Not sure on Price Action?

A thread on:

- Market Structure

- Bull & Bear Trends & Reversals

- Price targets / defining an exit

- Where to enter & place a SL (in both bull & bear situations)

A thread on:

- Market Structure

- Bull & Bear Trends & Reversals

- Price targets / defining an exit

- Where to enter & place a SL (in both bull & bear situations)

Market Structure:

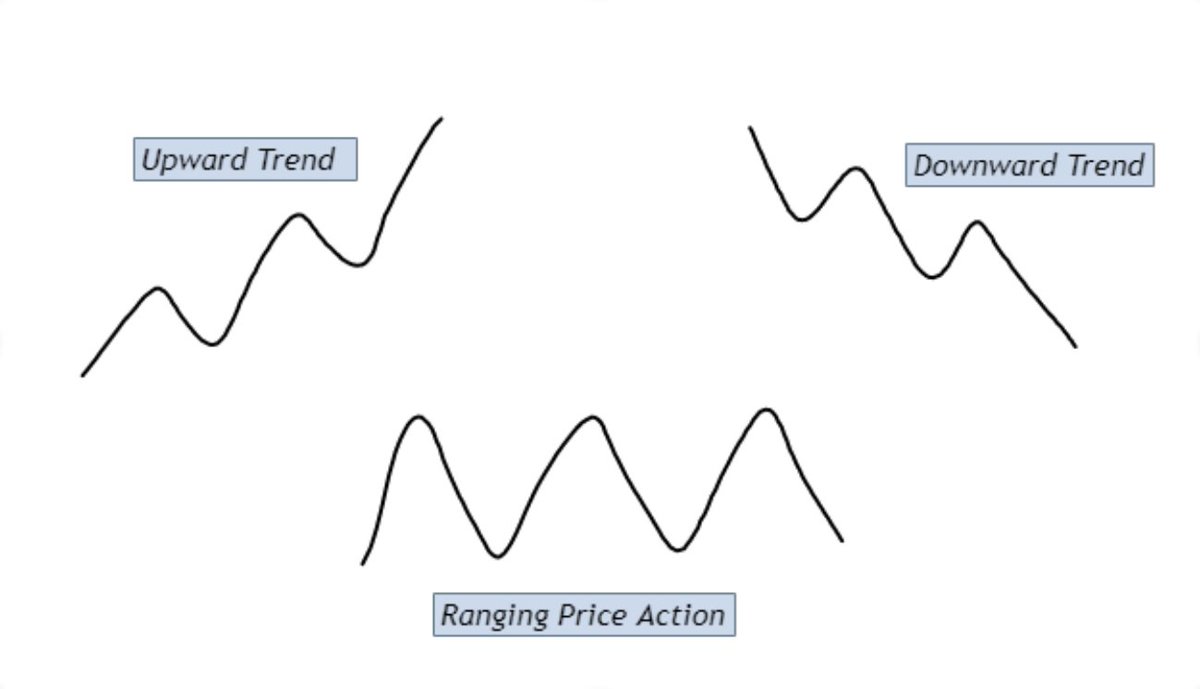

Market structure can basically be defined as the series of swing highs and swing lows and all the price action in between that can be found in the following scenarios: upward trend, downward trend, or in a ranging environment.

Market structure can basically be defined as the series of swing highs and swing lows and all the price action in between that can be found in the following scenarios: upward trend, downward trend, or in a ranging environment.

Bear in mind that market structure is fractal and can be found replicating itself across all timeframes (1H chart, 15M chart, 1M chart).

Eg - the 1H chart could be in a downtrend, but the 15M chart is showing signs of a bullish uptrend

Eg - the 1H chart could be in a downtrend, but the 15M chart is showing signs of a bullish uptrend

Swing Highs & Lows

Swing High

Defined as when price makes a clear high, but is flanked by two consecutive lower high candles

Swing Low

Defined as when price makes a clear low, but is flanked by two consecutive higher low candles

Swing High

Defined as when price makes a clear high, but is flanked by two consecutive lower high candles

Swing Low

Defined as when price makes a clear low, but is flanked by two consecutive higher low candles

Up Trends

Where each peak and trough is successively higher than the previous occurences;

Essentially, when higher swing lows and higher swing highs are successively occurring, the trend is considered intact; that is until this structure or continued formation is broken

Where each peak and trough is successively higher than the previous occurences;

Essentially, when higher swing lows and higher swing highs are successively occurring, the trend is considered intact; that is until this structure or continued formation is broken

Down Trends

Where each peak and trough is successively lower than the previous occurences;

Essentially, lower swing lows and lower swing highs that are successively occuring, where the trend is considered intact until this structure or continued formation is broken

Where each peak and trough is successively lower than the previous occurences;

Essentially, lower swing lows and lower swing highs that are successively occuring, where the trend is considered intact until this structure or continued formation is broken

Bullish Reversals:

Where a downtrend has occurred, but after a rally in price, recent market structure is retested, whereby we experience:

Where a downtrend has occurred, but after a rally in price, recent market structure is retested, whereby we experience:

1) A successful test of support;

2) The most recent swing high market structure from said impulse move must also be broken, with price continuing in the new trend direction to confirm that the trend has in fact changed / reversed.

2) The most recent swing high market structure from said impulse move must also be broken, with price continuing in the new trend direction to confirm that the trend has in fact changed / reversed.

Bearish Reversals:

Where a uptrend has occured, where recent market structure is then retested, which we then experience:

Where a uptrend has occured, where recent market structure is then retested, which we then experience:

1) A failed test of resistance;

2) The most recent swing low market structure must also be broken, with price continuing in the new trend direction to confirm that the trend has in fact changed / reversed.

2) The most recent swing low market structure must also be broken, with price continuing in the new trend direction to confirm that the trend has in fact changed / reversed.

Building a Narrative

How do you build a trading narrative to plan your trade?

Use the information provided so far in this thread where we've briefly explored market structure, swing highs and lows, and bullish and bearish reversals.

How do you build a trading narrative to plan your trade?

Use the information provided so far in this thread where we've briefly explored market structure, swing highs and lows, and bullish and bearish reversals.

We use this information to then identify a target / exit to trade to, where we can then identify a reasonable trade entry, determine a suitable stop loss, and then work out our position sizing and risk to take.

Let's explore the below:

Targets / Trade Exit

Entry & SL Placement

Let's explore the below:

Targets / Trade Exit

Entry & SL Placement

Target Identification

Identifying your target is key to building your trade narrative

You need a realistic goal that the market is likely to reach for and respect, rather than an arbitrary 2R or 3R

Identifying your target is key to building your trade narrative

You need a realistic goal that the market is likely to reach for and respect, rather than an arbitrary 2R or 3R

Taking a look at the previous and below examples:

We can see that after a bullish reversal is confirmed, then it makes sense to target just below some recent key resistance levels as a target for price to reach to (if you felt that you wanted to enter a long position).

We can see that after a bullish reversal is confirmed, then it makes sense to target just below some recent key resistance levels as a target for price to reach to (if you felt that you wanted to enter a long position).

Position Entry & SL Placement

Once we have defined where price could look to be heading, based on price action and market structure movements, we can then determine how we want to enter the trade and manage our risk

Once we have defined where price could look to be heading, based on price action and market structure movements, we can then determine how we want to enter the trade and manage our risk

In the example below, we've entered a trade once a bullish trend reversal is confirmed, with a SL placed below support that has just been tested. Please note that the placement of our SL is based on market structure, and again, not an arbitrary location similar to our targets.

Bearish Example:

In the snapshot below, we've entered a more riskier trade just before a trend reversal is confirmed, with a SL placed just above the recent swing high

Our target is some recent resistance which would give us just over a 2.34R if we were successful in this trade

In the snapshot below, we've entered a more riskier trade just before a trend reversal is confirmed, with a SL placed just above the recent swing high

Our target is some recent resistance which would give us just over a 2.34R if we were successful in this trade

This concludes the guide on Market Structure & Building a Trading Narrative

Hopefully you've been able to pick up some ideas and understanding of how price can trend upward or downward, how it can reverse, and what the market structure of these movements looks like

Hopefully you've been able to pick up some ideas and understanding of how price can trend upward or downward, how it can reverse, and what the market structure of these movements looks like

You should now have a fair idea of how to build upon a trading narrative in order to reasonably determine your targets based on some market structure and price action

These targets as we've covered are not arbitrary 2R or 3R targets, but have some reasonable substance

These targets as we've covered are not arbitrary 2R or 3R targets, but have some reasonable substance

You should also now have an idea on where to place a Stop Loss when trading that is based upon market structure, that when invalidated, is a reasonable area to be stopped out at. This is opposed to a random Stop Loss placment

And lastly, thank you for taking the time to go through this quick thread that has hopefully given you some further insight, or if not, hopefully you can pass it on to someone who may be able to find some use from it.

Cheers - Mindset_BTC

Cheers - Mindset_BTC

• • •

Missing some Tweet in this thread? You can try to

force a refresh