❄️Attention Yetis❄️

THREAD - What Key DeFi Indicators to Know

Defi moves at an incredibly high speed, making it almost impossible to track.

Here are indicators every DeFi investor should familiarize themselves with to keep up with decentralized finance’s rapid developments.

THREAD - What Key DeFi Indicators to Know

Defi moves at an incredibly high speed, making it almost impossible to track.

Here are indicators every DeFi investor should familiarize themselves with to keep up with decentralized finance’s rapid developments.

2/ Total Value Locked (TVL)

TVL is the first step to understanding the true worth of a project, whether undervalued or overvalued.

Ultimately this indicator allows investors to know how much money is being used (locked) inside the protocol.

TVL is the first step to understanding the true worth of a project, whether undervalued or overvalued.

Ultimately this indicator allows investors to know how much money is being used (locked) inside the protocol.

3/ Annual Percentage Yield

APY refers to the staked returns as a percentage over a year. Investors should be cautious of outlandish APY offerings.

NOTE: APR reflects the simple interest rate over a year’s time, while APY describes the rate with the effect of compounding.

APY refers to the staked returns as a percentage over a year. Investors should be cautious of outlandish APY offerings.

NOTE: APR reflects the simple interest rate over a year’s time, while APY describes the rate with the effect of compounding.

4/ Inflation Rate

Investors making decisions based on project tokens total or circulating supply are very wary of high inflation tokens. These days, token TS or CS is not an exact determinant for project success.

Use Etherscan or BscScan to better understand the token supply.

Investors making decisions based on project tokens total or circulating supply are very wary of high inflation tokens. These days, token TS or CS is not an exact determinant for project success.

Use Etherscan or BscScan to better understand the token supply.

5/ Unique Address Count

Tracking the project’s new token holders has proven a reliable strategy to gauge a project’s relevance. An increasing amount of new holders points to an increase in buyers and usage.

Tracking the project’s new token holders has proven a reliable strategy to gauge a project’s relevance. An increasing amount of new holders points to an increase in buyers and usage.

6/ Social Data

Google Trends and Twitter Analytics are helpful resources to check for the increasing popularity and relevance of a Defi project.

Keywords like “How to stake X tokens” “what is X tokens” are strong indications of a project’s increasing popularity and demand.

Google Trends and Twitter Analytics are helpful resources to check for the increasing popularity and relevance of a Defi project.

Keywords like “How to stake X tokens” “what is X tokens” are strong indications of a project’s increasing popularity and demand.

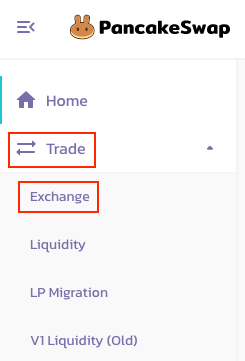

7/ Token Supply on Exchange

When tokens move into an exchange, it is to act as collateral for trading or to sell tokens. The large sale of tokens creates an excess supply against demand. Monitoring wallets for these movements is a fail-proof strategy adopted by DeFi traders.

When tokens move into an exchange, it is to act as collateral for trading or to sell tokens. The large sale of tokens creates an excess supply against demand. Monitoring wallets for these movements is a fail-proof strategy adopted by DeFi traders.

8/ TVL - Market Capitalization Ratio

Easily calculated by dividing TVL by market cap.

Suppose the ratio is higher than 1. In that case, i.e., TVL is higher than market cap, the project is still undiscovered, indicating that its current value is yet to match its real value.

Easily calculated by dividing TVL by market cap.

Suppose the ratio is higher than 1. In that case, i.e., TVL is higher than market cap, the project is still undiscovered, indicating that its current value is yet to match its real value.

9/ Conclusion

Using these indicators when investing and trading will, over time, strengthen any chosen system adopted. It is important to note that learning should ideally come first before earning.

Always take profit, no matter the indicator used. Stay SAFU on your investment!

Using these indicators when investing and trading will, over time, strengthen any chosen system adopted. It is important to note that learning should ideally come first before earning.

Always take profit, no matter the indicator used. Stay SAFU on your investment!

• • •

Missing some Tweet in this thread? You can try to

force a refresh