$DIDI seeks to make life better by transforming mobility. $DIDI is the largest ride-sharing company in China. $DIDI has IPO on 30 June 2021 becoming the largest Chinese IPO in the US since $BABA in 2014. Here is a thread on the things you need to know about $DIDI. 👇👇

1. $DIDI Overview

$DIDI offers a range of services, such as ride hailing, taxi hailing, chauffeur, hitch as well as electric mobility, auto solutions, food delivery, intra-city freight and financial services across 15 countries. $DIDI in many ways is the Chinese version of $UBER

$DIDI offers a range of services, such as ride hailing, taxi hailing, chauffeur, hitch as well as electric mobility, auto solutions, food delivery, intra-city freight and financial services across 15 countries. $DIDI in many ways is the Chinese version of $UBER

2. Total Addressable Market

The global ride sharing market is projected to grow at a CAGR of 16.6% from $85.8 billion in 2021 to $185 billion by 2026.

The global ride sharing market is projected to grow at a CAGR of 16.6% from $85.8 billion in 2021 to $185 billion by 2026.

3. Penetration Rate

The penetration rate of ride sharing services out of total mobility expenditure is estimated to be at 4% and will grow to 8.1% by 2025.

The penetration rate of ride sharing services out of total mobility expenditure is estimated to be at 4% and will grow to 8.1% by 2025.

4. Value Proposition

$DIDI's value proposition is to make ride sharing services cheaper than owning a private car. $DIDI in its S1 filing has stated that taking $DIDI everywhere in China is cheaper than owning a private car. However, not for US because of higher labor costs.

$DIDI's value proposition is to make ride sharing services cheaper than owning a private car. $DIDI in its S1 filing has stated that taking $DIDI everywhere in China is cheaper than owning a private car. However, not for US because of higher labor costs.

5. $DIDI's strategy

$DIDI aims to create a classic platform flywheel effect. When there are more supply and demand, the better the service will be and the lower the cost.

$DIDI aims to create a classic platform flywheel effect. When there are more supply and demand, the better the service will be and the lower the cost.

6. $DIDI’s Scale

According to $DIDI’s S1 filing, $DIDI operates in 15 countries and nearly 4000 cities, counties, and towns. $DIDI has 493 million of annual active users, 15 million of annual active drivers, 41 millions of average daily transactions.

According to $DIDI’s S1 filing, $DIDI operates in 15 countries and nearly 4000 cities, counties, and towns. $DIDI has 493 million of annual active users, 15 million of annual active drivers, 41 millions of average daily transactions.

7. Monopoly in China

According to Statista, $DIDI have a ride sharing monopoly in China with over 90% of market share. However, $DIDI do not enjoy monopoly outside of China and is constantly facing fierce competition with price pressure.

According to Statista, $DIDI have a ride sharing monopoly in China with over 90% of market share. However, $DIDI do not enjoy monopoly outside of China and is constantly facing fierce competition with price pressure.

8. Autonomous Driving

$DIDI has sensed that autonomous driving is the future. $DIDI are developing their L4 autonomous driving and operating system. $DIDI currently operates a fleet of over 100 ‘robotaxi’ in real life.

$DIDI has sensed that autonomous driving is the future. $DIDI are developing their L4 autonomous driving and operating system. $DIDI currently operates a fleet of over 100 ‘robotaxi’ in real life.

9. Autonomous driving is critical for $DIDI, as it can eliminate $DIDI biggest cost, ‘driver cost’. However, as $DIDI uses a Lidar solution, $DIDI's autonomous fleet can only be scaled slowly, as all area of operations must be ‘pre-mapped’ first.

10. $DIDI D1

$DIDI had partnered with $BYD to produce the D1, an electric vehicle built specifically for ride shares. $DIDI has put 10,000 D1 in service in 2020 and aimed to put another 100,000 D1 to service in 2021.

$DIDI had partnered with $BYD to produce the D1, an electric vehicle built specifically for ride shares. $DIDI has put 10,000 D1 in service in 2020 and aimed to put another 100,000 D1 to service in 2021.

11. Electric Charging Network

$DIDI runs Xiao Ju Che Fu which have 20,000 electric chargers (and 70,000+ when Xiao Ju partners’ chargers are included) over 31 cities in China. Xiao Ju is currently the largest ‘public’ charging network in China, with a market share of around 30%.

$DIDI runs Xiao Ju Che Fu which have 20,000 electric chargers (and 70,000+ when Xiao Ju partners’ chargers are included) over 31 cities in China. Xiao Ju is currently the largest ‘public’ charging network in China, with a market share of around 30%.

12. Auto Solutions

$DIDI finance provides services, such as insurance, loans, and payment solutions specifically for ridesharing. $DIDI’s Xiao Ju also provides solutions for car financing and leasing. $DIDI had the largest vehicle leasing network in China according to $DIDI’s S1

$DIDI finance provides services, such as insurance, loans, and payment solutions specifically for ridesharing. $DIDI’s Xiao Ju also provides solutions for car financing and leasing. $DIDI had the largest vehicle leasing network in China according to $DIDI’s S1

13. Shared bicycle

$DIDI runs $DIDI bike, which provides shared bicycle. $DIDI bike is the biggest bike sharing player in China with 34.92 million monthly active users (MAU). $DIDI bike is closely followed by Hellobike’s 31.53 million MAU and Meituan bike’s 2262.4 million.

$DIDI runs $DIDI bike, which provides shared bicycle. $DIDI bike is the biggest bike sharing player in China with 34.92 million monthly active users (MAU). $DIDI bike is closely followed by Hellobike’s 31.53 million MAU and Meituan bike’s 2262.4 million.

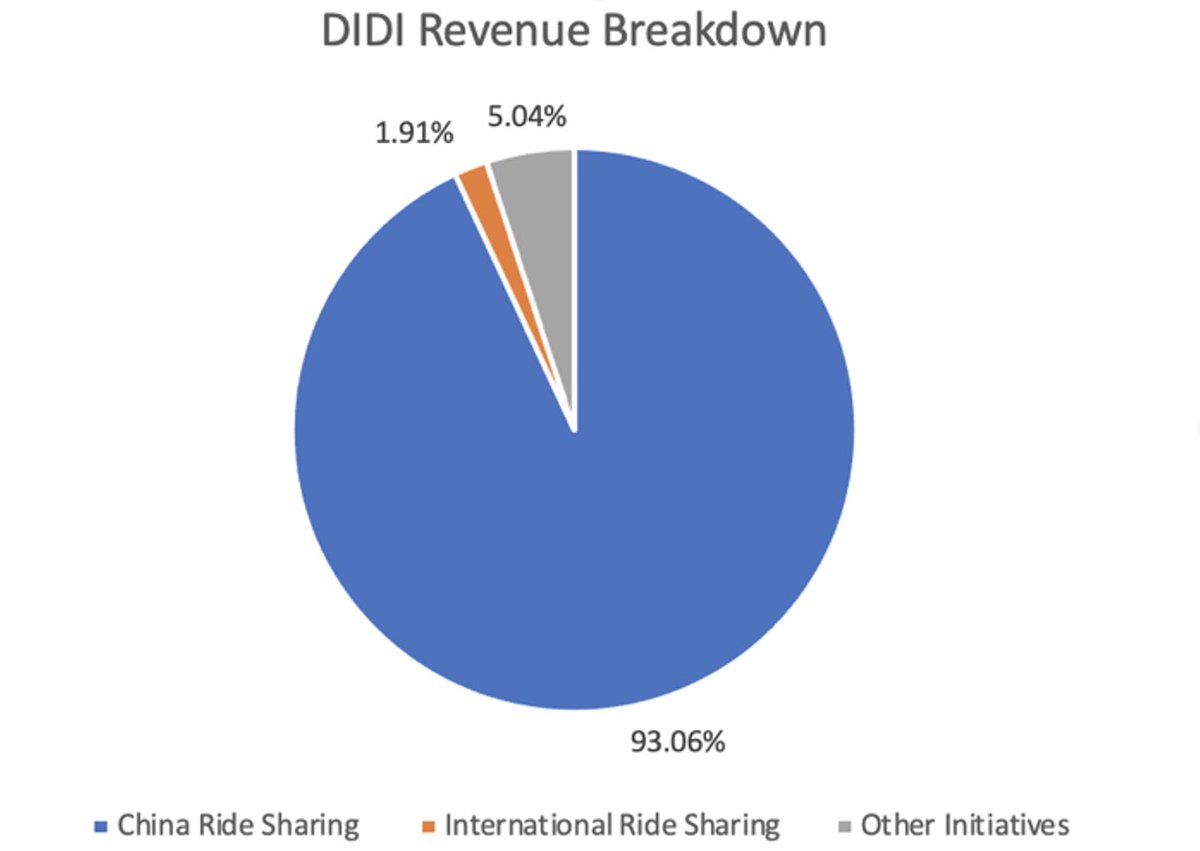

14. Revenue Breakdown

$DIDI’s revenue has grown by 14.41% from 2018 to 2019 and declined by 8.43% in 2020. For 2021 Q1, $DIDI has recorded a revenue of 42.163 billion RMB (6.514 billion USD), a 106% YoY growth over 2020 Q1.

$DIDI’s revenue has grown by 14.41% from 2018 to 2019 and declined by 8.43% in 2020. For 2021 Q1, $DIDI has recorded a revenue of 42.163 billion RMB (6.514 billion USD), a 106% YoY growth over 2020 Q1.

14.1 Both $DIDI's past yearly and quarterly revenue growth cannot be interpreted off its face value, because yearly annual growth was severely impacted by Covid, whereas 2020 Q1 was a relatively small base due to China being in lockdown, making YoY quarterly growth inaccurate.

14.2 The market consensus is that $DIDI is likely to grow around 25-30% in the coming years, but no growth rates are guaranteed. We may need to wait until the end of Covid to obtain a better picture of $DIDI's true revenue growth.

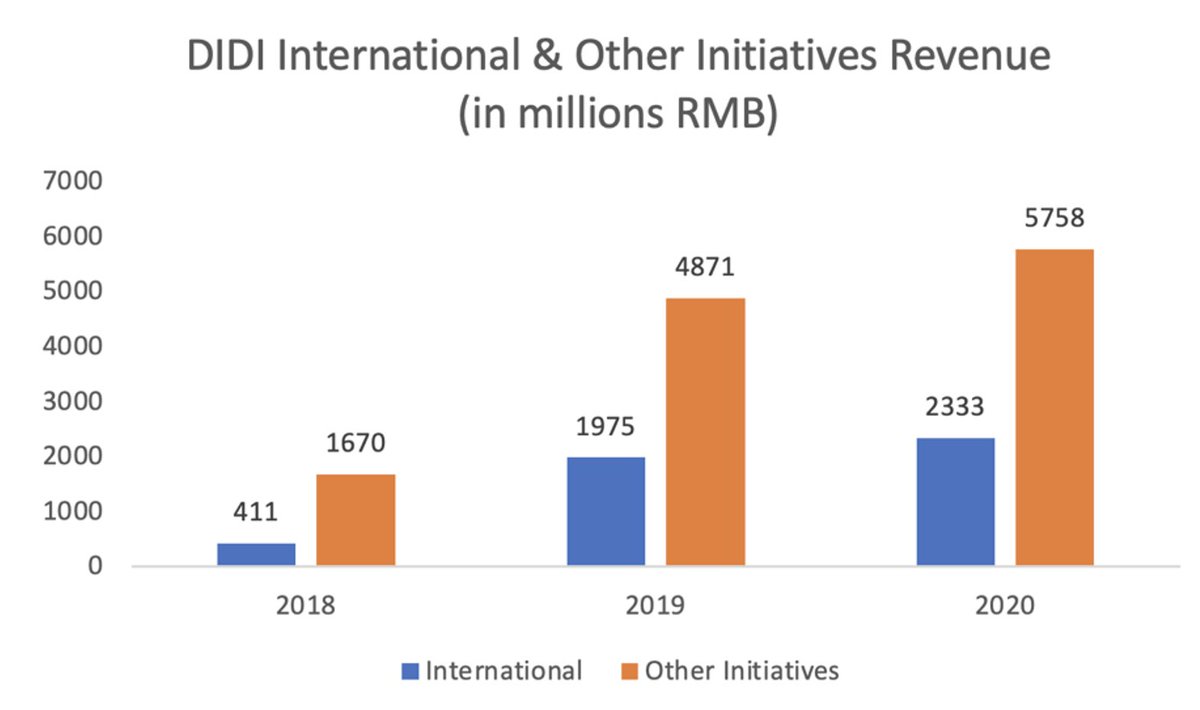

14.3 Although $DIDI has been expanding outside of China aggressive, $DIDI still receives 93.06% of their revenue from China in 2021 Q1, a slight improvement from 2018’s 98.46%.

14.4 $DIDI has been growing their international and other initiatives businesses, However, these still only made up less than 7% of $DIDI’s total revenue in Q1 2021.

15. Cost Breakdown

For 2021 Q1, $DIDI's costs have totaled to 116% of $DIDI's revenue, with cost of revenue, which includes driver fees and driver/passenger incentives being the largest expense.

For 2021 Q1, $DIDI's costs have totaled to 116% of $DIDI's revenue, with cost of revenue, which includes driver fees and driver/passenger incentives being the largest expense.

15.1 $DIDI’s different costs as a percentage of revenue have not had a clear decreasing trend from 2018 to 2021 Q1.

16. Loss from Operations and Net Loss

$DIDI is a money losing business as indicated below. Surprisingly, $DIDI had made a net income for 2021 Q1. However, it is a one-off event due to $DIDI's investment income of 12.36 billion RMB rather than income from $DIDI's operations.

$DIDI is a money losing business as indicated below. Surprisingly, $DIDI had made a net income for 2021 Q1. However, it is a one-off event due to $DIDI's investment income of 12.36 billion RMB rather than income from $DIDI's operations.

16.1 Profitability remains a concern going forward for $DIDI and it may take many years until $DIDI reach profitability (that is if $DIDI ever becomes profitable).

17. Catastrophic Events – Two Murder Cases

In 2018, there were two cases where a girl was raped and killed when she took $DIDI’s hitch services. These murders created an intense public outburst and government attention in China, blaming $DIDI's inability to protect their customer

In 2018, there were two cases where a girl was raped and killed when she took $DIDI’s hitch services. These murders created an intense public outburst and government attention in China, blaming $DIDI's inability to protect their customer

17.1 $DIDI stopped its hitch service after the second murder and implemented additional protective measures. Although no murders had happened with $DIDI after 2018, if such unfortunate case happened again, $DIDI will likely face even heavier criticism and public boycott.

18. Risk – Growth

Although the Street expects $DIDI to grow at around 25-30%, $DIDI already has a monopoly in China, and its ability to grow and maintain international market share remains to be proven.

Although the Street expects $DIDI to grow at around 25-30%, $DIDI already has a monopoly in China, and its ability to grow and maintain international market share remains to be proven.

19. Risk – International expansion and other initiatives

$DIDI need to continue expanding internationally and not having 90% of its revenue solely coming from China, if $DIDI aims to be a global company. $DIDI’s other initiatives may provide a diversified income stream for $DIDI

$DIDI need to continue expanding internationally and not having 90% of its revenue solely coming from China, if $DIDI aims to be a global company. $DIDI’s other initiatives may provide a diversified income stream for $DIDI

19.1 If these two components do not expand, $DIDI’s potential will be vastly capped at only being a China ride-sharing company, leaving no room for ‘valuation imagination’.

20. Risk – Driver Cost

Driver cost is by far the largest cost for $DIDI. If driver cost increases or legislations determines that $DIDI must classified their drivers as ‘employees’ rather than ‘independent contractors’, $DIDI would be even further away from profitability.

Driver cost is by far the largest cost for $DIDI. If driver cost increases or legislations determines that $DIDI must classified their drivers as ‘employees’ rather than ‘independent contractors’, $DIDI would be even further away from profitability.

21. Regulatory Risk

Just days after $DIDI’s IPO, China’s internet regulator has announced that they are reviewing the cybersecurity of $DIDI and no new user registration will be allowed during the review.

Just days after $DIDI’s IPO, China’s internet regulator has announced that they are reviewing the cybersecurity of $DIDI and no new user registration will be allowed during the review.

21.1 Given that $DIDI is a monopoly and the previous case of $BABA and Jack Ma, regulatory scrutiny and antitrust action on $DIDI by the Chinese government is possible.

BREAKING: At the time of me publishing this thread, there are news that the $DIDI app has been removed in China citing cybersecurity concerns and allegation that $DIDI has sold data to western countries. When $DIDI can be downloaded again is unknown.

This signals the severity and the real possibility of a crackdown on $DIDI considering its monopoly in China. Therefore, regulatory risks must be considered when considering an investment in $DIDI.

22. Risks – Price War

Although $DIDI said it provides a different ‘service’ compare to its competitors, in my respective opinion, ride sharing is a ‘commodity’, which companies compete almost solely on price. Below is a brief history of $DIDI’s price war.

Although $DIDI said it provides a different ‘service’ compare to its competitors, in my respective opinion, ride sharing is a ‘commodity’, which companies compete almost solely on price. Below is a brief history of $DIDI’s price war.

23. A $DIDI Price War History

In 2014, $DIDI only had 50% market share, whereas $DIDI’s biggest competitor, Kuaidadi, 40%. The two competed by going on a fierce price war. The price war was so fierce that the two spent 2 billion RMB in 2014 just to subsidize their customers

In 2014, $DIDI only had 50% market share, whereas $DIDI’s biggest competitor, Kuaidadi, 40%. The two competed by going on a fierce price war. The price war was so fierce that the two spent 2 billion RMB in 2014 just to subsidize their customers

23.1 $DIDI has even burnt 40 million RMB a day in subsidies. Chinese have even half-jokingly said that ride sharing was free. After a year of price war, the two realized that it was unsustainable, and the two ultimately came into good terms with a blockbuster merger.

23.2 Soon after the merger, $UBER arrives at China, and $UBER's CEO Travis Kalanick said to $DIDI's founder, Cheng Wei, ‘there’s only two routes for $DIDI, either $DIDI accepts a large investment from $UBER or $UBER will crush $DIDI’. Cheng Wei rejected $UBER's offer.

23.3 Unsurprisingly, $DIDI and $UBER went on price war. Cheng Wei sensed that $DIDI could not beat $UBER alone, decided to invest in Lyft, $UBER’s biggest competitor in the US, and Grab, $UBER’s competitor in Southeast Asia. All these companies then all have price war with $UBER.

23.4 $UBER realized that having price war everywhere was not going to cut it, decided to sell $UBER China to $DIDI for about 7 billion and a stake in $DIDI. $DIDI also invested about 1 billion in $UBER. This thereby concluded the price war of ride sharing in China.

23.5 As the price war ends in China, $DIDI started its international expansion. Well, how did $DIDI expand? You guessed it, $DIDI started price war almost everywhere that $DIDI expand to. Until today, $DIDI is still having price war all over the world.

23.6 With so many price wars and fierce competition, it is hard to see when these price war will end. I am therefore doubtful to when $DIDI will be profitable.

24. Valuation

$DIDI currently has a market cap of 74.9B, a P/S ratio of 3 and EV/Sales of 5.42. $UBER has a market cap of 97.11B, P/S of 9 and EV/Sales 9.78. Although on its face, $DIDI is cheaper, this is not the reality, because $DIDI and $UBER recognizes revenue differently.

$DIDI currently has a market cap of 74.9B, a P/S ratio of 3 and EV/Sales of 5.42. $UBER has a market cap of 97.11B, P/S of 9 and EV/Sales 9.78. Although on its face, $DIDI is cheaper, this is not the reality, because $DIDI and $UBER recognizes revenue differently.

24.1 $UBER recognizes its revenue net of driver and merchant earnings and driver incentive, whereas $DIDI recognizes its revenue before driver earnings and incentives. This difference created the ‘delusion’ that $DIDI is cheaper than $UBER.

24.2 To better compare the two, I decided to compare the two companies’ net revenue (revenue – cost of sales). Bloomberg has estimated that $DIDI will have a 30B revenue in 2021, whereas $UBER 16B. $DIDI has a cost of revenue of 89% of revenue, whereas $UBER around 46%.

24.3 With these numbers, I calculated the Price/2021 net revenue for $UBER to be 11.24, whereas for $DIDI 22.70. $DIDI also has an EV/2021 net revenue of 40.97 larger than $UBER’s 12.21, On these two rough but more comparable terms, $UBER is cheaper than $DIDI.

25. Conclusion

$DIDI is the top 2 ride sharing company in the world. However, I am skeptical about $DIDI’s business model, as $DIDI will need to improve their margins while being handicapped by $DIDI’s biggest cost ‘drive cost’ as this would probably not decrease much.

$DIDI is the top 2 ride sharing company in the world. However, I am skeptical about $DIDI’s business model, as $DIDI will need to improve their margins while being handicapped by $DIDI’s biggest cost ‘drive cost’ as this would probably not decrease much.

25.1 Although $DIDI has a monopoly in China, such monopoly can only be maintained by low price. $DIDI must also continue its price war and discount price in other countries as they expand internationally. Regulatory crackdown/risks also just gotten VERY REAL.

25.2 In my humble opinion, $DIDI’s history of price wars, the ongoing price wars, combine with $DIDI’s inability to differentiate beside on merely ‘being cheap’, makes me skeptical of $DIDI’s long term success.

26. This is by no means the most comprehensive thread and I may have missed something about $DIDI, therefore be sure to write your insights or thoughts on $DIDI if you have any, especially if you have any contrary thoughts or a bull case for $DIDI!

27. Thank you very much for reading this thread! I hope you have learnt one or two things about $DIDI. If you liked the thread, be sure to consider liking it and retweeting it! It really does help me out a lot and I really appreciate it!

This thread may interest you and I would really appreciate your input/comments on $DIDI! 🙏🙏

@mukund

@daniel_toloko

@TanArrowz

@snorlax_support

@ripster47

@MrFourToEight

@NIONenad

@LaMonicaBuzz

@BrokeBackRican

@Innovestor_

@MT_Capital1

@HonestInvesting

@mukund

@daniel_toloko

@TanArrowz

@snorlax_support

@ripster47

@MrFourToEight

@NIONenad

@LaMonicaBuzz

@BrokeBackRican

@Innovestor_

@MT_Capital1

@HonestInvesting

If you are interested in $DIDI, here is another thread that i did which goes over some very sneaky (even borderline illegal) tactics $DIDI has played when they where trying to acquire their drivers.

https://twitter.com/JoshuaTai0427/status/1411591391772241921

• • •

Missing some Tweet in this thread? You can try to

force a refresh