Regardless of price action everyone should be focused on Tether as I have been discussing.

This is a very important variable and things are getting very real now.

Who is up for a story?

This is a very important variable and things are getting very real now.

Who is up for a story?

I would like to kickstart this story with this scene:

Please watch first:

Please watch first:

Let's start,

according to its website, Tether is incorporated out of Hong Kong and has 13 employees according to its Linkedin.

Tether is amongst the global giants (Vanguard and BlackRock) in the commercial paper market.

according to its website, Tether is incorporated out of Hong Kong and has 13 employees according to its Linkedin.

Tether is amongst the global giants (Vanguard and BlackRock) in the commercial paper market.

Throughout its history, Tether has touted itself as a "Stablecoin.

This Stablecoin is designed as such:

1 USDT = 1 US dollar

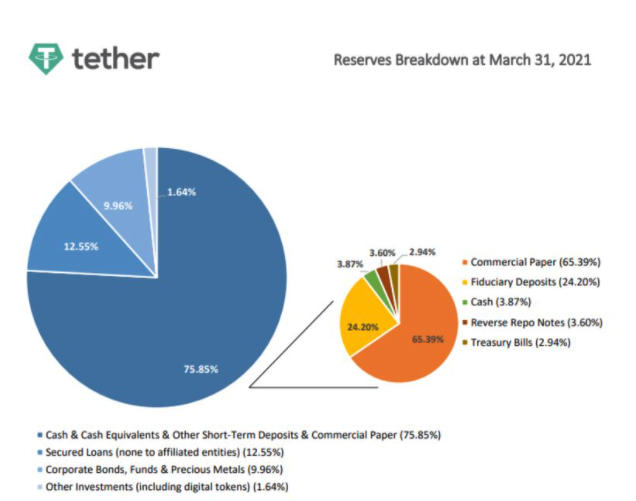

However, according to disclosure, it is only backed by ~3.87% = cash, which out of 75.85% = 2.9%

Vital piece of plumbing = for global crypto market.

This Stablecoin is designed as such:

1 USDT = 1 US dollar

However, according to disclosure, it is only backed by ~3.87% = cash, which out of 75.85% = 2.9%

Vital piece of plumbing = for global crypto market.

Why is Tether (#USDT) a vital piece of plumbing for the global cryptocurrency market?

This is because traders capture arbitrage for when a bank wire is unavailable or not fast enough.

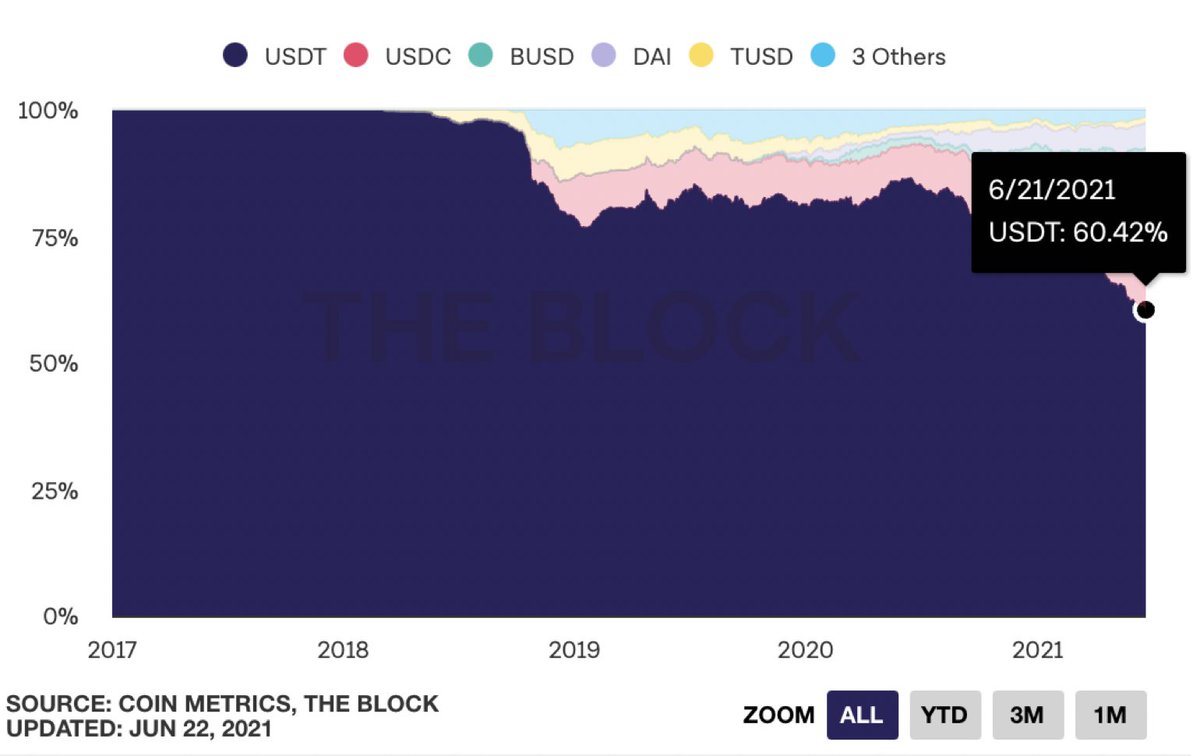

As of right now, over 60% of Stablecoins in the world are USDT.

This is because traders capture arbitrage for when a bank wire is unavailable or not fast enough.

As of right now, over 60% of Stablecoins in the world are USDT.

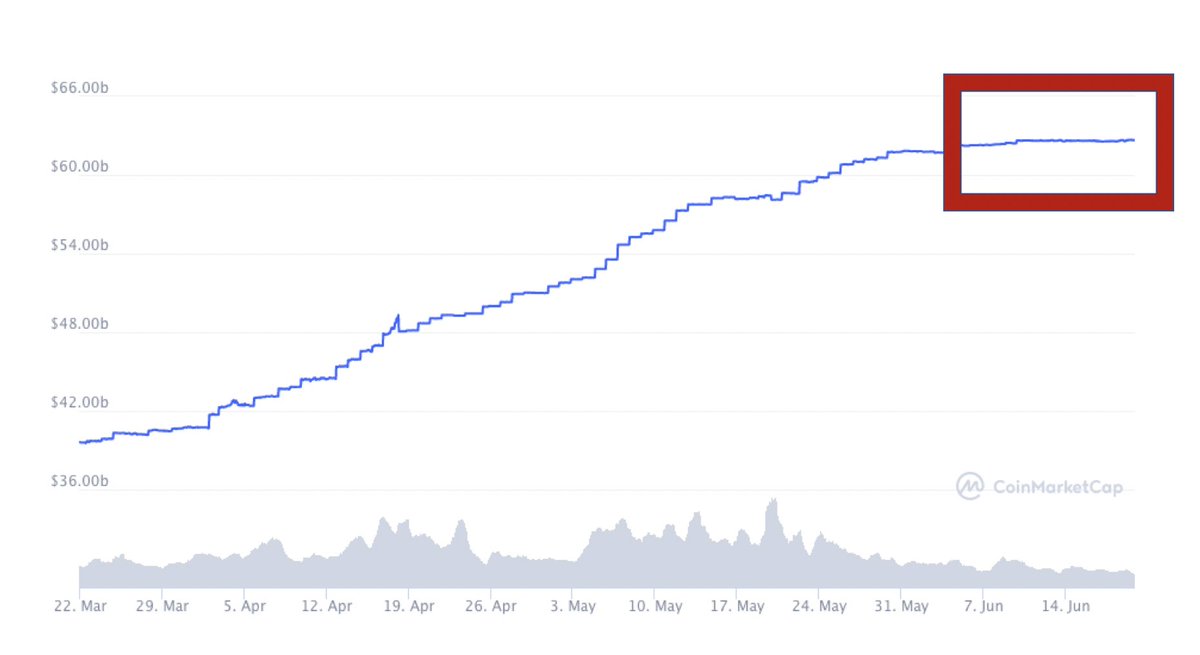

Tether is the third-largest cryptocurrency in the world, with a market cap of $62 billion, which is behind:

1: Bitcoin

2: Ethereum

Interestingly, I have noticed since the beginning of June no new #USDT has been minted.

Velocity is down, yes. But the "why" could be big...

1: Bitcoin

2: Ethereum

Interestingly, I have noticed since the beginning of June no new #USDT has been minted.

Velocity is down, yes. But the "why" could be big...

Next,

Tether is heavily concentrated in terms of ownership. But I will not make everyone bored from ranting about that

I will now showcase why the world's largest exchange, Binance, is strongly interlinked with Tether, and why IMO represents a MAJOR potential liquidity problem

Tether is heavily concentrated in terms of ownership. But I will not make everyone bored from ranting about that

I will now showcase why the world's largest exchange, Binance, is strongly interlinked with Tether, and why IMO represents a MAJOR potential liquidity problem

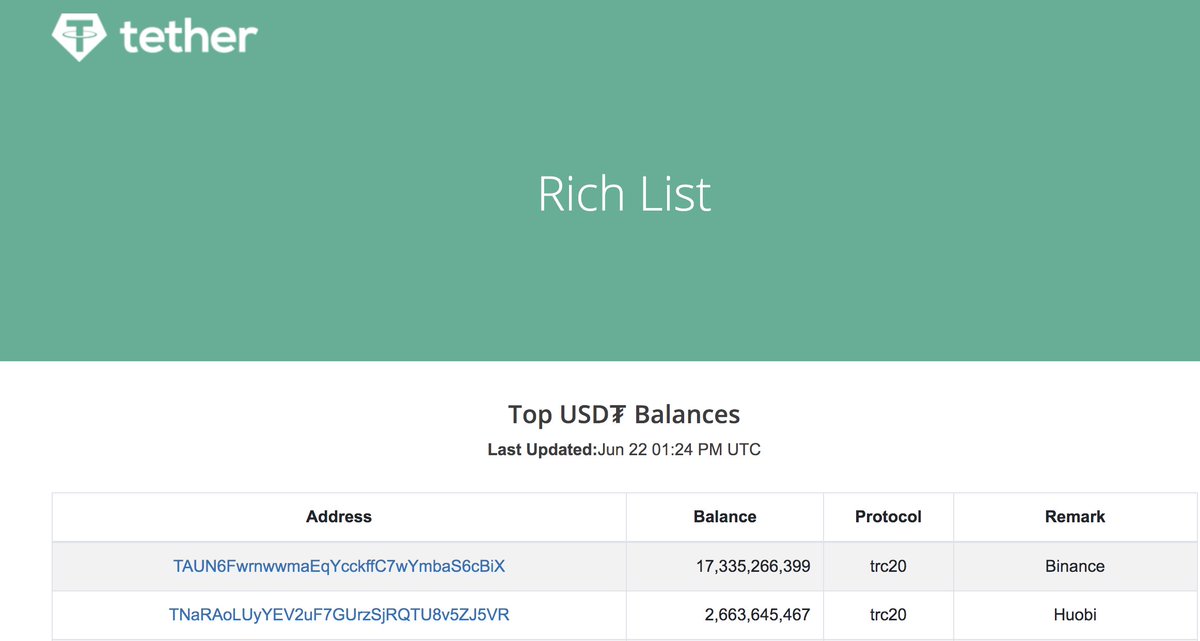

Tether enables everyone to keep track of the wealthiest Tether wallets holding the most USDT via the Tether Ritchlist. wallet.tether.to/richlist

Currently:

1) Binance

2) Huobi

Are the leaders.

Both companies were founded in China.

Currently:

1) Binance

2) Huobi

Are the leaders.

Both companies were founded in China.

This loops back to to the 2.9% cash backing of this alleged 1:1 backed "stablecoin"

What really backs these reserves is U.S commercial paper. (half of its reserves)

In fact, disclosures show that its holdings of companies short-term debt make it the 7th largest in the world.

What really backs these reserves is U.S commercial paper. (half of its reserves)

In fact, disclosures show that its holdings of companies short-term debt make it the 7th largest in the world.

Nobody knows the specific commercial paper holdings due to its lack of transparency and lack of regulation.

This further validates why a product such as this offering poses a risk to the crypto space but most importantly could trigger an major event within the financial system.

This further validates why a product such as this offering poses a risk to the crypto space but most importantly could trigger an major event within the financial system.

Tether is the most-traded digital asset on this planet.

But do you the majority of its users care about its actual reserves? Absolutely not.

What would they do if they found out billions held by exchanges led by Binance are not worth an equivalent in USD?

Time to turn it up:

But do you the majority of its users care about its actual reserves? Absolutely not.

What would they do if they found out billions held by exchanges led by Binance are not worth an equivalent in USD?

Time to turn it up:

First:

In my opinion, the unregulated nature of Tether is another WHY reason exchanges love it so much.

Why?

Fewer dealings with regulated banks.

Remember... Binance offers 125x leverage for some future contracts.

In my opinion, the unregulated nature of Tether is another WHY reason exchanges love it so much.

Why?

Fewer dealings with regulated banks.

Remember... Binance offers 125x leverage for some future contracts.

https://twitter.com/GoldTelegraph_/status/1386101036037943296

Now, ladies and gentlemen, I will document things I have already reported but to centralize everything in 1 place so you can see what I see

The trend is clear

1. All eyes are on the worlds biggest crypto exchange, Binance

2. Eyes on Tether

Is the cut-off starting? You judge:

The trend is clear

1. All eyes are on the worlds biggest crypto exchange, Binance

2. Eyes on Tether

Is the cut-off starting? You judge:

As announced yesterday...

Strike, the startup building a bitcoin-based payment system in El Salvador, is phasing out its use of Tether...

Strike, the startup building a bitcoin-based payment system in El Salvador, is phasing out its use of Tether...

https://twitter.com/GoldTelegraph_/status/1407127422068211713

TSB recently banned more than 5 million customers from buying cryptocurrencies...

Why?

"Fraud fears"

What exchange was included?

Binance.

Why?

"Fraud fears"

What exchange was included?

Binance.

https://twitter.com/GoldTelegraph_/status/1406257621636689926

India is currently investigating one of the countries largest crypto exchanges... WazirX.

This exchange is owned by Binance.

This exchange is owned by Binance.

https://twitter.com/GoldTelegraph_/status/1403415522893512704

India investigation into Binance:

"It was seen that the accused Chinese nationals had laundered proceeds of crime worth Rs 57 crore approximately by converting the INR deposits into cryptocurrency Tether and then transferring the same to Binance wallets"

coinmarketcap.com/zh/headlines/n…

"It was seen that the accused Chinese nationals had laundered proceeds of crime worth Rs 57 crore approximately by converting the INR deposits into cryptocurrency Tether and then transferring the same to Binance wallets"

coinmarketcap.com/zh/headlines/n…

Silvergate Bank, one of the few financial institutions serving cryptocurrency firms, will stop processing U.S. dollar deposits and withdrawals for exchange giant Binance:

finance.yahoo.com/news/silvergat…

finance.yahoo.com/news/silvergat…

Wei Zhou, the chief finance officer at Binance, has left the company after 3 years.

Date: June 9th.

coindesk.com/binances-chief…

Date: June 9th.

coindesk.com/binances-chief…

In late April, Germany's financial watchdog has warned investors that Binance, has probably violated securities rules over its launch of trading in stock tokens:

ft.com/content/f52826…

ft.com/content/f52826…

Now... central banks are intensifying things by looking to go after "Stablecoins" and bring in regulations similar as the banking system:

BoE says ‘stablecoin’ payments need same rules as banks

reuters.com/business/finan…

BoE says ‘stablecoin’ payments need same rules as banks

reuters.com/business/finan…

It is important to remember:

About 55% of all Bitcoin purchases are conducted with Tether according to researcher CryptoCompare.

This is a very important statistic.

About 55% of all Bitcoin purchases are conducted with Tether according to researcher CryptoCompare.

This is a very important statistic.

To reiterate the Bank of England... the Federal Reserve recently touched on the risks of Stablecoins:

Stablecoins driven by Tether is clearly the weak link of the ENTIRE cryptocurrency ecosystem driven by its centralized unregulated nature.

Stablecoins driven by Tether is clearly the weak link of the ENTIRE cryptocurrency ecosystem driven by its centralized unregulated nature.

https://twitter.com/GoldTelegraph_/status/1407139780454985750

I will end the story with this chart.

Since the start of June... Tether's supply has not grown.

Speculate accordingly.

Since the start of June... Tether's supply has not grown.

Speculate accordingly.

• • •

Missing some Tweet in this thread? You can try to

force a refresh