$FTCH

Bars: Revenue (TTM)

Lines: Gross Profit (TTM)

Between this chart and repeated raised analyst revenue estimates for 2021 (beat and raise cadence) trying to catch up to the company, the 'overvalued' argument falls flat, and it does so by a lot.

cmlviz.com/stocks/FTCH/fi…

/5

Bars: Revenue (TTM)

Lines: Gross Profit (TTM)

Between this chart and repeated raised analyst revenue estimates for 2021 (beat and raise cadence) trying to catch up to the company, the 'overvalued' argument falls flat, and it does so by a lot.

cmlviz.com/stocks/FTCH/fi…

/5

Now that we have seen financials, we can also see how analysts have been behind the curve.

$ROKU

This chart illustrates analyst estimates for FY 2021 revenue through time.

This is *not* a chart of revenue, it is a chart of estimates changing for the period: FY2021

/6

$ROKU

This chart illustrates analyst estimates for FY 2021 revenue through time.

This is *not* a chart of revenue, it is a chart of estimates changing for the period: FY2021

/6

Now that we have seen financials ☝️, we can also see...

$FSLY

This chart illustrates analyst estimates for FY 2021 revenue through time.

This is *not* a chart of revenue, it is a chart of estimates changing for the period: FY2021

Guidance is now $390M.

/7

$FSLY

This chart illustrates analyst estimates for FY 2021 revenue through time.

This is *not* a chart of revenue, it is a chart of estimates changing for the period: FY2021

Guidance is now $390M.

/7

Now that we have seen financials ☝️, we can also see...

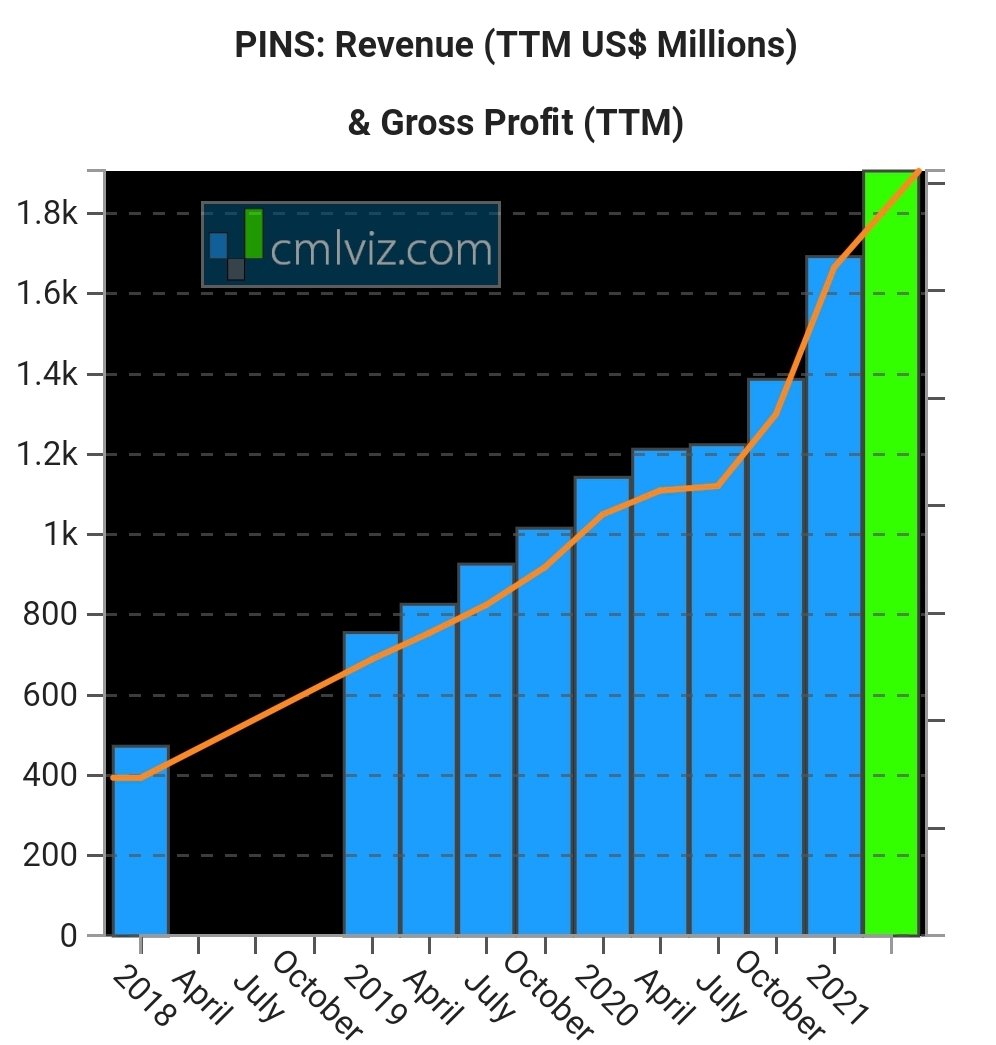

$PINS

This chart illustrates analyst estimates for FY 2021 revenue through time.

This is *not* a chart of revenue, it is a chart of estimates changing for the period: FY2021

Note incorrect COVID impacted estimates.

/8

$PINS

This chart illustrates analyst estimates for FY 2021 revenue through time.

This is *not* a chart of revenue, it is a chart of estimates changing for the period: FY2021

Note incorrect COVID impacted estimates.

/8

Now that we have seen financials ☝️ we can also see...

$PD

Chart illustrates analyst estimates for FY 2021 revenue through time.

This is *not* a chart of revenue, it is a chart of estimates changing for the period: FY2021

Note, again, incorrect COVID impacted estimates.

/9

$PD

Chart illustrates analyst estimates for FY 2021 revenue through time.

This is *not* a chart of revenue, it is a chart of estimates changing for the period: FY2021

Note, again, incorrect COVID impacted estimates.

/9

Perspective:

Price in short-term does not (necessarily) reflect business in long-term.

$ROKU $FSLY $PINS $PD $FTCH

(Do this with any of your holdings)

"What you see and what you are told are not necessarily the same thing."

See it right:

bit.ly/CMLPro

10/10

Price in short-term does not (necessarily) reflect business in long-term.

$ROKU $FSLY $PINS $PD $FTCH

(Do this with any of your holdings)

"What you see and what you are told are not necessarily the same thing."

See it right:

bit.ly/CMLPro

10/10

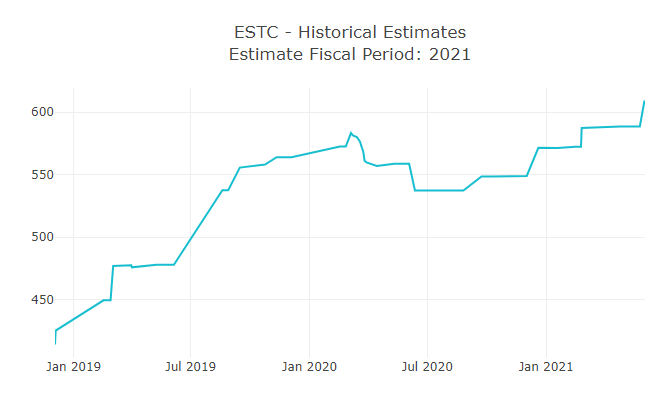

..and one extra...

$ETSC

Chart illustrates analyst estimates for FY 2021 revenue through time (FY21 just ended).

This is *not* a chart of revenue, it is a chart of estimates changing for the period: FY2021

Rising estimates as analysts try to catch up, created this today

/11

$ETSC

Chart illustrates analyst estimates for FY 2021 revenue through time (FY21 just ended).

This is *not* a chart of revenue, it is a chart of estimates changing for the period: FY2021

Rising estimates as analysts try to catch up, created this today

/11

• • •

Missing some Tweet in this thread? You can try to

force a refresh