Thread on Chart Patterns

I’m sure you all have heard of chart patterns and I hear many people saying they don’t believe in chart patterns. The reason why chart patterns work is because of supply and demand.

Chart patterns do not always workout the way people expect them to on every ticker. The reason for that is because nothing is guaranteed in the stock market, you’re trading a ticker with weak price actions, or chart has a history for not respecting certain patterns

This is why it’s important to make sure when trading these you go in with a plan and you are aware that anything can happen. The reason I like chart patterns is because it gives me good risk-reward if the pattern fails I will already have my stop set and will know how it failed.

It is really important to trade these patterns with tickers that have a history of respecting the certain pattern you are trading and the ticker must have strong price action. I also like to us VPA (Volume Price Analysis) with chart patterns since it can confirm a move

Now let’s get started with the chart patterns.

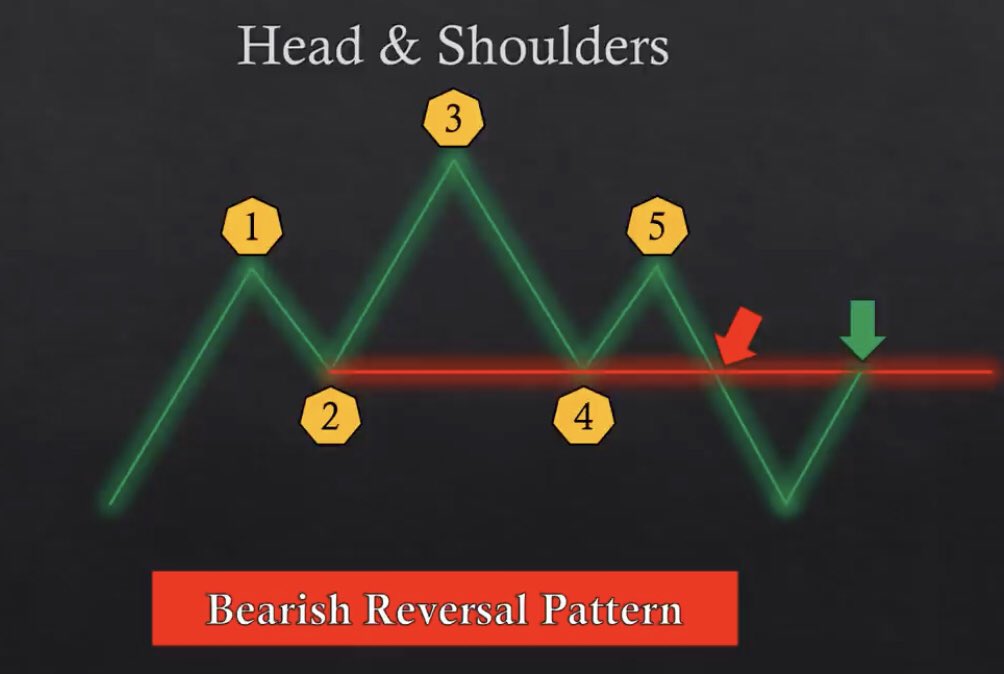

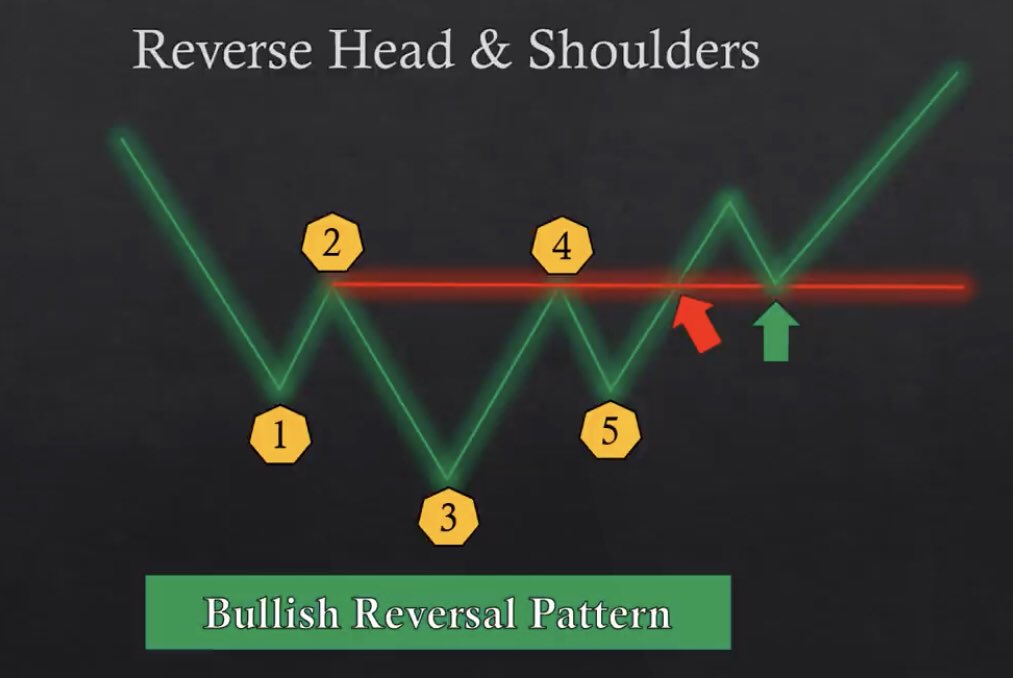

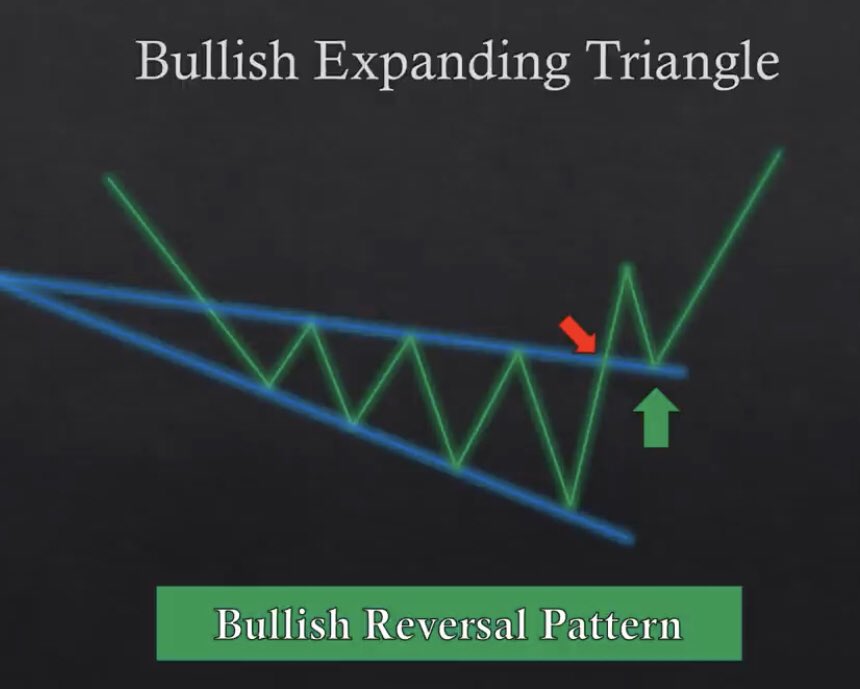

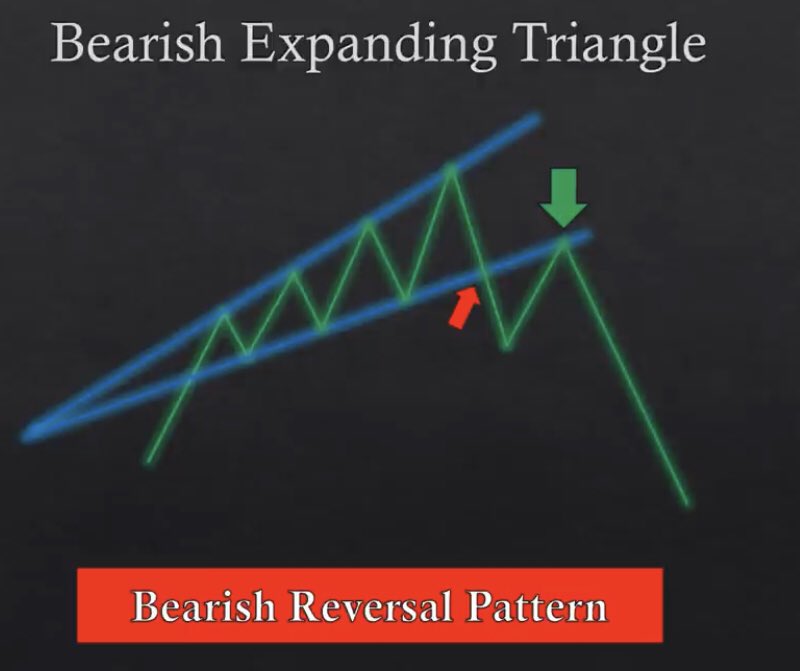

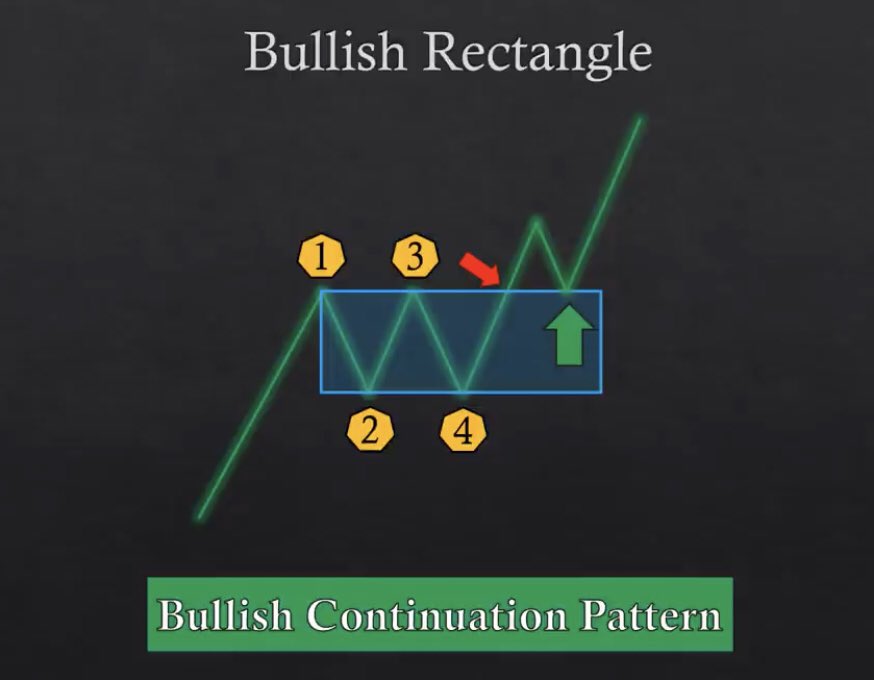

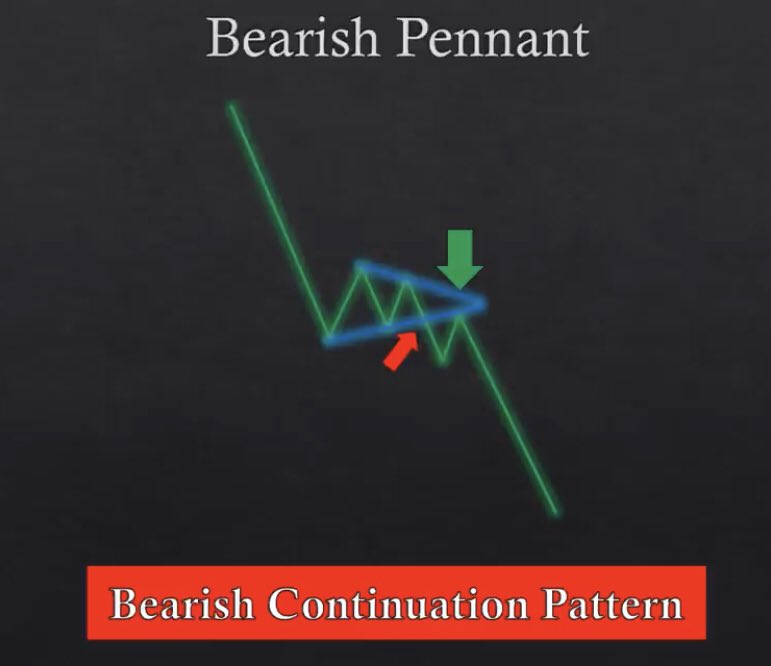

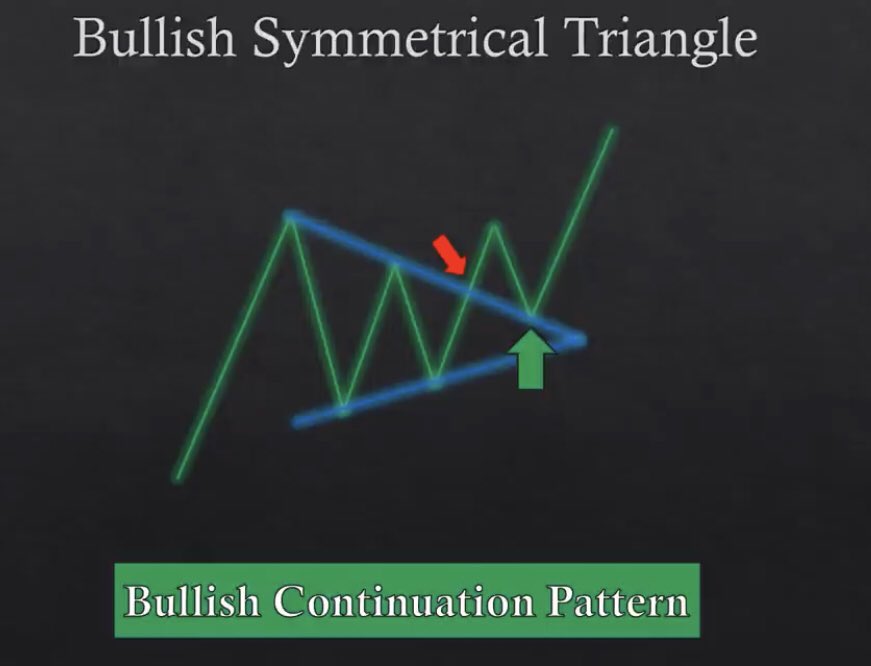

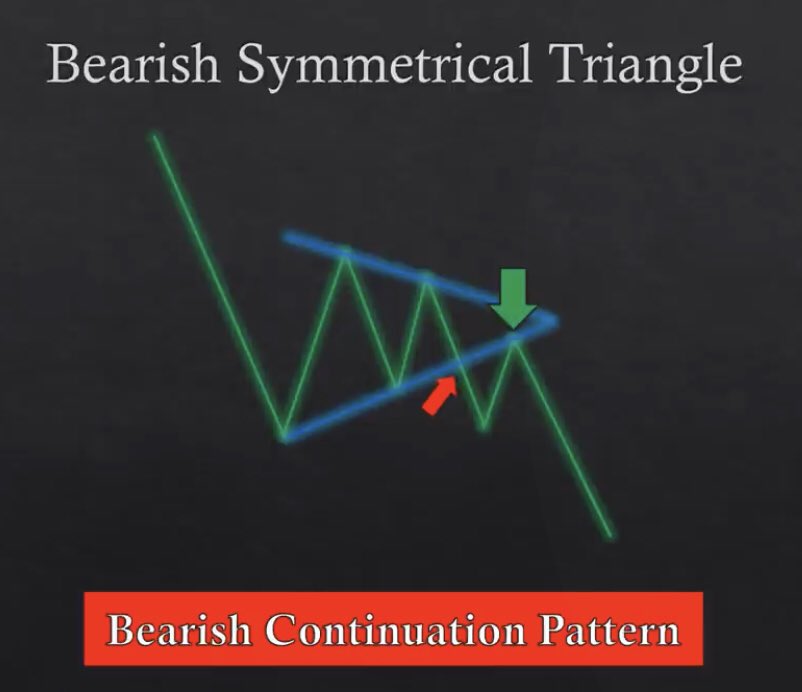

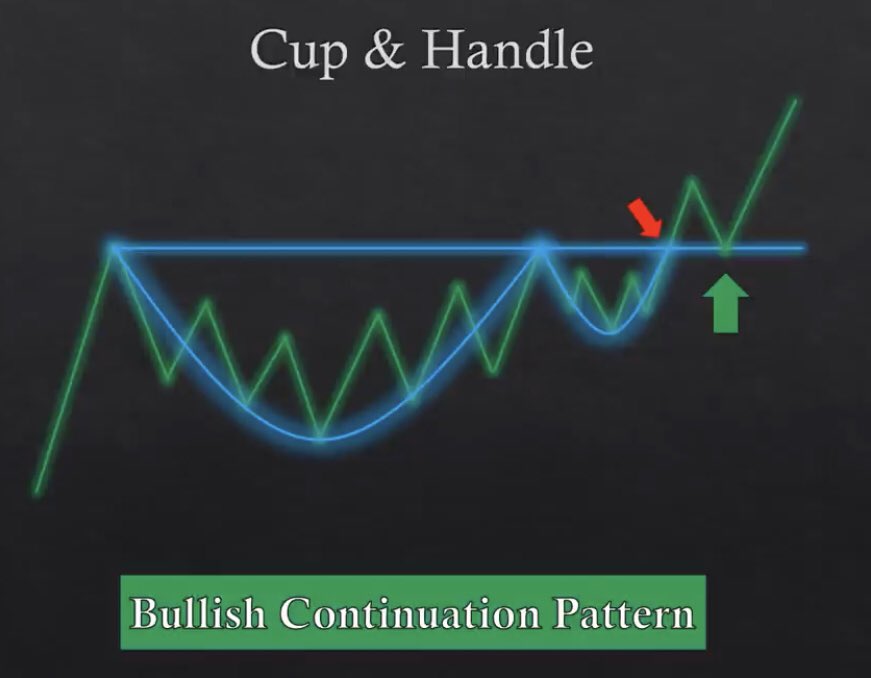

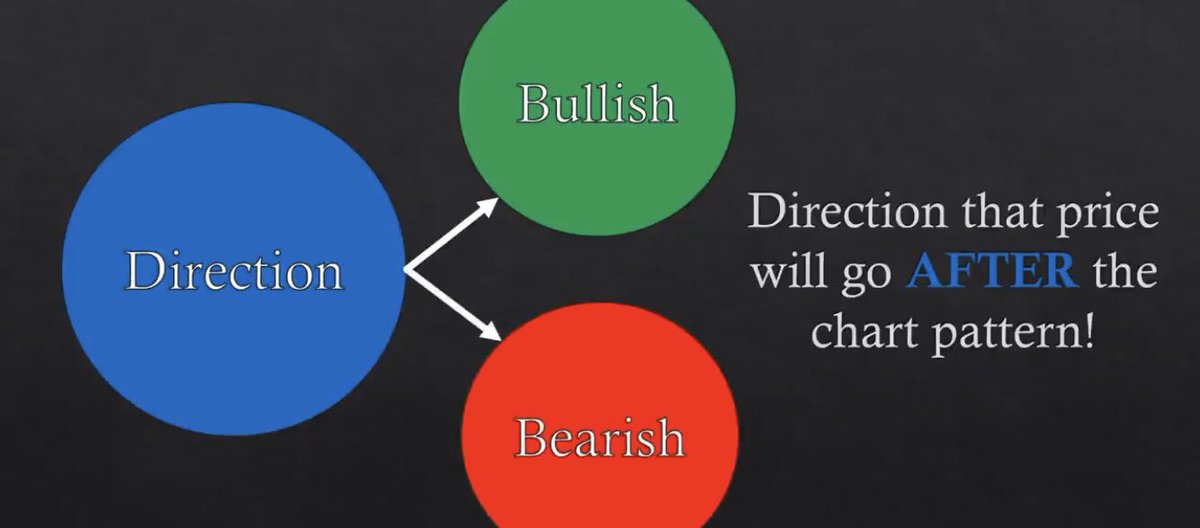

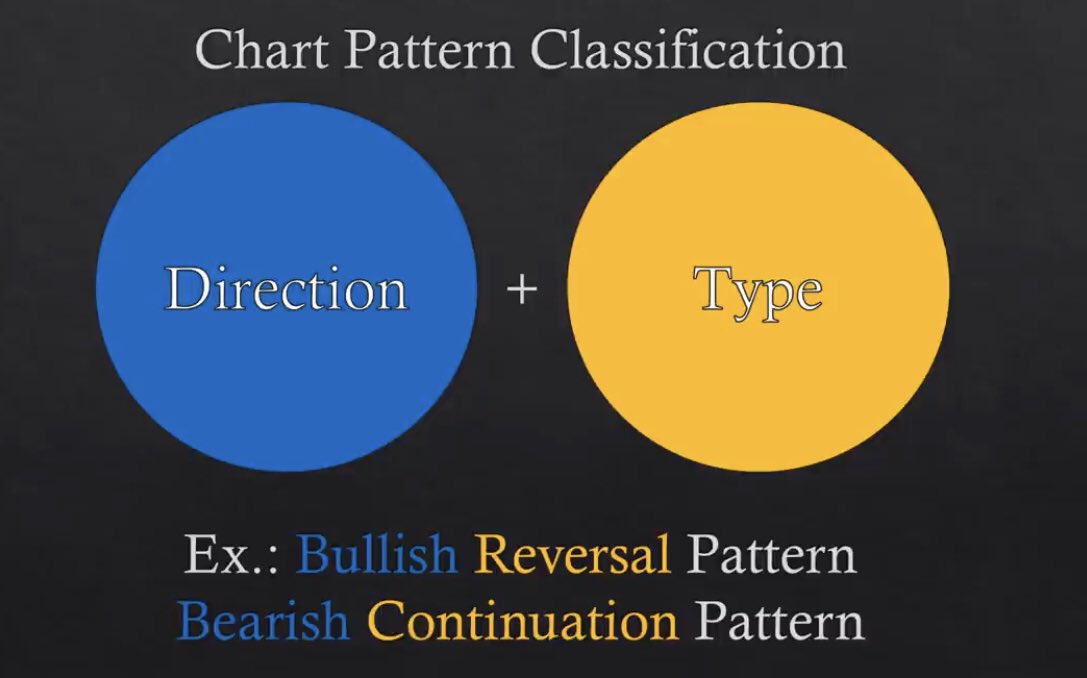

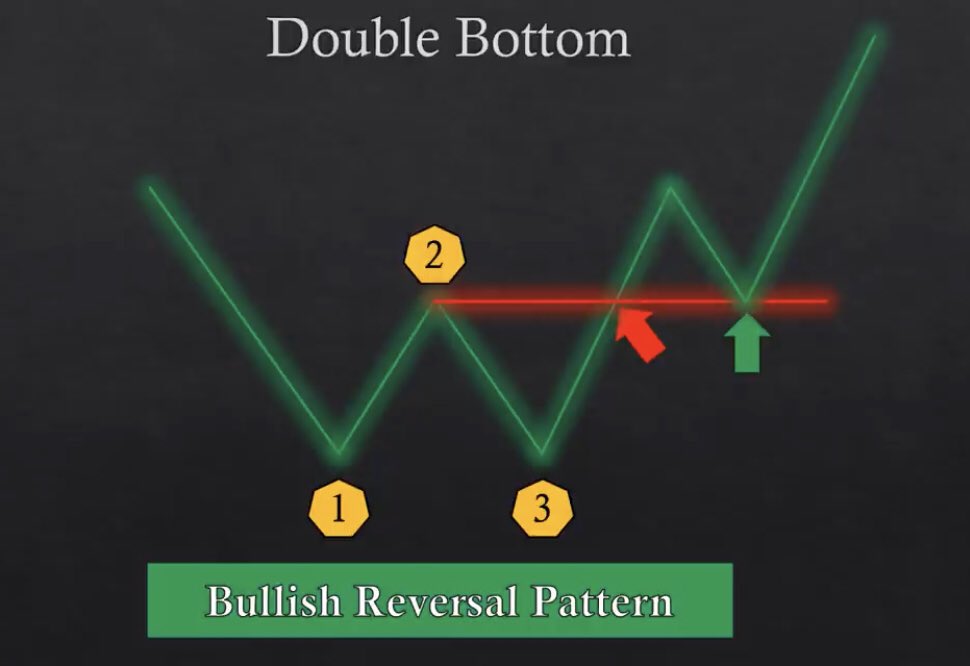

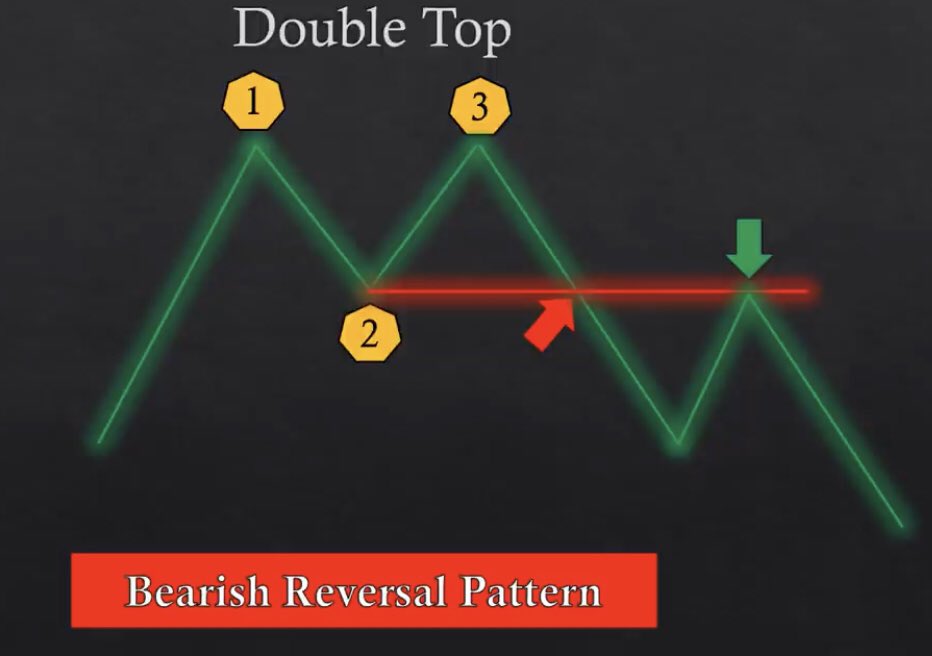

1. There are two types of directions a chart pattern will go. It’s either bullish or bearish

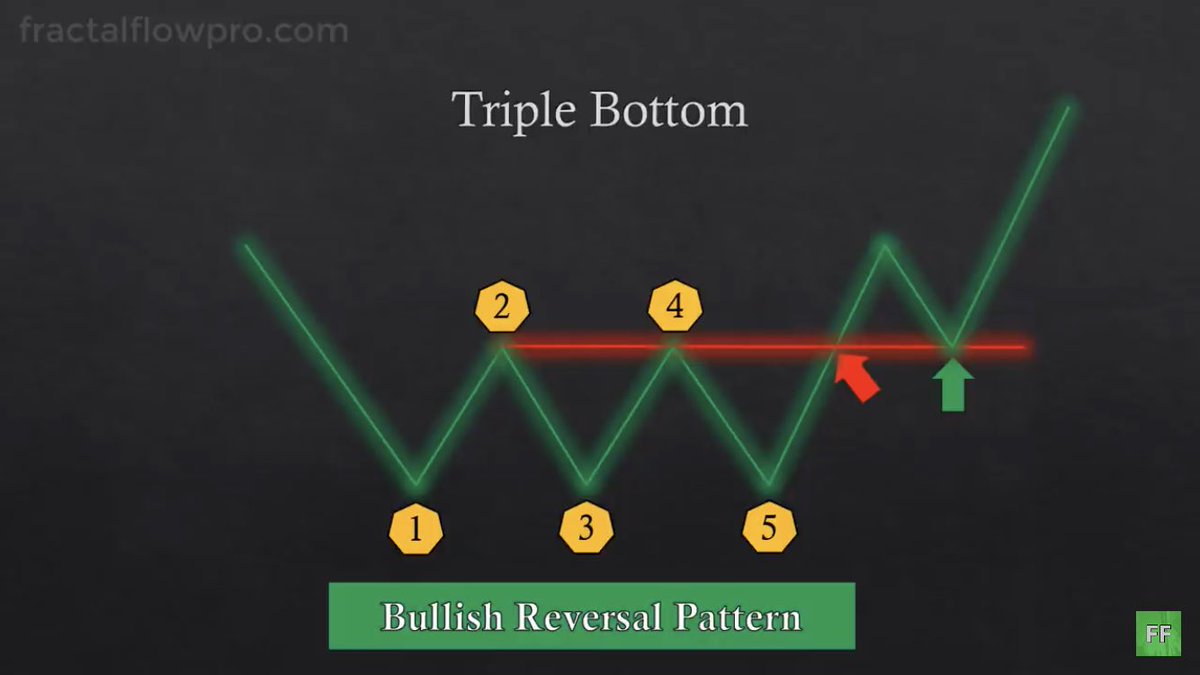

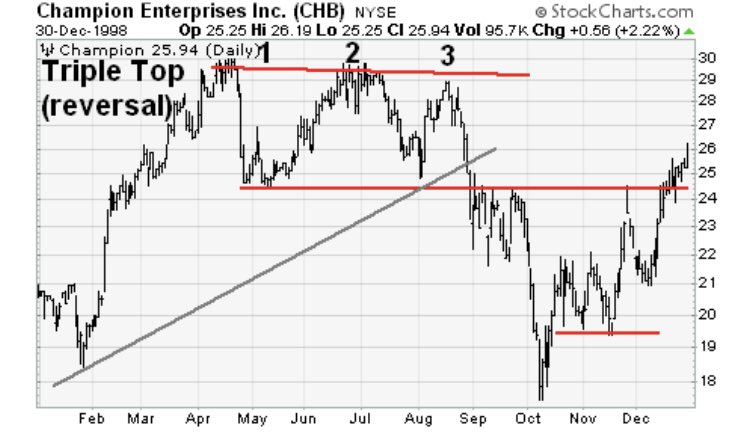

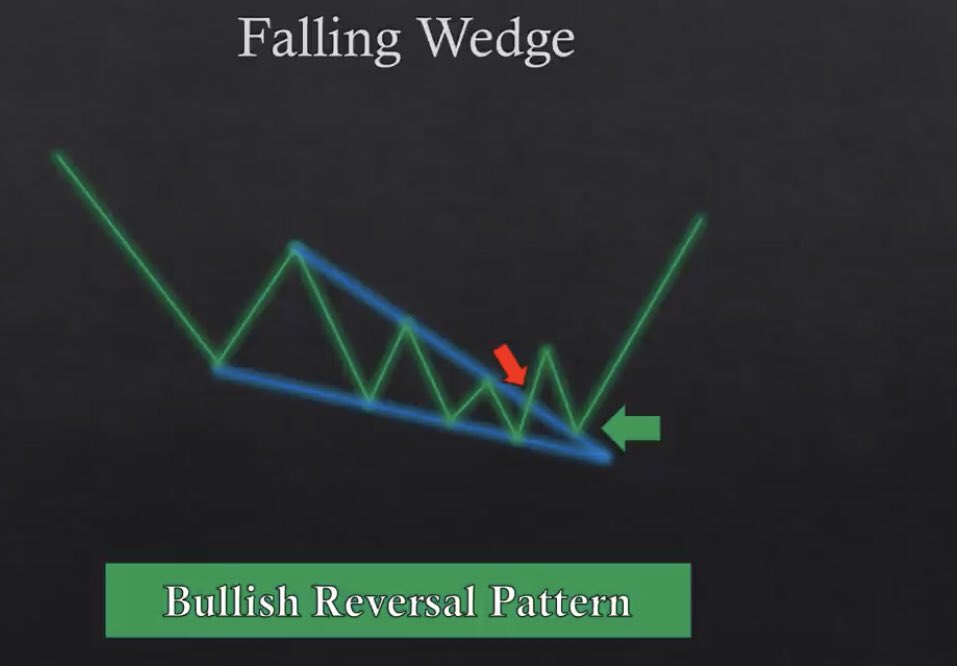

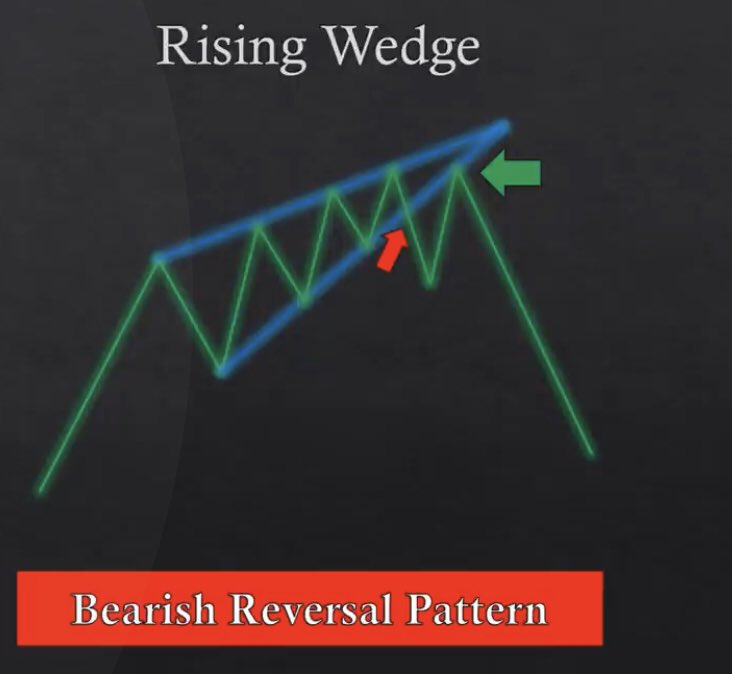

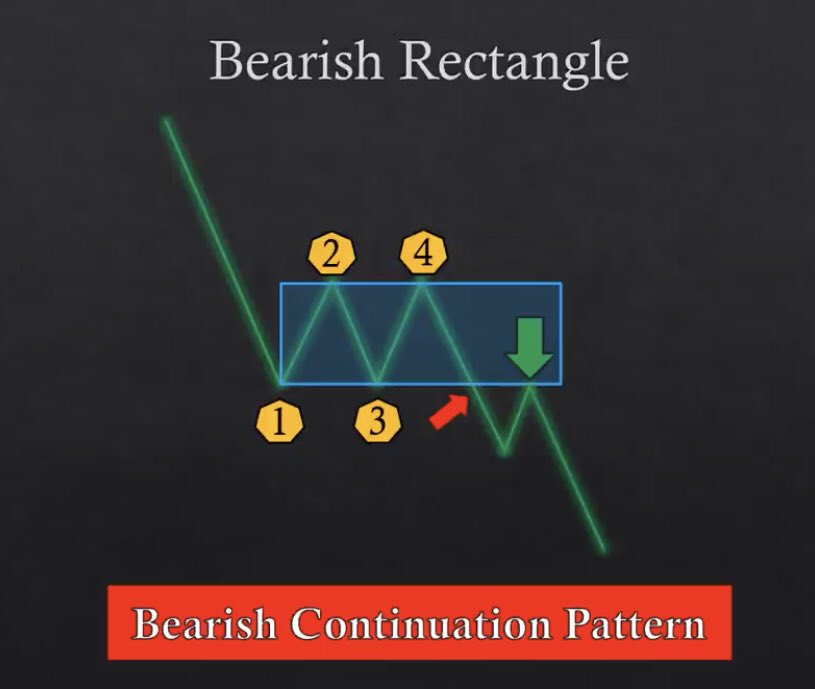

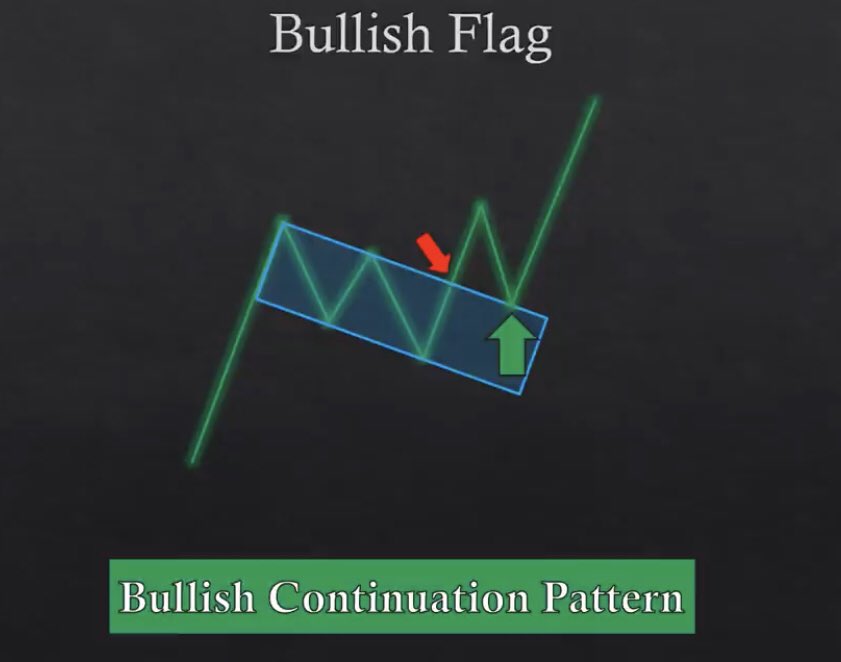

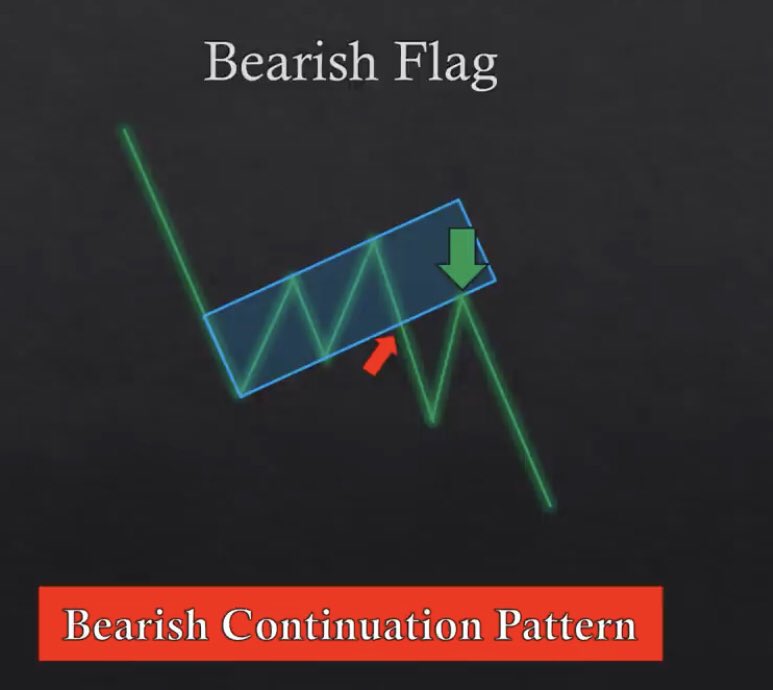

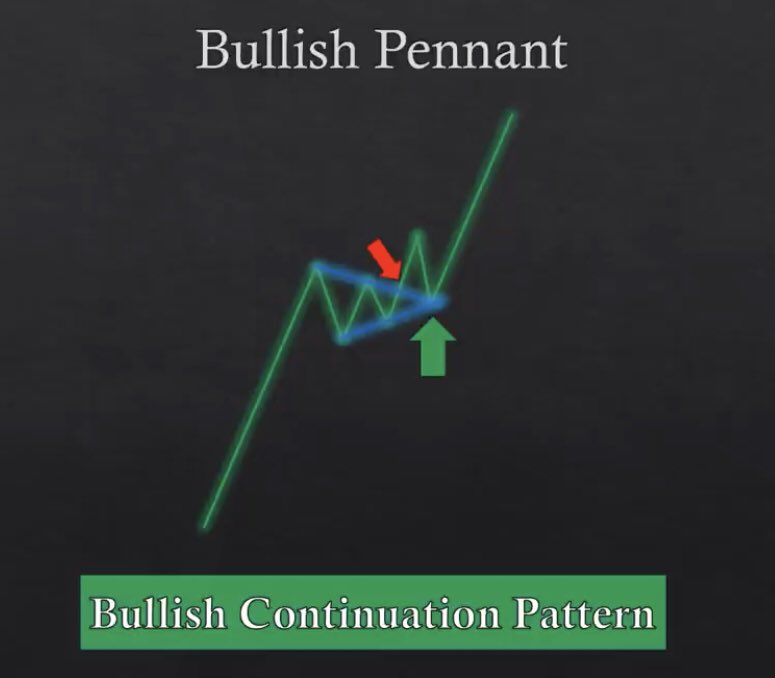

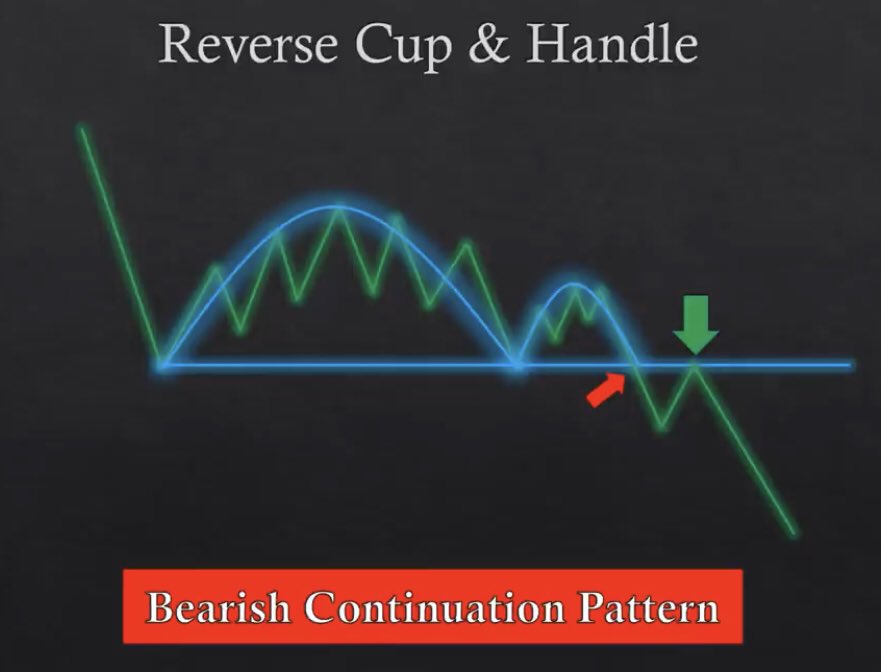

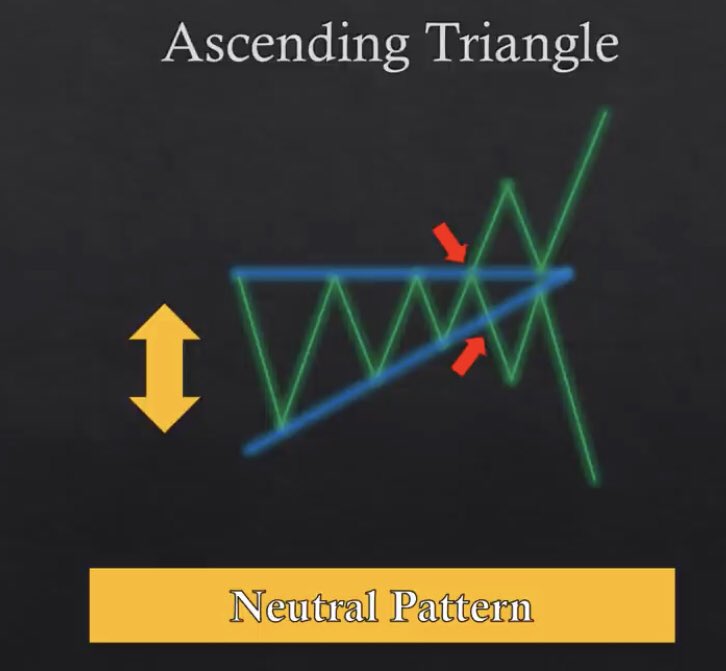

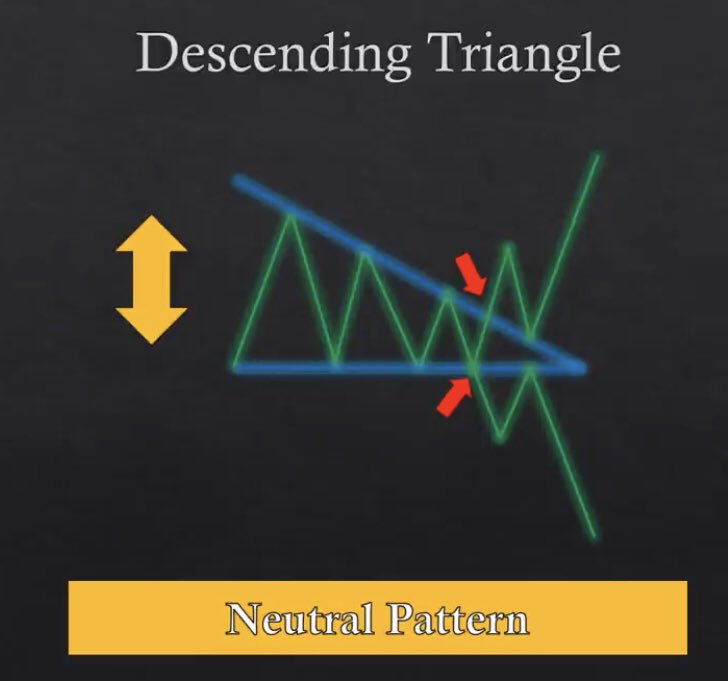

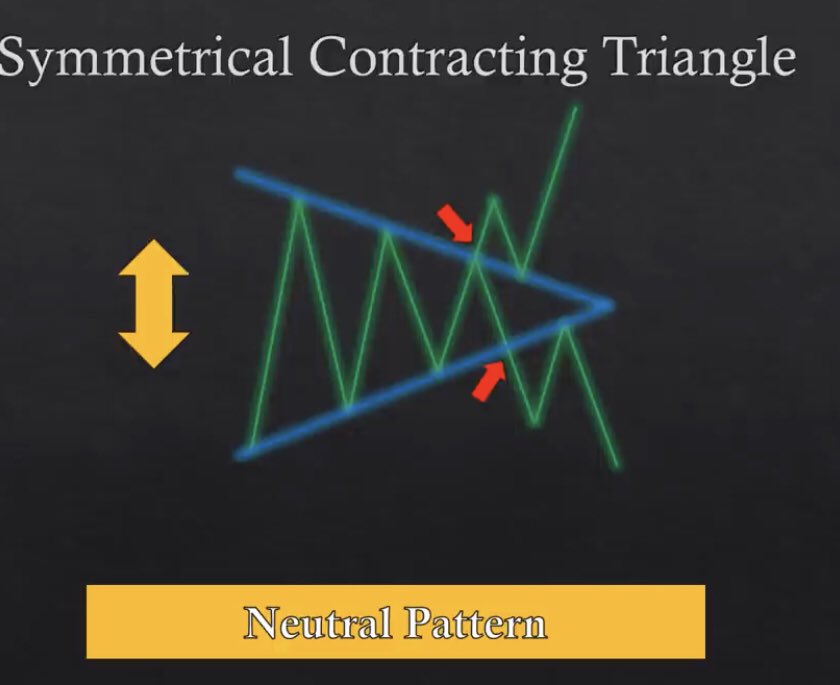

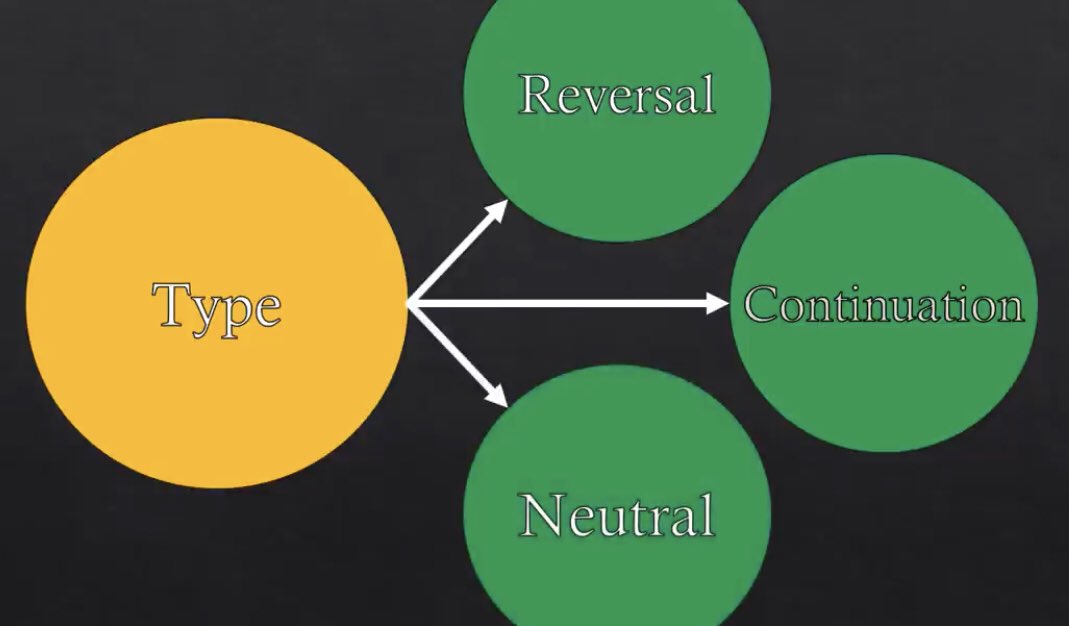

2. There are 3 types of chart patterns. Reversal, Continuation, Neutral

3. The name will be based on the above. Look at example below

1. There are two types of directions a chart pattern will go. It’s either bullish or bearish

2. There are 3 types of chart patterns. Reversal, Continuation, Neutral

3. The name will be based on the above. Look at example below

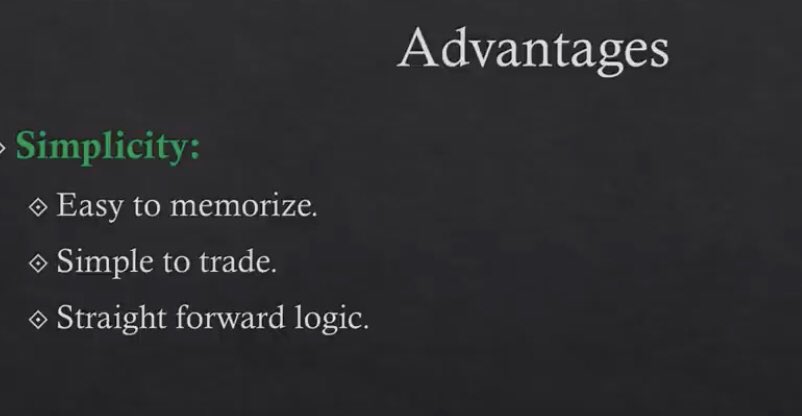

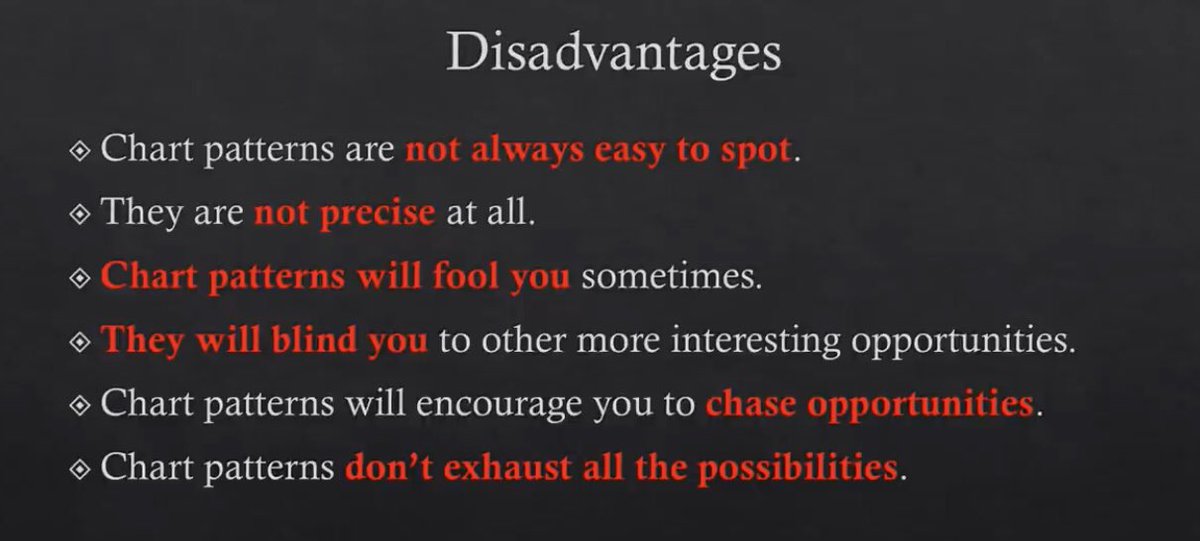

These are the advantages and disadvantages of trading chart patterns. That is why it is important to make sure you always have an edge and good risk management. btw I really recommend using VPA with the chart patterns

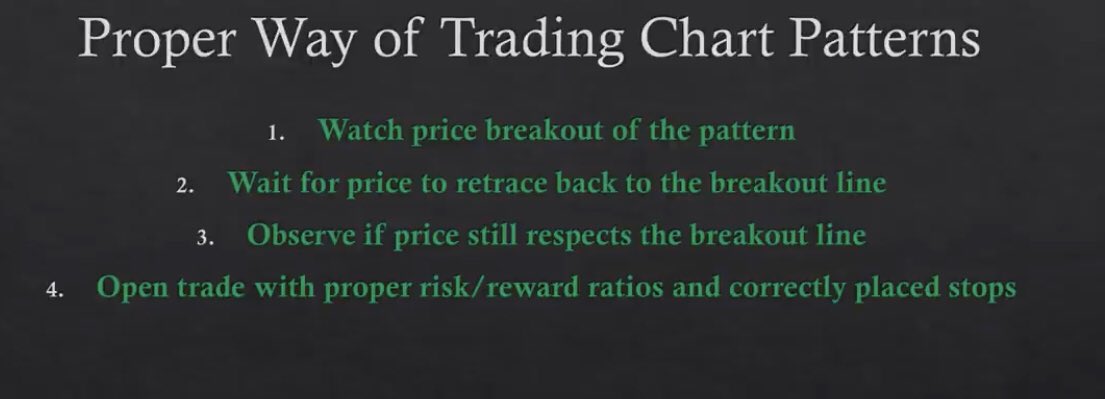

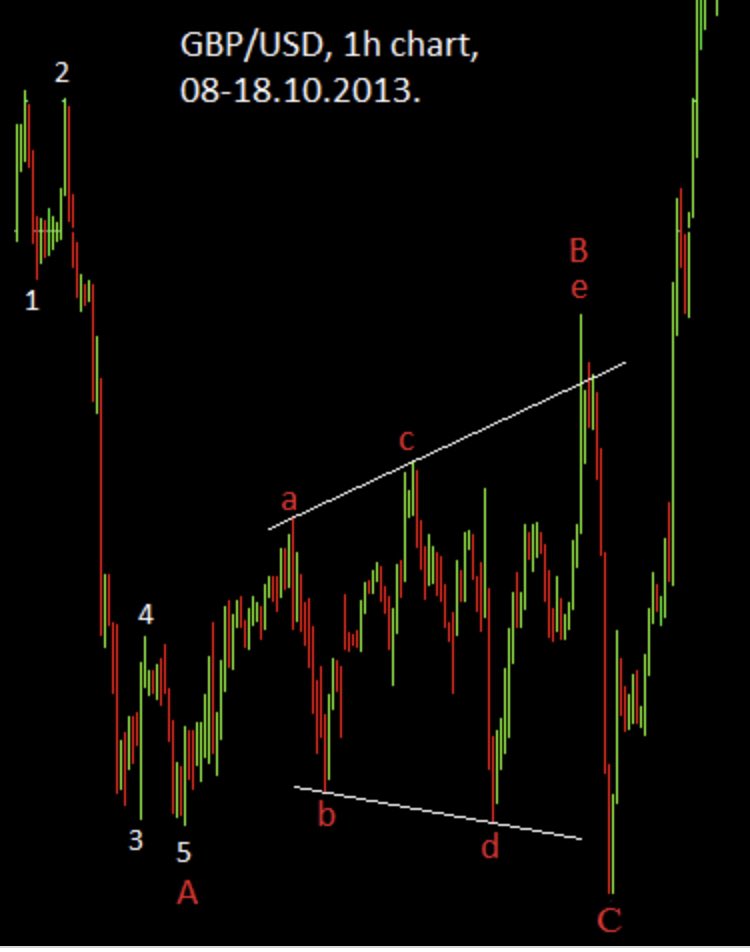

There are different ways to play chart patterns. You could either play it on the trigger of the pattern or wait for a pull back. You will see what I mean below.

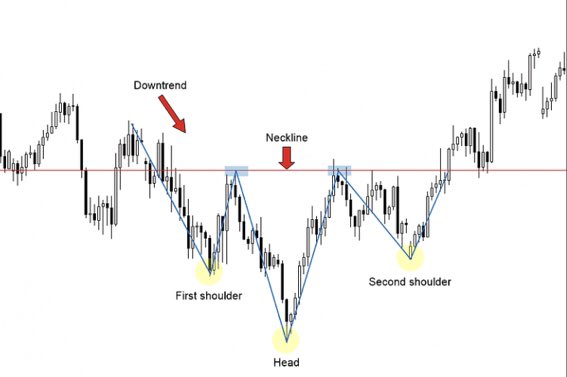

Now you see how these patterns look a bit choppy most of the time and are not so easy to catch but don’t worry it just takes screen time to get used to identifying most of them

Hope you guys learned something from this thread. It’s not going to be easy the first time you look at these but with more screen time you will get the hang of things. One thing I recommend is to takes notes on which patterns work best for u and which tickets respect the patterns

Big shout out to this one YouTuber named Fractol Flow for the line chart examples. I rlly recommend checking him out. He has a lot of good educational content

• • •

Missing some Tweet in this thread? You can try to

force a refresh