How to get URL link on X (Twitter) App

...early October and extending into mid-November. Like seen in Kerala mobility indicators that have just near normalised are expected to see a sharp increase. If Kerala #COVID19 cases rise now, can one extrapolate this into India infections? One cannot say for sure. But...(2/5)

...early October and extending into mid-November. Like seen in Kerala mobility indicators that have just near normalised are expected to see a sharp increase. If Kerala #COVID19 cases rise now, can one extrapolate this into India infections? One cannot say for sure. But...(2/5)

https://twitter.com/arjungn80/status/1422133166093922304

...issues. The recent policy shock aside, from mid-July, China saw power outages, significant floods, all in provinces housing key manufacturing-hubs. Adding to this, the recent surge in COVID-cases have led to a string of lockdowns/restrictions across 14 provinces. While...(2/4)

...issues. The recent policy shock aside, from mid-July, China saw power outages, significant floods, all in provinces housing key manufacturing-hubs. Adding to this, the recent surge in COVID-cases have led to a string of lockdowns/restrictions across 14 provinces. While...(2/4)

...calibration was just shifting of monies from one pocket to another, especially when the #callmoney rate is still 22bps below the reverse repo rate. The focus therefore is to bring the call rate closer to the policy rate, when system liquidity is on the rise. One can...(2/12)

...calibration was just shifting of monies from one pocket to another, especially when the #callmoney rate is still 22bps below the reverse repo rate. The focus therefore is to bring the call rate closer to the policy rate, when system liquidity is on the rise. One can...(2/12)

...in the UK continues to rise and is yet to see a peak, the daily fatalities have barely seen a pickup, compared to where it was the last time around. During the last wave, the mortality curve saw a pickup around a month or so after the infections curve. Looking...(2/6)

...in the UK continues to rise and is yet to see a peak, the daily fatalities have barely seen a pickup, compared to where it was the last time around. During the last wave, the mortality curve saw a pickup around a month or so after the infections curve. Looking...(2/6)

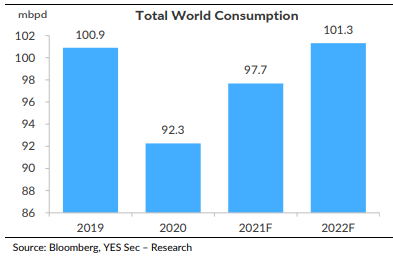

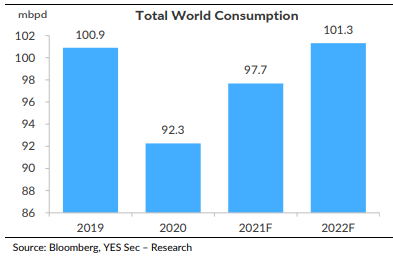

...deficit of (1.6)mbpd during the first six months of this year 2021. This deficit is an artificial one, on account of the production cuts imposed by the OPEC+ to keep prices elevated. Commentators appear to increasingly feel that crude could peak around $80/bbl. Higher...(2/6)

...deficit of (1.6)mbpd during the first six months of this year 2021. This deficit is an artificial one, on account of the production cuts imposed by the OPEC+ to keep prices elevated. Commentators appear to increasingly feel that crude could peak around $80/bbl. Higher...(2/6)