We have often witnessed too many MF schemes in the Investors’ portfolio. One prominent reason for this is various NFOs that keep hitting the floor. Given how smart AMCs are in marketing stuff – Investors end up taking a pie as they don’t want to miss the opportunity. #NFO (1/n)

Before putting your money in the next NFO - Please take a pause and ask yourself:

• What value addition does this NFO provide you?

• Is there something materially different than what you already have, which would lead to better diversification? #InvestSmartly (2/n)

• What value addition does this NFO provide you?

• Is there something materially different than what you already have, which would lead to better diversification? #InvestSmartly (2/n)

More often than not, you will get the answer very loud & clear after these questions.

And if it is your advisor suggesting you apply for an NFO – ask these questions to him. #advisory (3/n)

And if it is your advisor suggesting you apply for an NFO – ask these questions to him. #advisory (3/n)

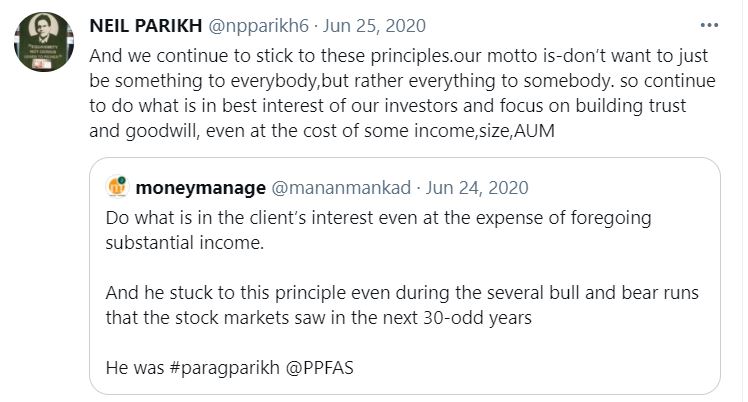

If you don’t get a satisfactory explanation – probably it’s time to revisit the decision to continue with that advisor because most likely he is keeping his personal interest above your interest. #SmartPaisa (4/4)

• • •

Missing some Tweet in this thread? You can try to

force a refresh