Results of our stockS

GPIL ( bumper )

RamcoIND ( good)

Granules (average/stable)

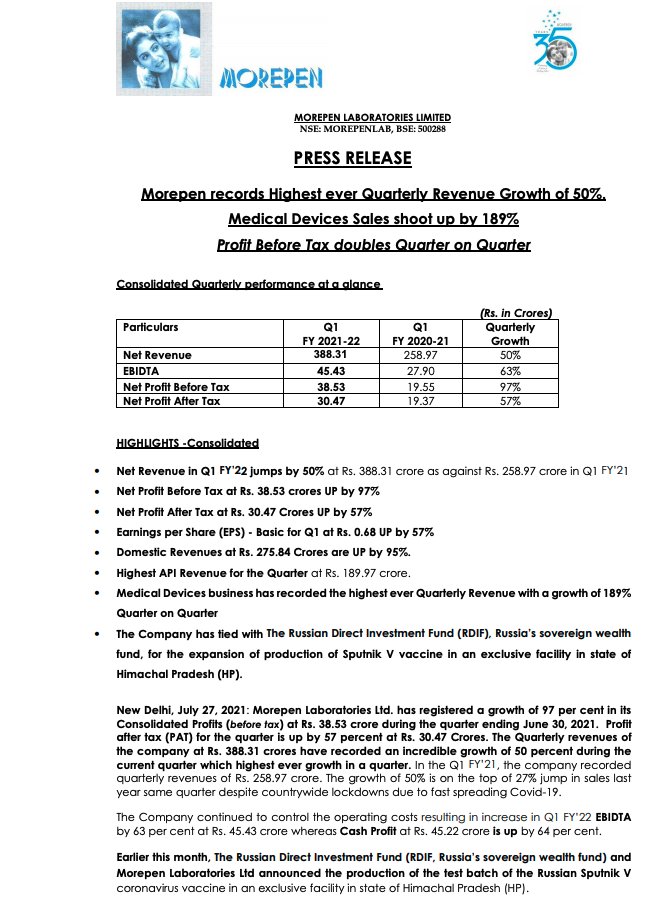

Morepen ( strong )

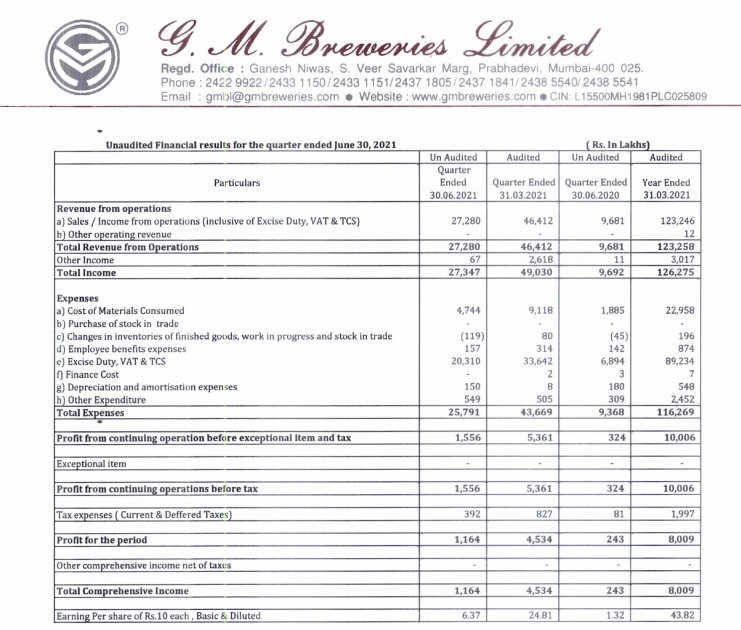

GM Breweries ( good )

MirzaInt ( waiting for results)'ll add in thread

GPIL Bumper QoQ YoY both

Hope circuit will continue charts and levels r given on my timeline

GPIL ( bumper )

RamcoIND ( good)

Granules (average/stable)

Morepen ( strong )

GM Breweries ( good )

MirzaInt ( waiting for results)'ll add in thread

GPIL Bumper QoQ YoY both

Hope circuit will continue charts and levels r given on my timeline

Morepen good results

Revenue up 50% YoY

Company set to start commercial production of SPUTNIK V In 4-6weeks

Revenue up 50% YoY

Company set to start commercial production of SPUTNIK V In 4-6weeks

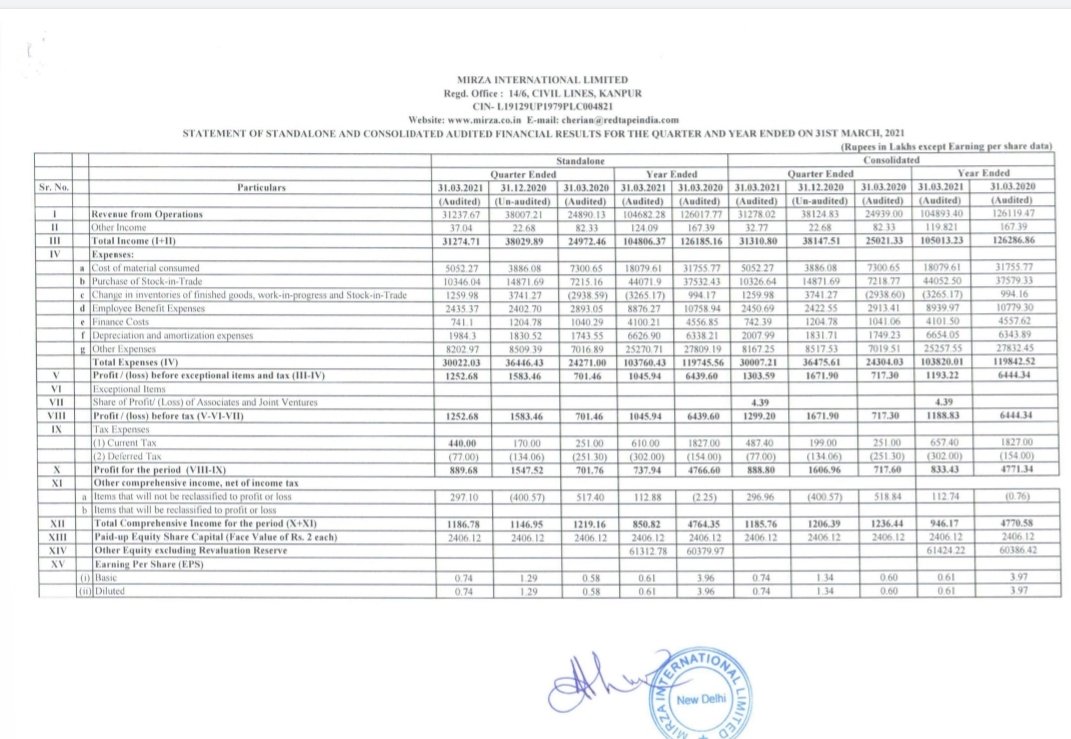

MirzaInt

QoQ rev , PAT , PBT down due to Covid

YoY rev , PAT , PBT up ✌️

EPS is up in both QoQ n YoY

Overall result is good let's see how market react.

QoQ rev , PAT , PBT down due to Covid

YoY rev , PAT , PBT up ✌️

EPS is up in both QoQ n YoY

Overall result is good let's see how market react.

• • •

Missing some Tweet in this thread? You can try to

force a refresh