This Crunchbase report reveals 3 increasingly relevant trends in the VC industry.

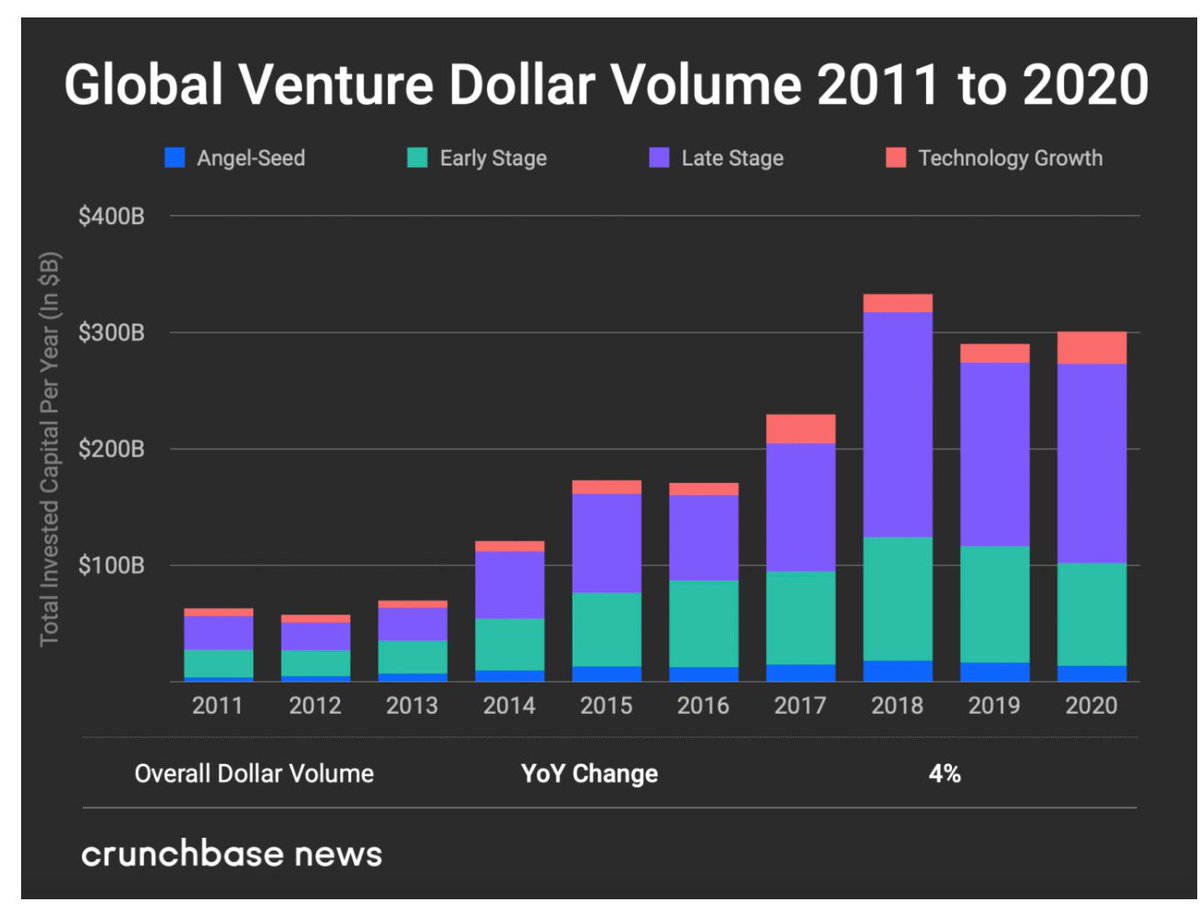

1. The amount of $ invested in startups is picking up.

2. The $ is being invested in fewer deals/Cos.

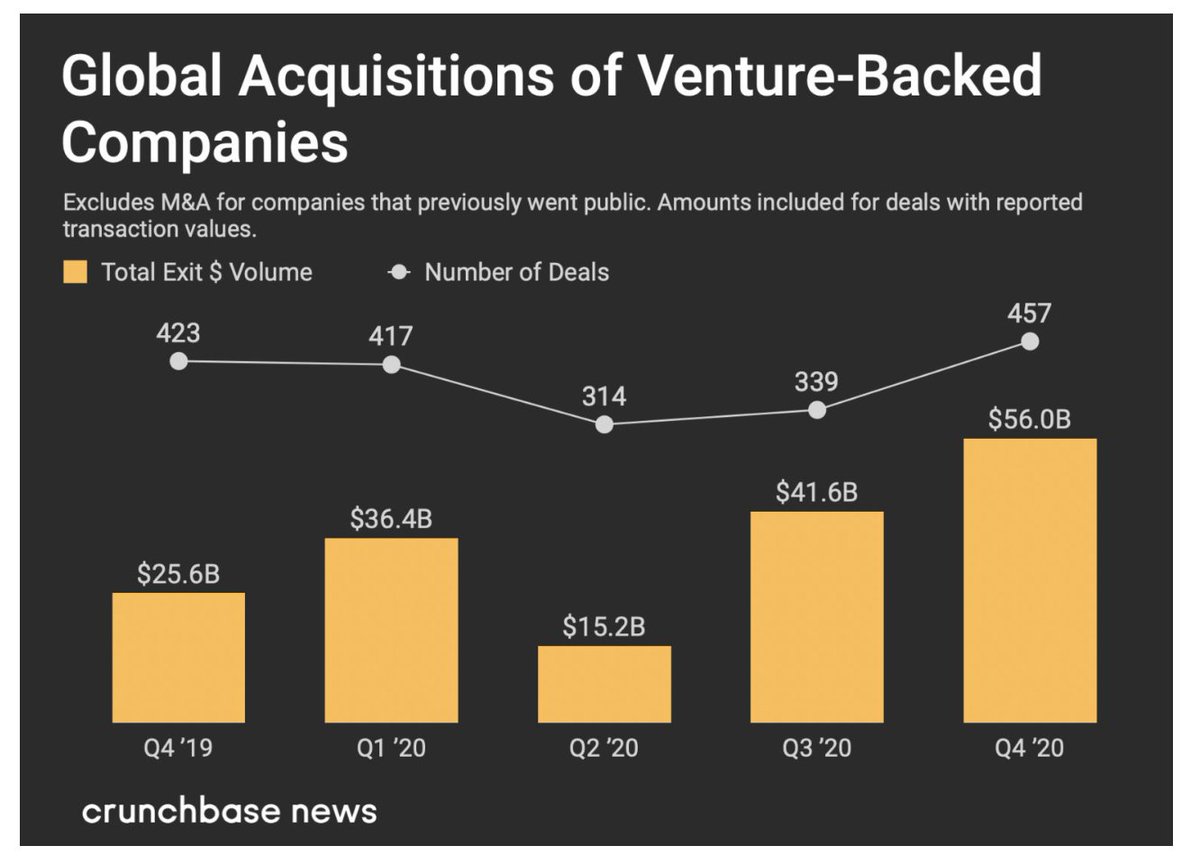

3. Acquisitions of venture-backed Cos. are skyrocketing.

(1/2)

news.crunchbase.com/news/global-20…

1. The amount of $ invested in startups is picking up.

2. The $ is being invested in fewer deals/Cos.

3. Acquisitions of venture-backed Cos. are skyrocketing.

(1/2)

news.crunchbase.com/news/global-20…

Conclusion: VC firms are raising barriers to entry for new competitors and are also promoting the concentration of markets with their aggresive, profit-seeking exit strategies.

If the SEC continues to gratuitously discriminate between accredited and non-accredited investors, these trends will continue to grow, leading to increasingly concentrated markets, i.e., worse products/services, less innovation, fewer alternatives, etc.

2/

2/

By "protecting" retail investors, the SEC is effectively contributing to the concentration of markets and the downfall of competition, hence, affecting retail investors.

• • •

Missing some Tweet in this thread? You can try to

force a refresh