Anda pernah dengar Real Estate kan? Pernah tak anda dengar pasal Real Estate Investment Trust (REIT) yang available di Bursa Malaysia?

REIT adalah salah instrumen yang memberikan income distribution yang agak kompetitif.

Ada yang berminat nak tahu about REIT? 😬

REIT adalah salah instrumen yang memberikan income distribution yang agak kompetitif.

Ada yang berminat nak tahu about REIT? 😬

Gambar ni adalah definisi asas REIT. Contoh 1 property harga RM100k, with REIT kita boleh dapatkan dengan harga yang lebih rendah sebab dibahagikan kepada lebih ramai shareholders.

Jelas kan gambar saya kongsi ni? Maaf pandai lukis orang lidi ja😆

Jelas kan gambar saya kongsi ni? Maaf pandai lukis orang lidi ja😆

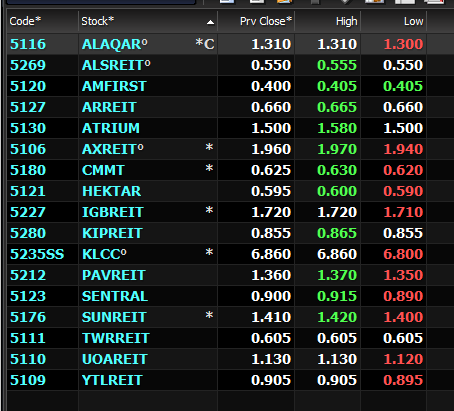

Sebenarnya, kita boleh beli REITS ni di Bursa Malaysia. Dalam gambar ni senarai REITs yang available di Bursa Malaysia

Yang patuh syariah ada 4 sahaja : ALAQAR, ALSREIT, AXREIT, KLCC.

Yang patuh syariah ada 4 sahaja : ALAQAR, ALSREIT, AXREIT, KLCC.

Perasan tak ada nama KLCC dekat situ? Yes, kita sebenarnya boleh jadi shareholders KLCC. 😬

Now saya akan cerita 'How it works' tetapi sebelum tu, saya akan cerita briefly business 4 REITs yang saya mention dekat atas. Boleh?

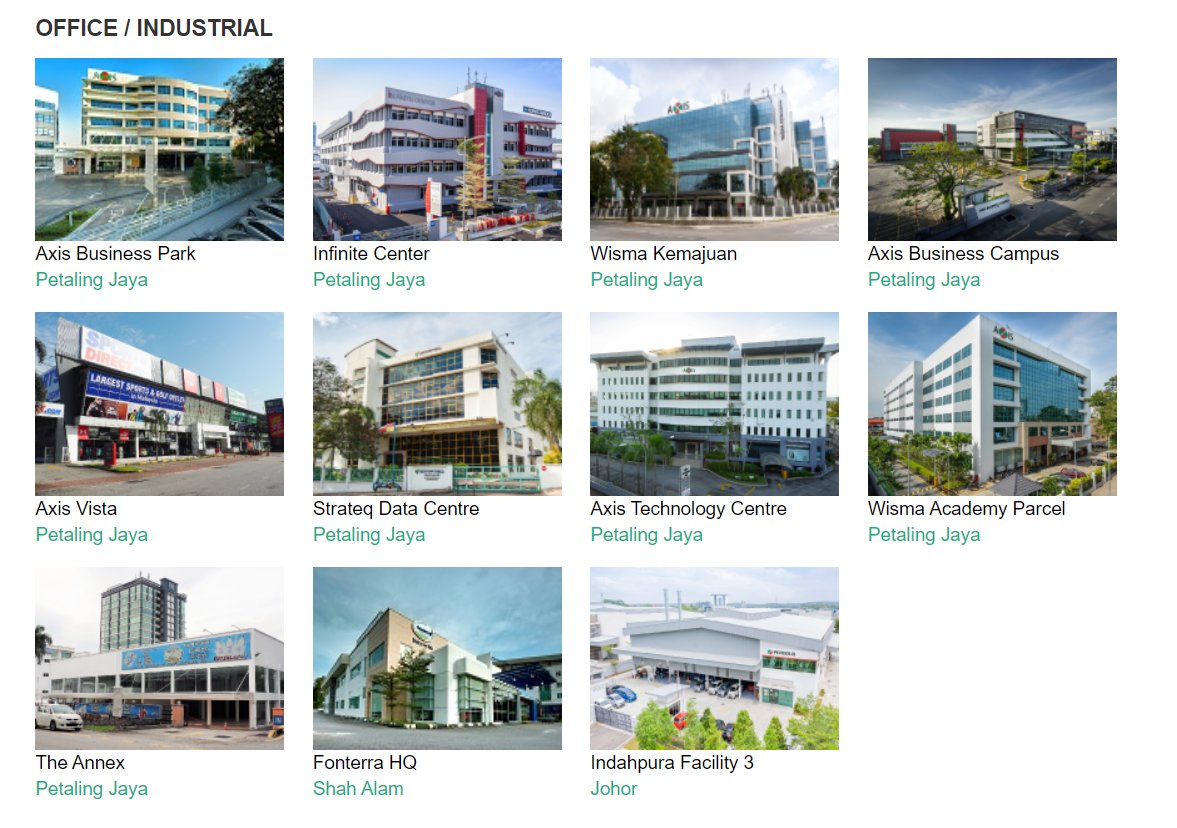

1. AXREIT

Dia banyak terlibat dengan bangunan industri atau erti kata lain kilang. For me, this is one of the best REITs sebab even waktu PKP, kilang masih dibuka.

Gambar contoh facilities yang AXREIT terlibat :

Dia banyak terlibat dengan bangunan industri atau erti kata lain kilang. For me, this is one of the best REITs sebab even waktu PKP, kilang masih dibuka.

Gambar contoh facilities yang AXREIT terlibat :

3. ALSREIT (AL SALAM REIT)

This one lebih diversify from retails sector, food and beverages etc.

Contoh property yang diurus oleh ALSREIT :

This one lebih diversify from retails sector, food and beverages etc.

Contoh property yang diurus oleh ALSREIT :

1. Ada CDS account

2. Beli saham REITs ni di platform dengan cara yang biasa.

3. Enjoy INCOME DISTRIBUTION every year.

So apa maksud income distribution ni?

2. Beli saham REITs ni di platform dengan cara yang biasa.

3. Enjoy INCOME DISTRIBUTION every year.

So apa maksud income distribution ni?

Income distribution dalam bahasa mudah adalah dividen yang anda terima setiap tahun. Is it fix? Not necessarily but what can I say it's competitive.

Saya bagi satu contoh : AXREIT

Saya bagi satu contoh : AXREIT

Gambar bawah ni adalah AXREIT Income Distribution History. Maintain around 8.25 sen hinggan 8.75 sen.

Macam mana kita nak kira yield or % daripada nilai duit yang kita beli?

Macam mana kita nak kira yield or % daripada nilai duit yang kita beli?

Contoh saya beli AXREIT pada harga RM1.80 awal tahun 2020. Jadinya saya boleh merasa total dividend 8.75sen.

Yield = RM0.0875/RM1.80 = 4.86%

Yield = RM0.0875/RM1.80 = 4.86%

But wait! The yield is 4.86 tetapi anda nampak something that? Ada capital aprreciation....

Harga sekarang RM1.95, jadinya selain dividen saya juga dapat merasa capital appreciation of 8.33%

Formula : (RM1.95-RM1.80)/RM1.80 = 8.33%

Harga sekarang RM1.95, jadinya selain dividen saya juga dapat merasa capital appreciation of 8.33%

Formula : (RM1.95-RM1.80)/RM1.80 = 8.33%

So here, I get both income distribution dan juga capital aprreciation. Menarik kan?

Dalam masa sama it's very liquid. Senang nak cairkan asset sebab anda boleh jual bila-bila masa saja di platform.

Dalam masa sama it's very liquid. Senang nak cairkan asset sebab anda boleh jual bila-bila masa saja di platform.

Dan cuba tengok chart saya share tu, in a long run tke share price keep moving upward dan dalam masa sama the income distribution kekal kompetitif dan bayangkan juga kalau kita reinvest balik income distribution tu, your return will be compounded over time.😍

Okay itu sahaja sedikit sebanyak asas berkenaan REITs ni. Kalau ada sebarang soalan boleh hit me up by replying to this thread.

To conclude : Boleh lah kaji-kaji, mana lah tahu boleh jadi salah satu instrumen pelaburan jangka masa panjang.😬

To conclude : Boleh lah kaji-kaji, mana lah tahu boleh jadi salah satu instrumen pelaburan jangka masa panjang.😬

Ada reply menarik 'Apa risiko REITs?'

Yes pastinya ada. Contoh KLCC yang terkesan waktu pandemic. You can see here the revenue drop, share price drop dan juga income distribution drop...

Yes pastinya ada. Contoh KLCC yang terkesan waktu pandemic. You can see here the revenue drop, share price drop dan juga income distribution drop...

Macam saya cakap, sometimes mungkin ada sudut negative but AXREIT (industrial property) for example dah buktikan a very good performance from 2006.

Capital gain more than 100% dan juga income distribution yang competitive.

Capital gain more than 100% dan juga income distribution yang competitive.

Atas permintaan, saya bagi 1 case study berkenaan REIT. Boleh tengok contoh kiraan dalam gambar.

Nota :

1. Fees are not included (you may consider RM20+- for buy transaction.

2. Saya ambil kira harga dibuka pada awal Jan dan penutup hujung Dec 2020.

Nota :

1. Fees are not included (you may consider RM20+- for buy transaction.

2. Saya ambil kira harga dibuka pada awal Jan dan penutup hujung Dec 2020.

Gambar di atas hanyalah contoh dan bukan saranan jual atau pun beli mana-mana stocks ya. Saya just nak bagi you guys roughly the idea possible return yang you boleh dapat from REITs. Past performance tak menjamin future performance yang sama.🙏

To continue on this, anda boleh sambung baca thread from Dr Jabbar about his investment journey in REITs ⤵️

https://twitter.com/abd_jabbar/status/1388987285845069827?s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh