We need to learn to live with COVID-19 and its variants. This appears to be what bellweather economies seem to be saying. While we are all aware of the US opening up, almost entirely in July, Singapore, and UK stand out in particular. Singapore is moving away from a...(1/7)

...“Covid-Zero” strategy of completely stamping out the virus from its country through strong border controls/aggressive contact tracing/social distancing. Singapore is now moving to a strategy that focussess on reopening its economy through mass-vaccinations with...(2/7)

...a broad assumption that COVID-19 would not completely exit the country for the next few years. Singapore also senses that it is falling behind its western counterparts on the recovery trajectory. It plans to live with the virus that would be contained through...(3/7)

...vaccinations. The reopening of its economy therefore would be tied to vaccination milestones and vaccinated individuals will be given more allowances to travel and move around.

Yet another economy, appears to be doing the same, but in very different conditions. UK's PM...(4/7)

Yet another economy, appears to be doing the same, but in very different conditions. UK's PM...(4/7)

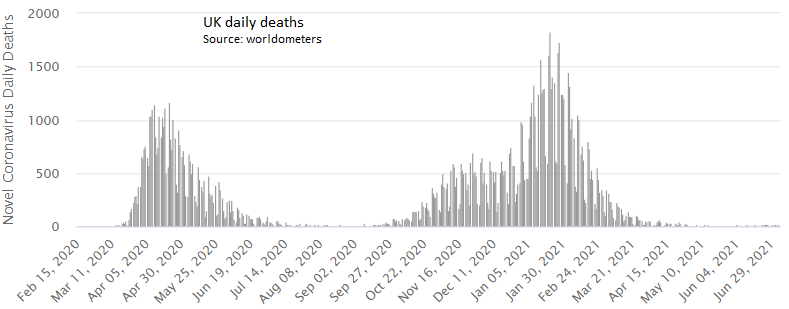

...Boris Johnson announced yesterday that social distancing and face mask rules are likely to end on 19th July as the country moves towards reopening. This is despite the fact that UK daily infections are on the rise. The UK has been heavily criticised for opening up an...(5/7)

...economy even before its COVID-wave has peaked. Note here that this confidence is probably on the back of the fact that daily deaths in the UK are in single digits, despite daily infections north of 27k. If one ties-up the data in the UK, it seems evident that...(6/7)

...vaccinations are leading to much lower fatalities. Note here that 86% of UK adults (67% of pop) have received at least one shot of the vaccine and 64% (50% of pop) have received both doses of the vaccine. (7/7)

• • •

Missing some Tweet in this thread? You can try to

force a refresh