The BIS Quarterly Review out today has an introductory piece outlining what's new

bis.org/publ/qtrpdf/r_…

bis.org/publ/qtrpdf/r_…

Bird's eye view of what's on offer from the BIS on its coverage of government bonds

Table C4 is brand new; it has the all-important breakdown by currency of issue

bis.org/statistics/sec…

Table C4 is brand new; it has the all-important breakdown by currency of issue

bis.org/statistics/sec…

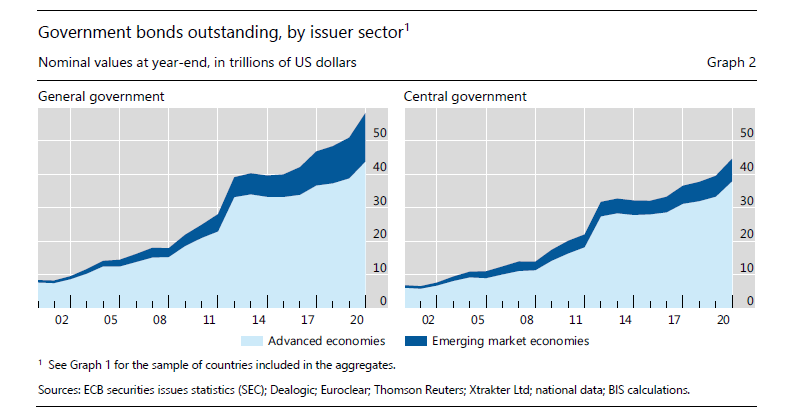

Total amounts have risen, and emerging market economies (in dark blue) now account for around a quarter of the total

("general government" includes regional government bonds, as well as sovereign bonds narrowly defined)

bis.org/publ/qtrpdf/r_…

("general government" includes regional government bonds, as well as sovereign bonds narrowly defined)

bis.org/publ/qtrpdf/r_…

The key takeaway is that emerging markets increasingly borrow in their own currencies, reducing their reliance on foreign currency borrowing

... at least, on the part of their governments; corporate borrowing is a different matter

... at least, on the part of their governments; corporate borrowing is a different matter

https://twitter.com/BIS_org/status/1401860492440879108?s=20

Watch this space for further updates; we will augment these series to report how much of the domestic currency sovereign bonds are held by foreign investors

Or, how much have EMEs left behind Original Sin only to encounter "Original Sin Redux"?

bis.org/speeches/sp190…

Or, how much have EMEs left behind Original Sin only to encounter "Original Sin Redux"?

bis.org/speeches/sp190…

And speaking of corporate debt, the BIS Quarterly Review released today has a must-see piece on the subject

Thread continues to guide you through the highlights

bis.org/publ/qtrpdf/r_…

Thread continues to guide you through the highlights

bis.org/publ/qtrpdf/r_…

One key theme is the prevalence of offshore borrowing; corporates borrow in dollars through their affiliates abroad

For international debt securities, the "nationality" series that sees through to the parent is more than double the "residence" series for EMEs (right-hand panel)

For international debt securities, the "nationality" series that sees through to the parent is more than double the "residence" series for EMEs (right-hand panel)

This touches on another BIS theme - the risk-taking channel of exchange rates

Financial conditions in EMEs fluctuate with the strength of the dollar

Financial conditions in EMEs fluctuate with the strength of the dollar

• • •

Missing some Tweet in this thread? You can try to

force a refresh