Rolex Rings - Everything you need to know!

A Thread 🧵👇 (Long-form Article and PDF format link also given at the end)

Do hit the retweet and help us educate more investors :)

#IPOwithJST

A Thread 🧵👇 (Long-form Article and PDF format link also given at the end)

Do hit the retweet and help us educate more investors :)

#IPOwithJST

1/

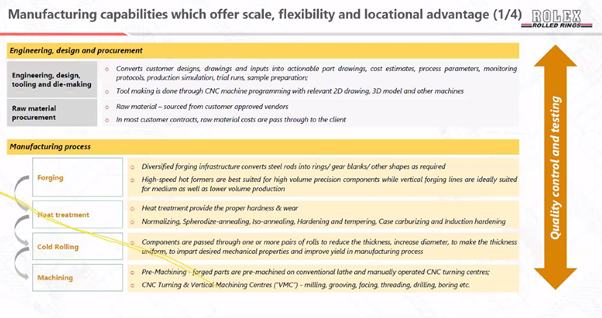

About Rolex Rings -

- Top 5 Indian forging companies

- Manufacturer and global supplier of hot rolled - forged and machined bearing rings, and automotive components for segments of vehicles - PV, CV, Off-road highway vehicles, 2W and EV

About Rolex Rings -

- Top 5 Indian forging companies

- Manufacturer and global supplier of hot rolled - forged and machined bearing rings, and automotive components for segments of vehicles - PV, CV, Off-road highway vehicles, 2W and EV

2/

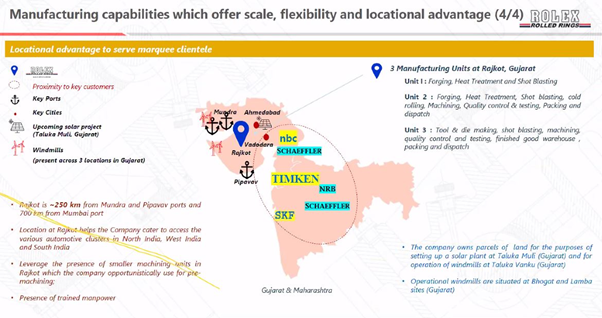

Renewable - 8.75MW wind capacity and 1.58MW of solar capacity, solar capacity to be ramped up to 12MW

Location advantage - Plants located at Rajkot which is ~250km from Mundra and Pipavav ports and 700km from Mumbai port. Also helps to get cheap labor for plants

Renewable - 8.75MW wind capacity and 1.58MW of solar capacity, solar capacity to be ramped up to 12MW

Location advantage - Plants located at Rajkot which is ~250km from Mundra and Pipavav ports and 700km from Mumbai port. Also helps to get cheap labor for plants

3/

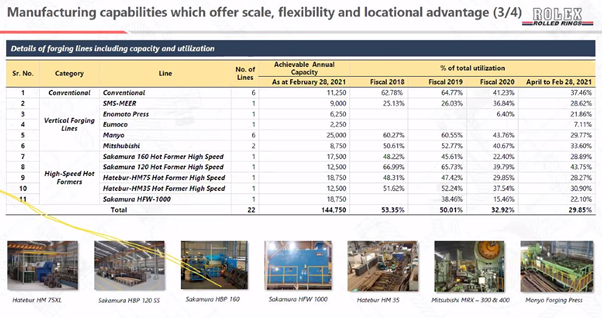

Capex - No major CAPEX till FY25 as major Capex done

Increasing forging utilization to 60% and machining capacity to 85%

Till FY25, they expect to grow 10-12% YoY

Capex - No major CAPEX till FY25 as major Capex done

Increasing forging utilization to 60% and machining capacity to 85%

Till FY25, they expect to grow 10-12% YoY

6/

Diversified Revenue Base

Management

Selling Shareholder (Reducing holding from 27.1% to 8.3% post issue)

Some Numbers

Diversified Revenue Base

Management

Selling Shareholder (Reducing holding from 27.1% to 8.3% post issue)

Some Numbers

7/

Risks -

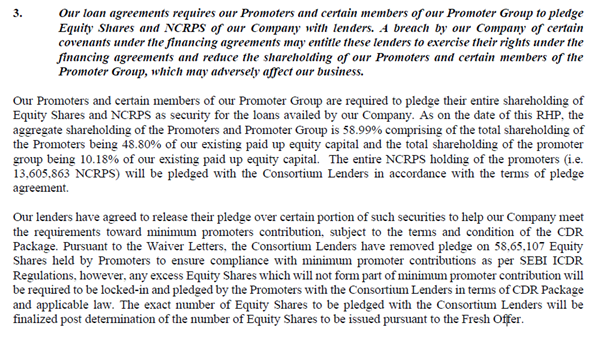

- Company is a part of Corporate debt restructuring plan as they defaulted on a loan that concerned a 487 cr borrowing (March 2022 they would exit CDR)

- Pledge on Equity shares and NCRPS

Risks -

- Company is a part of Corporate debt restructuring plan as they defaulted on a loan that concerned a 487 cr borrowing (March 2022 they would exit CDR)

- Pledge on Equity shares and NCRPS

8/

- Repayment delays on some borrowings for certain periods including up to Fiscal 2019 (they may be restricted in taking some actions including buy-back)

- Fy18 and FY19 delayed repayment of 103 cr and 37 Cr (the delay was less than 110 and 62 days respectively)

- Repayment delays on some borrowings for certain periods including up to Fiscal 2019 (they may be restricted in taking some actions including buy-back)

- Fy18 and FY19 delayed repayment of 103 cr and 37 Cr (the delay was less than 110 and 62 days respectively)

9/

Financials -

B/S - Debt to Equity reduced

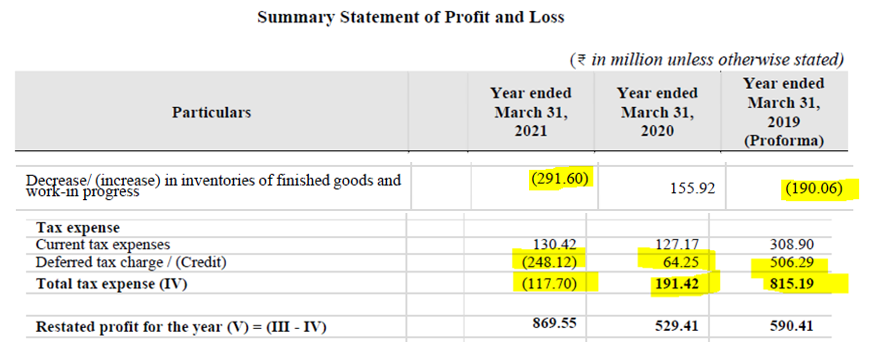

P&L - 2-year CAGR - Revenue is -17.5% and EBITDA is -26.7% (Forging industry had something similar) + the net profit growth looks optical due to tax credit and inventory

Financials -

B/S - Debt to Equity reduced

P&L - 2-year CAGR - Revenue is -17.5% and EBITDA is -26.7% (Forging industry had something similar) + the net profit growth looks optical due to tax credit and inventory

10/

Cash Flows - CFO and FCF reducing. The firm is not raising much of a fresh issue (IPO to give an exit on a big part of the PE holding)

Cash Flows - CFO and FCF reducing. The firm is not raising much of a fresh issue (IPO to give an exit on a big part of the PE holding)

11/

Conclusion

At the upper band of Rs 900, the issue is priced at 25x P/E and 6x P/BV. The price to sales is at 5.93x. The valuations are stretched given the many ancillaries available at 1x P/S or below

Article link - (PDF format inside)

jstinvestments.com/rolex-rings-ip…

Good day!

Conclusion

At the upper band of Rs 900, the issue is priced at 25x P/E and 6x P/BV. The price to sales is at 5.93x. The valuations are stretched given the many ancillaries available at 1x P/S or below

Article link - (PDF format inside)

jstinvestments.com/rolex-rings-ip…

Good day!

Minor Change - Mcap post listing 2449 Cr and P/S is 4x. everything else same.

• • •

Missing some Tweet in this thread? You can try to

force a refresh