Locking Yield Case Study (Update)

Our first case study on hedging yield received some attention from those new to DeFi.

Credits to @AutomataEmily and @SamuelShadrach4 for the explanation on crypto inherent risks beyond price. We have updated the piece to reflect those. 👇

Our first case study on hedging yield received some attention from those new to DeFi.

Credits to @AutomataEmily and @SamuelShadrach4 for the explanation on crypto inherent risks beyond price. We have updated the piece to reflect those. 👇

Pendle is a new protocol and using it assumes the risk of Pendle smart contracts.

We are built on top of other protocols such as Aave and Compound, and users assume their smart contract risk too.

Those unfamiliar with such risks should NOT use Pendle.

We are built on top of other protocols such as Aave and Compound, and users assume their smart contract risk too.

Those unfamiliar with such risks should NOT use Pendle.

https://twitter.com/AutomataEmily/status/1408425642098520066

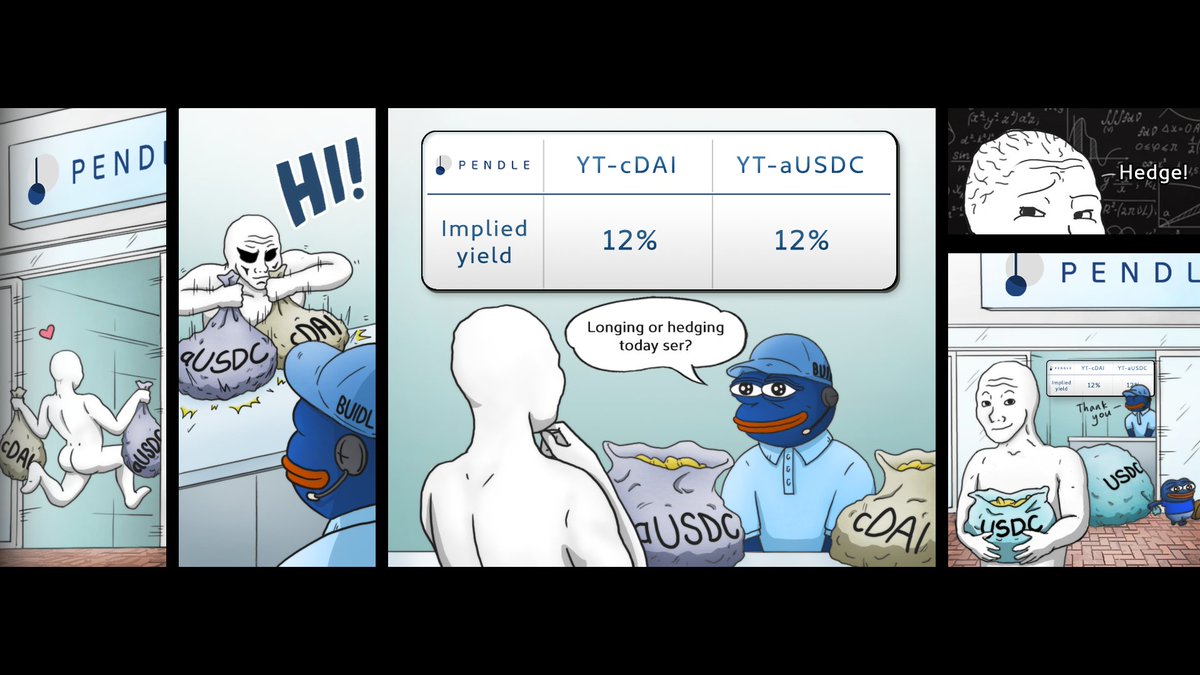

On to the case study:

A Pendle user locked-in yield on $300k worth of aUSDC and cDAI, receiving a return of 54.5k USDC (18%). This USDC was immediately available in his wallet.

A Pendle user locked-in yield on $300k worth of aUSDC and cDAI, receiving a return of 54.5k USDC (18%). This USDC was immediately available in his wallet.

The $54.5k was then redeployed to purchase OT assets at a discount of 20% and 11%. Assuming all smart contracts work as intended, the user will be able to realize this fixed return on expiry.

Read the full process here: link.medium.com/DkCPtgsCqhb

Read the full process here: link.medium.com/DkCPtgsCqhb

The user deposited aUSDC and cDAi into Pendle to mint Yield Tokens (YTs) and Ownership Tokens (OTs).

YT represents the future yield and OT represents ownership of the underlying aUSDC and cDAI assets.

YT represents the future yield and OT represents ownership of the underlying aUSDC and cDAI assets.

YTs were sold to lock returns immediately:

150,000 YT-aUSDC → 27,376 USDC (~18% return)

6,984,825 YT-cDAI → 27,121 USDC (~18% return)

150,000 YT-aUSDC → 27,376 USDC (~18% return)

6,984,825 YT-cDAI → 27,121 USDC (~18% return)

The user redeployed the gains to obtain assets at a discount by purchasing OT.

33,487 USDC → 40,282 OT-aUSDC (~20% discount)

21,014 USDC → 1,169,700 OT-cDAI (~ 11% discount)

33,487 USDC → 40,282 OT-aUSDC (~20% discount)

21,014 USDC → 1,169,700 OT-cDAI (~ 11% discount)

OT can be traded or redeemed for the underlying assets at expiry.

What does this mean?

At expiry, the 40,282 OT-aUSDC that the user purchased for $33,487 can be redeemed for 40,282 aUSDC ($40,282), a fixed return of 20%.

What does this mean?

At expiry, the 40,282 OT-aUSDC that the user purchased for $33,487 can be redeemed for 40,282 aUSDC ($40,282), a fixed return of 20%.

Yield Tokens are a new derivative in the DeFi space, and yield strategies are just starting to be explored.

Here’s a good resource to check out if you’re new to the concept:

Here’s a good resource to check out if you’re new to the concept:

https://twitter.com/pendle_fi/status/1401161925036167170?s=20

We also have YT and OT cheatsheets to get you up to speed about Pendle’s core mechanics.

https://twitter.com/pendle_fi/status/1405553562424283141?s=20

Get through the 🦀 market with the right tools!

Start managing your yield here: app.pendle.finance

Start managing your yield here: app.pendle.finance

• • •

Missing some Tweet in this thread? You can try to

force a refresh