1/ Random thread inspired by an antiquated credit union:

A family member had their primary checking account closed by a credit union for using PayPal. The CU said they "don't allow PayPal transactions."

The struggles of small banks are sometimes self-induced.

A family member had their primary checking account closed by a credit union for using PayPal. The CU said they "don't allow PayPal transactions."

The struggles of small banks are sometimes self-induced.

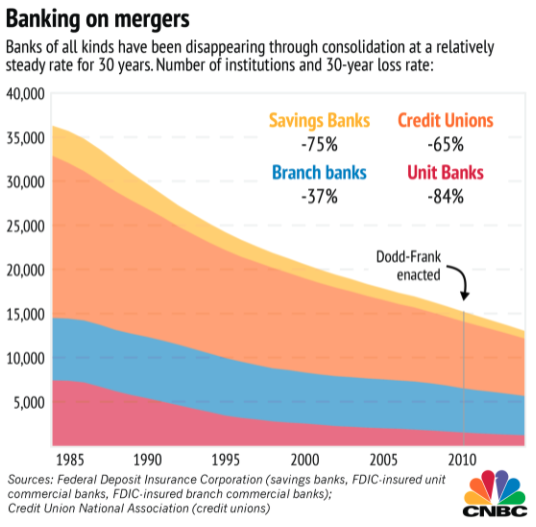

2/ Conventional wisdom in DC is that the shrinking number of comm banks and credit unions (via M&A) is bad, with the GOP blaming Obama-era regulations, and Dems using it to justify small bank regulatory exemptions.

3/ The loss of rural bank branches, and urban banking deserts, are undoubtedly problematic. There needs to be a solution that ensures financial inclusion for vulnerable Americans.

4/ But in 2021, the solution for most Americans isn't more brick and mortar locations. The solution is digital. 85% of Americans have smartphones, 97% have a cellphone of some kind.

5/ Look at M Pesa in Kenya - 96% (!) of households now have a mobile money account. vox.com/future-perfect…

6/ In the US, the community banks and credit unions, with their grassroots membership in every congressional district, have significant control over the financial policy agenda in DC.

7/ Instead of embracing innovation and competition from digital players, like policymakers in most other high-income countries, I fear the political incentives in the US result in anti-innovation policymaking.

8/ This is self-defeating at times for a number of stakeholders, who are missing the forest for the trees.

https://twitter.com/JonahCrane/status/1408233592120033281?s=20

9/ The US is a global leader on financial technology innovation with its talent, tech, and capital, but I worry our country is resting on its laurels and squandering its advantage as govts around the world aggressively embrace innovation and competition.

10/ Too big to fail won't be solved by a bill with minimal support. It'll be solved through competition from new entrants.

Similarly, overdraft fees aren't going away bc of CFPB regs (which I support!), they're going away bc of competition. Same with intl fx hidden fees.

Similarly, overdraft fees aren't going away bc of CFPB regs (which I support!), they're going away bc of competition. Same with intl fx hidden fees.

11/ It's not the 1950s. Brick and mortar banks aren't coming back. Whether it's 2k, 5k, or 10k small banks, that's not the source of competition in financial sector anymore.

The US needs to embrace digital financial innovation to improve financial inclusion and access.

The US needs to embrace digital financial innovation to improve financial inclusion and access.

FYI @mikulaja and @regulatorynerd to your policy-related comments earlier this week on under-discussed fintech trends.

• • •

Missing some Tweet in this thread? You can try to

force a refresh