I own 7 stocks that are 15+ baggers (and counting)

Here are 10 traits they all have in common:

Here are 10 traits they all have in common:

The data:

Stock / # of bags / purchase year:

$AMZN / 15+ / 2010

$FB / 15+ / 2012

$GOOG / 15+ / 2009

$MELI / 15+ / 2011

$CMG / 20+ / 2012

$NFLX / 60+ / 2010

$TSLA / 60+ / 2012

Stock / # of bags / purchase year:

$AMZN / 15+ / 2010

$FB / 15+ / 2012

$GOOG / 15+ / 2009

$MELI / 15+ / 2011

$CMG / 20+ / 2012

$NFLX / 60+ / 2010

$TSLA / 60+ / 2012

1: Founder-led

$AMZN - Bezos

$CMG - Ells

$FB- Zuck

$GOOG - Page

$MELI- Galperin

$NFLX - Hastings

$TSLA - Musk

Founders tend to be:

+Detail oriented

+Innovative

+Mission driven

+Think long-term

+Have skin/soul in the game

Look for founders!

$AMZN - Bezos

$CMG - Ells

$FB- Zuck

$GOOG - Page

$MELI- Galperin

$NFLX - Hastings

$TSLA - Musk

Founders tend to be:

+Detail oriented

+Innovative

+Mission driven

+Think long-term

+Have skin/soul in the game

Look for founders!

2: Consumer-facing

All of these companies attract millions/billions of consumers

This eliminates customer concentration risk and enables long-term brand building

All of these companies attract millions/billions of consumers

This eliminates customer concentration risk and enables long-term brand building

3: High sales growth

All of these companies were growing revenue 20%+ BEFORE I bought them

Sales growth is the engine that drives profit growth

Profit growth is the engine that drives stock appreciation

Find companies that can grow sales 20%+ for decades

All of these companies were growing revenue 20%+ BEFORE I bought them

Sales growth is the engine that drives profit growth

Profit growth is the engine that drives stock appreciation

Find companies that can grow sales 20%+ for decades

4: Word of mouth advertising

The best advertising is no advertising

Invest in companies that make products/services that are so good that their customers do all the marketing

The best advertising is no advertising

Invest in companies that make products/services that are so good that their customers do all the marketing

5: Category Mindshare

▪️Name an electric car company

▪️Name a search engine

▪️Name a streaming service

The odds are good that you said Tesla, Google, Netflix

Find companies that grab all of the mindshare in an important, emerging market

▪️Name an electric car company

▪️Name a search engine

▪️Name a streaming service

The odds are good that you said Tesla, Google, Netflix

Find companies that grab all of the mindshare in an important, emerging market

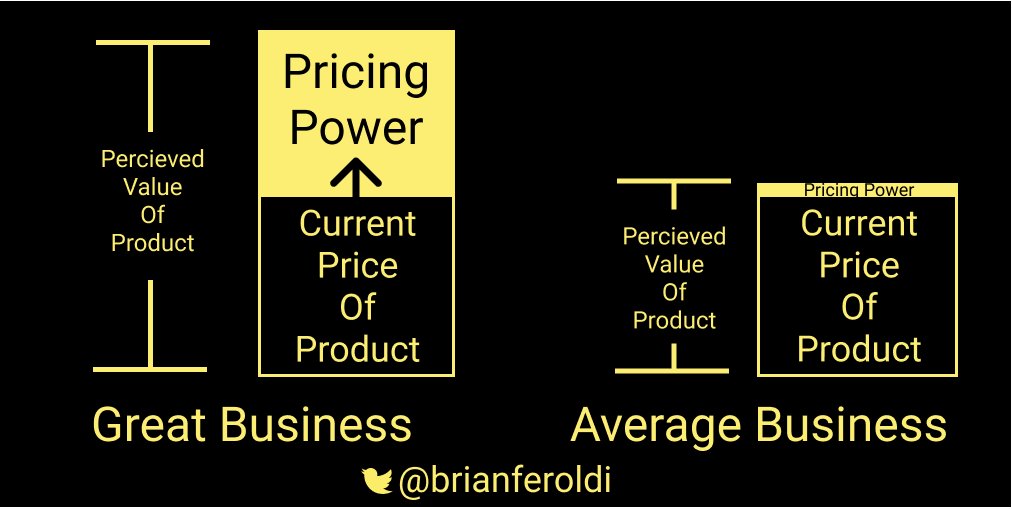

6: Pricing Power

▪️If $AMZN raised prices, would you notice?

▪️If $CMG raised prices, would you notice?

▪️If $NFLX raised prices, would you cancel?

Find companies that create so much value that they can raise prices and not lose customers

▪️If $AMZN raised prices, would you notice?

▪️If $CMG raised prices, would you notice?

▪️If $NFLX raised prices, would you cancel?

Find companies that create so much value that they can raise prices and not lose customers

7: Optionality

$AMZN Bookseller ➡️ AWS / Everything Store

$MELI eBay of Latin America ➡️ PayPal of LatAm

$NFLX DVD-by-mail ➡️ Streaming

$TSLA Sports cars ➡️ Energy Storage

Look for companies with innovation & experimentation built into their DNA

$AMZN Bookseller ➡️ AWS / Everything Store

$MELI eBay of Latin America ➡️ PayPal of LatAm

$NFLX DVD-by-mail ➡️ Streaming

$TSLA Sports cars ➡️ Energy Storage

Look for companies with innovation & experimentation built into their DNA

8: Massive opportunity

▪️Facebook wants to connect the world

▪️Netflix wants to entertain the world

▪️Tesla wants the world to switch to sustainable transport

All of these opportunities are measured in the hundreds of billions (if not trillions)

▪️Facebook wants to connect the world

▪️Netflix wants to entertain the world

▪️Tesla wants the world to switch to sustainable transport

All of these opportunities are measured in the hundreds of billions (if not trillions)

9: Widening Moat

All of these companies widened their moat over time

Moat sources:

▪️Network Effect

▪️Switching Costs

▪️Low-cost production

▪️Brand

Look for companies that are building a lasting competitive advantage

All of these companies widened their moat over time

Moat sources:

▪️Network Effect

▪️Switching Costs

▪️Low-cost production

▪️Brand

Look for companies that are building a lasting competitive advantage

10: Distinctive cultures

▪️ $NFLX 125-slide culture presentation

▪️ $TSLA attracts people who believe deeply in Tesla’s mission

▪️ $AMZN culture celebrates experimentation

Great cultures attract great employees

Find cultures that stand out!

▪️ $NFLX 125-slide culture presentation

▪️ $TSLA attracts people who believe deeply in Tesla’s mission

▪️ $AMZN culture celebrates experimentation

Great cultures attract great employees

Find cultures that stand out!

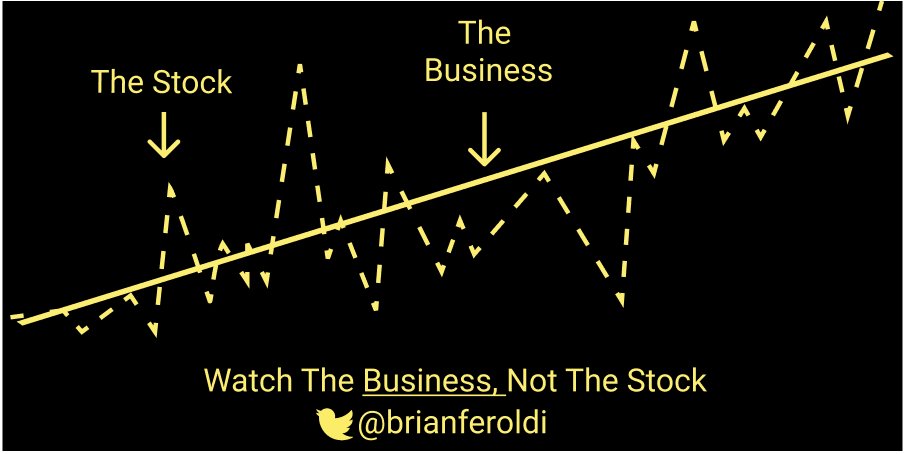

Important:

To earn multi-bagger returns I had to hold through:

▪️50%+ declines

▪️Short-seller reports

▪️Public Relations fiascos

If my behavior was wrong, I wouldn’t have earned multi-baggers

This is why I always:

To earn multi-bagger returns I had to hold through:

▪️50%+ declines

▪️Short-seller reports

▪️Public Relations fiascos

If my behavior was wrong, I wouldn’t have earned multi-baggers

This is why I always:

Interestingly, aside from $MELI, none of these stocks were “hidden”

I had heard of:

▪️Amazon

▪️Chipotle

▪️Facebook

▪️Google

▪️Netflix

▪️Tesla

YEARS before I became a shareholder

Sometimes, great investments are obvious

I had heard of:

▪️Amazon

▪️Chipotle

▪️Netflix

▪️Tesla

YEARS before I became a shareholder

Sometimes, great investments are obvious

What company checks all of these boxes today?

One idea: Peloton $PTON

(All the details can be found in my most recent YouTube video)

youtube.com/brianferoldiyt

One idea: Peloton $PTON

(All the details can be found in my most recent YouTube video)

youtube.com/brianferoldiyt

Want to screen for these traits?

All of them are covered in my investing checklist

You can download a free copy of it here: gum.co/zWXye

All of them are covered in my investing checklist

You can download a free copy of it here: gum.co/zWXye

Enjoy this thread?

Follow me @brianferoldi

You may enjoy all of my other threads on money, investing, & self-improvement

Follow me @brianferoldi

You may enjoy all of my other threads on money, investing, & self-improvement

https://twitter.com/BrianFeroldi/status/1386309937597321218?s=20

Summary:

1: Founder-led

2: Consumer-facing

3: High sales growth

4: Word of mouth

5: Mindshare

6: Pricing Power

7: Optionality

8: Huge TAM

9: Widening Moat

10: Distinctive cultures

1: Founder-led

2: Consumer-facing

3: High sales growth

4: Word of mouth

5: Mindshare

6: Pricing Power

7: Optionality

8: Huge TAM

9: Widening Moat

10: Distinctive cultures

• • •

Missing some Tweet in this thread? You can try to

force a refresh