So many updates on #SequentScientific Results, almost none focus on the most important metric

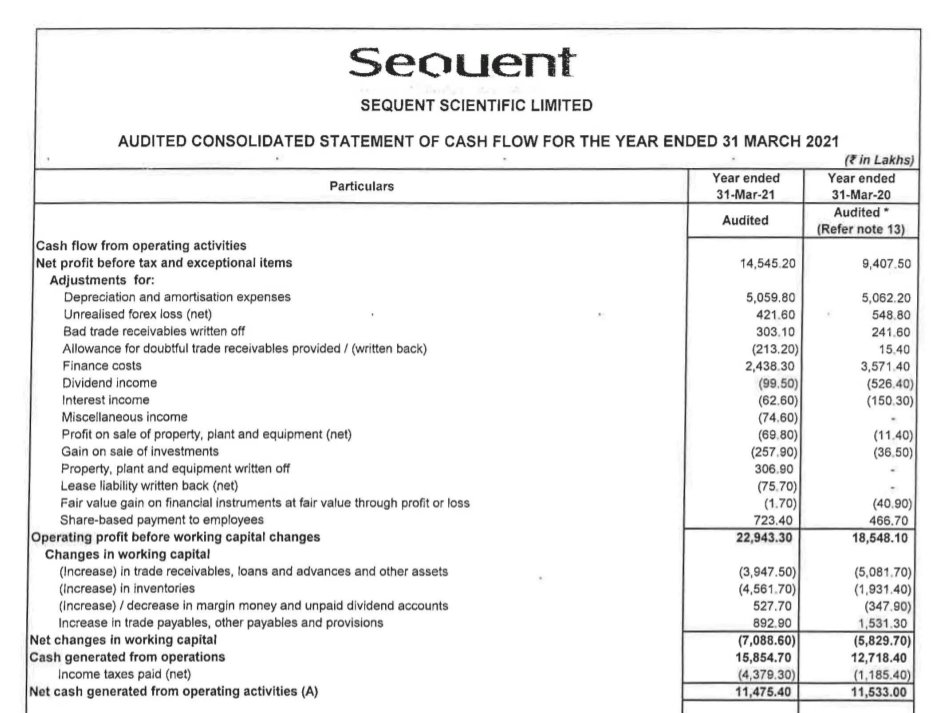

Net profit before tax and exceptional items (True Cash earned by the company) increase by ~55% YoY

Net profit before tax and exceptional items (True Cash earned by the company) increase by ~55% YoY

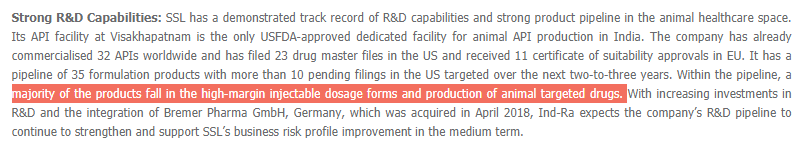

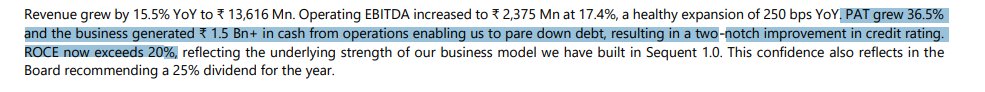

ROCE now above 20% and PAT increase by 36.5% are signs of Operating Leverage

Before Op Leverage kicked in for Laurus, its ROCE was in ~14%

Before Op Leverage kicked in for Laurus, its ROCE was in ~14%

The Advisor onboarded created the animal healthcare business for Boehringer Ingelheim (~2nd largest animal healthcare business in the world with net sales of ~4.5 Billion+ and presence in over 150 countries

• • •

Missing some Tweet in this thread? You can try to

force a refresh