1) Over the past couple of months, I have looked into 20+ projects in crypto, but none has impressed me the most other than @PythNetwork. Let me elaborate why Pyth Network will take over the crypto and DeFi landscape by storm in this generational wealth accumulation opportunity👇

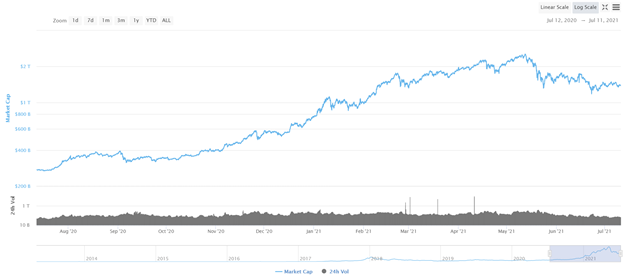

2) Seasoned participants of the market understand that crypto will be the future of finance. By just observing the marketcap growth of the ecosystem happening since last yr from USD 270 bn to USD 1.38 tn (more than 500%📈), people will understand how rapidly the space evolves:

3)Yet behind this staggering growth story, DeFi is still in its infancy. Standing at only USD 75.7 bn, DeFi ecosystem consists of less than 6% of the whole crypto market, which poses a huge opportunity to capture the potential growth of DeFi in years to come.

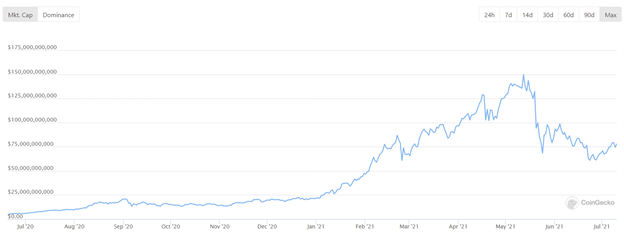

4) What kind of potential growth? Below is a chart of DeFi marketcap over the last 12 months, as more eyes investigate the space. The growth for DeFi has been phenomenal, from USD 5 bn to USD 75.7 bn, denoting an increase of 1500%🤯

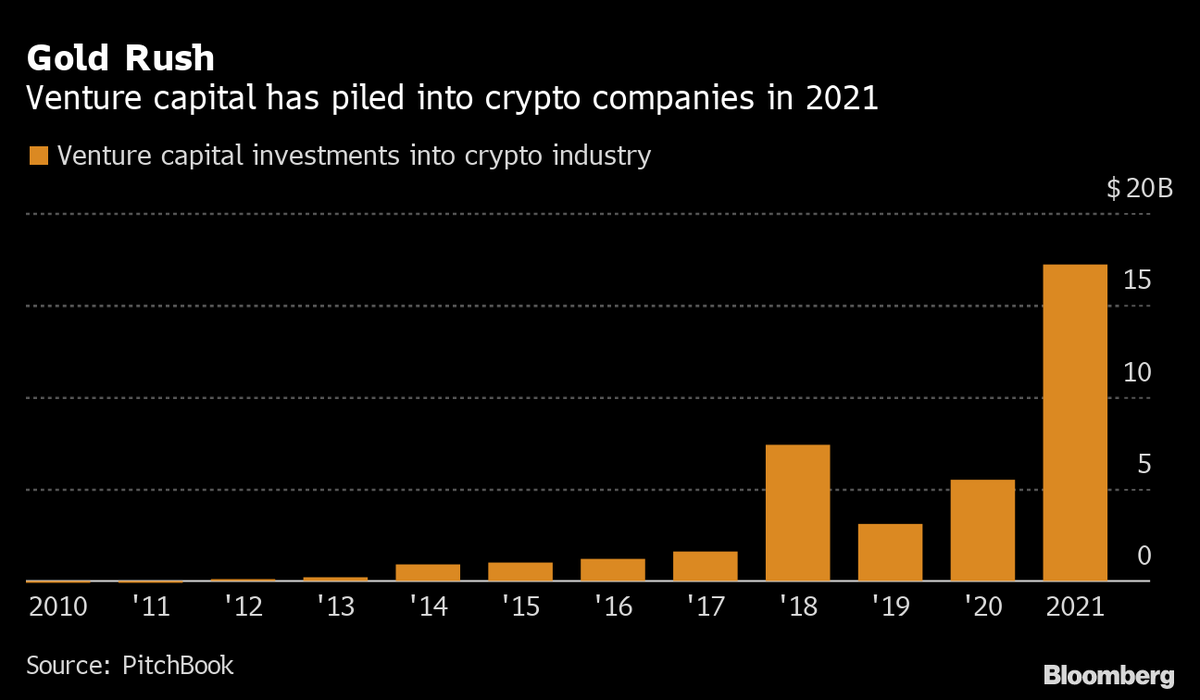

5) With such an astronomical surge happening in the past 12 months, it is no surprise that we have seen major interest coming from heavy institutional investors, not only from major VCs but also from traditional asset management and trading firms.

6) Regardless, DeFi is still a work-in-progress, and there needs to be a lot of infrastructure updates happening in the sector. One of the critical components of the efficiency in the traditional market infra is the ease of getting market data, of which DeFi still struggles.

7) To illustrate how early it is in DeFi, we are talking about USD 33 bn in yearly revenue for traditional market data, and yet no reliable info on DeFi oracle revenue numbers.

prnewswire.com/news-releases/…

prnewswire.com/news-releases/…

8) With existing oracle players such as Chainlink, The Graph, Band Protocol, and others continue to #buidl, more emerging talents from the tech or TradFi space will flock in and push boundaries of DeFi innovation, unlocking more possibilities to collaborate🤝🤝

9) As new players for oracles and market data providers emerge, I am really excited about what Pyth Network is building with their team. You’re probably asking “what is Pyth and how can it distinguish itself from other oracles and price feeders? What’s so special about it?”

10) There are 3 elements that distinguish Pyth from others. The first is its use-case and the tech, the second is the partners, and lastly the blockchain it’s built on. These three factors differentiate Pyth more so than any other oracles in the existing crypto market in my view.

11) #1 Usecase and Tech:

As you might have predicted, Pyth is an oracle. But it’s not an ordinary oracle. It’s an oracle designed specifically to bring in quality, institutional-type market data into DeFi, something that I believe can be a gamechanger to the oracle market 🚀🚀

As you might have predicted, Pyth is an oracle. But it’s not an ordinary oracle. It’s an oracle designed specifically to bring in quality, institutional-type market data into DeFi, something that I believe can be a gamechanger to the oracle market 🚀🚀

12) To onboard more institutions, there must be a big push of providing legally authorized access to unique datasets, and the Pyth team recognized this issue. An oracle with sophisticated outputs, unique aggregation methods, sub-second updates, is still missing in the space.

13) With hopes of filling the gap of idiosyncrasies between DeFi and institutional players who require a special oracle solution, Pyth Network has attracted large trading firms and exchanges to harness their unused data points and compile those into high-quality market data 📊📊

14) As for the tech, the way the oracle works is that Pyth will gather data from multiple data providers, and through their aggregation method, the price feed for each asset will have a confidence interval of where the price should approximately be.

15) The confidence intervals serve as a function where one expects trade to occur from the “true” price, i.e. the potential dispersion estimation. In other words, using Pyth aggregation, the intervals can be seen as the lowest/highest price the particular asset was last traded.

16) Also, Pyth covers not just crypto but also equities and FX, which is severely needed as the market matures. And the crazier part is all updates on prices happen every few milliseconds, which are extremely fast. Below is an example of how Pyth quotes SOL/USD into their feed:

17) #2 Partners:

Pyth has some of the most amazing lineups of TradFi and crypto partnerships I’ve seen in the space. Just by doing a bit of due diligence, I realized it’s directly backed by Jump Trading, one of the biggest traditional HFT firms in the world🤯🤯

Pyth has some of the most amazing lineups of TradFi and crypto partnerships I’ve seen in the space. Just by doing a bit of due diligence, I realized it’s directly backed by Jump Trading, one of the biggest traditional HFT firms in the world🤯🤯

18) Why is it a big deal? Because Jump Trading rarely goes out to support a venture project, let alone in crypto.

For those not familiar with Jump Trading, it is a high-frequency trading firm based in Chicago with a global presence in NY, AMS, LDN, SH, SG. Will expand in a bit.

For those not familiar with Jump Trading, it is a high-frequency trading firm based in Chicago with a global presence in NY, AMS, LDN, SH, SG. Will expand in a bit.

19) While not publicly well known, Jump can be considered as one of the top-tier algorithmic trading firms in the world. Think the likes of Citadel, Two Sigma, Jane Street, which are some of the best HFT firms in all of TradFi!

20) Their involvement in TradFi covers not only equities and FX, but also derivatives such as futures and options. Other than Citadel and a few other well-known market makers, Jump is also a market maker for Robinhood (which is about to go IPO soon!)

21) Interestingly, over the past couple of years Jump has participated in the crypto ecosystem as a market maker (MM), providing liquidity to the world’s leading crypto exchanges such as BitMEX, Bitfinex, with amounts starting from 100 BTC📈

https://twitter.com/fintechfrank/status/1191854711235895297?s=20

22) The turning point happened last year when Jump announced its investment in the Solana-based Serum and said to be providing MM and liquidity services for assets in the platform. Jump's level of involvement in crypto far outperforms other HFT firms!

coindesk.com/jump-trading-i…

coindesk.com/jump-trading-i…

23) Fast forward in April, Jump took a big stride in launching a new initiative that aims to decentralize real-time trading data, and that is Pyth. Jump's President Dave Olsen talked about it in their podcast (do check it out!)

theblockcrypto.com/linked/100875/…

theblockcrypto.com/linked/100875/…

24) “That’s great but is it only Jump Trading?”

No, apart from Jump Trading, Virtu Financial and GTS are also supporting the project. The two of them are household names in the HFT space and are highly respected as equity market makers.

bloomberg.com/news/articles/…

No, apart from Jump Trading, Virtu Financial and GTS are also supporting the project. The two of them are household names in the HFT space and are highly respected as equity market makers.

bloomberg.com/news/articles/…

25) Oh, I should add that other than the 3 firms mentioned, there are many other players who have announced data partnerships with Pyth. They are:

Genesis Global Trading

Chicago Trading Company

LMAX

FTX (yes, that FTX)

Bermuda Stock Exchange

Serum

And others are coming soon!

Genesis Global Trading

Chicago Trading Company

LMAX

FTX (yes, that FTX)

Bermuda Stock Exchange

Serum

And others are coming soon!

26) #3 Blockchain:

As I learned that Pyth will be built on top of Solana and be directed towards institutions looking for ultra-low latency trading data, it suddenly clicked for me. Combine the 50,000 TPS Solana has and Pyth's ability to crunch data, the potential is limitless!

As I learned that Pyth will be built on top of Solana and be directed towards institutions looking for ultra-low latency trading data, it suddenly clicked for me. Combine the 50,000 TPS Solana has and Pyth's ability to crunch data, the potential is limitless!

27) Also apart from Ethereum, Polkadot and Cosmos, and BSC, Solana is the fastest and most developed L1 that is undergoing massive expansion in the upcoming months and years. Check out their latest funding round that happened a few weeks ago:

wsj.com/articles/crypt…

wsj.com/articles/crypt…

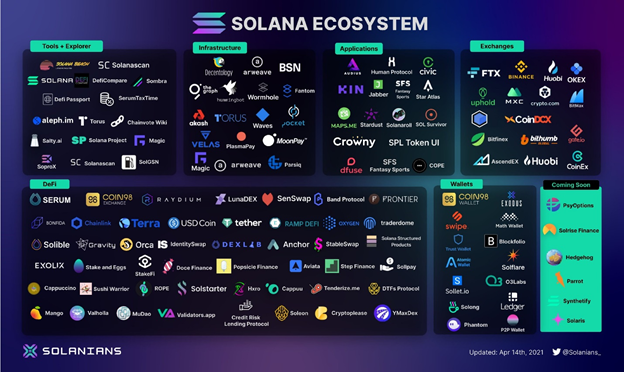

28) With all these updates happening in Solana, it’s hard not to be uber bullish on Pyth as a project. Just take a glimpse on the current Solana ecosystem, it’s absolutely a sight to behold:

29) “Well, all of those are good and all, but wen token ser?”

Unfortunately, the team has expressed that any token which claims to be Pyth is a scam, implying that there is no token for the project for now.

Unfortunately, the team has expressed that any token which claims to be Pyth is a scam, implying that there is no token for the project for now.

30) Even if the project is still in Devnet, the team has been very active in the Discord group, answering all kinds of questions members are asking while providing cool giveaways at times such as this NFT😮😮

31) Overall, there’s no indication as to when they’ll launch a token for interested individuals to invest, but I believe that a project’s success isn’t solely determined by having a token. Many successful DeFi projects aren’t issuing any tokens, and Pyth will be in this category!

32) I will be constantly updating the journey of the project, and update on any significant news as they come along.

If you like my content, please share the thread and give me a follow on Twitter, as I am documenting other projects I am bullish on 🤝

If you like my content, please share the thread and give me a follow on Twitter, as I am documenting other projects I am bullish on 🤝

• • •

Missing some Tweet in this thread? You can try to

force a refresh