. Even those we spoke to that had repatriated were primarily hybrid.

This is why we don't take a stance on it in the post. We just present it as one of many options.

This is why we don't take a stance on it in the post. We just present it as one of many options.

16/ “What about engineering costs? Are you just re-shuffling COGS into R&D?” Very good and Important question(!) Our analysis of recurring savings is net of the engineering/labor costs ..

(cont...) We use gross profit multiples as a shorthand given some of the companies profiled don’t trade on current free cash flow (yet) but these savings should flow through to cash flows.

17/ “But classic server/network vendors have high margins too!” Yes, and when the Cloud Service Providers (CSPs) found they contributed to COGS, they decided to bring this in-house. OEMS look dramatically different today as a result.

18/ “Shouldn't they focus on growth?” If you can increase FCF and share price you'll have a lot more $$ to invest in growth (also increasing market cap). We don't argue to sacrifice growth/innovation for COGS but there is clearly a tipping point. The question is when ...

19/ ... again what the CSPs did to the OEMs is illustrative. Even though building servers and switches wasn't a core competency (and hard to do right), the CSPs decided to do it once the impact to COGs was high enough. It's not hard to see this as a similar dilemma.

20/ How will this all resolve? My best guess is that cloud margins will eventually erode. But workloads will largely stay on them.

However, the economics are getting very burdensome

So maybe SaaS will eventually do to cloud what cloud did to the OEMs🤷🏻♂️

However, the economics are getting very burdensome

So maybe SaaS will eventually do to cloud what cloud did to the OEMs🤷🏻♂️

21/ We're going to continue to explore this. We love all the commentary and hope you continue the discussion with us ✌️ /fin

• • •

Missing some Tweet in this thread? You can try to

force a refresh