Thread

How to Network like a Pro (in Nigeria)

Thought to share few tips on how to get almost anybody talking to you. Domesticated because of cultural nuances as some of the tips may not work in other countries.

Will also be sharing some personal examples.

Let's go

How to Network like a Pro (in Nigeria)

Thought to share few tips on how to get almost anybody talking to you. Domesticated because of cultural nuances as some of the tips may not work in other countries.

Will also be sharing some personal examples.

Let's go

I. Package yourself well

Whether physical or virtual, most people make decision about giving you attention after scanning who you are. Could be as simple as looking at how you dress (in physical meeting) or how you couch your message (in virtual) or as involving as spending

Whether physical or virtual, most people make decision about giving you attention after scanning who you are. Could be as simple as looking at how you dress (in physical meeting) or how you couch your message (in virtual) or as involving as spending

time to check your bio and posts or even Googling/LinkedIn-ing you (in virtual) before deciding whether to respond to you. So you may want to be deliberate in some of these things.

II. Opening matters

Whether physical or virtual, opening matters. You can't go to a Nigerian

II. Opening matters

Whether physical or virtual, opening matters. You can't go to a Nigerian

bank ED's DM and say "Hi Bola". Proper intro in first message is always helpful. If physical (say you meet at a conference or in a flight), "Good evening sir, my name is Wale Alabi, an accountant, happy to meet you sir.." could be a good ice breaker. If it's a popular face, you

can add "I have been following you in the news for long; happy to meet you sir"

III. Load the intro

Whether verbal (physical) or written (email, sms, DMs etc), load your intro message as much as possible. Say what you know about them, compliment them, talk about yourself too.

III. Load the intro

Whether verbal (physical) or written (email, sms, DMs etc), load your intro message as much as possible. Say what you know about them, compliment them, talk about yourself too.

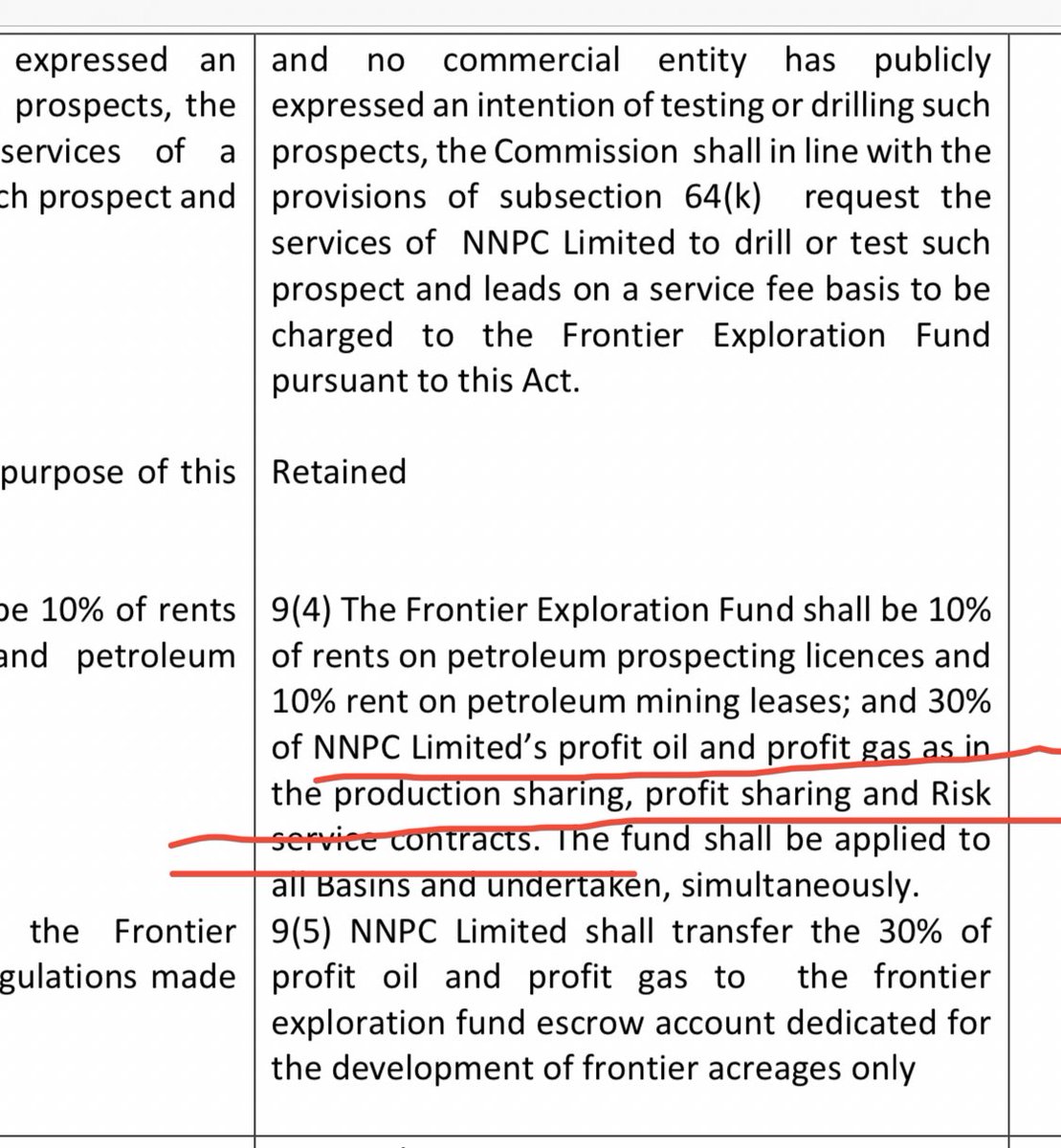

Case 1: I used this LinkedIn message to network with a former CEO of NLNG.

This satisfies all points above - proper intro of myself, compliment to him, demonstrated knowledge of him, made my request straight away, the request is a cause I knew would interest him

This satisfies all points above - proper intro of myself, compliment to him, demonstrated knowledge of him, made my request straight away, the request is a cause I knew would interest him

My first contact was this message sent early this year. Now, he is a good senior friend 😊

IV. Flaunt your network

This is psychology. People feel comfortable with you when they know other people in their social and economic class are comfortable enough to associate with you

IV. Flaunt your network

This is psychology. People feel comfortable with you when they know other people in their social and economic class are comfortable enough to associate with you

despite being below their class.

So if I want to get a new contact into my network, I find a way to mention a mutual friend in the opening conversation or someone in their class who I know they respect.

V. Get introduced

Sometimes, get someone from your existing network to

So if I want to get a new contact into my network, I find a way to mention a mutual friend in the opening conversation or someone in their class who I know they respect.

V. Get introduced

Sometimes, get someone from your existing network to

be the go-between.

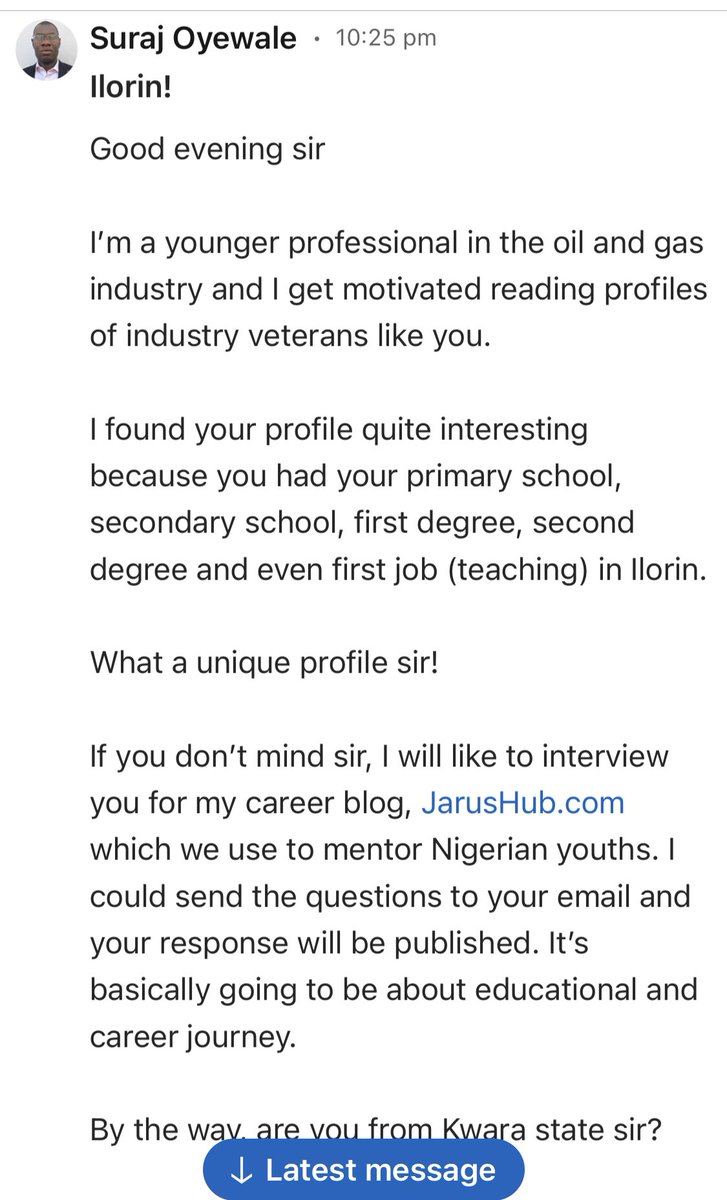

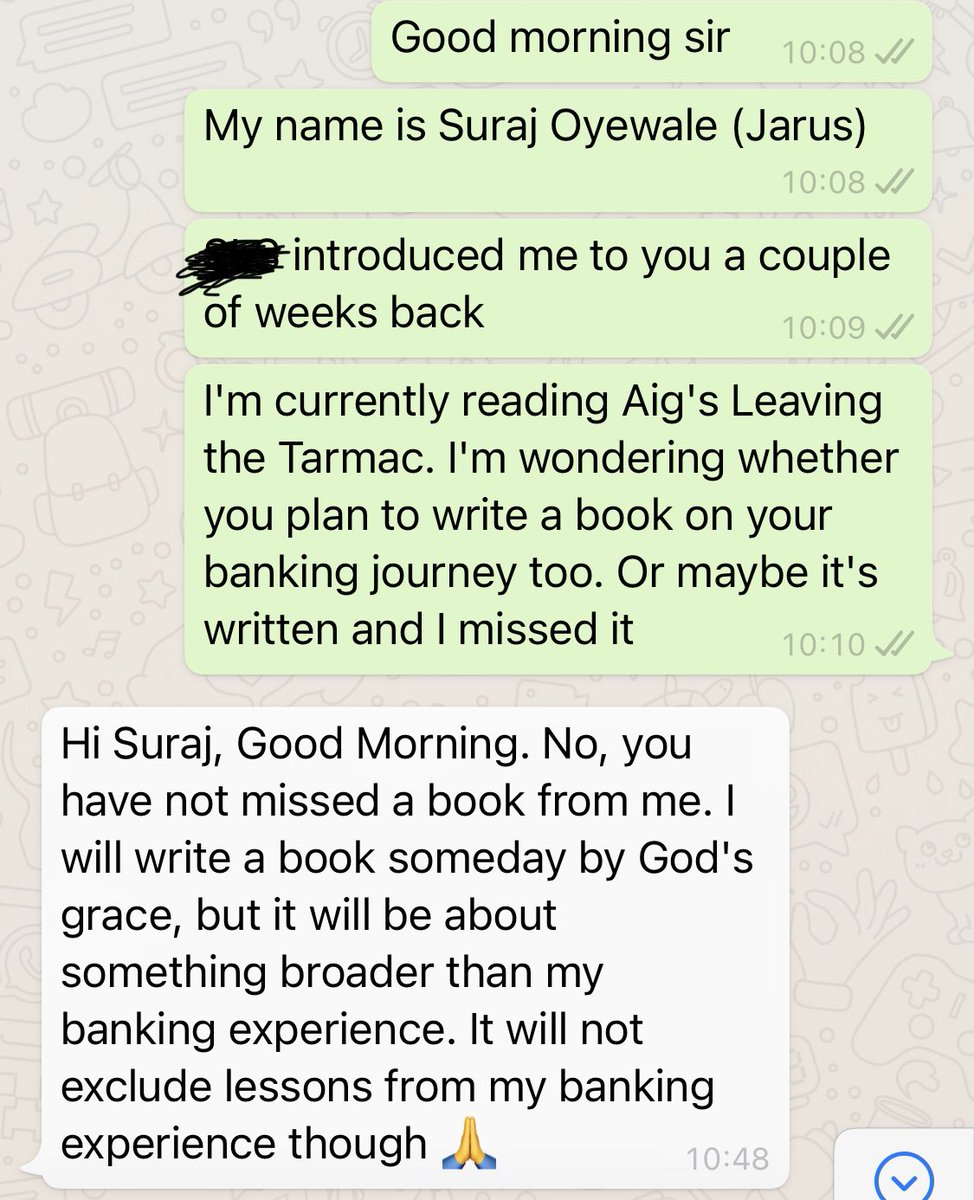

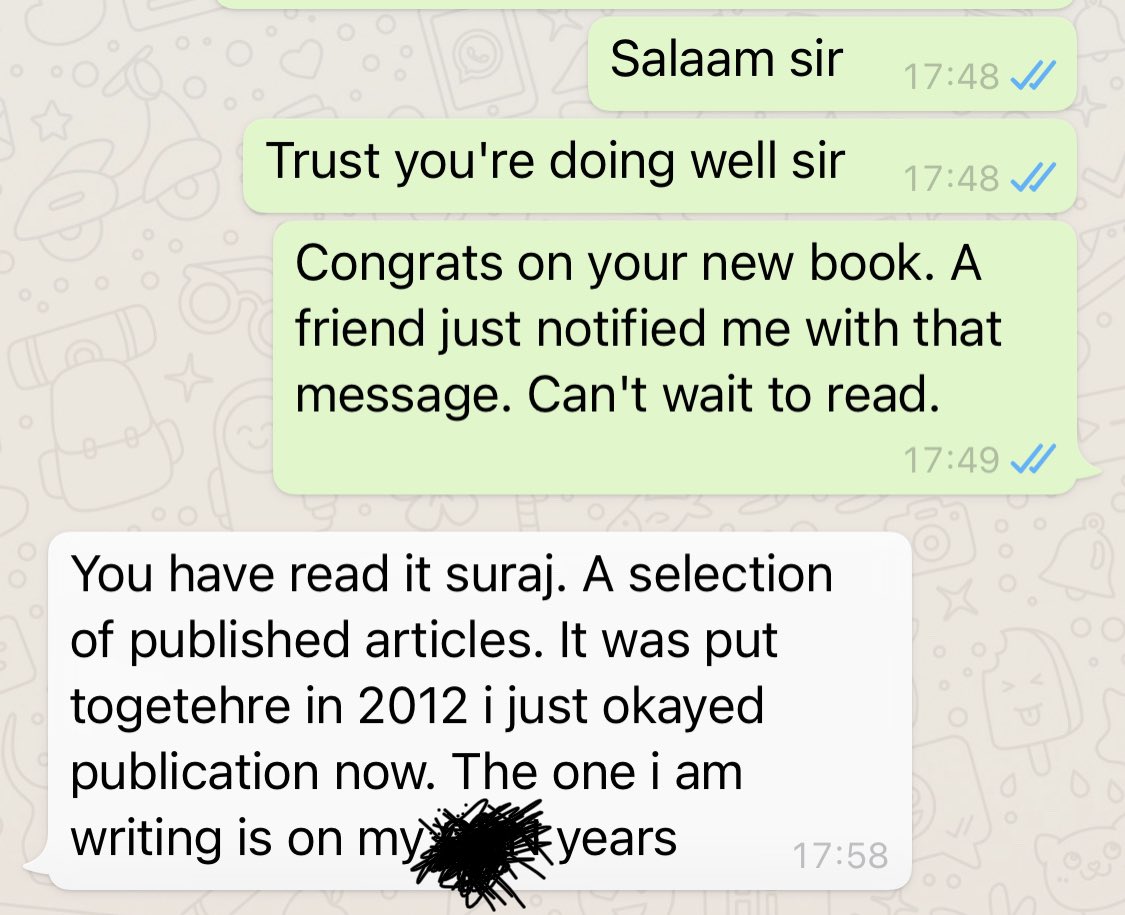

Case 2: Used this for a founder of one of Nigeria's top 7 banks. It wasn't an intro, but it was to lubricate the network. Wanted to be sure he hadn't forgotten me. Brought a topic that I knew he would find interesting. This combines point V and point VI

Case 2: Used this for a founder of one of Nigeria's top 7 banks. It wasn't an intro, but it was to lubricate the network. Wanted to be sure he hadn't forgotten me. Brought a topic that I knew he would find interesting. This combines point V and point VI

VI. Lubricate the network

When you bring a new VIP into your network, don't forget them after first contact. Stay in touch. Doesn't mean you should be disturbing with weekly call or "forwarded as received" whatsapp messages. But at least once in 3 months, get in touch.

When you bring a new VIP into your network, don't forget them after first contact. Stay in touch. Doesn't mean you should be disturbing with weekly call or "forwarded as received" whatsapp messages. But at least once in 3 months, get in touch.

If you find something interesting about them in the news, send a message to congratulate them (if +ve news) or commiserate (if -ve). Don't meet someone and not get in touch till after 1 year or till you need a favour. Relationship is like an equipment, lubricate to avoid rust.

VII. Minimize asking for favour

Don't let the relationship be parasitic. If you must ask for favour, social causes are preferred. Sparingly ask for commercial favour. And respect their no. Some people wanted to use me as go-between to contact a former CBN governor to be on the

Don't let the relationship be parasitic. If you must ask for favour, social causes are preferred. Sparingly ask for commercial favour. And respect their no. Some people wanted to use me as go-between to contact a former CBN governor to be on the

board of their small company. I knew the answer was likely going to be a no, but just not to lose the relationship at their own end, decided to tell the ex-gov about it. He said he can't take it because he was busy. Took the message to them and they asked me to pester him further

Told them they should respect the person's no and not strain my own relationship.

So be circumspect in making demands. Don't abuse relationships.

VIII. Whatsapp groups are goldmines

People underestimate whatsapp groups - especially those which have members across all strata

So be circumspect in making demands. Don't abuse relationships.

VIII. Whatsapp groups are goldmines

People underestimate whatsapp groups - especially those which have members across all strata

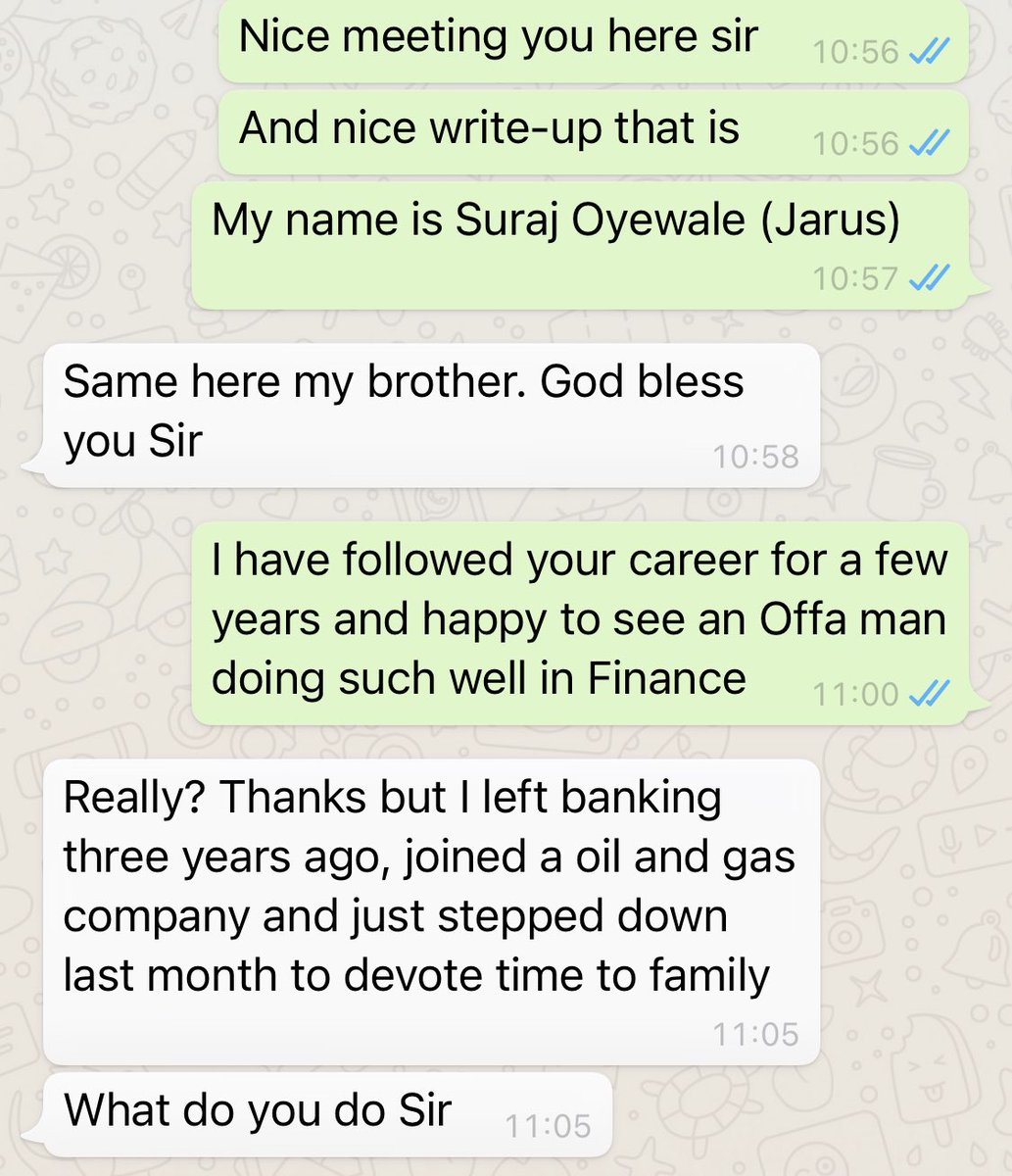

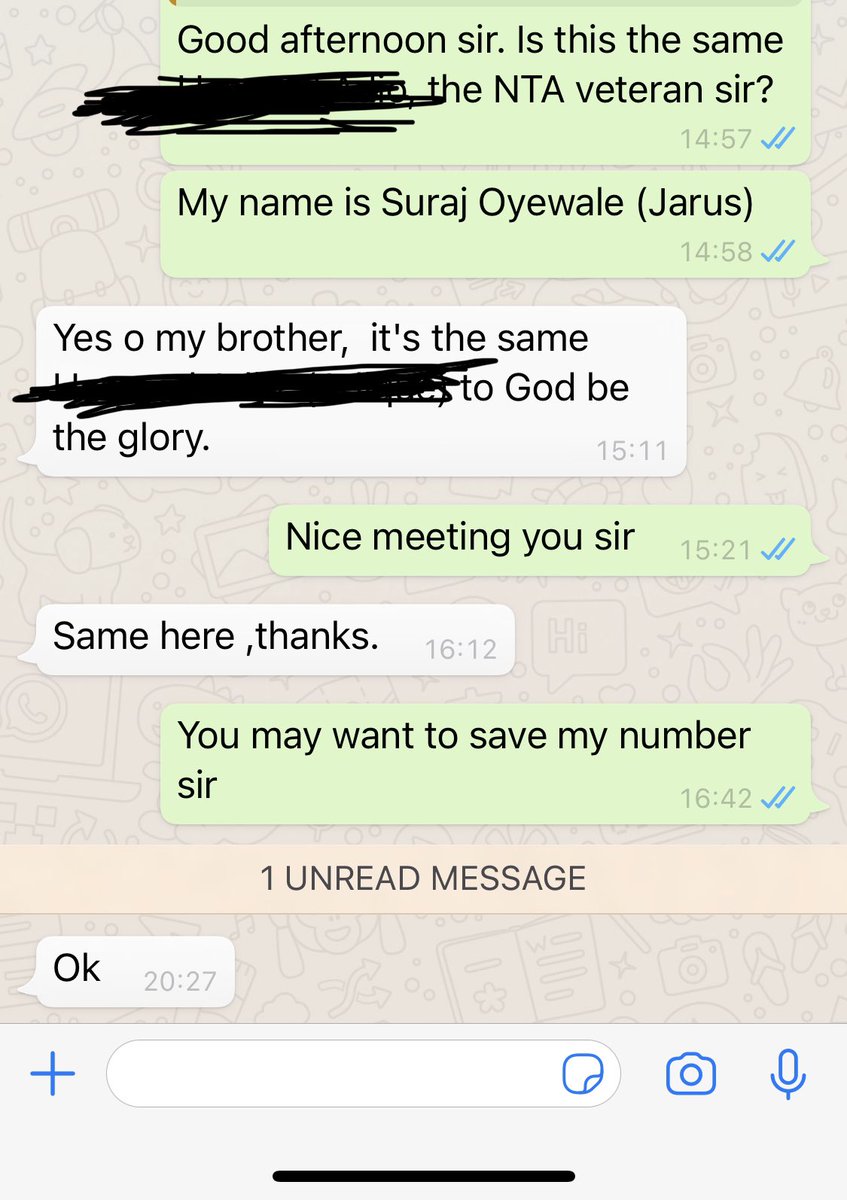

Nowadays you find yourself in whatsapp groups with folks you probably need 3 levels of security check & 3 PAs to access. You can corner them and turn the relationship personal if you play your game well. Start by making meaningful contribution to the group, then "reply privately"

to your target and strike a nice conversation.

Case 4: I cornered a former GM of a Big 5 bank and CFO of a top oil company using this approach. Now, we have a forthcoming lunch. Pulled him aside from a community whatsapp group.

Case 4: I cornered a former GM of a Big 5 bank and CFO of a top oil company using this approach. Now, we have a forthcoming lunch. Pulled him aside from a community whatsapp group.

Used same method for a veteran journalist I had been looking forward to meet since my secondary school days and a former commissioner. We happened to be in same sports whatsapp group and I "pulled" him aside.

Let me stop with these 8 tips so the thread doesn't get too long. Hopefully will do a part 2 in the future.

PS: I know this is mainly about networking upward (with people of higher social or economic class). Hopefully part 2 will cover horizontal networking.

PS: I know this is mainly about networking upward (with people of higher social or economic class). Hopefully part 2 will cover horizontal networking.

• • •

Missing some Tweet in this thread? You can try to

force a refresh