The great thing with investing is letting your research take you to interesting and new areas. I've been looking at fish stocks (pun intended) for longer than any sane person probably should.🤪

Here's a primer on the #ASX aquaculture sub-sub-sub-industry. 👇

Here's a primer on the #ASX aquaculture sub-sub-sub-industry. 👇

Aquaculture is farmed fish or seafood. It's been around for millennia (for the history buffs, check the link below).

Interestingly agriculture went through green and blue revolutions post 1970s, and aquaculture arguably is going through that now.

alimentarium.org/en/knowledge/h…

Interestingly agriculture went through green and blue revolutions post 1970s, and aquaculture arguably is going through that now.

alimentarium.org/en/knowledge/h…

The Australian fisheries as a sector isn't really expected to grow much at all according to ABARES ...

.. but what can get missed in this is the displacement of wild caught / unsustainable fishing practices with intensive fish farming and aquaculture. 🎣

If we look at intensive poultry farming, you notice pretty quickly that the farms are near urban centres. Essentially, the cost of transporting feed is less than that of transporting birds.

So what?

So what?

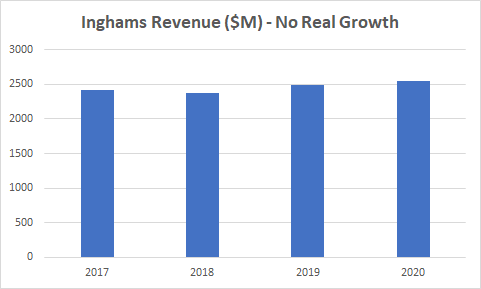

Well for companies like Inghams $ING $ING.AX they operate in a mature market where volume growth approximates population growth.

Essentially, they can't easily find export markets, they need to look at value adding / processing or new verticals (turkey, feeds, etc).

Essentially, they can't easily find export markets, they need to look at value adding / processing or new verticals (turkey, feeds, etc).

Aquaculture is different. Fish farms are located where the growing conditions are best, and then the fish are transported to where the consumers are.

You can see from Rabobanks clear map below the international trade flows of aquaculture produce.

You can see from Rabobanks clear map below the international trade flows of aquaculture produce.

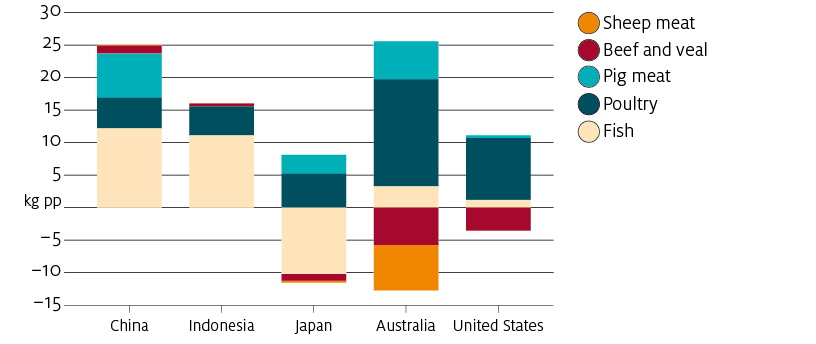

Demand for fish varies based on cultural and consumer habits. As many would expect, consumption per capita and on a total volume basis is substantially more in Asia.

As wealth and population continues to grow in Asia, this will drive even more demand. Similarly, we are seeing shifting preferences towards fish in places likes Aus, US, Europe, and elsewhere.

So we should see:

🐟Growing demand for fish consumption

🐟Aquaculture replacing wild caught fish

🐟Increased export demand

🐟Growing demand for fish consumption

🐟Aquaculture replacing wild caught fish

🐟Increased export demand

The total market cap of aquaculture on the ASX is $1.7bn. There's not a single company in the ASX200 (Tassal fell out earlier this year), and only 5 companies have an MC greater than $100m.

When you look at the revenue though, you see not all fish are created equally.

In fact, Murray Cod Australia with 12% of the market cap has only 1% of the revenue. That's a lot of growth baked in. 🐡

In fact, Murray Cod Australia with 12% of the market cap has only 1% of the revenue. That's a lot of growth baked in. 🐡

But the real kicker is looking at operating EBITDA.

Clearly Tassal stands out, and Huon is doing it's bit. But what happened to Murray Cod or Seafarms (that's minus 7%, come on $MSFT you've had years to work out negative pie chart in excel).

Clearly Tassal stands out, and Huon is doing it's bit. But what happened to Murray Cod or Seafarms (that's minus 7%, come on $MSFT you've had years to work out negative pie chart in excel).

With Covid impacting on the markets, you may think the above is an unfair characterisation. Well, let's look at PEAK EBITDA (the best result any company has ever achieved).

Tassal is still FY20, and FY21 will be more; Seafarms -7% was the best result (negative people!)

Tassal is still FY20, and FY21 will be more; Seafarms -7% was the best result (negative people!)

Tassal will be reporting on 18 August 2021, so we can come back to that then. For those interested in why I'm long $TGR, you can see the link below.

https://twitter.com/DownunderValue/status/1408223745861251086

Huon is also a salmon producer, but has higher cost of production than TGR with greater export exposure. They've got great assets, and there is a potential asset play /takeover bid.

But with forecast FY21 EV/EBITDA=40, I find these assets a bit rich. I'll leave it for Twiggy

But with forecast FY21 EV/EBITDA=40, I find these assets a bit rich. I'll leave it for Twiggy

Murray Cod Australia $MCA $MCA.AX has a market cap now of $200m, but in May '21 it was $300m with $4m of sales.

Production actually declined in FY21 vs FY20; margins are low as people only pay $20/kg for cod vs salmon ($25), prawns ($30), etc. Nice packaging though.

Production actually declined in FY21 vs FY20; margins are low as people only pay $20/kg for cod vs salmon ($25), prawns ($30), etc. Nice packaging though.

NZ King Salmon $NZK $NZK.AX has premium sockeye salmon for restaurants, half in US and half in NZ. It's good! 👍

But, "troubling" times for NZK again in FY21 due to poor growing season, while revenue has flatlined/declined for 4-5yrs. Covid didn't help with -40% revs.

But, "troubling" times for NZK again in FY21 due to poor growing season, while revenue has flatlined/declined for 4-5yrs. Covid didn't help with -40% revs.

Seafarms $SFG $SFG.AX is a prawn farming entity based in the top-end - you may have heard of "Project Sea Dragon" with billion dollar price tags, politicians kissing baby prawns (fingerlings), and promises that in 8 simple stages it'll be producing 180,000tonnes!

Meanwhile in the real world, if they meet their target of 900t they will have added +300t or 50% since 2014 and really remain quite far away from their 6,000t target which has no defined date.

Yet their marketing continues to reference 180,000t visions. 🤷

Yet their marketing continues to reference 180,000t visions. 🤷

Further, the cost of production exceeds their revenue, so they have negative operating EBITDA and have so for years. There's no clear pathway for profitability, only more capital raises.

P.S. TGR will expand to 4000t prawns this year, with $4-6/kg operating EBITDA. 🎯

P.S. TGR will expand to 4000t prawns this year, with $4-6/kg operating EBITDA. 🎯

Clean Seas Tuna $CSS $CSS.AX produces yellowfin tuna (lighter grade than bluefin, less flavoursome but still used in sushi).

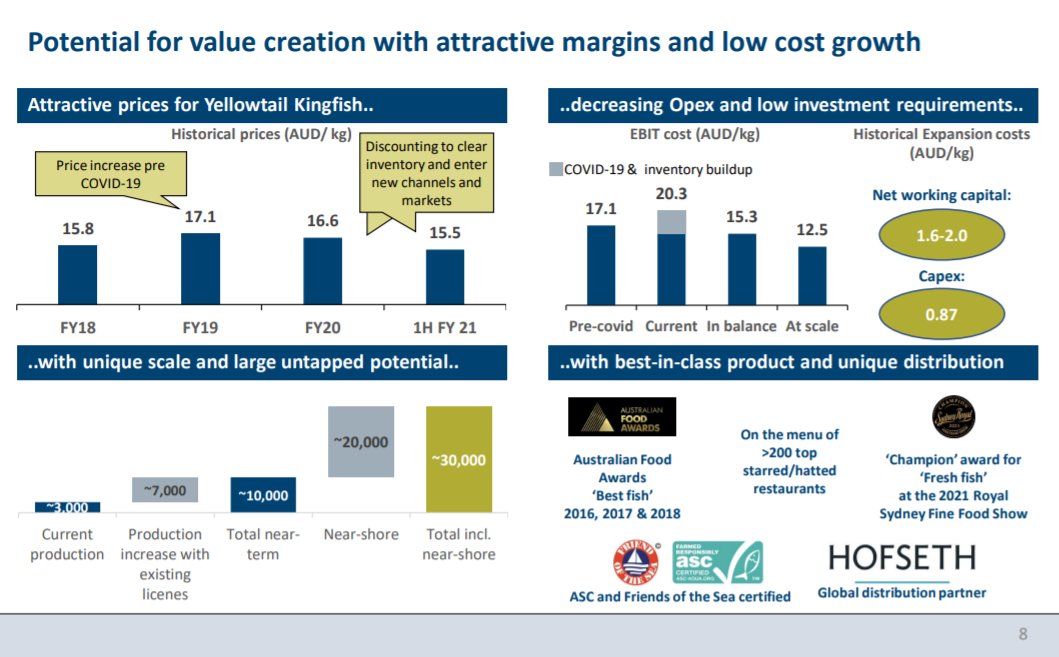

They produce 3k tonnes, and have plans in the short term for 10kt and in the long term 30kt. Operationally, this may be possible.

They produce 3k tonnes, and have plans in the short term for 10kt and in the long term 30kt. Operationally, this may be possible.

Covid really squeezed them at a bad time. But if things normalise and they hit 10kt scale, they can earn $35m operating EBITDA and $10m EBIT on $66m EV.

Hmm, we may need a deep dive here! 🤔

Hmm, we may need a deep dive here! 🤔

Ocean Grown Abalone $OGA has cash in the bank, is producing 80t with plans for 600t in nearish future, is at bottom-cycle abalone prices while not burning much cash, and trades at EV/EBITDA of 5.4.

If anyone knows about future trends in global abalone prices, let's talk! 🤫

If anyone knows about future trends in global abalone prices, let's talk! 🤫

If you enjoyed this, bash the like / retweet / follow buttons.

A deep dive per week is my commitment to FinTwit.

Questions and feedback always welcome. DYOR.

Disclaimer, I'm long TGR.

A deep dive per week is my commitment to FinTwit.

Questions and feedback always welcome. DYOR.

Disclaimer, I'm long TGR.

• • •

Missing some Tweet in this thread? You can try to

force a refresh