Michael Mauboussin:

“Companies generating high economic returns will attract competitors willing to take a lesser, albeit still attractive return, which will drive aggregate industry returns to opportunity cost of capital.”

Bob Marley:

"No moat, you cry."

“Companies generating high economic returns will attract competitors willing to take a lesser, albeit still attractive return, which will drive aggregate industry returns to opportunity cost of capital.”

Bob Marley:

"No moat, you cry."

https://twitter.com/ubermepizza/status/1419194477210636288

2/ A story about identifying moats.

X asked Mozart how to write a symphony.

Mozart: "You are too young to write a symphony.”

X: "You were writing symphonies when you were 10 years of age, and I am 21.”

Mozart: "Yes, but I didn’t run around asking people how to do it.”

X asked Mozart how to write a symphony.

Mozart: "You are too young to write a symphony.”

X: "You were writing symphonies when you were 10 years of age, and I am 21.”

Mozart: "Yes, but I didn’t run around asking people how to do it.”

3/ Everyone has the idea of owning great companies. The problem: they have high prices in relation to free cash flow.

"That takes all of the fun out of the game. If all you needed to do is to figure out what company is better than others, everyone would make a lot of money."

"That takes all of the fun out of the game. If all you needed to do is to figure out what company is better than others, everyone would make a lot of money."

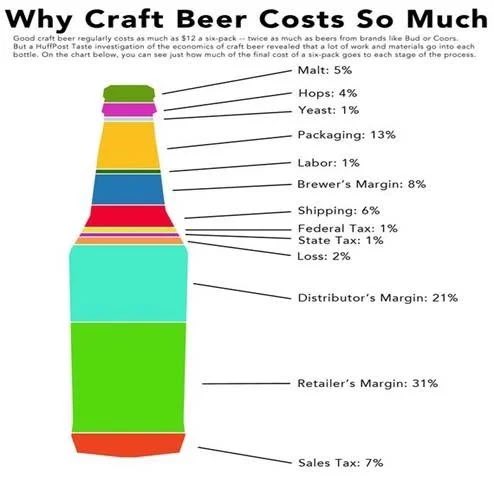

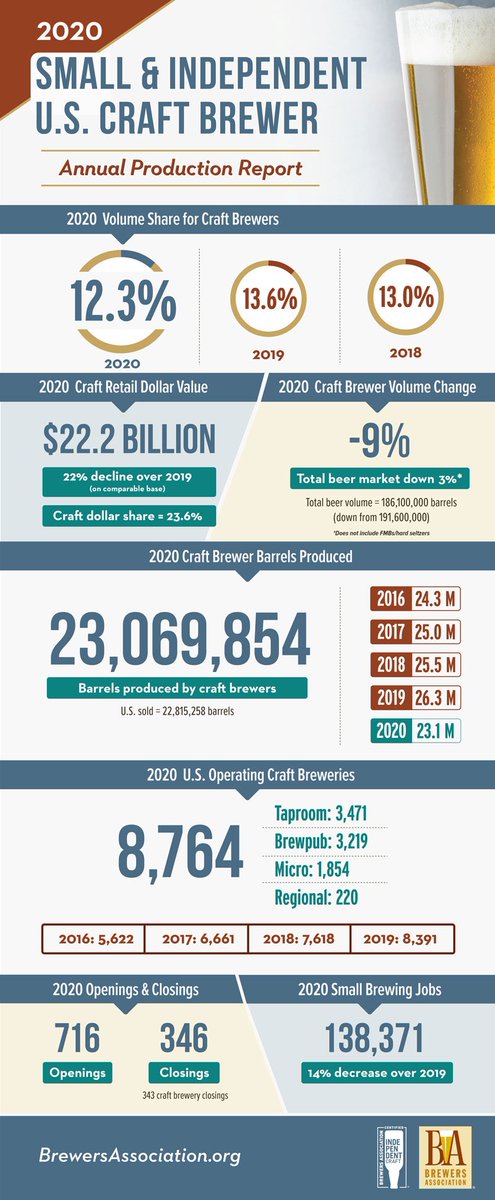

4/ Are barriers to entry in craft brewing and distilling high or low? What do their margins look like? Do craft breweries and distillers have pricing power? 25iq.com/2017/02/04/gro…

5/ Do businesses that people just love as a profession tend to exhibit oversupply? What does that do to pricing power?

"Seattle is home to nearly 70 breweries — a staggering number, greater than several states can boast."

Bodhizafa IPA is popular.

nytimes.com/2021/07/21/tra…

"Seattle is home to nearly 70 breweries — a staggering number, greater than several states can boast."

Bodhizafa IPA is popular.

nytimes.com/2021/07/21/tra…

6/ "The number of operating craft breweries in the US continued to climb in 2020, reaching an all-time high of 8,764, including 1,854 microbreweries, 3,219 brewpubs, 3,471 taproom breweries, and 220 regional craft breweries."

• • •

Missing some Tweet in this thread? You can try to

force a refresh