AR20-21 Notes

Tata Elxsi

Design Digital

Helping Enterprises Re-imagine Products & Services

Simplifying Technological Complexity

Retweet to help more Investors read AR.🙂

Tata Elxsi

Design Digital

Helping Enterprises Re-imagine Products & Services

Simplifying Technological Complexity

Retweet to help more Investors read AR.🙂

1/

Message From the Chairman

~Strong Operating Performance

~Diversify-Geopolitical & Currency Risk mitigated

~Ranked in the leadership zone of Zinnov Zones 2020 Report

Message From the Chairman

~Strong Operating Performance

~Diversify-Geopolitical & Currency Risk mitigated

~Ranked in the leadership zone of Zinnov Zones 2020 Report

2/

DESIGN DIGITAL

~Industrial Design & Visualization

~Healthcare

~Media Broadcast & Communications

~Transportation

~System Integration

DESIGN DIGITAL

~Industrial Design & Visualization

~Healthcare

~Media Broadcast & Communications

~Transportation

~System Integration

3/

Notes from MDA

~IT Sector- 8% of GDP, 52% of Services Exported

~Capex budgets diverted to IT & digitalization

~Disturbance in Automotive Industries

~Global Auto demand is going to increase but at a slow pace

Notes from MDA

~IT Sector- 8% of GDP, 52% of Services Exported

~Capex budgets diverted to IT & digitalization

~Disturbance in Automotive Industries

~Global Auto demand is going to increase but at a slow pace

4/

Notes from MDA

~Media & Communication -1 of the few sectors that did well in pandemic

~5G adoption faster due to pandemic

~Inflection point for digital transformation in healthcare

Notes from MDA

~Media & Communication -1 of the few sectors that did well in pandemic

~5G adoption faster due to pandemic

~Inflection point for digital transformation in healthcare

5/

Notes from MDA

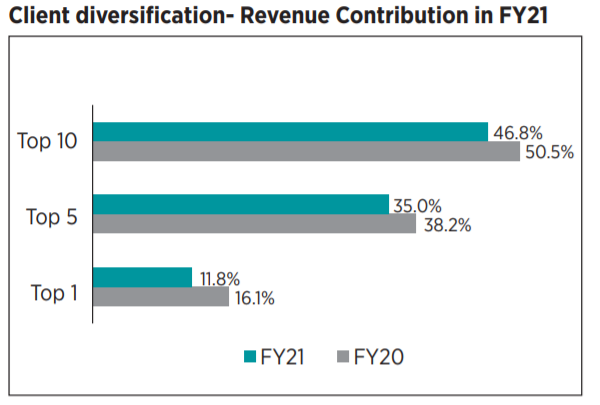

~Client Diversification

~Geographical Diversification

~Global Automotive ER&D to rebound

~Global Hi-Tech led ER&D to grow further

Notes from MDA

~Client Diversification

~Geographical Diversification

~Global Automotive ER&D to rebound

~Global Hi-Tech led ER&D to grow further

7/

Financial Analysis

~Other expenses decreased

~Overhead expenses came down drastically

~Travel Exp gone down 60-70%.

~A&P and Communication Exp fell 20%

~Leading to higher-margin & PAT

Financial Analysis

~Other expenses decreased

~Overhead expenses came down drastically

~Travel Exp gone down 60-70%.

~A&P and Communication Exp fell 20%

~Leading to higher-margin & PAT

9/

More Resources to learn:

~10 concall Notes: bit.ly/3qiD6FM

~5 Min Stock Idea(July-2020) bit.ly/3j6pSus

~Infographic: bit.ly/3qkIKqT

~FY20 AR Notes bit.ly/3qjjyBf

~@soicfinance video: bit.ly/35MXLZm

End

More Resources to learn:

~10 concall Notes: bit.ly/3qiD6FM

~5 Min Stock Idea(July-2020) bit.ly/3j6pSus

~Infographic: bit.ly/3qkIKqT

~FY20 AR Notes bit.ly/3qjjyBf

~@soicfinance video: bit.ly/35MXLZm

End

• • •

Missing some Tweet in this thread? You can try to

force a refresh