Thread

Basics of Doji Candlestick Pattern

The Doji candlestick pattern is a formation that occurs when a market’s open price and close price are almost exactly the same.

@caniravkaria @SouravSenguptaI @Puretechnicals9

Basics of Doji Candlestick Pattern

The Doji candlestick pattern is a formation that occurs when a market’s open price and close price are almost exactly the same.

@caniravkaria @SouravSenguptaI @Puretechnicals9

It is formed when the market opens and bullish traders push prices up whereas the bearish traders reject the higher price and push it back down.

It could also be that bearish traders try to push prices as low as possible, and the bulls fight back and push the price up.

It could also be that bearish traders try to push prices as low as possible, and the bulls fight back and push the price up.

The upward and downward movements that happen between open and close form the wick.

The body is formed when the price closes at or almost the same level as it opened.

There are 4 types of Doji candles

Source Elearnmarkets and Investing. com

The body is formed when the price closes at or almost the same level as it opened.

There are 4 types of Doji candles

Source Elearnmarkets and Investing. com

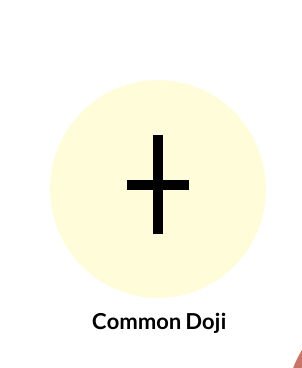

👉Common Doji

This is the most common type of Doji candlestick pattern.

When buying and selling are almost the same, this pattern occurs.

The future direction of the trend is uncertain as indicated by this Doji pattern

This is the most common type of Doji candlestick pattern.

When buying and selling are almost the same, this pattern occurs.

The future direction of the trend is uncertain as indicated by this Doji pattern

👉Long-Legged Doji

As the name suggests this is a long-legged candlestick pattern.

When the supply and demand factors are at equilibrium, then this pattern occurs. The trend’s future direction is regulated by the prior trend and Doji pattern.

As the name suggests this is a long-legged candlestick pattern.

When the supply and demand factors are at equilibrium, then this pattern occurs. The trend’s future direction is regulated by the prior trend and Doji pattern.

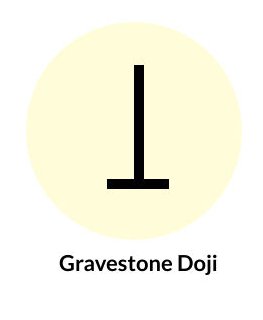

👉Gravestone Doji

This pattern is found at the end of the uptrend when supply and demand factors are equal.

At the day’s low, the candlestick opens and closes. The future direction of the trend is regulated by the prior trend and Doji pattern.

This pattern is found at the end of the uptrend when supply and demand factors are equal.

At the day’s low, the candlestick opens and closes. The future direction of the trend is regulated by the prior trend and Doji pattern.

Dragonfly Doji

This pattern appears at the end of the downtrend when the supply and demand factors are at equilibrium.

This pattern appears at the end of the downtrend when the supply and demand factors are at equilibrium.

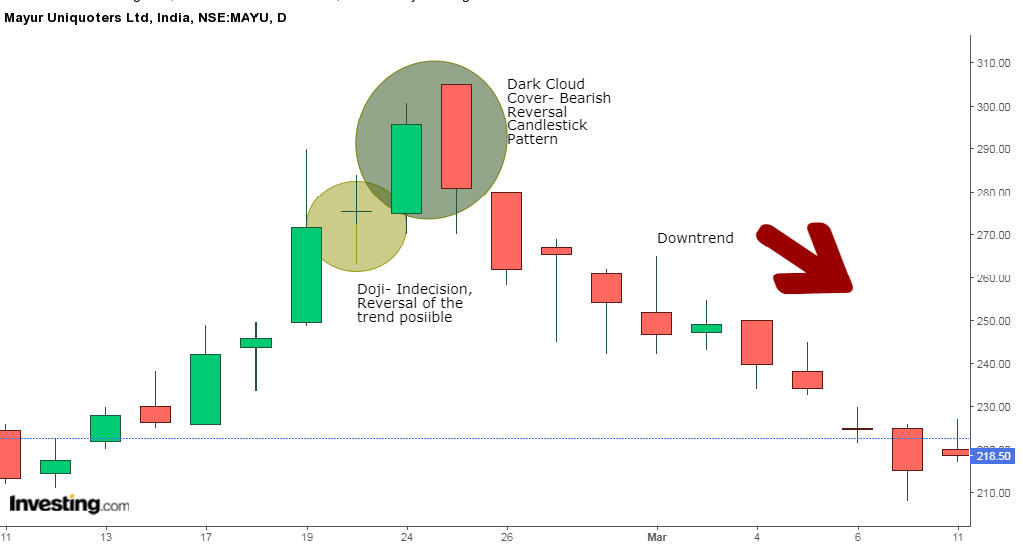

Doji Example:

here Mayur Uniquoters Ltd, we see that at the end of the uptrend a Doji is formed which is indicating that the ongoing trend has become certain. it is then followed by the Dark Cloud Cover candlestick pattern that confirms that the reversal is going to take place

here Mayur Uniquoters Ltd, we see that at the end of the uptrend a Doji is formed which is indicating that the ongoing trend has become certain. it is then followed by the Dark Cloud Cover candlestick pattern that confirms that the reversal is going to take place

• • •

Missing some Tweet in this thread? You can try to

force a refresh