1/ Lets briefly talk about Option pricing, more specifically the Greek called Delta.

An important thing to remember is Option prices are influenced by a few factors, not just the directional movement of $BTC. Compartmentalize in your mind Option contract prices and $BTC price.

An important thing to remember is Option prices are influenced by a few factors, not just the directional movement of $BTC. Compartmentalize in your mind Option contract prices and $BTC price.

2/ To price Options we feed inputs into a model and it spits out the theoretical price for that specific option. The Greek called Delta is the Option price rate of change relative to every one dollar move in the underlying ($BTC). Photo ripped directly from Investopedia lolz.

3/ A simple example. Lets say our Option contract is worth $2000 with a Delta of .50, and $BTC is trading at $30,000, what would happen if $BTC were to move to $31,000? Our Option contract would now be worth $2500. Note: It wont be perfect because there are other variables...

4/ but that's the idea. Here, I've circled the 35k strike, which has a delta of .52. If you look to the left you will see this contract has a mark price of $2,778. The strike above is 34k (1k lower and further ITM), its mark price is $3,268.

5/ Do the math, 1k move (35k to 34k) * .52 (Delta) = $520. What's $2759+$520 = $3279. Not exactly $3,268 but close. So Delta will tell you how much your option price will increase or decrease.

6/ Side note: Heuristically, Option traders also look at delta as the percentage chance the option will expire "In the Money." So if you have a .30 delta, you have a 30% chance that option will expire ITM. Its a down and dirty way to look at probabilities.

7/ So delta is important to know if you want to hedge or be "Delta Neutral", meaning you don't care whether $BTC goes up or down (directionally agnostic.)

8/ The strategy of being Delta neutral also applies to yield farming. When you are delta neutral in an LP you are essentially in a Options strangle collecting Theta. We cover delta neutral yield farming for beginners in our course *wink*.

variantresearch.store

variantresearch.store

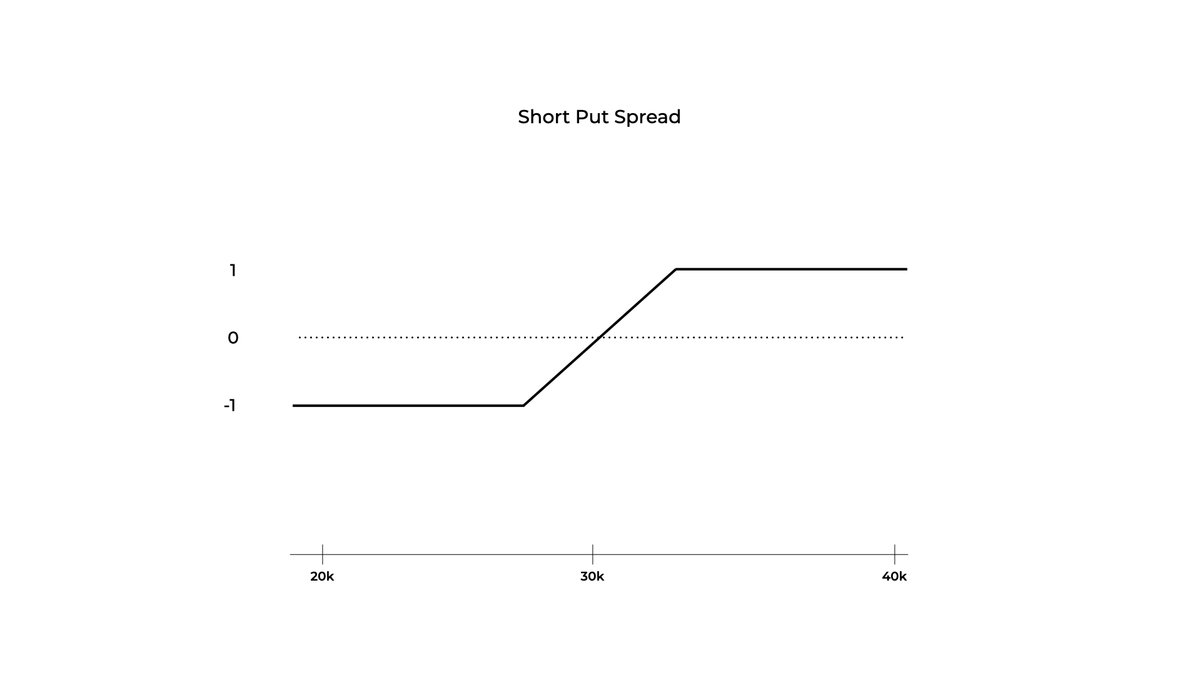

9/ Last thing to note (this is where it gets confusing.) You can have negative deltas, for example if you long (buy) a Put you have neg delta (I circled in blue.) When you sell a Put you have pos delta, and when you long (buy) a Call you have pos delta, but when you short a call,

10/ you have neg deltas. I marked the short call and long Put in Orange and the short Put and long Call in Blue. MM's are always hedging their deltas, so this pos or neg position dictates whether they buy or sell to balance. But, I think this is beyond the scope of this thread.

11/ To sum up, if you have a delta of .30 for every one dollar move up your contract would be worth .30 cents more, and every one dollar move down your contract would be worth .30 cents less.

12/ Something to think about...

If you just hold 1 $BTC spot what is your "delta"?

If you just hold 1 $BTC spot what is your "delta"?

13/ Ok, I'll quit here otherwise I'll keep rambling. Bonus points to anyone who can tell me the second order derivative that measures the rate of change in Delta?

Also, read it: 👇

Also, read it: 👇

Anything to add. I'd love some more input from people smarter than myself. @DeribitExchange @tztokchad @laevitas1 @Mtrl_Scientist @PelionCap

• • •

Missing some Tweet in this thread? You can try to

force a refresh