Until 2020, Bitcoin could not be used in most DeFi protocols due to its lack of interoperability.

However, there are now many protocols available that allow users to borrow, lend, provide liquidity, and more using bitcoin.

Ex:

+ $WBTC

+ $renBTC

+ $tBTC

+ $BTCB

+ $xBTC

+ $sBTC

However, there are now many protocols available that allow users to borrow, lend, provide liquidity, and more using bitcoin.

Ex:

+ $WBTC

+ $renBTC

+ $tBTC

+ $BTCB

+ $xBTC

+ $sBTC

CeFi companies allow users to deposit bitcoin as borrowing collateral or as a savings vehicle.

Most new users prefer CeFi as opposed to DeFi, however many are switching over to protocols like @compoundfinance, @AaveAave, and @Uniswap.

More have emerged as this trend continues⬇️

Most new users prefer CeFi as opposed to DeFi, however many are switching over to protocols like @compoundfinance, @AaveAave, and @Uniswap.

More have emerged as this trend continues⬇️

.@WrappedBTC is a centralized wrapping solution that allows users to use their Bitcoin on @ethereum.

It's the most used interoperability solution to date controlling ~78% of the market with circulating supply of about 189,000 $WBTC.

However, WBTC is only one option for users.

It's the most used interoperability solution to date controlling ~78% of the market with circulating supply of about 189,000 $WBTC.

However, WBTC is only one option for users.

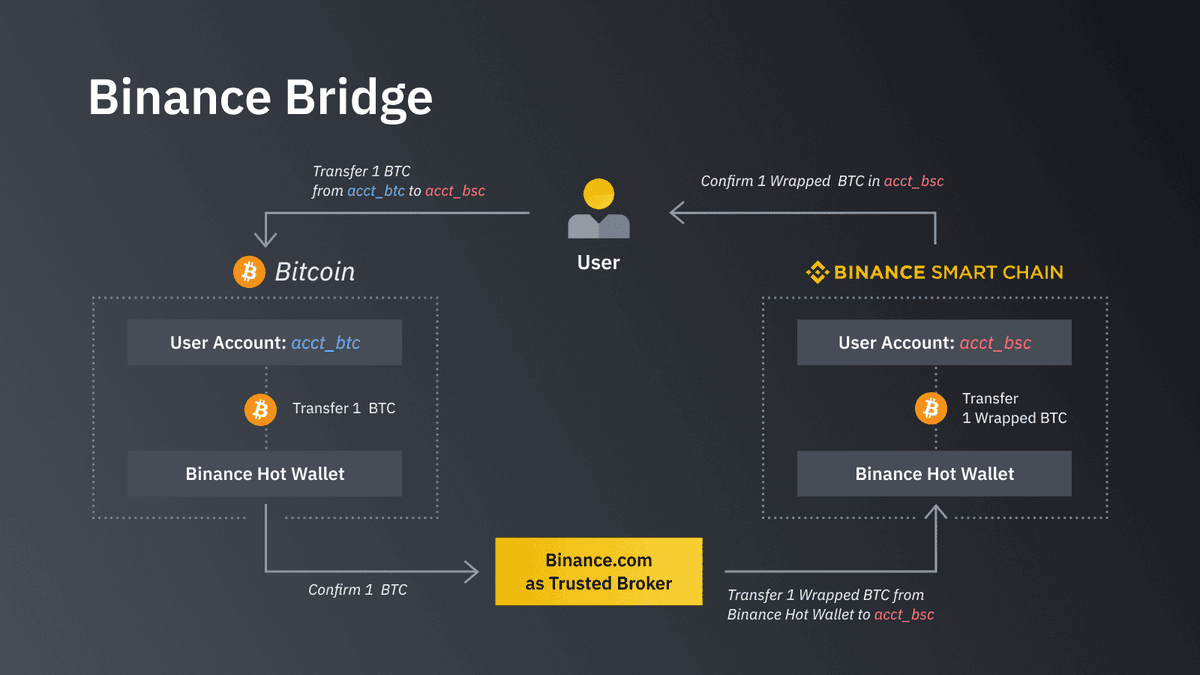

$BTCB is @BinanceChain's $BTC pegged asset that allows Bitcoin to be used in BSC’s DeFi protocols.

Advantages:

+ its centralized nature regarding custody and trust of users' native BTC

+ ability to use BTC value in DeFi protocols w/o missing out on potential BTC appreciation

Advantages:

+ its centralized nature regarding custody and trust of users' native BTC

+ ability to use BTC value in DeFi protocols w/o missing out on potential BTC appreciation

Learn about more options for Bitcoin's use in DeFi in @coleworld3019's latest article messari.io/article/unlock…

• • •

Missing some Tweet in this thread? You can try to

force a refresh