A Mega thread on #Angelbroking.

@NeilBahal @sahil_vi

@Amit_Jeswani1

Old age broking company getting transformed into digital native, cloud first , open architecture #fintech broker.

They started thier modernization journey in 2016 and now have total 5 million clients.

@NeilBahal @sahil_vi

@Amit_Jeswani1

Old age broking company getting transformed into digital native, cloud first , open architecture #fintech broker.

They started thier modernization journey in 2016 and now have total 5 million clients.

They have approx 1.8 million Active clients on nse(3rd), #zerodha is clear leader with 4 million active clients and upstox with 2.8 million active clients.

In last 6 months #upstox has grown at ferocious pace and has ambition to have 6 million active clients by end of FY22.

In last 6 months #upstox has grown at ferocious pace and has ambition to have 6 million active clients by end of FY22.

Active clients is good indicator but doesn't capture whole picture.

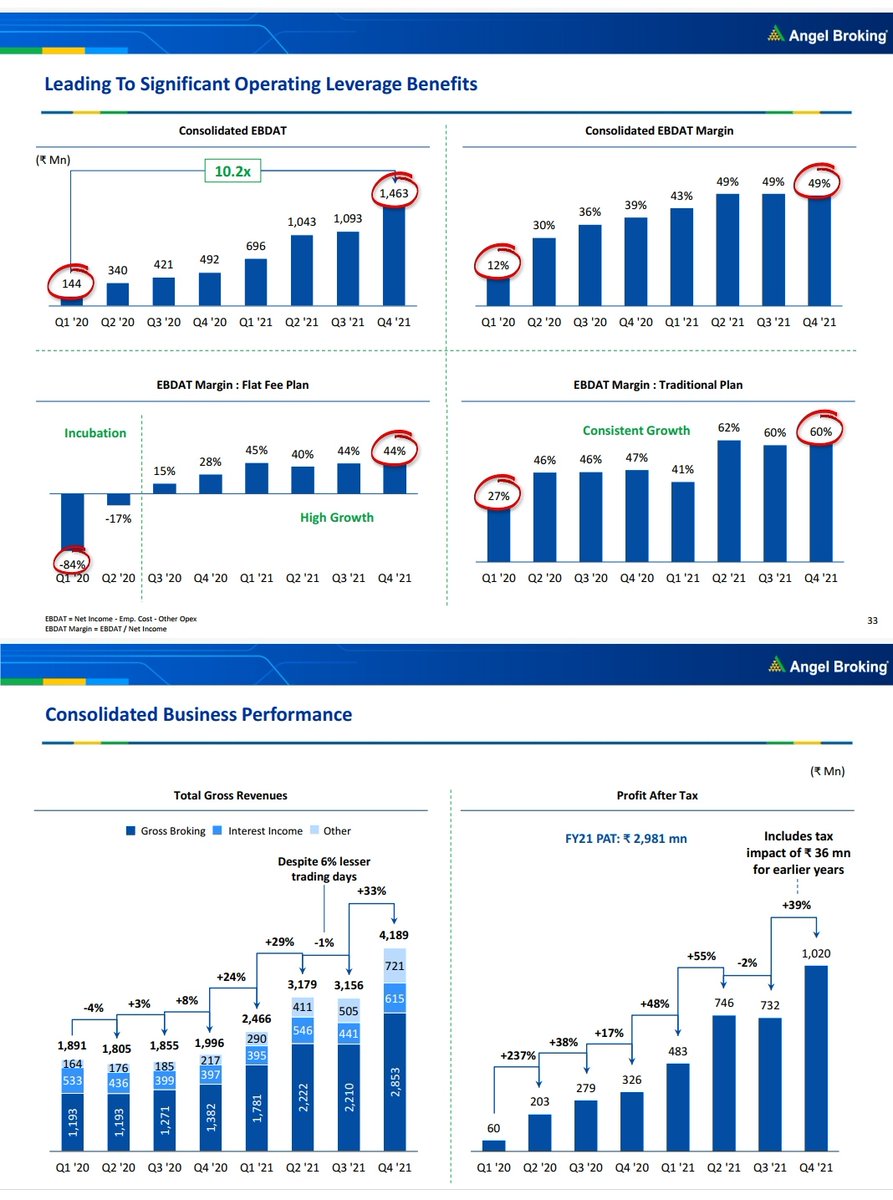

Angel has 9% market share in active clients and 20% market share in F&O. Brokers make money on no of trades executed. Last quarter Angel executed 21 cr trades . And this quarter it is expected to execute 25cr.

Angel has 9% market share in active clients and 20% market share in F&O. Brokers make money on no of trades executed. Last quarter Angel executed 21 cr trades . And this quarter it is expected to execute 25cr.

Average revenue per active client is right metric in conjunction with active clients. Angel average revenue per active client is around ₹9000. This may tread down slightly because of churn rate.

With 44% margin angel pay back period is around 3-4 months. This represents quiet strong unit economics. Thier CAC( Customer Acquisition cost) is around ₹1000. We have taken slightly higher because we could not ascertain exact organic growth.

Zerodha has much lower CAC, 5 paisa and upstox has similar kind of CAC. However, #5paisa average revenue per active clients is 6 times lower.

For 5 paisa to break even it takes around 18 months.

For 5 paisa to break even it takes around 18 months.

Technology

Angel have reduced silos and segmentation in thier data management platform and working on integrated data intelligence platform. Major breakthrough would come when #angel spark would go online with native API interacting across digital properties.

Angel have reduced silos and segmentation in thier data management platform and working on integrated data intelligence platform. Major breakthrough would come when #angel spark would go online with native API interacting across digital properties.

Thier data pipeline is still fragmented due to friction in interfaces, as of now they are good at data managment , but going forward they would become AI factory.

They have agile,focused teams and have start up culture having Chief growth officer and chief product officer.

Company has Management bandwidth to deliver outcomes and have ambition to become largest broker in 2 years. They see it as 2 player market,

Company has Management bandwidth to deliver outcomes and have ambition to become largest broker in 2 years. They see it as 2 player market,

And they want to be leader in that. From our perspective, it would be quiet tough to achieve in next 2 years.

Groww can be dark hourse in quest of brokers to have larger market share.

Groww can be dark hourse in quest of brokers to have larger market share.

Various products by angel have good traction such as Smart API, ARQ and Smart Buzz.

With help of ARQ, they gave automated stock recommendation , which would be leaveraged to make smart beta low cost financial products.

With help of ARQ, they gave automated stock recommendation , which would be leaveraged to make smart beta low cost financial products.

This will happen when they have license of AMC for manufacturing of products.

They have just launched #smartbuzz , which is information segregation platform with hyper personalized recommendation.

They have just launched #smartbuzz , which is information segregation platform with hyper personalized recommendation.

Whichever broker win community part would win big, they have to challenge #moneycontrol to be by default financial content platform.

Whole broking space is quiet buzzing, news of any VC backed broking firm listing would materially re rate stock

Whole broking space is quiet buzzing, news of any VC backed broking firm listing would materially re rate stock

Although, it is somewhat cyclical industry, but this time change is structure because of no avenue for savers to put money anywhere else.

Reduce risk by position sizing

Disclosure- Invested,

Reduce risk by position sizing

Disclosure- Invested,

• • •

Missing some Tweet in this thread? You can try to

force a refresh