#marketupdate, IMO from on-chain is sideways then bullish in maybe a week or so.

Some downside risk if stonks tank, a lot of rallying in the DXY (USD strength) which is typical of money moving to safety.

Some downside risk if stonks tank, a lot of rallying in the DXY (USD strength) which is typical of money moving to safety.

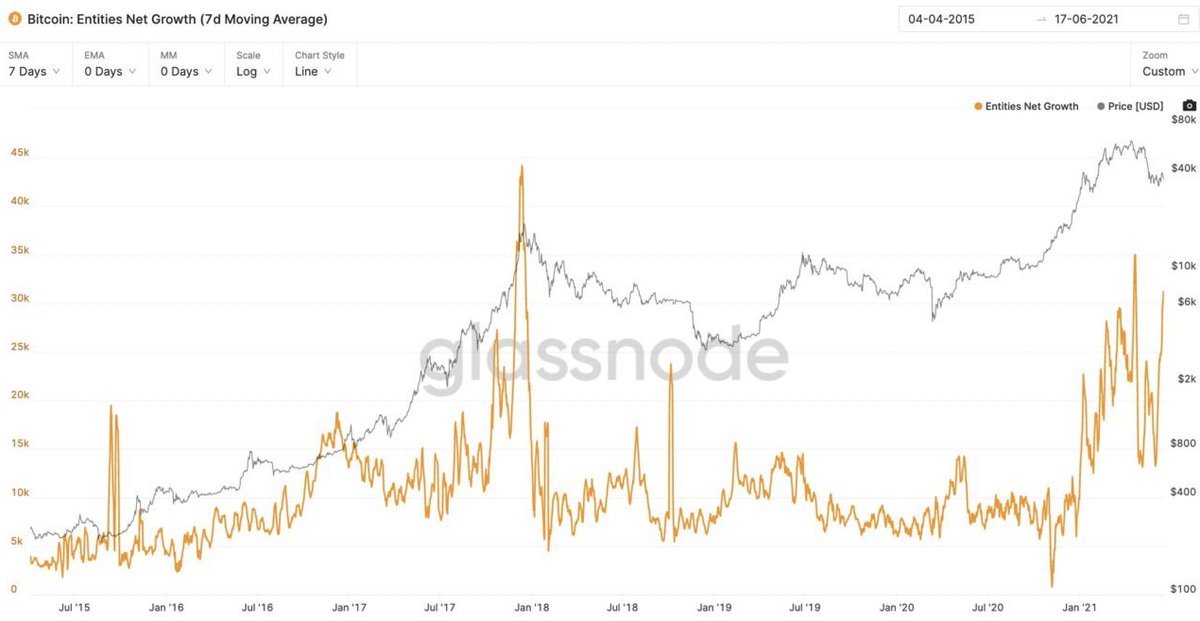

The first thing to look at is to answer "are we in a bear market". Welp, bear markets start when no new buyers enter to support price and that aint happening, we have healthy growth of new users joining the network.

Let this frame all other metrics.

Let this frame all other metrics.

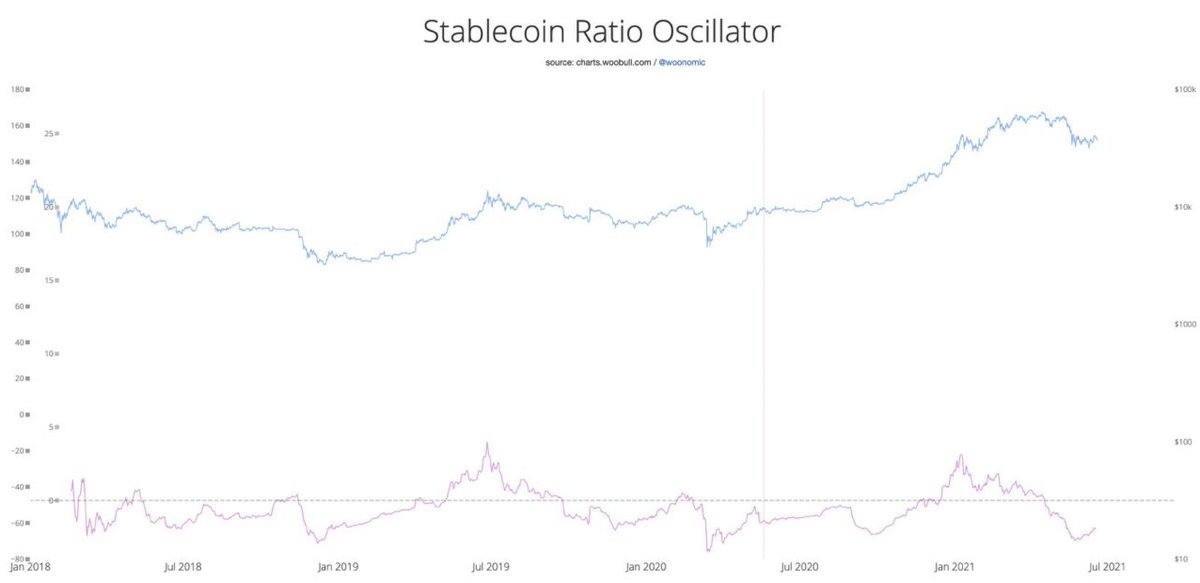

Of primary interest is capital rotation from stablecoins back into the crypto markets (I'll say that's mainly BTC since alt coins are reducing in dominance).

All of that dry powder sitting on the sidelines has started flowing back in.

All of that dry powder sitting on the sidelines has started flowing back in.

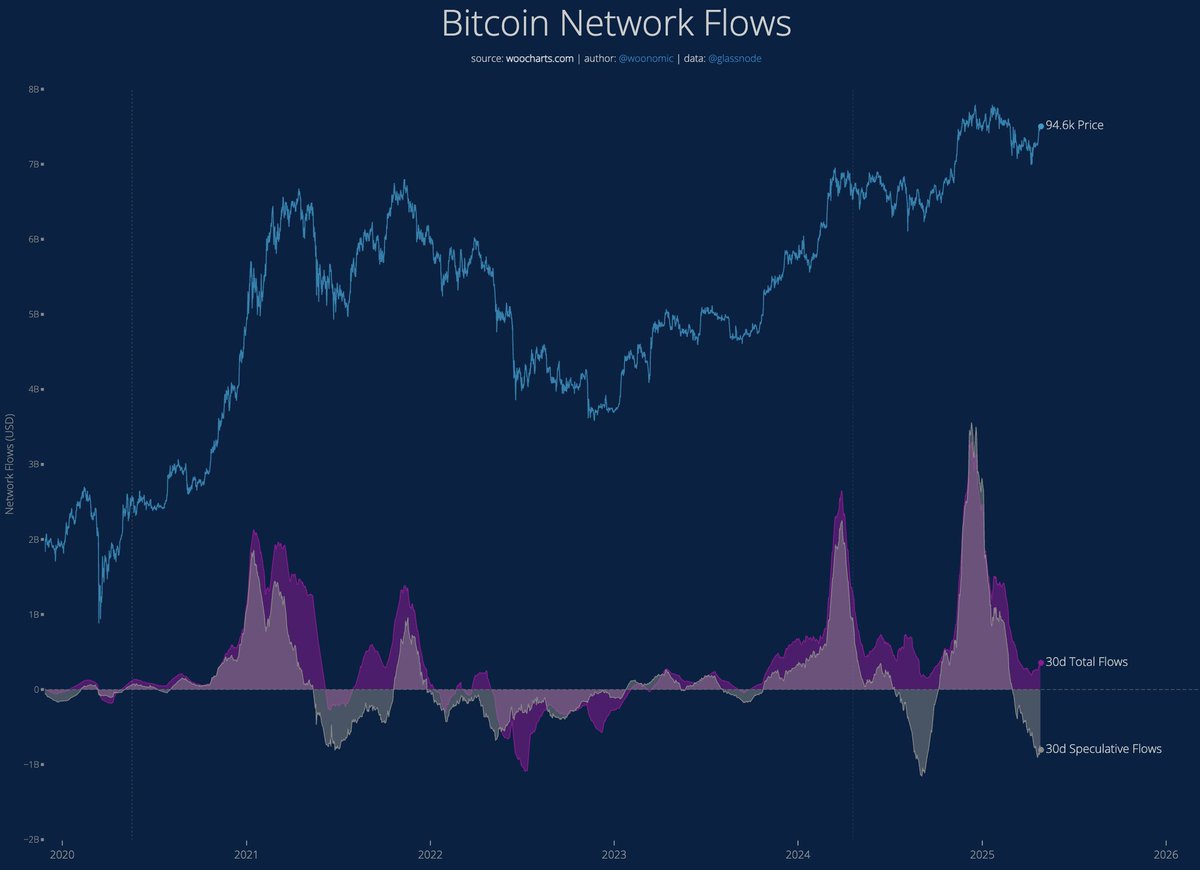

We had a huge sell off by previously strong hands (looks like noob buyers that bought 1m - 6m ago). All of those coins that dumped onto the market needs time to be re-accumulated, this is happening now.

Price action looks like an accumulation bottom because of this.

Price action looks like an accumulation bottom because of this.

Exchange flows (2 week = solid red, 1 week = dotted red) showing that buying is happening but not yet at an exaggerated pace, so likely we have some time to burn before upward price action can launch.

So now let's look at some short range indicators...

If you know we are in a bear market (which we know is the case from user growth metrics) then SOPR resets near 1.0 is a great time to buy the dip.

If you know we are in a bear market (which we know is the case from user growth metrics) then SOPR resets near 1.0 is a great time to buy the dip.

Using NVT to value the network, we are statistically oversold from fundamentals at historic levels.

Note we were devoid of a mania top before the sell-off. This sell-off happened when price was well within fair value. So it doesn't match the start of bear season.

Note we were devoid of a mania top before the sell-off. This sell-off happened when price was well within fair value. So it doesn't match the start of bear season.

My only concern for downside risk is if we get a major correction in equities which will pull BTC price downwards no matter what the on-chain fundamentals may suggest.

Noticing USD strength on the DXY, which suggest some investors moving to safety in the USD.

Noticing USD strength on the DXY, which suggest some investors moving to safety in the USD.

Raw on-chain data for this analysis is from @glassnode

• • •

Missing some Tweet in this thread? You can try to

force a refresh