Chime is the largest of the “neobanks” that thrived during the pandemic by marketing themselves to Americans who needed a place to deposit stimulus checks.

Now some @Chime users say they can’t withdraw their money.

Here are two of their stories👇👇

Now some @Chime users say they can’t withdraw their money.

Here are two of their stories👇👇

2/ The day after Jonathan’s stimulus payment landed in his bank account, he took his 5-year-old twins out to lunch at Applebee's.

But when he went to pay, his Chime card was declined, even though the account had held $10,000 that morning.

propublica.org/article/chime

But when he went to pay, his Chime card was declined, even though the account had held $10,000 that morning.

propublica.org/article/chime

4/ “I was so embarrassed,” said Jonathan, who had to call his parents to ask them to pay the lunch bill.

“If it was $100, I wouldn’t sweat it. But it was everything I had for my kids.”

“If it was $100, I wouldn’t sweat it. But it was everything I had for my kids.”

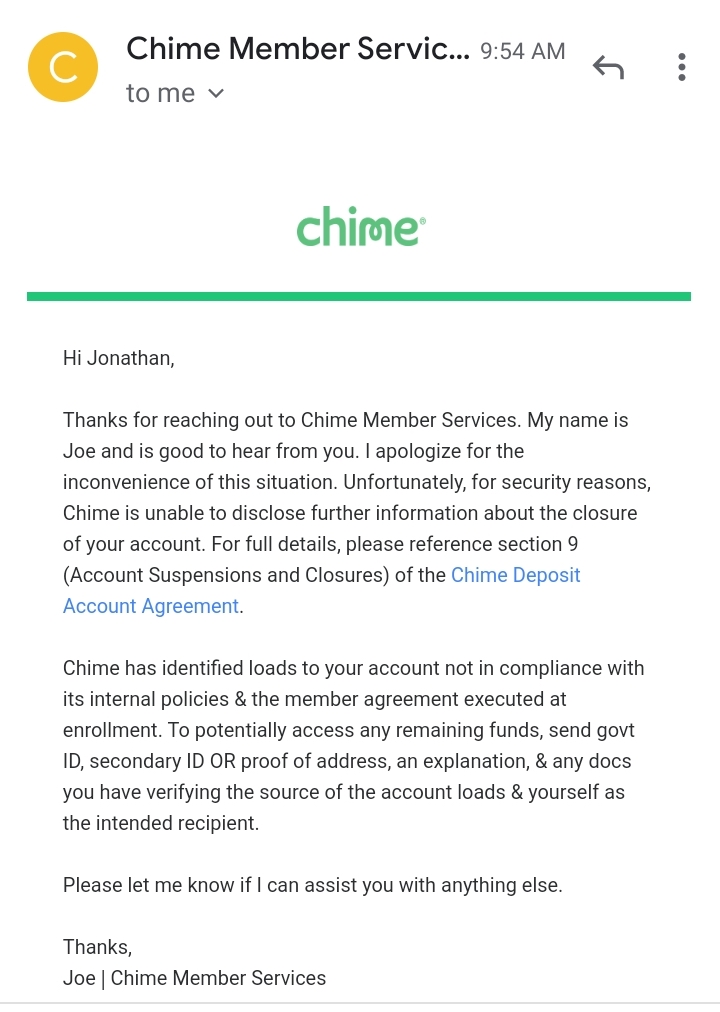

5/ He emailed Chime to ask what happened to his account.

But Chime told him sharing information about his account closure would be a security risk. 👇

But Chime told him sharing information about his account closure would be a security risk. 👇

6/ A month after the Applebee's incident, Jonathan was still emailing Chime, trying to access his savings.

It took him over two months to get his money back.

It took him over two months to get his money back.

7/ Chime confirmed to @Propublica that it made a mistake in closing Jonathan’s account, but gave him no explanation for the closure beyond "suspicious activity."

"It's been torture," he said.

"It's been torture," he said.

8/ @Chime not only closed accounts, they were slow to correct their mistakes.

As we see in this second example, losing access to your money for months can shatter your sense of security and jeopardize your ability to pay essential bills. 👇

As we see in this second example, losing access to your money for months can shatter your sense of security and jeopardize your ability to pay essential bills. 👇

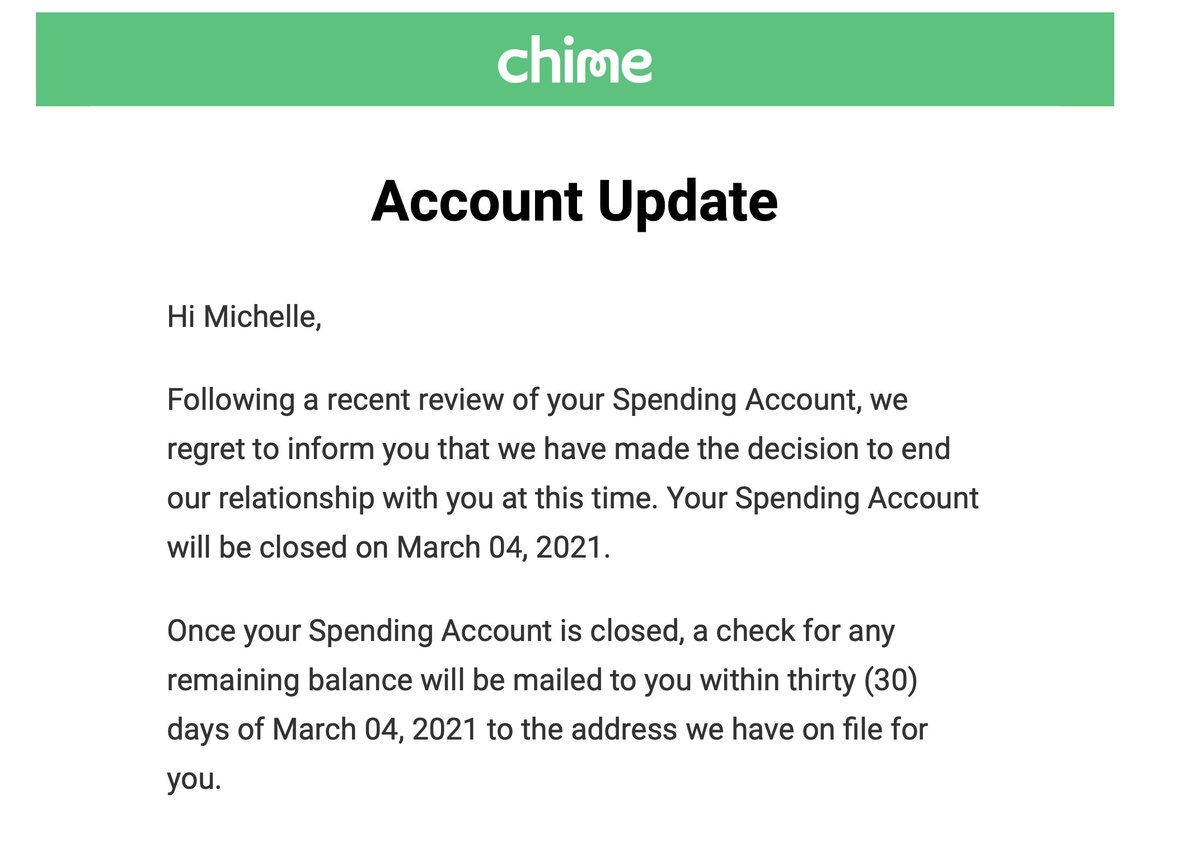

9/ Michelle is a single mother and full-time caregiver for her father. Her bills were piling up in March, but she was expecting a stimulus check and a $3,500 tax refund to be deposited into her Chime account soon.

And then came the email from @Chime closing her account.

And then came the email from @Chime closing her account.

10/ Chime gave no explanation for closing her account other than “security reasons.”

“I lost my mind. I couldn't believe it,” Michelle said.

She emailed Chime immediately:

“I lost my mind. I couldn't believe it,” Michelle said.

She emailed Chime immediately:

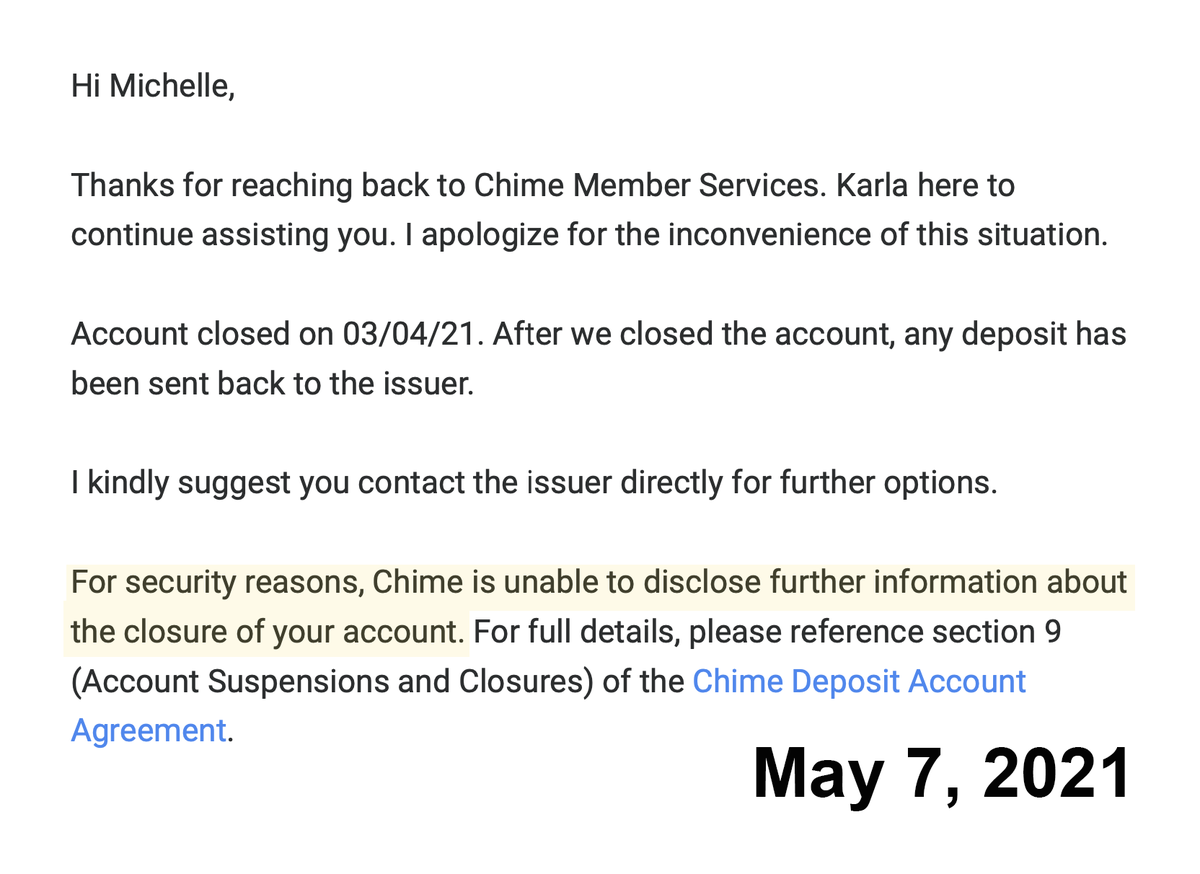

11/ Chime directed Michelle to the IRS, which directed her back to Chime, but she couldn’t get money or answers from anyone. The company repeatedly refused to specify the reason for the closure.

12/ Two months later, Michelle was afraid she would be evicted from her home. Her cell phone was shut off and late fees piled up.

13/ She received her checks, not because Chime fixed her account, but because the IRS sent them to her in the mail.

Michelle says she won’t be opening another Chime account.

Michelle says she won’t be opening another Chime account.

14/ Chime says it was only closing accounts in an attempt to crack down on people fraudulently collecting unemployment benefits or federal stimulus checks.

15/ The @CFPB received hundreds of complaints from Chime customers about accounts being closed without consent.

The @BBB also received thousands of complaints about @Chime—more than @WellsFargo, which is 6 times its size & not exactly squeaky clean.

justice.gov/opa/pr/wells-f…

The @BBB also received thousands of complaints about @Chime—more than @WellsFargo, which is 6 times its size & not exactly squeaky clean.

justice.gov/opa/pr/wells-f…

16/ “We are proud of Chime’s robust anti-fraud efforts, which have returned hundreds of millions of dollars to state and federal agencies during the pandemic,” a Chime spokesperson wrote. “And despite our best efforts, we do make mistakes.”

17/ The issue is, Chime was closing accounts after flagging perfectly legal federal deposits as “suspicious,” even though the company actively marketed itself to people looking for a place to deposit stimulus checks.

18/ Read the full story to learn more about the new wave of “neobanks” like Chime, the regulatory no man’s land they exist in, and the regular people paying for their mistakes: propublica.org/article/chime

19/ And sign up here to get notified about stories like this as soon as they're published:

propublica.org/newsletters/th…

propublica.org/newsletters/th…

• • •

Missing some Tweet in this thread? You can try to

force a refresh