• Primary Target

Net income: R 13 200

- Property Investors

- Small Family

- Young Couples

- Singles

Net income: R 13 200

- Property Investors

- Small Family

- Young Couples

- Singles

• Features

- 84 sqm

- 2 bedrooms

- Full bathroom

- Modern kitchen

• Selling Points

- Lock up Garage

- 24 hour Security

- Close to Schools

- Near a Shopping Center

- Newly renovated -remember this

- 84 sqm

- 2 bedrooms

- Full bathroom

- Modern kitchen

• Selling Points

- Lock up Garage

- 24 hour Security

- Close to Schools

- Near a Shopping Center

- Newly renovated -remember this

• Purchase Price

Price : R439 000

Offer: R351 000

(20% discount)

This is where it gets interesting. The agent’s selling point is

‘newly renovated’

It tells me one thing;

someone is flipping this flat.

Another unit sold in May for R330k👇🏽

property24.com/for-sale/troye…

Price : R439 000

Offer: R351 000

(20% discount)

This is where it gets interesting. The agent’s selling point is

‘newly renovated’

It tells me one thing;

someone is flipping this flat.

Another unit sold in May for R330k👇🏽

property24.com/for-sale/troye…

Try to offer this person 20% less and they will flat out refuse.

Why?

Because they have no equity in the deal.

Let’s assume they paid R280k on the property (negotiated 15% off R330k)

Spent +- R70k to renovate

Final cost R350k (breakeven point)

They’ll never accept!

Why?

Because they have no equity in the deal.

Let’s assume they paid R280k on the property (negotiated 15% off R330k)

Spent +- R70k to renovate

Final cost R350k (breakeven point)

They’ll never accept!

The current owner(s) wouldn’t go through all that effort just to breakeven.

Let’s assume those were all their costs and they sold the unit today.

They would make themselves a 25% profit.

However, the longer they aren’t able to sell the unit the lower the return.

Let’s assume those were all their costs and they sold the unit today.

They would make themselves a 25% profit.

However, the longer they aren’t able to sell the unit the lower the return.

• Greater Fool Theory

Is the idea that, during a market bubble, one can make money by buying overvalued assets and selling them for a profit later, because it will always be possible to find someone who is willing to pay a higher price.

That’s the concept.

Is the idea that, during a market bubble, one can make money by buying overvalued assets and selling them for a profit later, because it will always be possible to find someone who is willing to pay a higher price.

That’s the concept.

• Mistakes

Now, let’s run the numbers here.

Assume they bought it for R280k with no deposit. (20 years @ 7%)

Here are what their monthly costs would be until they flip the property:

Bond : R2 170

Levies : R1 700

R/taxes: R400

Insurance : R300

Total: R4 570

Now, let’s run the numbers here.

Assume they bought it for R280k with no deposit. (20 years @ 7%)

Here are what their monthly costs would be until they flip the property:

Bond : R2 170

Levies : R1 700

R/taxes: R400

Insurance : R300

Total: R4 570

• Running the numbers

Rental: R4000

Cost: R4570

Monthly loss: (R570)

*That’s if they had a tenant

I’d say there is a high chance of the Greater Fool Theory playing out here. Numbers don’t make sense as an investment, so the next best move is to sell it higher to some1 else

Rental: R4000

Cost: R4570

Monthly loss: (R570)

*That’s if they had a tenant

I’d say there is a high chance of the Greater Fool Theory playing out here. Numbers don’t make sense as an investment, so the next best move is to sell it higher to some1 else

That’s this Friday’s Thread, if you want more property analysis then follow me @talkcentss

You can expect:

- Property Threads

- Investment Research

- Trading tips

- Stock picks

You can expect:

- Property Threads

- Investment Research

- Trading tips

- Stock picks

Or you can be like 100’s of others, who know how to find winning deals and are buying cash generative properties 👇🏽

gum.co/property

gum.co/property

• Thinks to Ponder

- Risk reward ratio sucks

- Too many parameters

- Margins are low

- Return on Investment is terrible

- Attractive gross yields don’t automatically make properties a good buy.

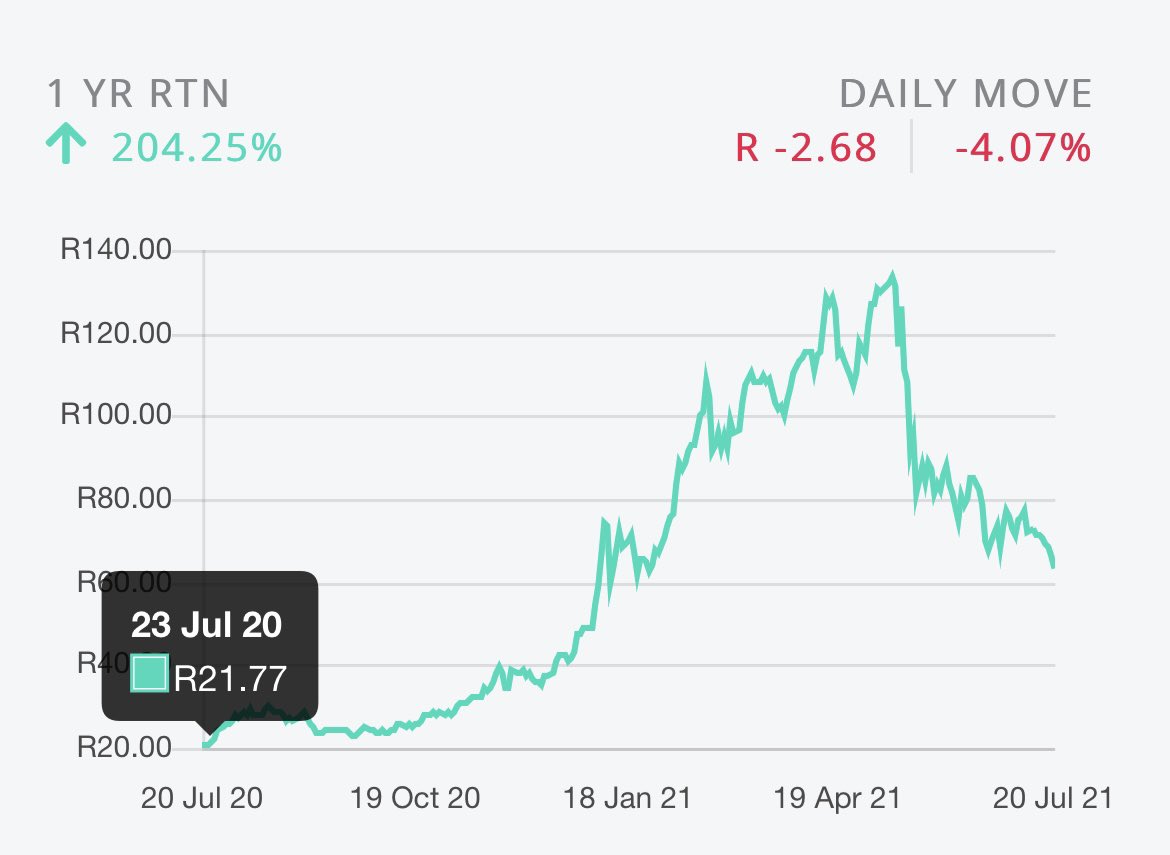

-Equity is a better investment-IMO

- the end -

- Risk reward ratio sucks

- Too many parameters

- Margins are low

- Return on Investment is terrible

- Attractive gross yields don’t automatically make properties a good buy.

-Equity is a better investment-IMO

- the end -

• • •

Missing some Tweet in this thread? You can try to

force a refresh