Semiconductors: The Indispensable Cog in the ‘Global Tech’ Machine.

- Industry Evolution

- Semiconductor Value Chain

- Roots of Semiconductor Shortage

- US-China Trade Tussle

Decoded!🕵️

Please hit retweet and help us educate more investors.

🧵👇

- Industry Evolution

- Semiconductor Value Chain

- Roots of Semiconductor Shortage

- US-China Trade Tussle

Decoded!🕵️

Please hit retweet and help us educate more investors.

🧵👇

The year 1947 was a landmark year in the history of the 20th century for it brought into the world one of the most revolutionary inventions of humankind- a transistor.

But it was 1958 truly, that changed the way we looked at the potential of a transistor when it was put into an integrated circuit to form what we today call a chip.

These semiconductor chips are the lifeblood of all digital products. Every electronic component that is in use today, ranging from the most advanced supercomputer to the most basic toaster oven comprises these chips.

As we plunge into the digital age, the relevance of semiconductor chips is only growing by the day and for all we know, it may be the next oil for the global economy.

Every year, the world produces around 1 trillion chips which estimates to be about 128 chips per human being.

Every year, the world produces around 1 trillion chips which estimates to be about 128 chips per human being.

In 1965, a brilliant young engineer noticed a fascinating pattern in the way chips were produced in the then, most premium chip company called the Fairchild Semiconductor.

The company released its first silicon transistor in 1958. 2 years later, they could integrate 4 transistors in the chip meaning the power of the chip doubled in the next two years.

By 1965, the number of transistors they could fit into the chip skyrocketed to 60.

By 1965, the number of transistors they could fit into the chip skyrocketed to 60.

All this led the young engineer to conclude that in 10 years' time, they would go from 60 to 60,000 transistors per chip.

The engineer was Gordon Moore who later co-founded the most cutting-edge chip company-Intel.

The engineer was Gordon Moore who later co-founded the most cutting-edge chip company-Intel.

His principle was named 'Moore’s law' & still remains a prevalent guiding principle in the way the industry progresses

It says, as the density of transistors that can be mapped on a chip doubles every 2 years, so does its computing power while the cost of the device gets halved.

It says, as the density of transistors that can be mapped on a chip doubles every 2 years, so does its computing power while the cost of the device gets halved.

Today, we’re getting almost to the atom level of building a chip with only about 5 nanometers of space between two transistors and immensely advanced computing power.

All of this has made the Semiconductor industry highly complex with ultra-specialised companies that regularly make science fiction look mundane in comparison.

Over the last few decades, the industry has managed to grow at an incredible pace.

The complex nature of the business had led to the development of various sub-industries specializing in different phases of the production process.

The complex nature of the business had led to the development of various sub-industries specializing in different phases of the production process.

The Semiconductor Value Chain

Architecture

The first step is to create an instruction set architecture that defines how the Central Processor (CPU) in the chip will respond to the basic instructions.

Architecture

The first step is to create an instruction set architecture that defines how the Central Processor (CPU) in the chip will respond to the basic instructions.

There are mainly 2 types of architecture called- Complex Instruction Set Computing (CISC) & Reduced Instruction Set Computing (RISC).

In RISC-based chips, the program gives a single task to the chip at a time. On its completion, the chip returns to the program for another task.

In RISC-based chips, the program gives a single task to the chip at a time. On its completion, the chip returns to the program for another task.

However, in CISC-based chips, all the tasks are given together and it is for the chip to figure out the order and the priority of each task.

Thus, while RISC-based chips take less power to run, CISC, on the other hand, takes huge power.

Thus, while RISC-based chips take less power to run, CISC, on the other hand, takes huge power.

In the early times, what differentiated both these architectures was that RISC allowed chips to perform minimal functions but CISC allowed its chips to do more advanced level jobs and was hence, made for high-powered devices.

But as the world began inching towards low-powered devices such as a mobile phone over a desktop, RISC began flourishing.

Today, the A14 Bionic chip in the latest apple iphone12 runs on the RISC architecture and interestingly, performs better than most of the CISC-based chips while also being power efficient.

The architecture sub-sector is dominated by two companies Intel and ARM.

x86 is a CISC architecture designed by Intel which not only creates the instruction set but also designs the CPUs for the chip that processes those instructions.

x86 is a CISC architecture designed by Intel which not only creates the instruction set but also designs the CPUs for the chip that processes those instructions.

ARM, on the other hand, is a RISC architecture that creates the instruction set and then licenses it to the designers who can customize their own CPUs on top of this basic architecture.

Chip Designing

The second step is to design the chips wherein the companies create actual circuit diagrams on how the components are to be arranged on the chip so as to deliver a primary framework.

The second step is to design the chips wherein the companies create actual circuit diagrams on how the components are to be arranged on the chip so as to deliver a primary framework.

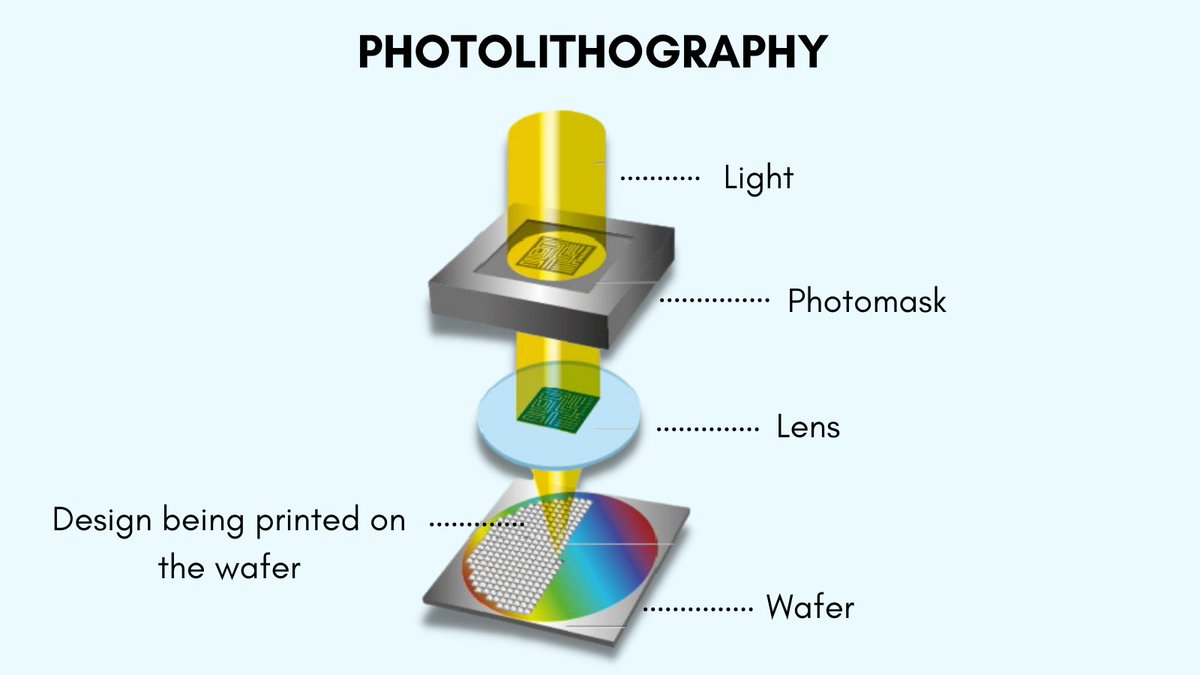

The companies use a software to create these designs and then print those designs on a photographic element which is known as a photomask.

Thus, a photomask is the output of the software that the designer passes on to the manufacturer.

Thus, a photomask is the output of the software that the designer passes on to the manufacturer.

This is the step where the semiconductor gets the most competitive in nature with companies such as Apple, Samsung, Intel, Qualcomm, Mediatek, and so many more, all into designing the chips.

Fabrication

The next step is to get the designs fabricated onto actual silicon wafers and the process is termed as fabrication.

The next step is to get the designs fabricated onto actual silicon wafers and the process is termed as fabrication.

This is where the process gets extremely complicated and also, requires huge bouts of capital investment.

The process is performed by contract manufacturers which are called fabs or foundries.

The process is performed by contract manufacturers which are called fabs or foundries.

At this stage, small grains of silicon sand are moulded into a silicon cylinder which are sliced into circular silicon wafers.

The manufacturer takes the photomask and uses light to imprint miniature copies of that on to the silicon wafer. This method is called Photolithography.

The manufacturer takes the photomask and uses light to imprint miniature copies of that on to the silicon wafer. This method is called Photolithography.

For photolithography, companies require highly advanced machines each of which cost them as high as $150 million.

The only one dominant company which manufactures such machines is ASML, a Dutch company that churns out only about 25-50 of these machines every year.

The only one dominant company which manufactures such machines is ASML, a Dutch company that churns out only about 25-50 of these machines every year.

Then, the wafer gets cut into individual chips, the chips are attached to wires are put into a protective housing.

Finally, they are tested for quality before being sold to the company that goes onto assemble them with some device such as a mobile phone.

Finally, they are tested for quality before being sold to the company that goes onto assemble them with some device such as a mobile phone.

Back in the nascent stages of the chip industry, everything was Integrated Device Manufacturing (IDM) which means one company did everything right from designing to manufacturing.

But over so many years, only two companies- Intel and Samsung- remain as IDMs.

But over so many years, only two companies- Intel and Samsung- remain as IDMs.

The rest of the companies have chosen either to be a fab or to be a fabless i.e to be a designer that outsources manufacturing.

This is because foundry economics is not for the faint hearted.

This is because foundry economics is not for the faint hearted.

Fabs require huge capital- around $ 10 billion to build a basic factory & twice as much for the most cutting-edge one.

On top of that, factories become obsolete in about 5 years given the rapid tech advancement. This leaves them with absolutely no room for mistakes.

On top of that, factories become obsolete in about 5 years given the rapid tech advancement. This leaves them with absolutely no room for mistakes.

Data shows that from 25 in 2016 to only 3 large players remain in this business & in fact just 1 remains as the most cutting edge player- Taiwan Semiconductor Manufacturing Company (TSMC).

The winner in this segment reinvests its earnings back and gains an edge over the others.

The winner in this segment reinvests its earnings back and gains an edge over the others.

In the past few months, the industry has been in the news for all the wrong reasons such as supply chain disruptions and chip shortages.

Companies that use chips from automakers to even companies like Apple have had to either delay or slow down their production process.

Companies that use chips from automakers to even companies like Apple have had to either delay or slow down their production process.

When the coronavirus pandemic hit, it changed the consumer behaviour and people began flocking towards home electronics such as laptops, routers, personal computers, etc.

Meanwhile, the automobile sector interpreted their sales to slump over the next few quarters.

Meanwhile, the automobile sector interpreted their sales to slump over the next few quarters.

This led the automakers to cancel their semiconductor orders and simultaneously, the consumer electronic brands to order extra semiconductors.

Thus, fabs shifted their production lines to produce for the consumer electronics.

Thus, fabs shifted their production lines to produce for the consumer electronics.

Interestingly, the economies in East Asia bounced back sooner than expected and the demand of automobile quickly reached to its pre-covid levels or even more in some cases.

This pushed the automakers into rigorously ordering chips.

This pushed the automakers into rigorously ordering chips.

Now, this is the root cause of all the chaos because there is actually nothing rigorous or fast about the chip production process.

A chip takes about 6 months to go through all steps in the production process till it finally reaches the end consumer.

A chip takes about 6 months to go through all steps in the production process till it finally reaches the end consumer.

The supply chain of semiconductor is spread across the entire globe, right from west to east, with each company specialising in its own area of expertise.

And while efficient, this consolidation of the industry within just a handful of players poses huge risks for the world.

And while efficient, this consolidation of the industry within just a handful of players poses huge risks for the world.

For example:

If Toyota wants to order navigation units for its cars, it contacts Panasonic. On receiving the order, Panasonic orders chips from the designer say Infineon. Then, Infineon contacts a fab such as TSMC, the largest foundry of the world, to send it finished chips.

If Toyota wants to order navigation units for its cars, it contacts Panasonic. On receiving the order, Panasonic orders chips from the designer say Infineon. Then, Infineon contacts a fab such as TSMC, the largest foundry of the world, to send it finished chips.

All of this globalised chain is manageable under normal circumstances but when demand spikes all at once from everywhere, it overwhelms the manufacturers especially when more than about 50-60% chips are manufactured by only one company,TSMC.

TSMC virtually maintains a monopoly in the foundry business of the world that not even companies like Samsung can beat.

It makes the most advanced level chips for almost every designer in the world.

It makes the most advanced level chips for almost every designer in the world.

With demand rushing in from all directions, TSMC has been stuck as the burden of the entire world lies on its shoulders with no other company even remotely near to its virtual monopoly.

The companies have began ramping up their inventories as they fear supply disruptions in the future.

This has led to massive hoarding from companies worldwide & thus, it has become difficult to tell that how much of it is actual shortage & how much is an outcome of hoarding.

This has led to massive hoarding from companies worldwide & thus, it has become difficult to tell that how much of it is actual shortage & how much is an outcome of hoarding.

But that's not all. No technological issue is complete without the superpowers of the world- US & China- locking horns.

In the war of supremacy, they seem to have worsened the crisis with US knowing nothing but to impose ‘sanctions’ on China, on the pretext of national security.

In the war of supremacy, they seem to have worsened the crisis with US knowing nothing but to impose ‘sanctions’ on China, on the pretext of national security.

USA is leading the semiconductor industry as they have managed to corner the higher end of the value chain such as software, designing, advanced machines, etc.

China being on the lower end, is trying to catch up but to match USA’s level, still remains a distant dream for them.

China being on the lower end, is trying to catch up but to match USA’s level, still remains a distant dream for them.

The fact that TSMC is overwhelmed at the moment provides a huge business opportunity to the Chinese chip producers but for that they need advanced equipment from companies like ASML.

As ASML depends a lot on the US tech, USA has blocked them from providing machinery to China.

As ASML depends a lot on the US tech, USA has blocked them from providing machinery to China.

Thus, when semiconductors are flowing freely, no one pays much attention to just how amazing their existence is but whenever there is a supply disruption from TSMC, the fragility of our modern world quickly becomes apparent.

While Semiconductors may be the future but as of now, the world depends only on a few companies which is nothing but putting a lot of eggs in one basket.

This thread wouldn't have been possible without the research conducted through the references mentioned in the following link:

docs.google.com/document/d/1q4…

docs.google.com/document/d/1q4…

Tagging you all for wider reach.

@unseenvalue @drprashantmish6 @jatin_khemani @NeerajMarathe @Kuntalhshah @abhymurarka @caniravkaria

Also, we would love to have your feedback on the thread. 🙏

@unseenvalue @drprashantmish6 @jatin_khemani @NeerajMarathe @Kuntalhshah @abhymurarka @caniravkaria

Also, we would love to have your feedback on the thread. 🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh