Let Twitter Pay Your Bills

• Financials

• User Growth

• Monetization

• Twitter Spaces

• Investing in the Stock

• Earning Income from Twitter

Let’s look at how to

‘Earn Income from your cellphone’

(Thread) 👇🏽

• Financials

• User Growth

• Monetization

• Twitter Spaces

• Investing in the Stock

• Earning Income from Twitter

Let’s look at how to

‘Earn Income from your cellphone’

(Thread) 👇🏽

• Introduction

Twitter is a microblogging and social networking service, and the man at the helm of the ship is no other than; @jack

For years, $TWTR has lagged other social media giants, some would even argue they’ve fallen asleep at the wheel-with regards to revenue growth

Twitter is a microblogging and social networking service, and the man at the helm of the ship is no other than; @jack

For years, $TWTR has lagged other social media giants, some would even argue they’ve fallen asleep at the wheel-with regards to revenue growth

• Twitter Revenue

In 2020, Twitter earned $3.72billion in revenue.

It may seem impressive, but they lost over $1billion in 2020 - Tax liability.

Their user base grew, but ad revenue declined, mainly because of the pandemic, which created a dislocation between the 2.

In 2020, Twitter earned $3.72billion in revenue.

It may seem impressive, but they lost over $1billion in 2020 - Tax liability.

Their user base grew, but ad revenue declined, mainly because of the pandemic, which created a dislocation between the 2.

• 2020 key metrics

• Debt= $4.4bill

• EPS= (-1.34)

• Current Ratio= (4.4)

*They need to invest capital wisely

Looking ahead, they need to unlock new avenues of income for their business and for their users too - they have to, or risk failing as a business.

• Debt= $4.4bill

• EPS= (-1.34)

• Current Ratio= (4.4)

*They need to invest capital wisely

Looking ahead, they need to unlock new avenues of income for their business and for their users too - they have to, or risk failing as a business.

• Q1 2021

Saw 28% improvement in total revenue compared to Q1 2020

Total income : $1billion

Their international market grew by 41% compared to Q1 last year. - showing strong recovery since the onset of pandemic.

So what’s the Bull case? 👇🏽

Saw 28% improvement in total revenue compared to Q1 2020

Total income : $1billion

Their international market grew by 41% compared to Q1 last year. - showing strong recovery since the onset of pandemic.

So what’s the Bull case? 👇🏽

• What’s New?

Twitter is slowly running out new features to try to grow revenue and attract more users.

You may have already seen the new tab ‘monetization’ appear on your menu bar. 👇🏽

What exactly is it?

Twitter is slowly running out new features to try to grow revenue and attract more users.

You may have already seen the new tab ‘monetization’ appear on your menu bar. 👇🏽

What exactly is it?

• Twitter Spaces

Announced in 2020 and launched as a beta a month later for a select few accounts.

Since then, Twitter spaces has become ubiquitous, and is now planning to offer users the chance to monetize their spaces by selling tickets to their followers.

#twitterspaces

Announced in 2020 and launched as a beta a month later for a select few accounts.

Since then, Twitter spaces has become ubiquitous, and is now planning to offer users the chance to monetize their spaces by selling tickets to their followers.

#twitterspaces

• Twitter Spaces (2)

“Imagine getting paid for doing what you love”.

Sidenote:

You no longer need to rely just on your economy to earn income, especially when you have the internet and platforms like Twitter that will slowly offer more and more Monetization avenues.

“Imagine getting paid for doing what you love”.

Sidenote:

You no longer need to rely just on your economy to earn income, especially when you have the internet and platforms like Twitter that will slowly offer more and more Monetization avenues.

• Monetization of Twitter Spaces

It’s as easy as ABC

1. Schedule a Space

2. Start selling Tickets

3. Make Money

It’s as easy as ABC

1. Schedule a Space

2. Start selling Tickets

3. Make Money

• Twitter Spaces (3)

IMO- This will be the start of many new features. The more users who can monetize their personal accounts, the more income for Twitter too.

• 199million active daily accounts

Moving away from the reliance of ads and focusing on users could = success.

IMO- This will be the start of many new features. The more users who can monetize their personal accounts, the more income for Twitter too.

• 199million active daily accounts

Moving away from the reliance of ads and focusing on users could = success.

• Examples

New exciting opportunities will be popping up regularly. Check this tweet 👇🏽

New exciting opportunities will be popping up regularly. Check this tweet 👇🏽

https://twitter.com/adamschefter/status/1413122919148965894

• Who is eligible?

There are 3 prerequisites that need to be met before one can apply for the opportunity to sell tickets for your Twitter spaces 👇🏽

This will also only be available to a few select accounts in certain regions, but if successful should roll out ubiquitously

There are 3 prerequisites that need to be met before one can apply for the opportunity to sell tickets for your Twitter spaces 👇🏽

This will also only be available to a few select accounts in certain regions, but if successful should roll out ubiquitously

• Many ways to skin a cat

Even if you aren’t eligible yet to qualify to monetize your account. There are a few other ways to earn income from Twitter:

• Paid promotions

• Affiliate marketing

• Investing in the stock

Check this thread below to see what I mean. 👇🏽

Even if you aren’t eligible yet to qualify to monetize your account. There are a few other ways to earn income from Twitter:

• Paid promotions

• Affiliate marketing

• Investing in the stock

Check this thread below to see what I mean. 👇🏽

https://twitter.com/talkcentss/status/1409718278587486216

• Investing in $TWTR

Twitter currently sells for $68.97 a share

The reason I mention this is because you can simply benefit from those that are monetizing their accounts.

The more accounts that are able to monetize and generate income, undoubtedly boosts $TWTR income too.

Twitter currently sells for $68.97 a share

The reason I mention this is because you can simply benefit from those that are monetizing their accounts.

The more accounts that are able to monetize and generate income, undoubtedly boosts $TWTR income too.

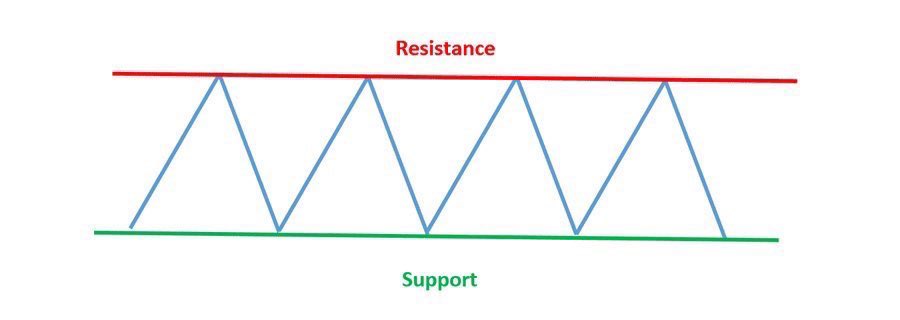

• Price and Value

If you believe in the success of $TWTR -then this is a stock to put on your watchlist

The company has been struggling and the stock price has been rising - possibly because stocks are forward looking - you are paying for the success already.

Take a look 👇🏽

If you believe in the success of $TWTR -then this is a stock to put on your watchlist

The company has been struggling and the stock price has been rising - possibly because stocks are forward looking - you are paying for the success already.

Take a look 👇🏽

$TWTR

Twitter has returned 94% over the last year. Even outpacing its rival #Facebook in that time.

There could be an opportunity for the long term here, especially if Twitter looks for new creative ways to increase revenue.

But monitoring their success is key here.

Twitter has returned 94% over the last year. Even outpacing its rival #Facebook in that time.

There could be an opportunity for the long term here, especially if Twitter looks for new creative ways to increase revenue.

But monitoring their success is key here.

• Management

How successful will they be in their mission to increase revenue? Can leadership help @jack steer the ship to ⬆️ levels

@nedsegal

@leslieberland

@boo

@jenchristiehr

@kayvz

This all remains unseen, but creates opportunities for users, investors + speculators

How successful will they be in their mission to increase revenue? Can leadership help @jack steer the ship to ⬆️ levels

@nedsegal

@leslieberland

@boo

@jenchristiehr

@kayvz

This all remains unseen, but creates opportunities for users, investors + speculators

• Earning income

Twitter is literally a gold mine if used correctly.

There are numerous ways to earn income from Twitter:

• Investing in the Stock

• Sponsored Tweets

• Affiliate Marketing

• Selling products

Check out this thread on how to earn passive income 👇🏽

Twitter is literally a gold mine if used correctly.

There are numerous ways to earn income from Twitter:

• Investing in the Stock

• Sponsored Tweets

• Affiliate Marketing

• Selling products

Check out this thread on how to earn passive income 👇🏽

https://twitter.com/talkcentss/status/1404350945014603779

• Closing Thoughts

#twitter is a great platform, but even great company’s fail

It’s going to require flawless execution+ innovative ways to boost income. You could easily benefit here from Twitter rediscovering themselves

IMO - the stock isn’t a buy now, but worth watching.

#twitter is a great platform, but even great company’s fail

It’s going to require flawless execution+ innovative ways to boost income. You could easily benefit here from Twitter rediscovering themselves

IMO - the stock isn’t a buy now, but worth watching.

• Youtube

If you found value in this tweet, consider this:

1. Retweet

2. Subscribe

Check the video out below 👇🏽

If you found value in this tweet, consider this:

1. Retweet

2. Subscribe

Check the video out below 👇🏽

• Newsletter

Bringing you gems every Monday straight to your inbox.

Making Monday’s less blue 👇🏽

davidketh.substack.com/p/coming-soon

Bringing you gems every Monday straight to your inbox.

Making Monday’s less blue 👇🏽

davidketh.substack.com/p/coming-soon

• Shoutout for making it to the end

Growing income online shouldn’t be looked at, as this impossible task. It will become more and more attainable as more features role out.

Unlocking the platforms potential is up to Twitter, boosting your income is up to YOU

Thank you.

Growing income online shouldn’t be looked at, as this impossible task. It will become more and more attainable as more features role out.

Unlocking the platforms potential is up to Twitter, boosting your income is up to YOU

Thank you.

• • •

Missing some Tweet in this thread? You can try to

force a refresh