A preliminary assessment of @thorstarter .

A very interesting project to tackle the ‘long-tail’ assets for the @THORChain network.

TS team feel free to correct anything I’ve mentioned :)

A very interesting project to tackle the ‘long-tail’ assets for the @THORChain network.

TS team feel free to correct anything I’ve mentioned :)

1. What is it?

a. Thorstarter (TS) appears to reflect features of an early stage venture cap (VC) fund, whereby portfolio managers (Council of Asgard) are tasked with vetting portfolio (launchpad) projects to invest in.

a. Thorstarter (TS) appears to reflect features of an early stage venture cap (VC) fund, whereby portfolio managers (Council of Asgard) are tasked with vetting portfolio (launchpad) projects to invest in.

b. Portfolio projects will be those deemed beneficial to driving value to @THORChain .

c. Capital (liquidity grants) is provided to projects from the TS treasury, resulting in TS treasury owning a portion of project tokens. This is subject to conditions (e.g. vesting periods), after which TS can realise the value through selling the tokens.

d. $XRUNE can act as unitholders of this VC fund by participating in forms of fund governance (vXRUNE). This will entitle them to a portion of realised value on portfolio projects.

2. How would the protocol create value (i.e. agg. value of projects within TS = Quantity x Value of projects)?

a. Reasonable ‘quantity’ of projects: There is an expectation that there would be demand from portfolio projects to launch through TS, based on the following:

a. Reasonable ‘quantity’ of projects: There is an expectation that there would be demand from portfolio projects to launch through TS, based on the following:

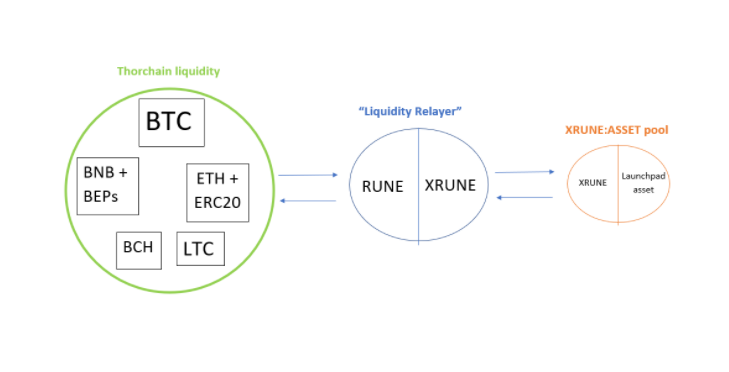

i. Portfolio projects become visible to stakeholders within the large @THORChain pools which could result in a seamless access of liquidity from TC (per my artistic diagram below); and

b. High value projects: The quality of projects depends on a vetting process, creating a high standard of project, ideally translating to high valuation on these pools and thus the overall TS protocol. (E.g. Focus is on high value/low volume projects)

3. How does the token accrue value from the protocol (i.e. token economics)? Based on the below accrual features, I view the $XRUNE token as a diversified exposure of non-RUNE, Thorchain-based ecosystem tokens.

a. Primary cash flow driver: $XRUNE holders locking their tokens to participate as vXRUNE holders are entitled to fees - which as currently described - relates to profits on the sale of portfolio projects once realised...

... this is on the basis vXRUNE holders have been involved in governance decisions on said realised portfolio project. On-chain snapshots will be used to verify this.

b. Secondary cash flow driver (my speculation): Through TC's ‘affiliate fee’ feature, I presume TS portfolio projects will likely turn this feature on once they’re providing a useful service...

.... I would expect a portion of fees would flow back to token holders which TS will have some ownership in as mentioned in 1c.

c. Flow-based driver: Buy pressure on the token as it is required to access the launchpad tokens when participating in primary issues (i.e. a settlement currency).

4. Considerations/clarifications going forward?

a. Will the members of the Council of Asgard be equipped to identify valuable projects? Similar to a portfolio manager within a VC fund. Assuming so given they are heavily involved in the existing Thorchain ecosystem.

Quarterly churn of council members also keeps it fresh.

Quarterly churn of council members also keeps it fresh.

b. What is the remuneration structure of council members to ensure they are incentivised appropriately (e.g. performance fees etc.)?

c. The governance of Asgard Council (vetting projects) and vXRUNE (referred to as Valhalla DAO I think) each have respective governance duties within TS. However, I think a table outlining each responsibility (as currently known) of each stakeholder would be useful.

d. How sustainable is it to keep providing grants in the long-term - Is there a more sustainable method of launching companies?

e. Is there an objective thesis/criteria for vetting projects that we can use as a yard stick to measure Council members' performance?

f. What are the parameters of the liquidity grants, how does one decide the amount of $X granted to each project etc.

g. Does the daily realisation of incubated tokens put a conflict between vXRUNE holders and incubator companies (i.e. vXRUNE holders want to realise token sales to receive the fees vs incubator companies wanting to avoid this and prevent unwanted sell pressure):

i. There is a minimum time lock to align time horizons and mitigate this risk, however what is the sweet spot to create sticky capital and who decides this (i.e. daily realisations begin 1, 2, n years from launch)?

ii. What is the sell criteria for a portfolio project, is daily realisation post time lock appropriate or are you forgoing further upside?

A couple of short-term, positive catalysts:

https://twitter.com/thorstarter/status/1409884315471822862?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh