The third edition of our flagship CIT publication, Corporate Tax Statistics, is out today – huge congratulations to the team who put this together. Some highlights in a thread: 1/

https://twitter.com/OECDtax/status/1420674290408697856

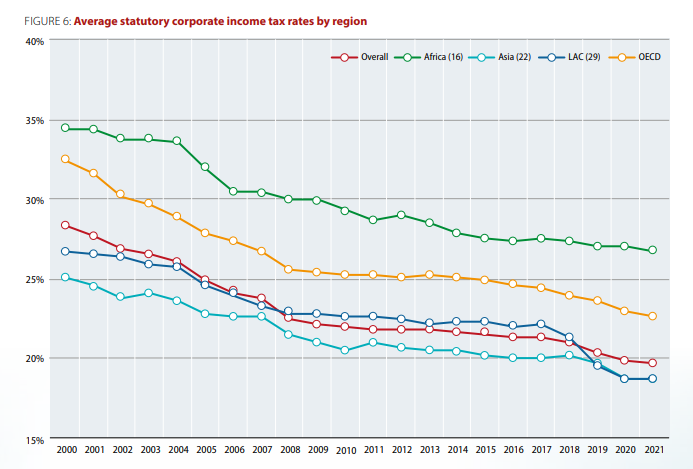

First, the decline in statutory CIT rates continues, albeit at a slightly more modest pace last year. It's particularly acute when considering zero-tax jurisdictions.

Side note: for more on why this is, see this talk () by @desaimihira as well as this @CESifoGroup paper by my colleague Felix Hugger & others (papers.ssrn.com/sol3/papers.cf…). Tl; dr the answer seems to be both higher profits and also broader tax bases.

@desaimihira @CESifoGroup Next, we also have new data on marginal effective tax rates – taking the statutory rate but also tax bases into account. Here we can see that on a breakeven investment, effective tax rates are essentially zero – normal returns are often untaxed – for the bottom quartile.

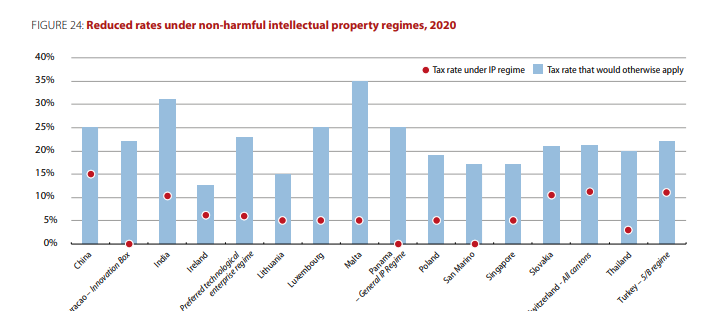

@desaimihira @CESifoGroup This year we also have new indicators showing the impact of R&D tax credits on effective tax rates – in about half of the countries covered, the cost of capital is below zero once R&D credits are accounted for – governments are essentially subsidising R&D using the tax system.

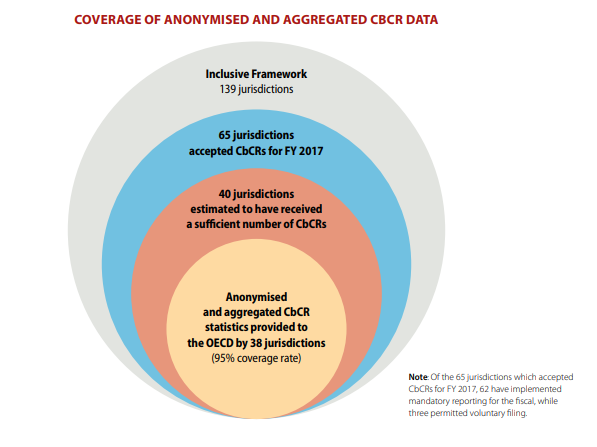

@desaimihira @CESifoGroup Finally - it merits a separate thread but we have substantially expanded the coverage of our #CbCR statistics, which now cover about 95% of all CbCRs exchanged.

This expansion to new countries is not always easy but every country is a little victory for tax transparency and is a big legacy of the BEPS project that continues to pay dividends. Much credit due to @ali_giulia for getting so many new countries on board this year.

Much credit also to all my colleagues for putting this publication together, @demipreaux, @THanappi, @AnaCintaCabral, @DBradbury1021, @hazelhealy, and many others who are not on twitter.

@demipreaux @THanappi @AnaCintaCabral @DBradbury1021 @hazelhealy Lastly a really nice dataviz of the CBCRs has been put together by @taxobservatory @ali_giulia and is well worth a look:

https://twitter.com/taxobservatory/status/1420671704603430914

• • •

Missing some Tweet in this thread? You can try to

force a refresh