There are 2 types of Investors:

• Who Loves @PPFAS

• Haven't heard of PPFAS

Very few fall in b/w these 2 options.

Through this thread, we'll delve deeper into the AMC covering: Philosophies, Principles, Investment Process & many more things.

(1/n)

• Who Loves @PPFAS

• Haven't heard of PPFAS

Very few fall in b/w these 2 options.

Through this thread, we'll delve deeper into the AMC covering: Philosophies, Principles, Investment Process & many more things.

(1/n)

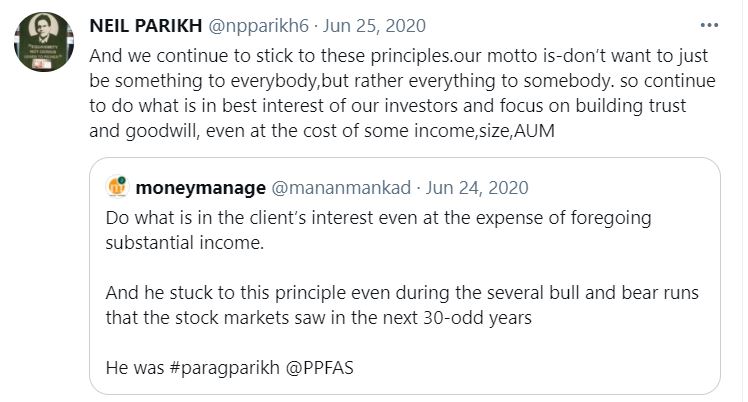

Strong Legacy of principles and investment processes set by visionary founder Lt. Mr. Parag Parikh Sir which has been taken forward to the next level by their CEO @npparikh6. They have always believed in doing the right thing, in the right way.

(2/n)

(2/n)

The clarity in thought - Think their job is to create HNIs, not to chase them. Have always focused on delivering value to the clients/Investors with a focus on the long-term performance rather than chasing momentum sectors or stocks.

Image source: May'21 factsheet

(3/n)

Image source: May'21 factsheet

(3/n)

Leaders & Innovators - Probably the only AMC to have Unitholder's meet. Genuinely believe that they are just trustees and unitholders are the true owners. They have always kept their communications very clear and transparent.

amc.ppfas.com/agm/

(4/n)

amc.ppfas.com/agm/

(4/n)

Diversification: One of the 1st AMC to invest Internationally – avoiding ‘home country bias’.

• Invest in Western Europe, North America, & Developed Asia

• Believe these regions have deep-rooted capitalism and a good track record of minority shareholder-friendly actions.

(5/n)

• Invest in Western Europe, North America, & Developed Asia

• Believe these regions have deep-rooted capitalism and a good track record of minority shareholder-friendly actions.

(5/n)

Lowering Expense Ratio - One of few AMCs to provide a roadmap to lower expense ratio. They are maintaining their competitiveness and lowering expense ratio was never just to attract more inflows.

amc.ppfas.com/media/quotes/e…

(6/n)

amc.ppfas.com/media/quotes/e…

(6/n)

Gathering AUM? Naah! Not something they believe in. Have just 4 schemes even after 8 years (incl. recently launched conservative hybrid).

3 earlier schemes:

• Flagship Flexi - 65% Dom. Invt. & Equity Taxation

• Liquid Fund - Parking ST money & STP

• ELSS - 80C Benefit

(7/n)

3 earlier schemes:

• Flagship Flexi - 65% Dom. Invt. & Equity Taxation

• Liquid Fund - Parking ST money & STP

• ELSS - 80C Benefit

(7/n)

Believe in 'Pull' marketing vs. 'Push': Have a small, dedicated team of 'RMs', whose main objective to establish a long-term relationship with the investors. Marketing efforts always stress more on communicating and not merely advertising.

amc.ppfas.com/about-us/we-ar…

(8/n)

amc.ppfas.com/about-us/we-ar…

(8/n)

Very transparent communications and actions. They disclose their financials here:

ppfas.com/about/financia…

(9/n)

ppfas.com/about/financia…

(9/n)

Fiduciary duties - Take fund management as a profession rather than merely a business. Hence, never lose sight of fiduciary duty to clients.

Have kept the same commission rates for distributors irrespective of their size to attract genuine MFDs

amc.ppfas.com/about-us/our-c…

(10/n)

Have kept the same commission rates for distributors irrespective of their size to attract genuine MFDs

amc.ppfas.com/about-us/our-c…

(10/n)

Impeccable Fund Managers with excellent academics, rich experience, and passion. You can learn from CIO @RajeevThakkar and @oraunak wisdom here:

youtube.com/c/ppfasltd/vid…

Consistent commentary - clear process for stock selection, provides immense conviction as an Investor

(11/n)

youtube.com/c/ppfasltd/vid…

Consistent commentary - clear process for stock selection, provides immense conviction as an Investor

(11/n)

Longevity - Similar to the tortoise, they stand for longevity - invest for the long term. Proven by their lowest turnover amongst 180 diversified funds.

moneycontrol.com/news/business/…

Turnover 7.03% excl. equity arbitrage as per May 2021 factsheet.

(12/n)

moneycontrol.com/news/business/…

Turnover 7.03% excl. equity arbitrage as per May 2021 factsheet.

(12/n)

As tortoise hibernates in winter, they believe in acting only when the time is ripe-Proven by high cash holdings when valuations appear frothy. A little drag due to⬆️cash can be more than overcome by buying a scrip well below its I.V. in a depressed market. Eg. COVID era

(13/n)

(13/n)

As tortoise symbolizes timelessness, the fund believes principles of sound investing are etched in stone and will not lose their relevance. They believe in investing at the right price. Few e.g:

• Nestlé SA ADR vs. Nestle India

• Suzuki Motor vs. Maruti Suzuki

• ITC

(14/n)

• Nestlé SA ADR vs. Nestle India

• Suzuki Motor vs. Maruti Suzuki

• ITC

(14/n)

Invests in world-class companies, having long-term growth prospects, operating in non-cyclical industries, run by honest and competent people, available at a reasonable price. Applies behavioral finance to identify any mispricing in the stocks.

(15/n)

(15/n)

Concentrated portfolio of ~25 stocks (will increase to 30 as per May'21 factsheet).

• Speaks of their conviction on the selection

• Followed basket approach in pharma where they wanted exposure in the beaten-down sector but not sure about the company due to FDA issues

(16/n)

• Speaks of their conviction on the selection

• Followed basket approach in pharma where they wanted exposure in the beaten-down sector but not sure about the company due to FDA issues

(16/n)

SEBI's new rule of Skin in the game is not new to them. They think the “only way to instill a sense of accountability is to ensure that the FM team is investing their own monies along with clients”.

M.V of Insider's holding in Flexi =~214cr

amc.ppfas.com/schemes/disclo…

(17/n)

M.V of Insider's holding in Flexi =~214cr

amc.ppfas.com/schemes/disclo…

(17/n)

Performances: Have always been very consistent in generating superior returns with lesser volatility across the market cycles. Numbers speak in themselves. Look at these statistics: (Source: Morningstar). No surprise they feature in the top quartile consistently

(18/n)

(18/n)

Baba Ranchod Das keh gaye "Returns ke peeche mat bhaago, process ka peecha karo, returns jhak maarke tumhare peeche ayegi".

Select fund/schemes that are well managed, have strong processes, transparent, and consistent not just in their commentary but actions as well.

(19/n)

Select fund/schemes that are well managed, have strong processes, transparent, and consistent not just in their commentary but actions as well.

(19/n)

We tried to explain things that you should look around while selecting a scheme. Obviously, this is not an exhaustive list - there are various other aspects but remember one thing - there is no best scheme ever. You would never come across "Sarv Gunn Sampann' scheme.

(20/n)

(20/n)

Look for good funds, that match your investment profile and stick to the schemes rather than moving in and out of the funds. Stay invested in good schemes for the long-term and then see the magic of compounding working in your favor.

(21/n)

(21/n)

IMO, PPFAS Flexi should definitely form part of the Investor's core portfolio. No surprise that PPFAS gets appreciation from various Industry stalwarts like @iRadhikaGupta and has a huge fan following.

(22/n)

(22/n)

https://twitter.com/iRadhikaGupta/status/1357697654940069889?s=20

If you liked the thread, pls do retweet to help us educate more investors.

#SmartPaisa #personalfinance

Tagging @contrarianEPS @TheMFGuy1 @dmuthuk @invest_mutual @KirtanShahCFP for greater reach

(23/23)

#SmartPaisa #personalfinance

Tagging @contrarianEPS @TheMFGuy1 @dmuthuk @invest_mutual @KirtanShahCFP for greater reach

(23/23)

• • •

Missing some Tweet in this thread? You can try to

force a refresh