A few friends, especially those entrenched in VC, have reached out to me over the last few days asking for a take on the $SUSHI situation. So I thought I'd start a thread to share my thoughts.

This has basically evolved in to a DeFi maxis version of reality TV. #drama

This has basically evolved in to a DeFi maxis version of reality TV. #drama

0/ First a disclaimer and some transparency: I've been HODLing $SUSHI ($XSUSHI since I'm staking) since late last year.

I believe $SUSHI is undervalued.

Let's start with some background and history:

I believe $SUSHI is undervalued.

Let's start with some background and history:

1/ Sushi is an automated market maker (AMM), a decentralized exchange (DEX) and a DeFi darling. Sushi runs on the Ethereum blockchain.

@0xMaki is one of the founding members of Sushi. He operates mostly anonymously (one of the beautiful aspects about working in this space).

@0xMaki is one of the founding members of Sushi. He operates mostly anonymously (one of the beautiful aspects about working in this space).

2/ Sushi (prev known as Sushiswap) is a fork of Uniswap, the biggest AMM in terms of volume. Uniswap is a true pioneer in this space and has raised > $12M from A16Z, USV, Paradigm, Version One and others. The last known funding round was in June '20.

uniswap.org/blog/uniswap-r…

uniswap.org/blog/uniswap-r…

3/ If you want to take a trip down memory lane:

https://twitter.com/haydenzadams/status/1120759500137537539

4/ Back to Sushi: Sushi was founded by @NomiChef in August 2020. Sushi's funding history is rather simple, yet probably one of the biggest and momentous events in DeFi's brief history.

5/ Now, Uniswap was the first mover and had the early advantage in the AMM + DEX space. So how does a new DEX challenge the incumbent? DEXes have a cold start problem - when there aren't enough liquid assets to trade, the DEX becomes useless.

6/ Sushiswap conceptualized something called a "vampire attack". Let's back up: When a user providers liquidity to a platform like Uniswap, they get back something called "liquidity pool tokens" (LP Tokens). These Uniswap LP tokens represent liquidity supplied on Uniswap.

7/ Sushiswap incentivized these liquidity providers to deposit (stake) their Uniswap LP tokens on Sushiswap. In return for doing this, the users were rewarded $SUSHI. There is more nuance here but Sushiswap was able to start draining liquidity from Uniswap and move it to Sushi.

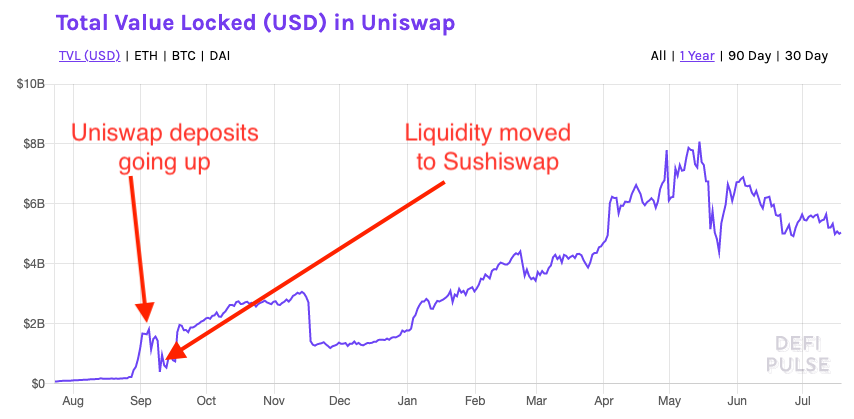

8/ This may sound like bad news for Uniswap, but it actually did quite the opposite. It drew more people to deposit on Uniswap.

Before Sushiswap's launch, Uniswap had $185M locked in LPs.

The Sushiswap incentive caused deposits on Uniswap to grow to $1.8B.

Before Sushiswap's launch, Uniswap had $185M locked in LPs.

The Sushiswap incentive caused deposits on Uniswap to grow to $1.8B.

10/ For more on this, you should read this excellent writeup by @CamiRusso :

https://twitter.com/DefiantNews/status/1303428971124723719

11/ Soon after, Sushiswap started offering high APYs to draw people to start providing liquidity. This is what is known as Yield Farming.

12/ Sushi has an interesting history and gained some notoriety because of a weird incident back in September '20. It appeared that one of the founders of Sushi "ran away" with ~$14M in ETH:

https://twitter.com/NomiChef/status/1304442495342796800

13/ Subsequently, @SBF_Alameda "entered the chat":

https://twitter.com/sbf_alameda/status/1304443354831175682?lang=en

14/ So why is this relevant? Why take this trip down memory lane?

For one, Sushi has not raised venture capital.

Second, this product and community are ... resilient.

Third, it is a product that the community feels really invested in. Sushi maxis are hardcore.

For one, Sushi has not raised venture capital.

Second, this product and community are ... resilient.

Third, it is a product that the community feels really invested in. Sushi maxis are hardcore.

15/ Early this year, Sushi released their impressive roadmap for features which was going to start to set them apart from Uniswap (Bentobox, Miso etc.):

medium.com/sushiswap-org/…

medium.com/sushiswap-org/…

16/ For all intents and purposes, Sushi can be considered a blue chip asset. It trades on several centralized exchanges (Binance, Coinbase Pro, FTX)

This brings us to what has unfolded over the last 2 weeks:

This brings us to what has unfolded over the last 2 weeks:

17/ Many DeFi projects have a treasury, which holds the project's native tokens. Sushi has ~51M in the treasury, in the form of the native $SUSHI token.

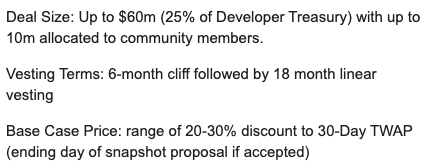

On July 7 '21, @0xMaki proposed selling up to $60M (25% of the treasury at the time) to institutional investors (VCs).

On July 7 '21, @0xMaki proposed selling up to $60M (25% of the treasury at the time) to institutional investors (VCs).

18/ One thing to note is that there is occasional risk to holding the treasury in the native token:

https://twitter.com/RobertoTalamas/status/1401960196394655753?s=20

19/ This is the open nature in which these decentralized projects operate. Proposals, community discussions and voting are all integral to how these are run.

20/ The investors on board are some of the most elite names in VC. And the appeal to invest in Sushi is really clear, especially given's Uniswap's raise and their growth.

21/ This proposal was not well received by the $SUSHI community, the 6 month cliff and the discount in particular. 62% voted negatively to this proposal.

- Won't the VCs just dump once the lockup is done?

- Won't the VCs just dump once the lockup is done?

22/

- If the current price holds, this will look like an arbitrage trade and VCs will just make 20-30% in 6 months.

- Maki says $SUSHI doesn't need capital. Why raise?

- What value can VCs bring to the table when Sushi has been successful without VC support?

- If the current price holds, this will look like an arbitrage trade and VCs will just make 20-30% in 6 months.

- Maki says $SUSHI doesn't need capital. Why raise?

- What value can VCs bring to the table when Sushi has been successful without VC support?

23/ On July 16, @jdorman81 from @arca had a new proposal which didn't make the raise exclusive to VCs:

https://twitter.com/jdorman81/status/1416192525346304000

24/ Of course, this proposal isn't entirely selfless but it is solid:

https://twitter.com/jdorman81/status/1416192530509570048?s=20

25/ I have founded companies but I now work in VC. So please take the following with a tub of salt:

- VCs are "long term greedy"

- VCs will play the long game and will continue to back with capital as and when necessary.

- VCs are "long term greedy"

- VCs will play the long game and will continue to back with capital as and when necessary.

- Most founders go an inch wide, and several miles deep into their project. VCs can go several miles wide, but may only get a few inches deep on many companies. This breadth gives VCs an incredible lens.

- The best VCs are excellent pattern matchers (for better or worse). When this muscle is exercised well, founders get to learn from VCs and operate efficiently and avoid pitfalls.

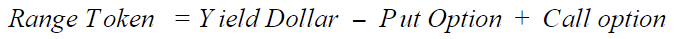

26/ @UMAprotocol recently made a proposal using their Range Token concept, which is like a form of convertible debt.

docs.google.com/document/d/1tJ…

docs.google.com/document/d/1tJ…

27/ That sort of brings us to where we are right now. Sushi is in an excellent position to raise capital. When they do (not if), it will really help propel them and accelerate product development (cross-chain anyone?)

28/ But we are seeing unfold in front of our eyes the power of the community vs the power of institutional VC.

This is most likely going to be a zero-sum game.

I'll keep updating this thread as the situation evolves...

This is most likely going to be a zero-sum game.

I'll keep updating this thread as the situation evolves...

29/ Here is an awesome thread summarizing this as well:

https://twitter.com/srinathariharan/status/1416863569652584449

30/ It looks like @0xMaki is scaling the raise down to $15M-20M to work with the community.

h/t @osamakhn @sutherlandphys for 👀 on this monster

Let’s do this:

https://twitter.com/jdorman81/status/1418030679997091840

• • •

Missing some Tweet in this thread? You can try to

force a refresh