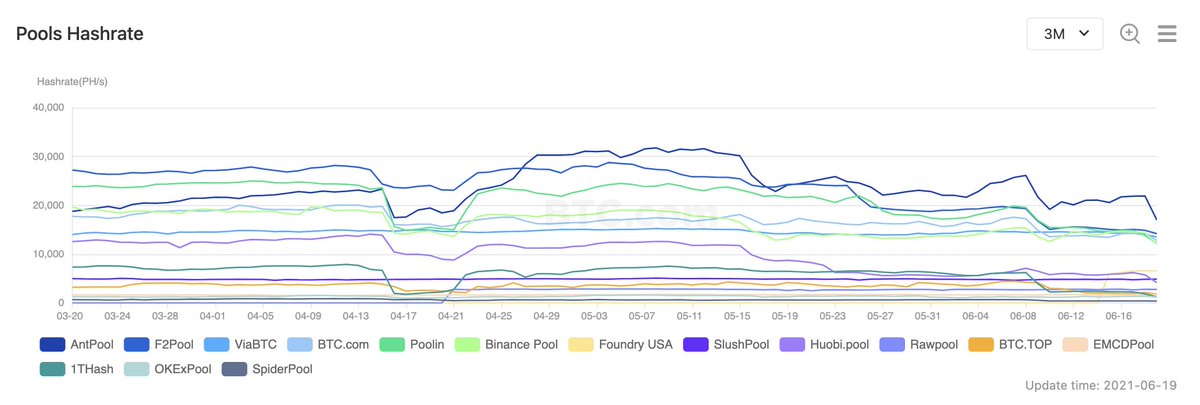

1/ the #Bitcoin network is a complex, dynamic ecosytem, and the latest changes to the distribution of the network are interesting, but not unpredecented

let's look at the data - here is how market share has evolved over the last three months

let's look at the data - here is how market share has evolved over the last three months

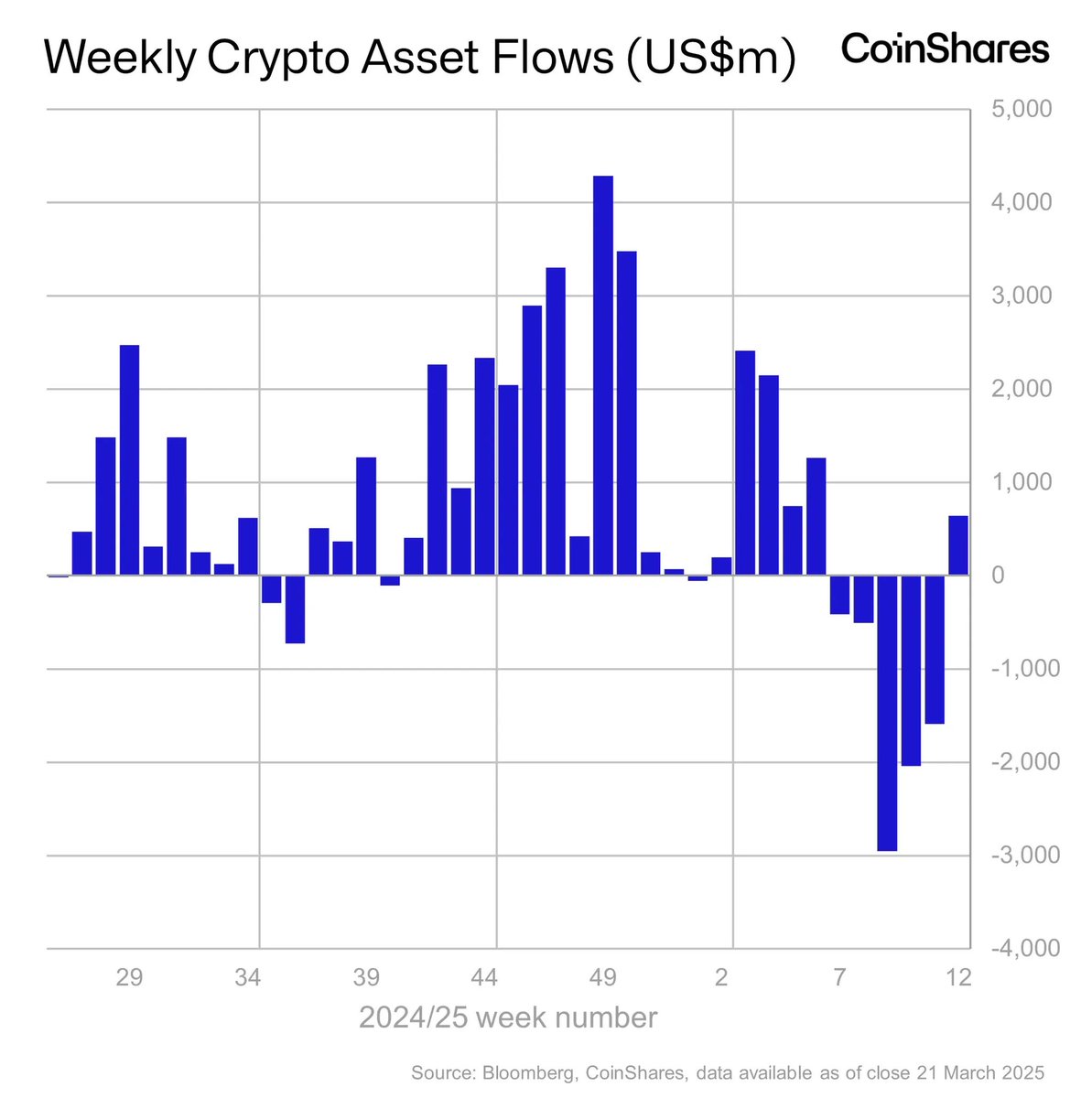

2/ total hash rate on the network fluctuates in response to a number of factors including the cost and availability of ASICs (capex), the cost and availability of power (opex), and the price of bitcoin

looking at the last six months, we've seen a lot of volatility in global hash

looking at the last six months, we've seen a lot of volatility in global hash

3/ the size and rate of this decrease is consistent with other previous drops. migratory mining has been a trend for the last 3-4 years!

long-term, hash rate will respond to these variables and seek jurisdictions where there is clear, consistent policy and ample renewable energy

long-term, hash rate will respond to these variables and seek jurisdictions where there is clear, consistent policy and ample renewable energy

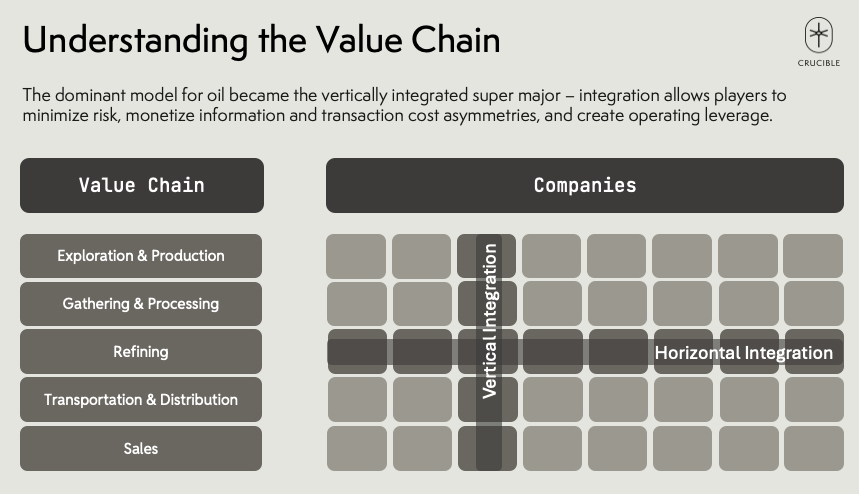

4/ the bitcoin network is a highly specialized global compute network. we are entering a new era of geopolitics that will be shaped not by energy commodities, but by compute commodities.

the political, social, and economic implications are profound.

the political, social, and economic implications are profound.

5/ financial compute will be especially important in defining new global power structures

nation states who recognize this will integrate bitcoin and other financial compute networks into their military industrial complex

the next decade will define the winner and losers

nation states who recognize this will integrate bitcoin and other financial compute networks into their military industrial complex

the next decade will define the winner and losers

6/ as an investor, i'm long this new era of infrastructure investing built around a global, digital, interconnected marketplace built on open-source protocols

this is just the beginning of a much longer narrative arc

i explain this here:

this is just the beginning of a much longer narrative arc

i explain this here:

7/ as these dynamics play out and the bitcoin network evolves, don't look at what governments say, look at what they *do*

iceland, khazakstan, el salvador, and other nation states are working to attract hash rate.

the US hasn't made up its mind, yet... but the prize is big

iceland, khazakstan, el salvador, and other nation states are working to attract hash rate.

the US hasn't made up its mind, yet... but the prize is big

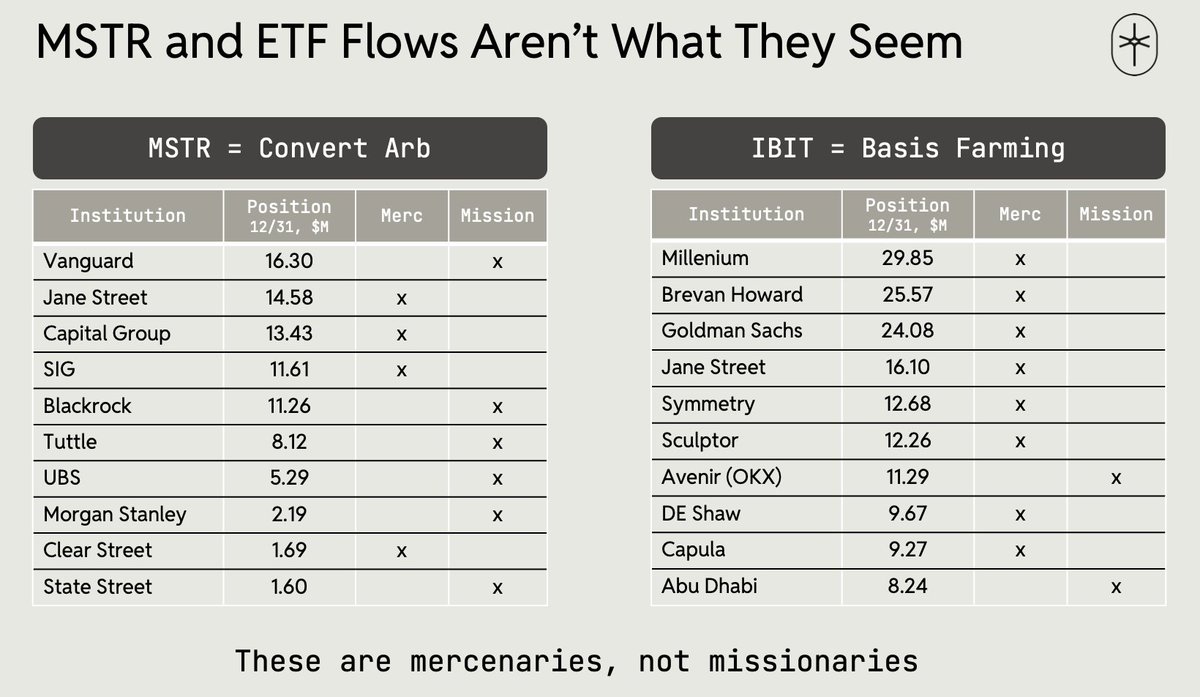

8/ there's a tremendous amount of private capital that's going to be deployed in the US over the coming weeks and months - over $1B in new facilities from my sources

but it's naïve to presume north american mining will be the winner here

the world is a very big place 🌎

but it's naïve to presume north american mining will be the winner here

the world is a very big place 🌎

• • •

Missing some Tweet in this thread? You can try to

force a refresh