There is a Narrative. There is data.

And then there is a narrative based on data.

The blog post below is one of those narratives based on data

rsharat.substack.com/p/the-naked-tr…

Do we agree with it?

No.

And then there is a narrative based on data.

The blog post below is one of those narratives based on data

rsharat.substack.com/p/the-naked-tr…

Do we agree with it?

No.

One of our investor friends is an ex @PPFAS but does not want his name to appear here.

He made some hard-hitting points to disprove the opinion formed in the above blog post which we believe cannot remain confined in a closed investor group.

So here we go.

He made some hard-hitting points to disprove the opinion formed in the above blog post which we believe cannot remain confined in a closed investor group.

So here we go.

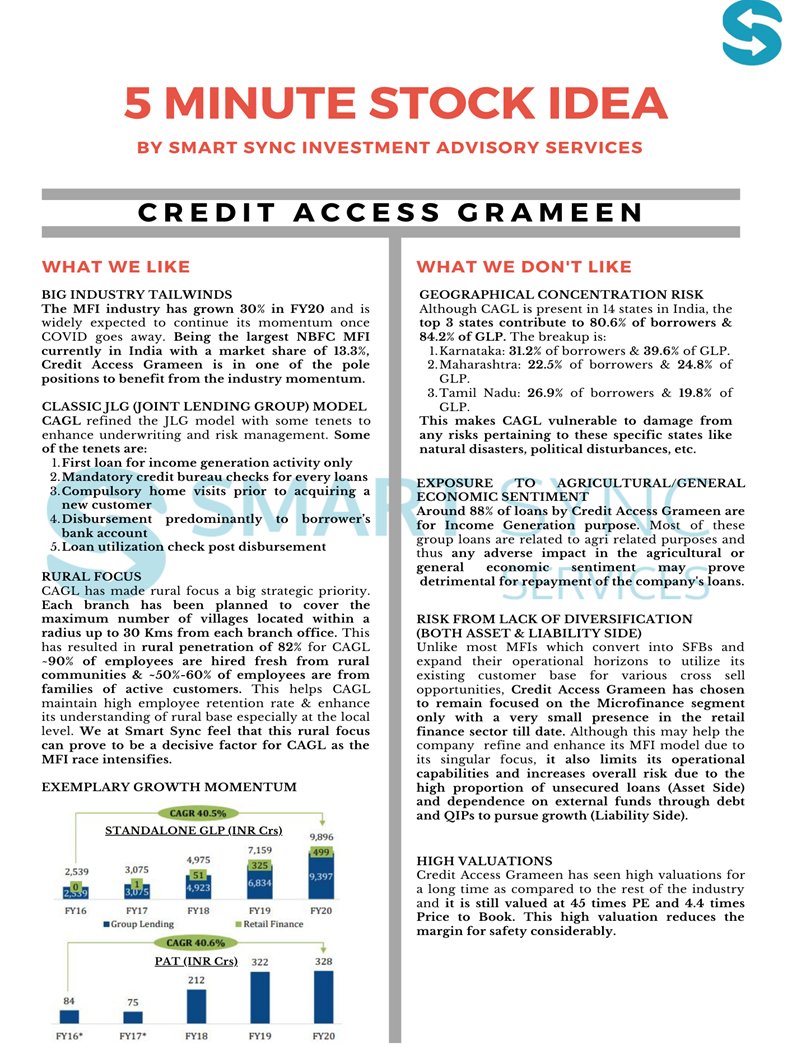

~Comparison of PPFAS with NASDAQ 100 for the entire time period is a flawed logic (check image)

~35% allocation is overseas and not NASDAQ.

~allocation to NASDAQ based stocks was very low in the initial period

~It only got increased during the last year.

~35% allocation is overseas and not NASDAQ.

~allocation to NASDAQ based stocks was very low in the initial period

~It only got increased during the last year.

Using MOSL ETF for benchmarking is again an imperfect way to come to a conclusion.

~MOSL ETF may also have a tracking error compared to NASDAQ100

~We do not know the hedging strategies of MOSL ETF whereas PPFAS is 90% hedged.

~MOSL ETF may also have a tracking error compared to NASDAQ100

~We do not know the hedging strategies of MOSL ETF whereas PPFAS is 90% hedged.

Finally,

It is easy to find faults in other people’s work. Not so easy to find faults in our analysis.

If you find any fault in ours, please let us know 🙂

End

It is easy to find faults in other people’s work. Not so easy to find faults in our analysis.

If you find any fault in ours, please let us know 🙂

End

• • •

Missing some Tweet in this thread? You can try to

force a refresh