Caplin Point Laboratories conducted Concall today at 3:30 PM for Q1 FY21

Here are the conference call highlights.

"Mgmt expects to grow at 25% for coming few year"

Hit 'Retweet' to educate more investors ☎️🧵

Here are the conference call highlights.

"Mgmt expects to grow at 25% for coming few year"

Hit 'Retweet' to educate more investors ☎️🧵

Business Updates:

• Latin America remain the favorite spot for Caplin

• There was some product changes, to improve the product basket of company.

• Started selling injectibles in domestic market for Covid.

• CRO is set to get the product approval in 15-20 days.

• Latin America remain the favorite spot for Caplin

• There was some product changes, to improve the product basket of company.

• Started selling injectibles in domestic market for Covid.

• CRO is set to get the product approval in 15-20 days.

New Products

• Caplin Onco expected to commercialize in March22.

• 4 product launches to be made this year.

• In Phase 2, co. got 2 Vial filling lines from Syntegon, expecting delivery within 12 months

• Lyophilizer from Tofflon ordered, expecting deliver within 9-12 months.

• Caplin Onco expected to commercialize in March22.

• 4 product launches to be made this year.

• In Phase 2, co. got 2 Vial filling lines from Syntegon, expecting delivery within 12 months

• Lyophilizer from Tofflon ordered, expecting deliver within 9-12 months.

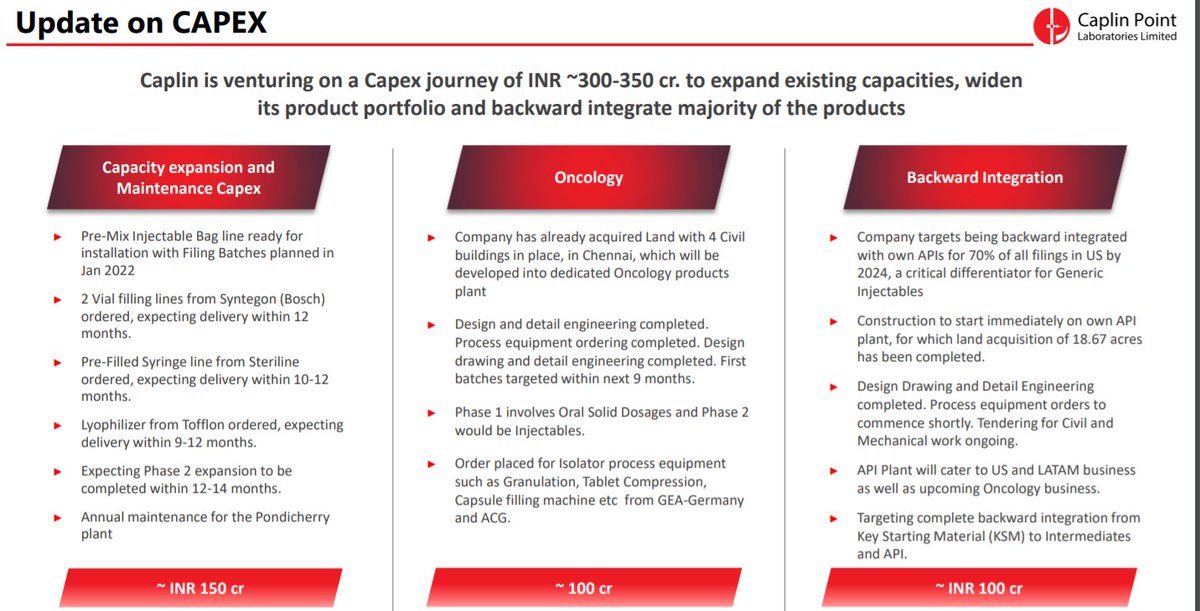

CAPEX:

• In US CAPEX, co. is expanding in Phase 2 which is expected to be completed in 15 months. Phase 2 will have spend of 150 cr.

• Onco. spend of CAPEX would be around 100cr, where in Phase 1 involves Oral Solid Dosages and Phase 2

would be Injectables.

• In US CAPEX, co. is expanding in Phase 2 which is expected to be completed in 15 months. Phase 2 will have spend of 150 cr.

• Onco. spend of CAPEX would be around 100cr, where in Phase 1 involves Oral Solid Dosages and Phase 2

would be Injectables.

• For API greenfield expansion would be around 50-60 cr of CAPEX, where co. targets backward integration for 70% of the fillings in US. It is expected to commercialize in 2024.

• This capacity would be enough to envisage 4-5 year revenue guidance of co.

• This capacity would be enough to envisage 4-5 year revenue guidance of co.

Competition:

"Competition would be there in every market. What creates unique if the Business Model Differentiation.

Caplin doesn't want to run blindly where market is running. Co. is huge scope of growth present, and Caplin is directly targeting bottom of pyramid."

"Competition would be there in every market. What creates unique if the Business Model Differentiation.

Caplin doesn't want to run blindly where market is running. Co. is huge scope of growth present, and Caplin is directly targeting bottom of pyramid."

Employees:

• With increasing focus on R&D, co. is continue attracting talent. While same in terms for production, co. is continuously hiring talent.

• With increasing focus on R&D, co. is continue attracting talent. While same in terms for production, co. is continuously hiring talent.

Margins:

• Gross margins is around 55%, and it would be similar in the range of the parent company.

• Mgmt is positive enough to maintain the margins.

• Gross margins is around 55%, and it would be similar in the range of the parent company.

• Mgmt is positive enough to maintain the margins.

Geographic Market:

• Chile has seen growth of 92% and Peru has also shown 50% of growth. There is splurge of demand of in both the countries.

• Latin America and RoW contributed shared 91% of revenue and US contributed 9% of revenue.

• Brazil is sort of tender business.

• Chile has seen growth of 92% and Peru has also shown 50% of growth. There is splurge of demand of in both the countries.

• Latin America and RoW contributed shared 91% of revenue and US contributed 9% of revenue.

• Brazil is sort of tender business.

Focus

• Focus remains on expanding geographic reach.

• Co. is expanding through Brand Generic, and Caplin is targeting via retail chain by going to every retail outlets.

• Co. is positive in Latin America and expected to be major growth driver. (2x the revenue in 5 year)

• Focus remains on expanding geographic reach.

• Co. is expanding through Brand Generic, and Caplin is targeting via retail chain by going to every retail outlets.

• Co. is positive in Latin America and expected to be major growth driver. (2x the revenue in 5 year)

Market share:

• Co. expects to gain market share of 10% in each of the product.

• In case of commodity product, where there many players, co. targets to have equal market share in terms of no. of players.

• In India co. is directly targeting institutions for brand marketing.

• Co. expects to gain market share of 10% in each of the product.

• In case of commodity product, where there many players, co. targets to have equal market share in terms of no. of players.

• In India co. is directly targeting institutions for brand marketing.

Other Data:

• Logistics issues remain this quarter, with freight cost hiking up.

• Last FDA inspection was in 2019, and till now there is no update on FDA. But co. is always ready for any inspection.

• Logistics issues remain this quarter, with freight cost hiking up.

• Last FDA inspection was in 2019, and till now there is no update on FDA. But co. is always ready for any inspection.

For more discussion on Equity research and OI analysis

Subscribe to our YouTube channel Smiling face with open mouth

Link 🖇: youtube.com/c/TheTycoonMin…

Subscribe to our YouTube channel Smiling face with open mouth

Link 🖇: youtube.com/c/TheTycoonMin…

• • •

Missing some Tweet in this thread? You can try to

force a refresh