Balaji Amines conducted the concall today at 4:00 Pm

Here are the Conference call highlights

" Achieving growth prospects with Over-all Expansion."

Hit 'Retweet' to educate more investors ☎️🧵

Here are the Conference call highlights

" Achieving growth prospects with Over-all Expansion."

Hit 'Retweet' to educate more investors ☎️🧵

Outlook

- Company stands strong by not letting it's operations getting hampered by second wave of Covid-19.

- They gained advantage of having products under essential category.

- Their subsidiaries has also delivered strong results, which supported their volume levels.

- Company stands strong by not letting it's operations getting hampered by second wave of Covid-19.

- They gained advantage of having products under essential category.

- Their subsidiaries has also delivered strong results, which supported their volume levels.

- Balaji speciality chemicals Pvt Ltd, recorded capacity utilisation of 42% and expect it to reach 50-60% soon.

- This company is expecting to increase their export share by 25-30%

- The company has now the largest Ethylamines in India at 22,500 tons per annum.

- This company is expecting to increase their export share by 25-30%

- The company has now the largest Ethylamines in India at 22,500 tons per annum.

- They have a good supply book for its main raw material Methanol , Ammonia and denatured ethyl for meeting Demand.

- Company stands out to be the only company to develop indigenous technology to manufacture Amines.

- Company stands out to be the only company to develop indigenous technology to manufacture Amines.

- Company has major of its business linked to pharma and paint industry.

- They both bring 76% of the total revenue.

- They have strong client base for amines, amine derivatives and speciality & other chemicals.

- They both bring 76% of the total revenue.

- They have strong client base for amines, amine derivatives and speciality & other chemicals.

- Speciality products volumes saw a decline during this quarter as it's raw material prices have gone up aggressively.

- Due to this plants are been stopped for some time.

- Same goes for DMF as due to low supply of oxygen.

- Due to this plants are been stopped for some time.

- Same goes for DMF as due to low supply of oxygen.

- It is very difficult to say when the price be back to normal.

- Companies Hotel division, balaji sarovar premiere has resulted in substantial amount of cash flow savings.

- They have an ARR of 3600 rupees approx.

- They have negligible Routine Capex incurred.

- They have an ARR of 3600 rupees approx.

- They have negligible Routine Capex incurred.

Financials

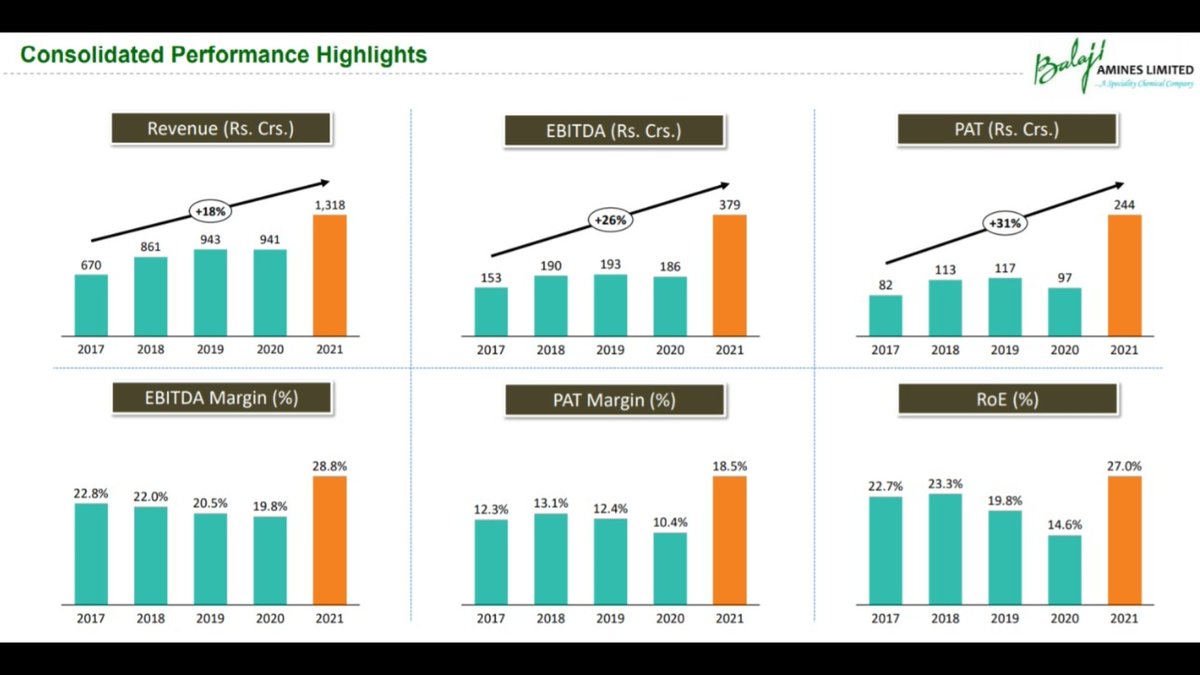

- Company has delivered strong topline growth during this period.

- There has been an increase in the EBITDA and PAT levels as well.

- The company operating margins were improved due to Healthy price relation and better capacity utilisation.

- Company has delivered strong topline growth during this period.

- There has been an increase in the EBITDA and PAT levels as well.

- The company operating margins were improved due to Healthy price relation and better capacity utilisation.

- The raw materials prices have been increasing for some time for company and they have reached its highest level before the end of quarter.

- Ammonia prove move to 40 to 50 rs. And same for others as well.

- They take about 2-3 months to pass on the cost to clients.

- Ammonia prove move to 40 to 50 rs. And same for others as well.

- They take about 2-3 months to pass on the cost to clients.

- This high price was due to shutting down of some main raw material suppliers and issues faced in the logistics business part.

- For speciality chemicals space the company undertook an Capex of about 250cr with a loan contribution of 150 cr.

- For speciality chemicals space the company undertook an Capex of about 250cr with a loan contribution of 150 cr.

- They are incurring many activities like upcoming mega power plant for saving.

- Under employees cost part there was reduction as well as few of the payments like bonuses were delayed.

- Under employees cost part there was reduction as well as few of the payments like bonuses were delayed.

Investments

- With commencement of 16500 tons Ethylamines plant under phase 1 of their 90 acer green field project they were able to increase their volumes and add new income source for them.

- With commencement of 16500 tons Ethylamines plant under phase 1 of their 90 acer green field project they were able to increase their volumes and add new income source for them.

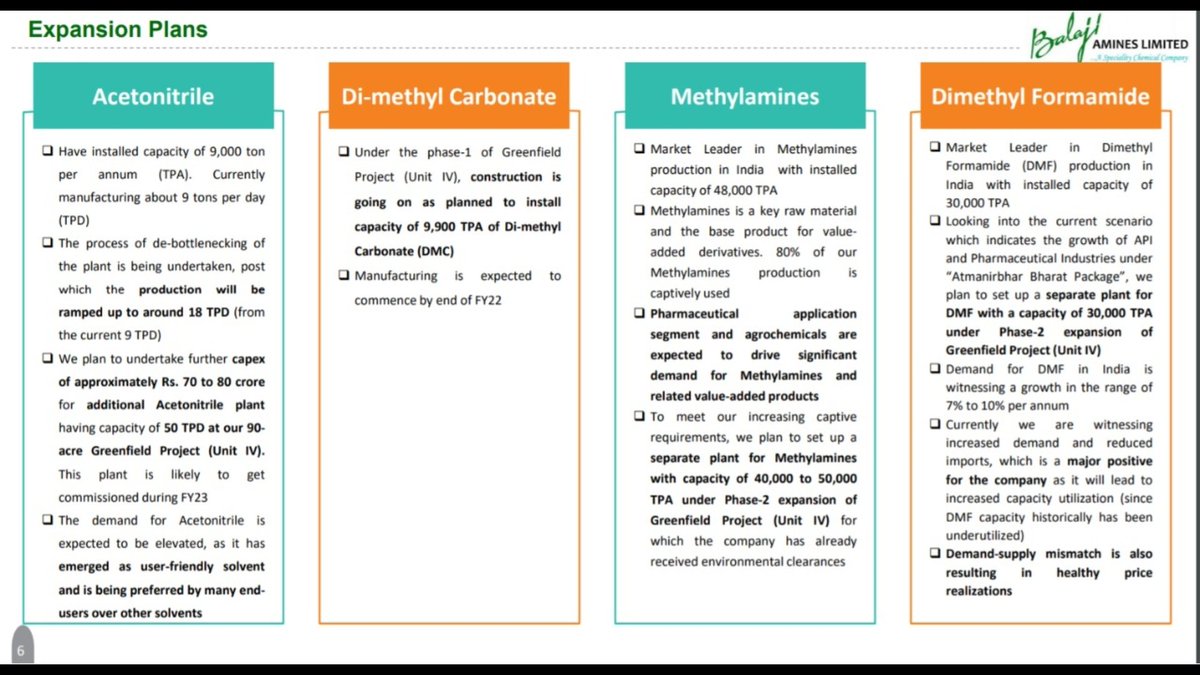

- They have decided to undertake new Capex of 70 to 80 cr for Acetonitrile and is expected to get it commissioned by FY23.

- Their DMC plant is hoped to commence production by end of FY22.

- Their DMC plant is hoped to commence production by end of FY22.

- New set of plans for Methylamines and DMF are been decided to increase their capacity in linked to government packages and meet captive demands.

- Till now 171 cr are been spend on phase 1 of the project.

- Till now 171 cr are been spend on phase 1 of the project.

- Company will also be running debottlenecking for its few products plant based on the requirements.

- They are also planning an backward integration for its oxygen plant along with power plant as mentioned above.

- They are also planning an backward integration for its oxygen plant along with power plant as mentioned above.

- After completion of all the projects the company is expected to achieve its 2000 to 2500 mark soon enough

For more discussion on Equity research and OI analysis

Subscribe to our YouTube channel 😃

Link 🖇: youtube.com/c/TheTycoonMin…

Subscribe to our YouTube channel 😃

Link 🖇: youtube.com/c/TheTycoonMin…

• • •

Missing some Tweet in this thread? You can try to

force a refresh