Crypto underwent a series of coordinated attacks these last few months.

I wanted to take the time below to illustrate just how much was thrown at the market on a timeline, and then discuss some of my feelings on this...

Let’s dive in! 🥐

I wanted to take the time below to illustrate just how much was thrown at the market on a timeline, and then discuss some of my feelings on this...

Let’s dive in! 🥐

April 16th, 2021

A coal mine in Xinjiang flooded, damaging miners in the area and resulting in the #Bitcoin hash rate dropping by 35%.

This also brought up serious concerns from the Chinese government who began to hint at a ban on mining.

A coal mine in Xinjiang flooded, damaging miners in the area and resulting in the #Bitcoin hash rate dropping by 35%.

This also brought up serious concerns from the Chinese government who began to hint at a ban on mining.

April 16th, 2021

Reports of Coinbase insiders and early investors selling roughly $5B of $COIN on its opening day broke, and headlines quickly spread

Updates to reports a few days later conveniently added background on a direct listing (excusing the selling for liquidity)

Reports of Coinbase insiders and early investors selling roughly $5B of $COIN on its opening day broke, and headlines quickly spread

Updates to reports a few days later conveniently added background on a direct listing (excusing the selling for liquidity)

April 17th, 2021

Fxhedgers posts inaccurate headline claiming the U.S. Treasury is accusing several financial institutions of money laundering with cryptocurrency

Just 54 minutes after the tweet was made, this Twitter account managed to wipe off more than $288B from the market

Fxhedgers posts inaccurate headline claiming the U.S. Treasury is accusing several financial institutions of money laundering with cryptocurrency

Just 54 minutes after the tweet was made, this Twitter account managed to wipe off more than $288B from the market

April 17th, 2021

CNBC revives old news that India proposed banning #Bitcoin for transactions

The Supreme Court of India later refused to follow through with this legislation

Prices fall over 10% after it is posted combined with the tweet shown previously

CNBC revives old news that India proposed banning #Bitcoin for transactions

The Supreme Court of India later refused to follow through with this legislation

Prices fall over 10% after it is posted combined with the tweet shown previously

April 21st, 2021

Turkey bans the use of #Bitcoin for transactions, after seeing a big drop in the Turkish Lira and a surge of people fleeing into crypto

Previously, Turkey has banned PayPal for use in online payment way back in 2016

Turkey bans the use of #Bitcoin for transactions, after seeing a big drop in the Turkish Lira and a surge of people fleeing into crypto

Previously, Turkey has banned PayPal for use in online payment way back in 2016

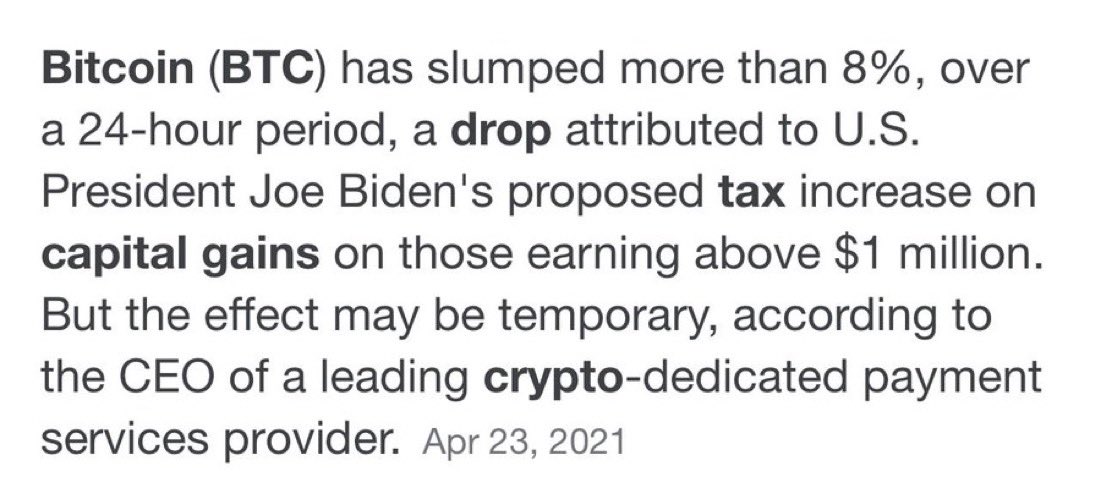

April 23rd, 2021

President Biden suggests capital gains tax hike by nearly double what it was previously (20%)

However, swing state polls indicate Biden will instead put his focus on corporate taxes

Regardless, this attributed to a steep decline in #Bitcoin prices after

President Biden suggests capital gains tax hike by nearly double what it was previously (20%)

However, swing state polls indicate Biden will instead put his focus on corporate taxes

Regardless, this attributed to a steep decline in #Bitcoin prices after

April 25th, 2021

The same Fxhedgers account from earlier made a tweet claiming his “sources” say that whales are selling a ton of #Bitcoin and aiming for as low as 21k

Prices fall more than 20% (following additional China miner news)

The same Fxhedgers account from earlier made a tweet claiming his “sources” say that whales are selling a ton of #Bitcoin and aiming for as low as 21k

Prices fall more than 20% (following additional China miner news)

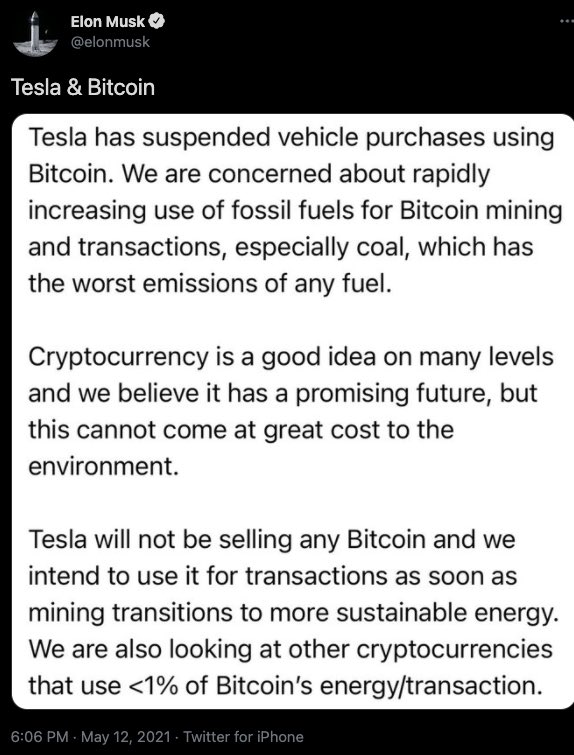

May 12th, 2021

Elon announces Tesla won’t be accepting #Bitcoin because of environmental concerns, leading to a sharp drop in price

Within just a few hours the price of #Bitcoin had fallen by more than 15%

Elon announces Tesla won’t be accepting #Bitcoin because of environmental concerns, leading to a sharp drop in price

Within just a few hours the price of #Bitcoin had fallen by more than 15%

May 13th, 2021

Justice Department and Internal Revenue Service open probe on Binance, targeting users of it for money laundering and purposes of tax evasion.

The announcement didn’t accuse them of wrongdoing, but rather just requested info

#Bitcoin fell by more than 20% after

Justice Department and Internal Revenue Service open probe on Binance, targeting users of it for money laundering and purposes of tax evasion.

The announcement didn’t accuse them of wrongdoing, but rather just requested info

#Bitcoin fell by more than 20% after

May 16th, 2021

After a user brings up the possibility of Tesla selling their #Bitcoin over hostility, Elon Musk replies agreeing with: “indeed”

Unsurprisingly, this tweet resulted in another 7% drop a few hours after it was posted

(He denied selling just a day later)

After a user brings up the possibility of Tesla selling their #Bitcoin over hostility, Elon Musk replies agreeing with: “indeed”

Unsurprisingly, this tweet resulted in another 7% drop a few hours after it was posted

(He denied selling just a day later)

May 18th, 2021

China bans financial payment institutions from the cryptocurrency business

This reiterated a ban from 2013, banning payment channels from offering services in crypto

A short time after this news broke #Bitcoin fell yet another 20% in a matter of hours

China bans financial payment institutions from the cryptocurrency business

This reiterated a ban from 2013, banning payment channels from offering services in crypto

A short time after this news broke #Bitcoin fell yet another 20% in a matter of hours

May 19th, 2021

Pope Francis (yes, seriously) makes a tweet claiming that #Bitcoin should be replaced “without delay” over environmental concern

Pope Francis (yes, seriously) makes a tweet claiming that #Bitcoin should be replaced “without delay” over environmental concern

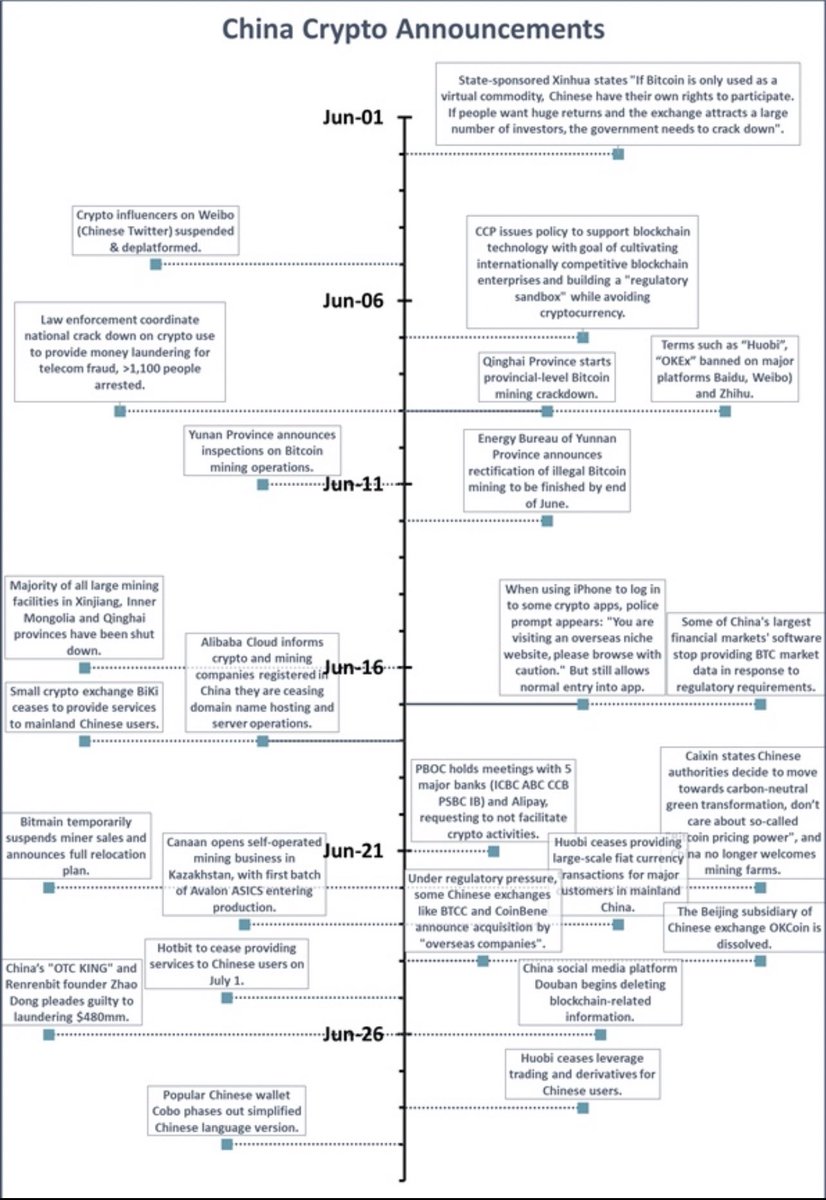

June 2nd, 2021

State-run media outlets in China publish a series of warnings to their citizens about dangers in the use of crypto markets

State-run media outlets in China publish a series of warnings to their citizens about dangers in the use of crypto markets

June 4th, 2021

#Bitcoin falls more than 8% after Elon Musk tweets a break up tweet

...Because the market ignored his troll tweet later that “make up sex is the best tho”

#Bitcoin falls more than 8% after Elon Musk tweets a break up tweet

...Because the market ignored his troll tweet later that “make up sex is the best tho”

June 7th, 2021

The United States government seizes $2.3M worth of #Bitcoin from colonial pipeline hackers, causing panic in the entire crypto market

Prices fell a further 7% after this news came out

The United States government seizes $2.3M worth of #Bitcoin from colonial pipeline hackers, causing panic in the entire crypto market

Prices fell a further 7% after this news came out

June 26th, 2021

The United Kingdom says popular cryptocurrency exchange Binance is not currently allowed to conduct any regulated activities

However people failed to note that this had no impact on users trading experience because it was an entity separate from Binance

The United Kingdom says popular cryptocurrency exchange Binance is not currently allowed to conduct any regulated activities

However people failed to note that this had no impact on users trading experience because it was an entity separate from Binance

July 2nd, 2021

Thailand SEC opens criminal complaint against Binance over unregistered operations

They argue that Binance continues to operate without registration from proper authorities

Thailand SEC opens criminal complaint against Binance over unregistered operations

They argue that Binance continues to operate without registration from proper authorities

There are tons of other things including Jerome Powell, “deflation”, IMF warnings, Cayman Islands, Singapore, Bitfinex + USDT, Okex + Hong Kong, CBDC, and much more that I couldn’t touch on for the sake of having room in this thread

This is all within the span of a few months...

This is all within the span of a few months...

If you’ve made it this far, you might have noticed the common theme I’m trying to get at here.

Reading over these & getting the deeper meaning of them tells almost a completely different story than when taken at first glance, compared to how the market reacted

(in most cases)

Reading over these & getting the deeper meaning of them tells almost a completely different story than when taken at first glance, compared to how the market reacted

(in most cases)

Whether it is issues of the environment, anti money laundering regulations, and/or Chinese mining centralization, this FUD is all being addressed one by one and will all soon be irrelevant.

Countries will make both historically bad and historically good decisions on #Bitcoin

Countries will make both historically bad and historically good decisions on #Bitcoin

China banned #Bitcoin because they saw it as a threat to the upcoming digital yuan, a currency which is the 8th most traded in the world making up about 5% of transactions (yes, also energy issues)

But #Bitcoin is only a $650B market cap.

This leads me to my last point...

But #Bitcoin is only a $650B market cap.

This leads me to my last point...

You didn’t think the U.S. would be putting #Bitcoin on ETFs without first challenging misconceptions on the market, right?

This FUD is short term, setting us up for institutional adoption down the road.

#Bitcoin is ESG investing, & I wrote an entire thread on this topic👇🏻

This FUD is short term, setting us up for institutional adoption down the road.

#Bitcoin is ESG investing, & I wrote an entire thread on this topic👇🏻

https://twitter.com/croissanteth/status/1403800846152966144

TLDR?

There may be choppy weeks ahead, but we will have some serious movement upwards as institutional money & green #Bitcoin mining flows into the United States and we watch the greatest transition of hash power to ever occur.

We all know how quickly narratives change here.

There may be choppy weeks ahead, but we will have some serious movement upwards as institutional money & green #Bitcoin mining flows into the United States and we watch the greatest transition of hash power to ever occur.

We all know how quickly narratives change here.

• • •

Missing some Tweet in this thread? You can try to

force a refresh