The year: 1847.

A middle-aged man was stressed and restless in a hall of his house.

In another room, his wife was about to give birth.

This was his 7th child. The 6 children before had all died.

A healthy little boy was born.

(Thread)

A middle-aged man was stressed and restless in a hall of his house.

In another room, his wife was about to give birth.

This was his 7th child. The 6 children before had all died.

A healthy little boy was born.

(Thread)

The family was not extravagantly rich but was well to do.

The boy grew up with his siblings (those born after him) who were well regarded by the neighbors.

They thought the siblings were all level-headed.

The boy grew up with his siblings (those born after him) who were well regarded by the neighbors.

They thought the siblings were all level-headed.

Except for the one boy we’re talking about - he was endlessly energetic and restless.

They once found him sitting on duck eggs - trying to hatch them (he was unsuccessful).

They once found him sitting on duck eggs - trying to hatch them (he was unsuccessful).

In school, he asked more questions than he answered. The teachers complained about this habit to his mother.

Frustrated at the school’s inability to satisfy the little boy’s curiosity, the mother withdrew him from school and started teaching him at home.

Frustrated at the school’s inability to satisfy the little boy’s curiosity, the mother withdrew him from school and started teaching him at home.

She encouraged him to read and write. And reading, he did a lot of.

Eternally curious, he wanted to see more of the world.

At the age of 12, he left home to find a job. He got a job on a train selling candy and newspapers.

Eternally curious, he wanted to see more of the world.

At the age of 12, he left home to find a job. He got a job on a train selling candy and newspapers.

He also made a printing press.

Soon, he went from selling newspapers to printing his own newspaper - on a train! It was a short newspaper but was well-received.

Soon, he went from selling newspapers to printing his own newspaper - on a train! It was a short newspaper but was well-received.

Four years after he joined the train, a random jerk caused some of his chemical jars to shatter. There was a small fire. It grew to become a big fire engulfing the entire coach.

He was fired.

He was fired.

As was always the case, this didn’t affect his morale much. He found himself a job as a traveling telegrapher.

Also, the young boy continued to experiment and make things.

He was inventing several contraptions but none were of any use.

Also, the young boy continued to experiment and make things.

He was inventing several contraptions but none were of any use.

In 1869, he invented the universal stock ticker - his first big hit.

A year later, he was able to sell it and take home a handsome income.

He bought a house. And attached to the house, he built a large lab - his dream lab.

A year later, he was able to sell it and take home a handsome income.

He bought a house. And attached to the house, he built a large lab - his dream lab.

He put in the best equipment. He hired the best minds. And then he got to work.

He wanted to set up a lab that continually invented new things.

Over the next few years, that is exactly what the lab did. Small but useful inventions kept pouring out of his lab.

He wanted to set up a lab that continually invented new things.

Over the next few years, that is exactly what the lab did. Small but useful inventions kept pouring out of his lab.

In 1877 though, things changed.

After tinkering with his lab mates, he invented a device that would speak! A device that would record human voices and talk back.

The phonograph.

This changed everything.

After tinkering with his lab mates, he invented a device that would speak! A device that would record human voices and talk back.

The phonograph.

This changed everything.

He was called to the White House. Everyone in America was talking about him.

Singers, comedians, poets, and musicians started recording themselves. This was the birth of recorded sound.

Singers, comedians, poets, and musicians started recording themselves. This was the birth of recorded sound.

Before this, if you wanted to listen to music, you had to have the artist live in front of you.

If you were an investor and were betting on this man’s lab, you’d be a very happy person.

If you were an investor and were betting on this man’s lab, you’d be a very happy person.

He was doing well all this while. But now, suddenly, he’s done something so big, the world would never be the same again.

Would you sell your shares now?

Would you sell your shares now?

If the question is asked in exactly this manner, your answer would probably be, ‘no, I wouldn’t sell’.

Why wouldn’t you sell?

Because this lab seems to have potential.

Why wouldn’t you sell?

Because this lab seems to have potential.

Right? It seems like this lab will produce more hits in the future.

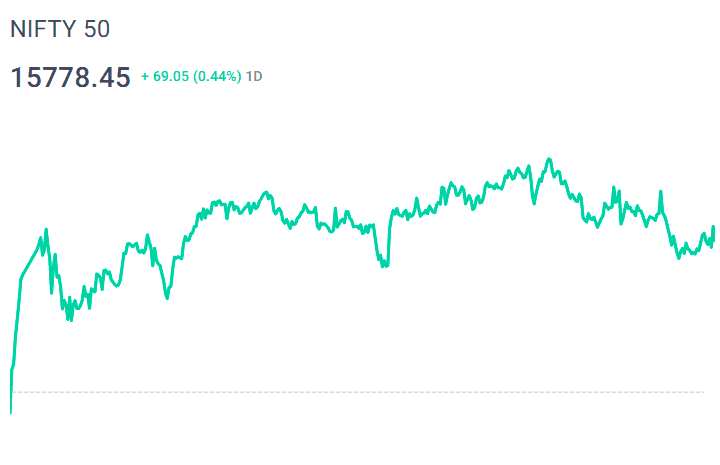

But countless investors sell their stocks the moment they see some upside.

A stock doubled its value in 1 year’s time. Would you sell? Or would you want to hold on?

But countless investors sell their stocks the moment they see some upside.

A stock doubled its value in 1 year’s time. Would you sell? Or would you want to hold on?

The logical answer seems to be ‘hold’.

But in reality, more investors sell after seeing some gains than holding on to a winner.

This man and his lab, just 2 years after inventing the phonograph, invented another world-changing invention.

But in reality, more investors sell after seeing some gains than holding on to a winner.

This man and his lab, just 2 years after inventing the phonograph, invented another world-changing invention.

In fact, this invention was so massive, the habits of the world changed. The human sleep cycle changed.

The invention: the light bulb.

And, he didn’t stop there.

The invention: the light bulb.

And, he didn’t stop there.

Another of his world-changing inventions was motion pictures. Before that, pictures were just pictures - still. He invented video.

He worked on batteries. He worked on countless inventions. He has 1093 patents to his name.

He worked on batteries. He worked on countless inventions. He has 1093 patents to his name.

So why do people sell a winner much before the winner has won several games?

Because they imagine a different game.

Horse racing.

Because they imagine a different game.

Horse racing.

You’re supposed to bet on horses. There are 5 horses running. You can bet on 1.

You bet horse number 3. It wins.

Now, in the very next race, new horses are brought. These horses haven’t raced today.

You bet horse number 3. It wins.

Now, in the very next race, new horses are brought. These horses haven’t raced today.

And, with these fresh horses, the old winner (horse 3) is also brought in.

All other horses are rested and fresh. Only horse 3 is tired from the previous race.

Will you bet on horse 3 this time?

All other horses are rested and fresh. Only horse 3 is tired from the previous race.

Will you bet on horse 3 this time?

When investors see a stock rise, they tend to think of it as a horse that has run its race.

So in investing, every single time, the question to ask really is, what kind of a game is this?

So in investing, every single time, the question to ask really is, what kind of a game is this?

Is it a game where one round tires out your horse?

Or is it a game where past experience only helps with winning future games?

Or is it a game where past experience only helps with winning future games?

• • •

Missing some Tweet in this thread? You can try to

force a refresh