A thread on the snippets (paragraphs & quotes) from the book ‘Lifespan’ by David Sinclair @davidasinclair

‘The clock is ticking’

This thread will be updated as I read further & further.

‘The clock is ticking’

This thread will be updated as I read further & further.

3/ And Nothing was ever the same again.

The author is talking about 50 extra years of Health-span being the norm.

The author is talking about 50 extra years of Health-span being the norm.

4/ 400crore years ago, we started with a 2 genes in a single cell with this mechanism👇 to survive, now we are at 21000 genes & 30Trillion cells.

Simpler explanation for Epigentics: explains how nuture (not nature) leads to changes in your DNA.

Simply, how 2 twins which have the same genes can have diametrically opposite lives.

Simply, how 2 twins which have the same genes can have diametrically opposite lives.

11/ That’s what is humbling about nature: something like yeast that is used in brewing beer can also help cure cancer.

15/ A caterpillar can’t transform to a human, but only into a butterfly: Why the genome is equally important.

16/ “Studies of identical twins place the genetic influences on longevity at between 10 and 25 percent which by any estimation is surprisingly low.”

Our DNA is not our destiny.

Our DNA is not our destiny.

23/ “Though smoking increases the risk of getting cancer by fivefold, being 50 years old increases your cancer risk hundred fold. By the age of 70, it’s a thousand fold.

Not just cancer, valid for heart disease. And Diabetes. And Dementia. The list goes on & on.”

Not just cancer, valid for heart disease. And Diabetes. And Dementia. The list goes on & on.”

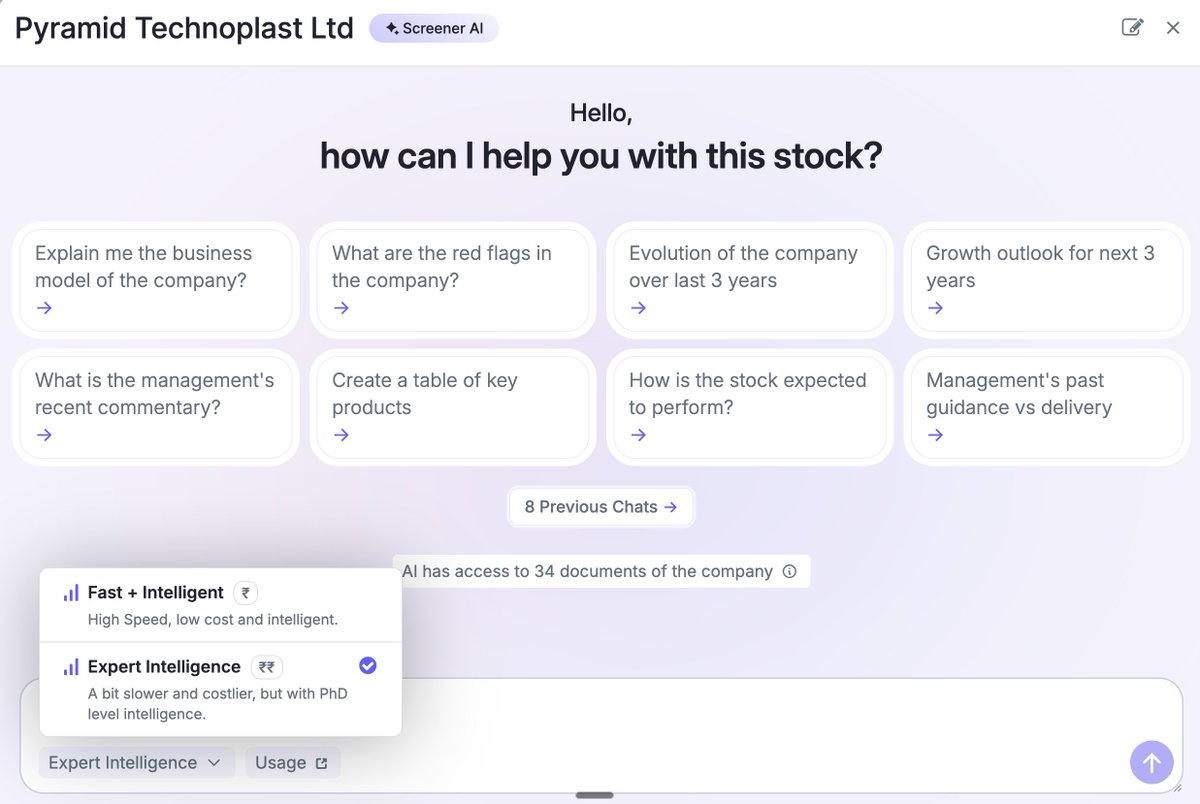

34/‘It won’t be long before prescribing a drug without first knowing a patient’s genome will seem medieval.’

Enter Pharmocoepigenetics: We all don’t respond to medicines in the same way.

Enter Pharmocoepigenetics: We all don’t respond to medicines in the same way.

36/ “Epidemiologists say a fast moving airborne pathogen will kill more than 30 million people in less than a year and they say that there is a reasonable probability that the world will experience such an outbreak in the next 10-15 years.” ~ Bill Gates in 2017.

38/ Even Nobel Laureates & Billionaires can underestimate compounding. The thing that differentiates us & them is that they are quick to change lanes.

43/ “In 1800, the global literacy rate was 12%, by 1900 and it was 21% & today it’s 85%. We now live in a world where more than 4 out of 5 people can read, the majority of whom have instant access to essentially all the world‘s knowledge.”

44/ This is something to watch out for: the working age population crisis in most countries could be solved.

46/ A dab of optimism goes a long way in the discovery of the new 💫

Wish I read this book earlier.

Time to make some changes to the epigenome.

Aging is a disease. (X9999)

End of Thread.

Wish I read this book earlier.

Time to make some changes to the epigenome.

Aging is a disease. (X9999)

End of Thread.

• • •

Missing some Tweet in this thread? You can try to

force a refresh