In the long-run DeFi protocols’ value will depend on three key variables:

1) Global Reach

2) Market Structure

3) Pricing Power

These variables may not only determine just how high DeFi valuations may get, but also determine how much value DeFi captures relative to ETH.

1/

1) Global Reach

2) Market Structure

3) Pricing Power

These variables may not only determine just how high DeFi valuations may get, but also determine how much value DeFi captures relative to ETH.

1/

Global Reach - DeFi protocols will scale more efficiently across the world than legacy financial institutions.

Like the internet protocols we take for granted today (TCP/IP, HTTP), DeFi protocols are not beholden to any jurisdiction and are available everywhere.

This allows DeFi protocols to reach far more users and achieve true internet scale like the Facebooks and Googles of the world.

This allows DeFi protocols to reach far more users and achieve true internet scale like the Facebooks and Googles of the world.

Market Structure - Will DeFi be a “winner-take-all / most” market?

It’s unclear how many winning protocols there will be per vertical, or whether “everything protocols” may emerge that completely absorb their rivals.

It’s unclear how many winning protocols there will be per vertical, or whether “everything protocols” may emerge that completely absorb their rivals.

The most likely scenario to me is each vertical having 1-2 dominant protocols.

If every protocol is permissionless to use and build upon why not just use whichever protocols are best of breed?

Bundling doesn’t seem a likely winning strategy.

If every protocol is permissionless to use and build upon why not just use whichever protocols are best of breed?

Bundling doesn’t seem a likely winning strategy.

What this means is entire sectors of the financial services industry worth trillions of $$$ being replaced by just 1-2 protocols per sector.

That is an incredible market opportunity.

That is an incredible market opportunity.

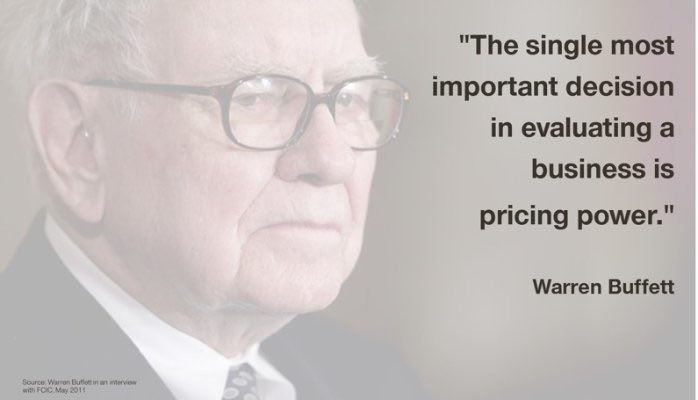

Pricing Power - How much can DeFi protocols charge users for their services?

This is the least certain variable of the three, but may be the most important in determining the terminal value of DeFi protocols.

This is the least certain variable of the three, but may be the most important in determining the terminal value of DeFi protocols.

On one hand open source development and permissionless protocols lead to low switching costs (competitors can copy your code and users can leave in an instant) so it's possible protocols will have low pricing power over users.

There’s also a delicate balance in managing stakeholder incentives in DeFi, and it's unclear how much extractable value there will be (or should be) for token holders today or in the future. placeholder.vc/blog/2019/10/6…

On the other hand there are legit ways DeFi protocols can build sustainable competitive advantages that may allow them to achieve greater pricing power than what appears on the surface.

Wrote about this in depth here.

messari.io/article/defi-c…

Wrote about this in depth here.

messari.io/article/defi-c…

Some protocols may also be able to capture more value depending on design decisions.

Ex: MakerDAO’s cost of capital is zero due to it creating its own lending inventory, allowing it to capture more value than secondary market lenders which most source inventory and pay for it.

Ex: MakerDAO’s cost of capital is zero due to it creating its own lending inventory, allowing it to capture more value than secondary market lenders which most source inventory and pay for it.

Anyways, so where does ETH fit in?

Well think about what value capture looks like if DeFi protocols have low pricing power.

Well think about what value capture looks like if DeFi protocols have low pricing power.

On one hand lower margins for DeFi protocols means more surplus to users, both on the supply and demand side (DeFi protocols are marketplaces).

But it also means Ethereum captures a higher % of total fees per transaction as gas becomes a larger portion relative to protocol fees.

But it also means Ethereum captures a higher % of total fees per transaction as gas becomes a larger portion relative to protocol fees.

If this scenario plays out then Ethereum may end up capturing more value from DeFi than DeFi protocols themselves (not even including ETH’s monetary premium)

@CryptoHayes makes this assumption in one of his latest DeFi essays that leads to some wild valuation targets for ETH.

link.medium.com/0EEoLnYCGhb

link.medium.com/0EEoLnYCGhb

So where does this leave us?

DeFi protocols will likely have global reach and winner-take-most market structure for each vertical, but unclear pricing power.

If DeFi protocols do indeed have low pricing power it would be the cherry on top for the already bullish case for ETH.

DeFi protocols will likely have global reach and winner-take-most market structure for each vertical, but unclear pricing power.

If DeFi protocols do indeed have low pricing power it would be the cherry on top for the already bullish case for ETH.

Only time will tell how this plays out.

Wrote about these ideas a few months ago in @MessariCrypto newsletter, but figure it needed an update after more thought on the topic. messari.io/article/messar…

Wrote about these ideas a few months ago in @MessariCrypto newsletter, but figure it needed an update after more thought on the topic. messari.io/article/messar…

Btw one of the few titles that wasn’t my choice lol

• • •

Missing some Tweet in this thread? You can try to

force a refresh