1/ A discussion was had in our discord about selling vol and risk. Here is a simple way to sell vol while mitigating risk. A short thread on selling put spreads...

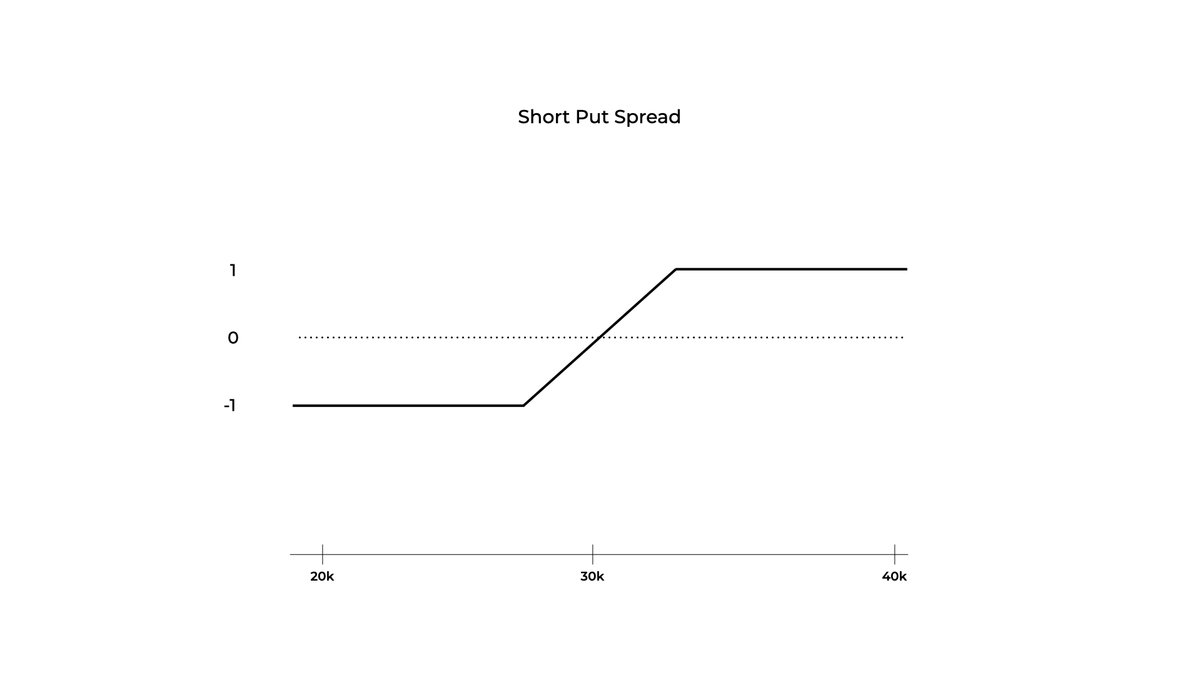

2/ Simply put (ha) to sell a Put spread you sell a Put closer to the ATM strike and buy a Put further down the strike ladder. If we would have sold the 31k Put and bought the 28k Put, the PnL curve would look something like the graphic above.

3/ If $BTC remains higher than 31k (at the time of the Options expiration) we keep the difference in premiums between the Put sold and the Put bought. But if $BTC goes below 28k we simply lose the difference between the two strikes (known risk.) Allow me to elaborate...

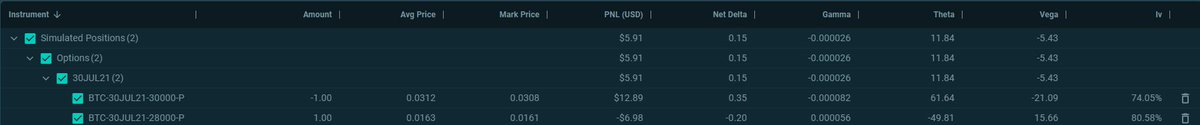

4/ In this example, the Options expire 30JUL21. I've sold the 30k Put and received .0312 #BTC for it. I've also bought the 28k Put for .0163 #BTC. Leaving me with net .0149 #BTC (around $500) in my pocket.

5/ You can see from looking at my greeks that I am net negative Vega (vol.) This is what people mean when they say "short vol".

6/ Furthermore, my short Put has positive Theta (61.64,) the important thing to understand for now is that as time nears expiration, my short Put will "collect Theta" meaning my PnL on that short contract will increase. (If $BTC is out of the money, or in this case above 30k.)

7/ My long 28K Put has a negative Theta though (-49.81), meaning my PnL will decrease on this contract as time passes. The overall positions Theta is positive (+11.84,) so this spread, as a whole, will gain value as time passes. This concept is best left for its own thread.

8/ Anyway, the best scenario for us would be if the Options contracts expire when $BTC is above our short 30k Put. If this were the case we would simply keep the difference in premiums we collected when we first sold the spread (around $500.)

9/ Now, what happens if the Options contracts expire below the 30k Put or even below the 28k Put? You can see from the graph that your loss levels out after 28k right?

10/ To sum it up, if $BTC drops below 28k, our 28k long Put starts making enough money to offset the loss on our 30k short put. This leaves us with known risk. The loss is simply the distance between the two strikes, 30k-28k = 2k (per 1 contract.) But...

11/ remember the $500 in premiums we collected when we sold the spread, we still hold that "in our pocket" right, we can now use that to pay off some of our "debt." Our 2k loss now becomes a 1.5k loss.

12/ The idea here is that we have a good chance to collect "yield" as time passes, and we have known risk so you can sleep at night. Now the question becomes, how do you choose which strikes to buy and sell?...

13/ What are the probabilities $BTC ends up either ITM or OTM, and how do you spot mispriced options? More on this to come...

14/ Anything to add, help me out here :) @PelionCap, @TraderSkew, @laevitas1, @Mtrl_Scientist, @tztokchad, @DeribitExchange, @ZetaMarkets?

• • •

Missing some Tweet in this thread? You can try to

force a refresh