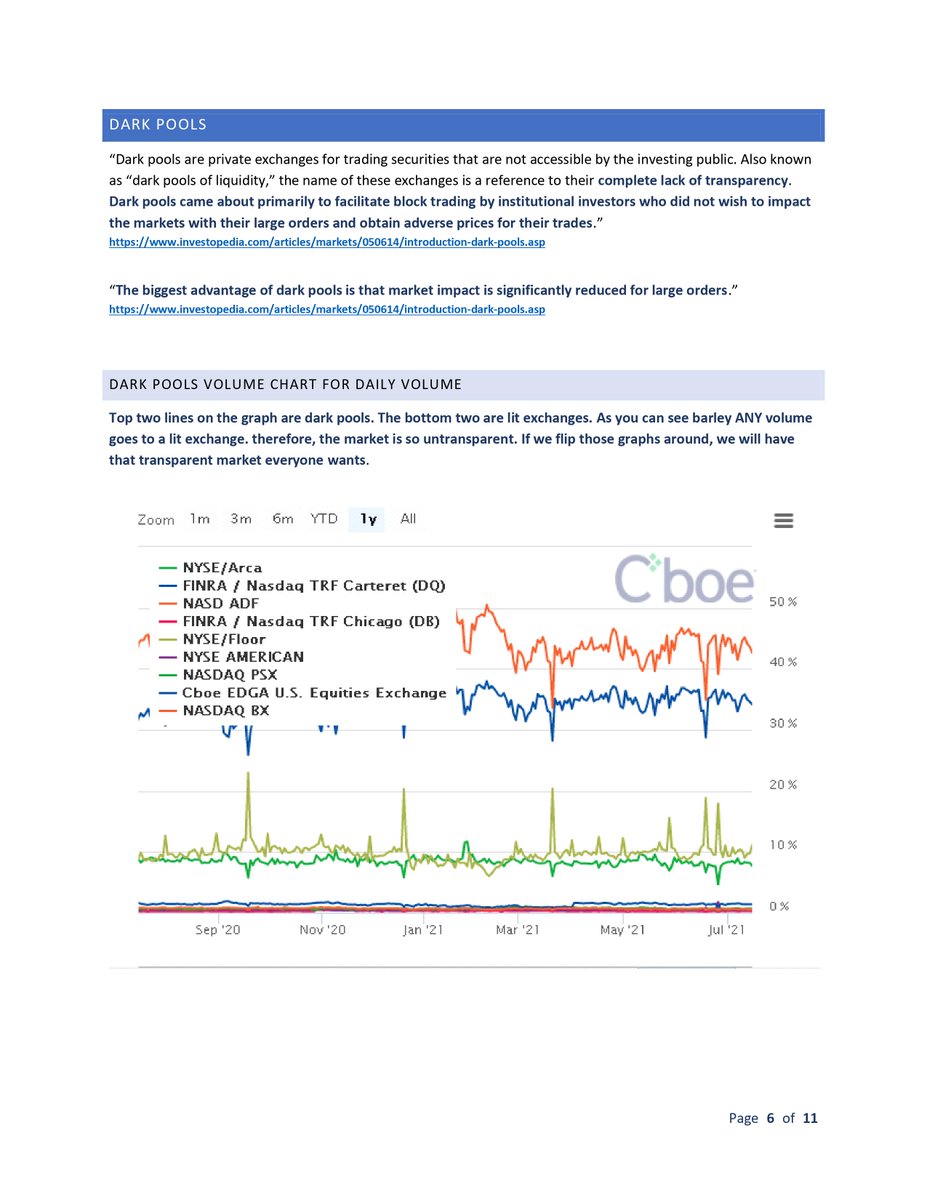

my take away from the meeting with @dlauer. @dlauer Thank you for your time yesterday i learned a lot. You also confirmed most of my theory. We disagree on the block volume but the rest we agree on. Take away from the meeting. OTC market is becoming a major issue in the us(1)

When retail orders from a payment for order flow type platform. It becomes an otc trade. This is done off exchanges(internalization or darkpools). Payment for order flow allows the Market maker to become the middle man to execute your trades. They pay the platform a "kickback"

With advancement in technology and Dark fibers. The mm is able to see Data milliseconds before it becomes public to other venues. They are able to use things like electronic front running as well as other forms of manipulation to profit multiple times off a single trade.

this also destroys the bid/ask spread because competition for your order is non existent. The mm Gets priority or can fill the order internally. MM also write around 30% if not higher now of options chains. This also tells me they see the data and can bet against our options

bets so they can collect the premiums. This is how they are able to avoid margin calls. They are gaining liquidity multiple times off trades and writing options. By skipping payment for order flow platforms. And DIRECTING your order to a lit exchange. Making the lit exchange

the middleman. This takes it out of the hands of the market maker. This takes away their ability to front run. This also would open up competition for your orders. Making a better bid to ask spread. option contracts are a huge source of liquidity for the mm. We now know the mm

writes 30-40% of the contracts and collects the premiums attached are the itm otm options for #amc $amc. by not doing crazy options or leaving options to people who are very experienced in them. This would take alot of liquidity away from the market makers.

So Everything i have been saying for the couple months are accurate. Payment for order flow allows mm to control the market. options are killing us. shares dont expire. pfof kills bid/ask spread and sends trades OTC to dark pools. LIT EXCHANGES DONT USE DPs.

@ThatGuyAstro @Xx_WiReD_xX @TradesTrey @matt_kohrs @dlauer @JBStocks_ @MerkTrades @TaraBull808 @RogueTheLegacy @masked_investor @Mangler_MMA @RandallCornett @Charlie1337420 @cvpayne @Katniss_Amc

almost forgot a very very special kitten @CringleKitten

• • •

Missing some Tweet in this thread? You can try to

force a refresh