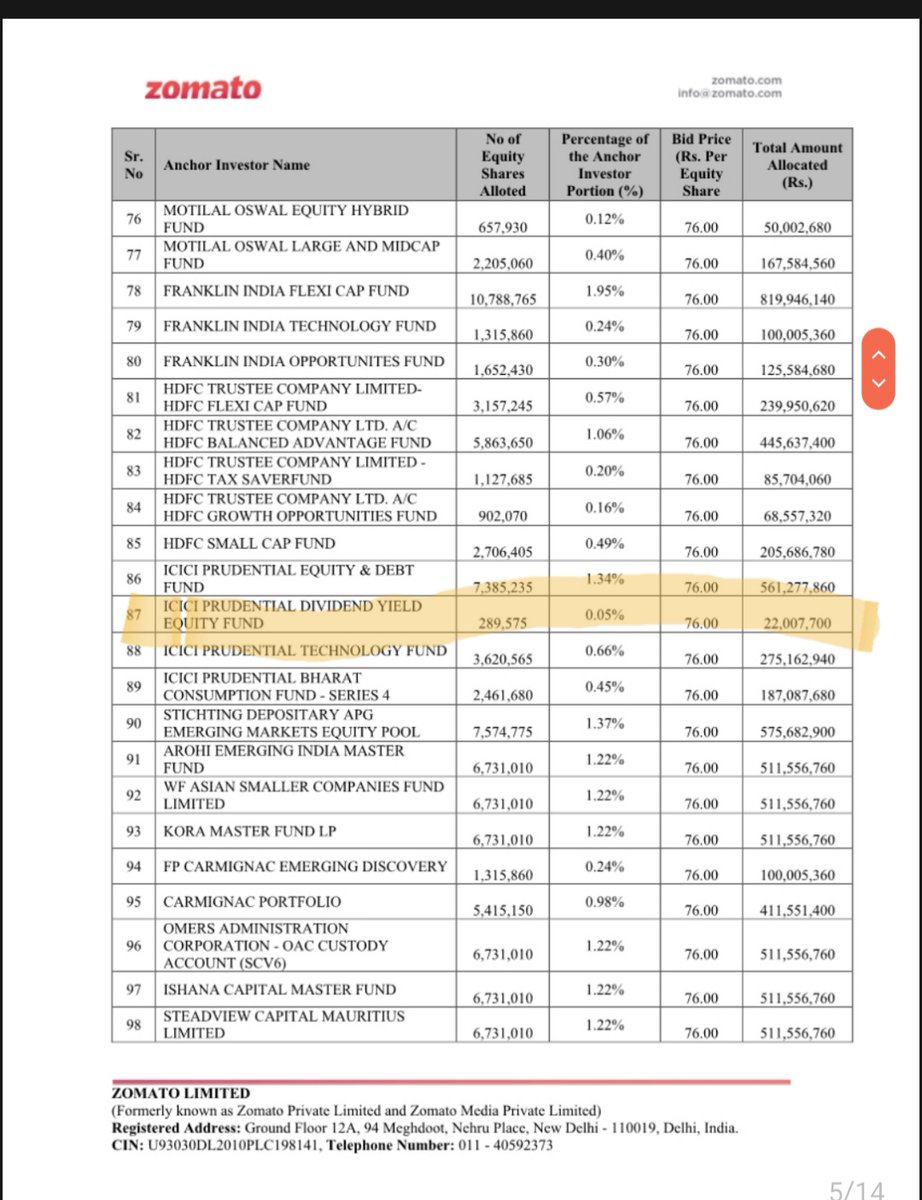

Big MF who invested for Zomato IPO

Axis, ABSL, Kotak, Kotak Nippon, UTI, Motilal Oswal, Franklin, HDFC, Edelweiss, SBI.

Next time if you see any fund manager speak in public forum about ROE, profit, margins, pls boycott them.

No doubt why 85% MF in India don't beat Index.

Axis, ABSL, Kotak, Kotak Nippon, UTI, Motilal Oswal, Franklin, HDFC, Edelweiss, SBI.

Next time if you see any fund manager speak in public forum about ROE, profit, margins, pls boycott them.

No doubt why 85% MF in India don't beat Index.

@Raamdeo has extensively spoken on QGLP where G is growth in EARNINGS and 'sustained' ROE. How did MOSL apply for this IPO. L stands for longevity of competitive advantage. Where is the moat? If anyone offers higher discounts, people will jump to that.

Have principles changed?

Have principles changed?

For decade @iRadhikaGupta has spoken about earnings earnings earnings growth. SUSTAINABILITY of earnings more so. Where did that go mam? You may want to listen your last month video on this pls - msn.com/en-in/video/mo…

How on earth can a dividend yield fund apply for this IPO.? Have @ICICIPruMF lost their mind?? Where is the profits to even get dividends.? What type of irresponsible investing is this? Why are unit holders not asking them this.

Om flip side, Extremely Extremely proud and happy to been a Unit holder of @PPFAS who have stood by its principles and is not driven away by greed. My money is safe. Can sleep peacefully and pass on to next Gen.

I am not against Zomato. They have made startups proud. Who knows, It may go on to double also post listing. I know the pain startup founders go thru in their journey.

Just that appalled with the MF managers who have tweaked all their Principles and threw them in dustbin.

Just that appalled with the MF managers who have tweaked all their Principles and threw them in dustbin.

• • •

Missing some Tweet in this thread? You can try to

force a refresh