Investing As a Stokvel

‘Investment > Consumption’

• What is a Stokvel

• Growth Potential

• Different Types

• Market Trends

• Getting Credit

• Investments

(Thread) 👇🏽

‘Investment > Consumption’

• What is a Stokvel

• Growth Potential

• Different Types

• Market Trends

• Getting Credit

• Investments

(Thread) 👇🏽

• What is a Stokvel

It is a savings club that serves as rotating credit unions.

Members contribute fixed sums of money to a central account- either weekly, fortnightly, or monthly.

Stokvel’s have become synonymous with the savings culture in South Africa.

#savingsmonth

It is a savings club that serves as rotating credit unions.

Members contribute fixed sums of money to a central account- either weekly, fortnightly, or monthly.

Stokvel’s have become synonymous with the savings culture in South Africa.

#savingsmonth

• Potential of Stokvels

There are over 11.5 million participants in the ecosystem that contribute R50 billion annually.

One in every 2 adults participate in over 800 000 Stokvels.

Let’s look at some types of Stokvels 👇🏽

There are over 11.5 million participants in the ecosystem that contribute R50 billion annually.

One in every 2 adults participate in over 800 000 Stokvels.

Let’s look at some types of Stokvels 👇🏽

• Types of Stokvels

• Contribution

• Purchasing

• Investment

• Borrowing

• Grocery

• Family

• Basic

• Party

Stokvels are mainly used for consumption and not investment.

This makes it an underutilized vehicle. It could help scale small businesses.

#economy

• Contribution

• Purchasing

• Investment

• Borrowing

• Grocery

• Family

• Basic

• Party

Stokvels are mainly used for consumption and not investment.

This makes it an underutilized vehicle. It could help scale small businesses.

#economy

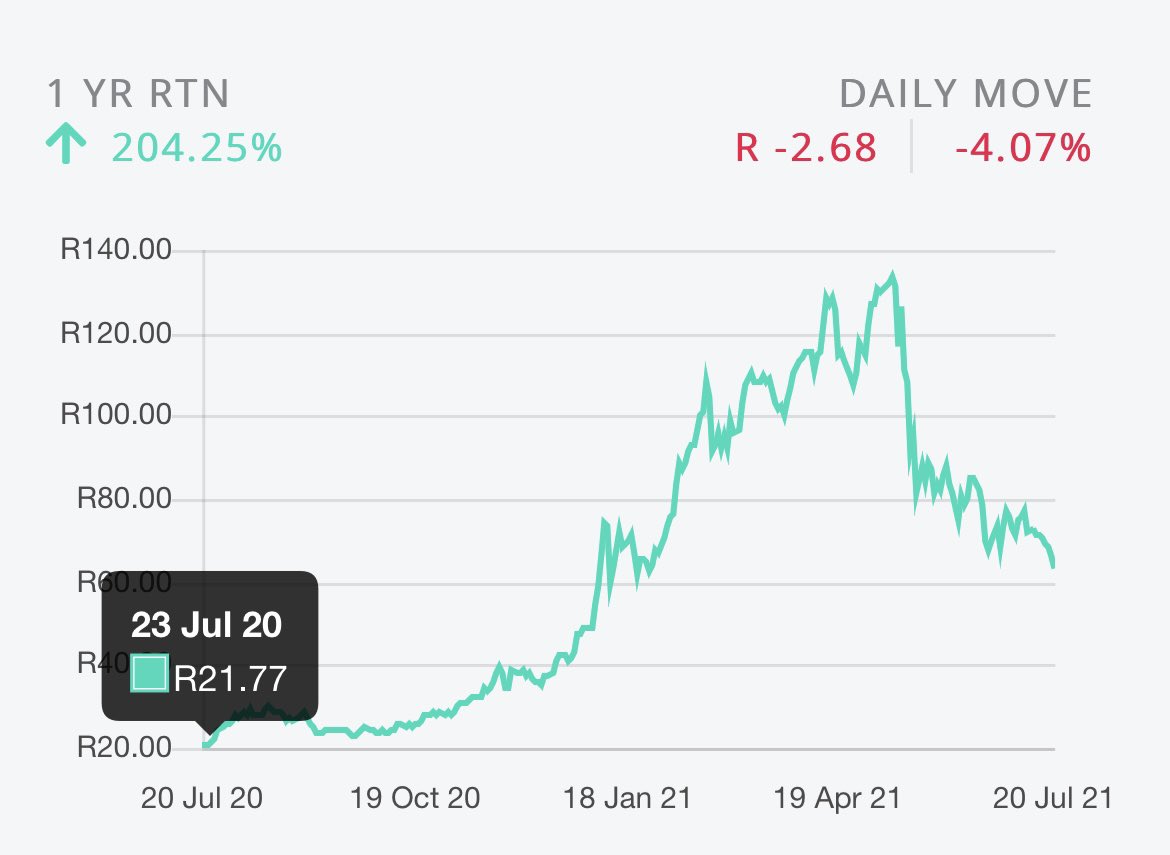

• Trends

In the last:

• 7 days

• 12 months

There has been a surge of interest in Stokvel’s. Possibly because of social unrest.

Many people don’t know where their next meal will come from, or how they will access funding for their business going forward.

In the last:

• 7 days

• 12 months

There has been a surge of interest in Stokvel’s. Possibly because of social unrest.

Many people don’t know where their next meal will come from, or how they will access funding for their business going forward.

• S.A Economy

Stokvels play a vital role in the S.A economy, they are self-help initiatives, designed to respond to the problems of poverty + income insecurity in communities

Stokvels can also provide opportunities for its members to save, invest + build assets

Let’s 👀👇🏽

Stokvels play a vital role in the S.A economy, they are self-help initiatives, designed to respond to the problems of poverty + income insecurity in communities

Stokvels can also provide opportunities for its members to save, invest + build assets

Let’s 👀👇🏽

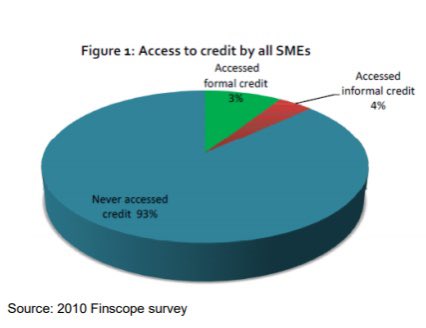

• Research Data

The visual graphs below come from research that was conducted by @UCT_Research

Some data may have changed since the research was done, but the purpose is to open the door to the understandings behind Stokvels and the role they play in the economy.

The visual graphs below come from research that was conducted by @UCT_Research

Some data may have changed since the research was done, but the purpose is to open the door to the understandings behind Stokvels and the role they play in the economy.

• Stokvel

If Stokvels were a province it would be the second biggest province in South Africa.

The amount of people relying on Stokvels is astronomical.

If Stokvels were a province it would be the second biggest province in South Africa.

The amount of people relying on Stokvels is astronomical.

• Investing as a Stokvel

Why are members reluctant to invest as Stokvels?

The main reasons:

• Haven’t thought about it

• Not enough money

This may signal that there isn’t enough financial education around the potential, + also highlights an economy that’s battling.

Why are members reluctant to invest as Stokvels?

The main reasons:

• Haven’t thought about it

• Not enough money

This may signal that there isn’t enough financial education around the potential, + also highlights an economy that’s battling.

• Access to capital

A major problem in the economy is that small businesses lack access to capital, then resort to unsecured lending which is costlier.

Stokvels could be bridging this gap between lack of capital and business growth - which indirectly could create more jobs.

A major problem in the economy is that small businesses lack access to capital, then resort to unsecured lending which is costlier.

Stokvels could be bridging this gap between lack of capital and business growth - which indirectly could create more jobs.

• Reasons to Save and Invest

Stokvels allow for businesses to access capital at a cheaper rate

If the economy needs to grow, then it must build the infrastructure that is supportive and conducive for smaller businesses.

A viable option is right here - Stokvels

Stokvels allow for businesses to access capital at a cheaper rate

If the economy needs to grow, then it must build the infrastructure that is supportive and conducive for smaller businesses.

A viable option is right here - Stokvels

• How to Start

You can follow these steps below to get started.

My Company has raised R500 000 in less than 3 years - and we started as a Stokvel.

We invest in

• Stocks

• Cash

We want to invest in

• Property

• Small businesses

Here are the blueprints 👇🏽

You can follow these steps below to get started.

My Company has raised R500 000 in less than 3 years - and we started as a Stokvel.

We invest in

• Stocks

• Cash

We want to invest in

• Property

• Small businesses

Here are the blueprints 👇🏽

https://twitter.com/talkcentss/status/1334512575497842688

Follow me @talkcentss for more finance related content.

Expect More:

- Personal Finance Tips

- Property Threads

- Investment ideas

- Business Tips

- Trading

Expect More:

- Personal Finance Tips

- Property Threads

- Investment ideas

- Business Tips

- Trading

Or you can join 1000+ other people who receive my premium content absolutely Free.

Making Monday’s less Blue 👇🏽

davidketh.substack.com/p/talkcents

Making Monday’s less Blue 👇🏽

davidketh.substack.com/p/talkcents

• Watch the full video

‘Stokvel Investing’

There’s only so many characters I can use in my tweets. To learn even more watch the video below 👇🏽

‘Stokvel Investing’

There’s only so many characters I can use in my tweets. To learn even more watch the video below 👇🏽

• • •

Missing some Tweet in this thread? You can try to

force a refresh