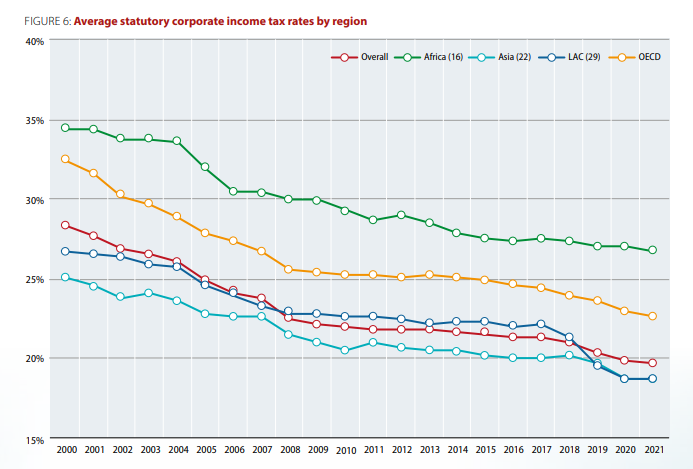

A few words on the new data and the international tax reforms. First, the decline in corporate tax rates has been pronounced.

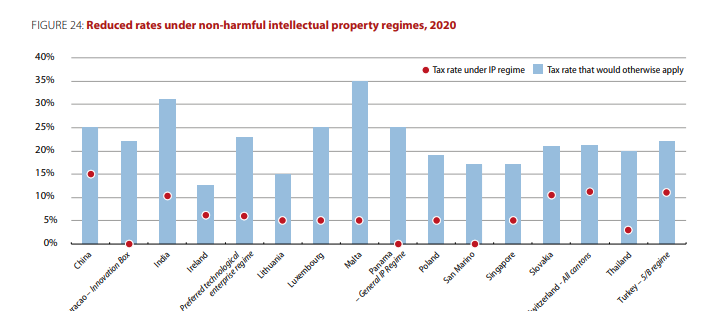

Second, our new data on also show that the decline in CIT isn't just about statutory rates. It is also about tax expenditures that countries use to attract mobile assets & activity such as intangibles through IP regimes – our data shows just how low these special rates can be.

Third, our CbCR data show continuing BEPS activity (albeit with a significant data lag – its 2017 data). We can see more profits and more related party revenues in investment hubs (which are often but not always low-taxed) than we can in other jurisdictions, as well as

less tangible assets & sales. In other words, there is still misalignment between profit and substantial economic activities. Pillar 2 of the recently-agreed deal puts multilaterally agreed limits on tax competition and these data show why that is necessary to protect tax bases.

Lastly, distortions to the tax system are not just about lost revenues, but they have real economic consequences too. The CBCR data show that the kinds of activities MNEs carry out in different jurisdictions differs a lot, mainly holding shares in investment hubs while

high & middle income countries have more sales & manufacturing. Tax distortions don’t just impact global profits but also global activity. A less distortive tax system can lead to a better allocation of activity & capital, which can in turn support productivity, & in turn growth.

• • •

Missing some Tweet in this thread? You can try to

force a refresh